Home>Finance>10-K: Definition, What’s Included, Instructions, And Where To Find It

Finance

10-K: Definition, What’s Included, Instructions, And Where To Find It

Published: September 23, 2023

Learn about 10-K in finance, including its definition, what's included, instructions, and where to find it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

10-K: Definition, What’s Included, Instructions, and Where to Find it

Finance, as a category on our page, covers a wide range of topics that help individuals and businesses manage their money effectively. Today, we’re diving into the world of 10-K, a report that provides valuable insights into a company’s financial performance and potential risks. If you’ve ever wondered what a 10-K is, what it includes, how to navigate it, and where to find it, you’re in the right place.

Key Takeaways:

- A 10-K is an annual report filed by companies with the Securities and Exchange Commission (SEC) and provides a comprehensive overview of their financial performance, business operations, and potential risks.

- It includes detailed information on a company’s financial statements, management discussion and analysis, risk factors, legal proceedings, and more.

Now, let’s explore the 10-K in more detail.

What is a 10-K?

A 10-K is a detailed annual report that publicly traded companies are required to submit to the Securities and Exchange Commission (SEC). It provides a comprehensive overview of a company’s financial performance, business operations, and potential risks. Think of it as a window into the inner workings of a company, allowing investors and stakeholders to make informed decisions.

What’s Included in a 10-K?

A 10-K includes a plethora of information that gives a comprehensive view of a company. Here are the key sections typically found in a 10-K:

- Business Overview: This section provides a summary of a company’s operations, including its products, services, markets, and competitors.

- Management Discussion and Analysis (MD&A): Here, you’ll find a candid narrative from the company’s management, discussing the financial results, significant trends, and future plans.

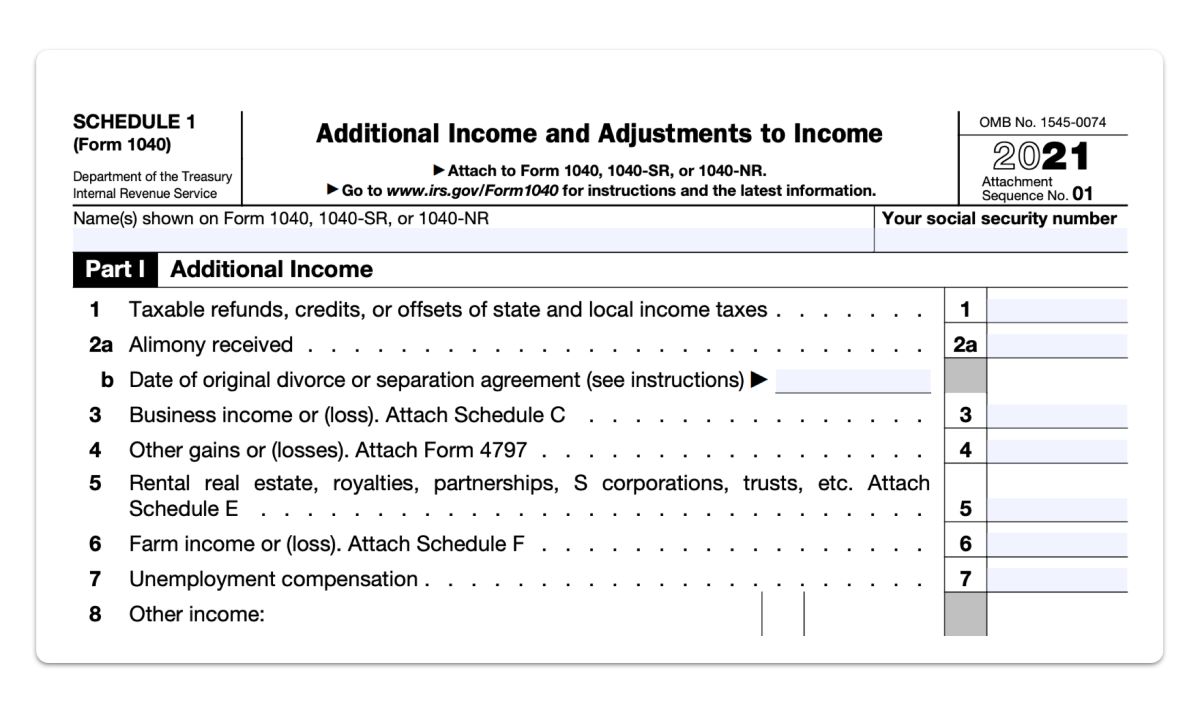

- Financial Statements: This section includes the balance sheet, income statement, cash flow statement, and statement of changes in shareholders’ equity, providing a detailed snapshot of the company’s financial health.

- Notes to Financial Statements: These notes provide additional details and explanations about the numbers presented in the financial statements, including accounting policies and assumptions.

- Risk Factors: Companies must disclose the potential risks that could negatively impact their business, such as competition, market volatility, legal proceedings, and regulatory changes.

- Legal Proceedings: If a company is involved in any pending or ongoing legal matters, it must disclose the details, potential liabilities, and possible outcomes.

- Management and Corporate Governance: This section covers information about the company’s directors, executive compensation, and any potential conflicts of interest.

How to Navigate a 10-K?

Navigating a 10-K can seem overwhelming at first, but with a systematic approach, you can extract valuable information. Here are a few tips to help you navigate through a 10-K:

- Start with the table of contents: The table of contents provides an overview of the sections and helps you find specific information quickly.

- Familiarize yourself with the structure: Understanding the structure of a 10-K, such as the various sections and their respective page numbers, can simplify your search for specific information.

- Focus on the management discussion and analysis (MD&A): The MD&A section provides insights into a company’s financial results, future plans, and significant trends. This narrative can be a goldmine of information.

- Pay attention to footnotes: The footnotes to the financial statements contain additional details, explanations, and disclosures that can enhance your understanding of the numbers.

- Scan risk factors and legal proceedings: Understanding potential risks and ongoing legal matters can help you assess the company’s overall risk profile and evaluate its future prospects.

Where to Find a 10-K?

Now that you know what a 10-K is and what it includes, where can you find it? Fortunately, accessing 10-K reports is relatively easy. Here are a few ways to find them:

- SEC’s EDGAR database: The EDGAR database is the primary source for all SEC filings, including 10-K reports. You can access it for free on the SEC’s website and search for a specific company’s filings.

- Company’s Investor Relations website: Many companies have a dedicated section on their website where they provide access to their 10-K filings. Look for the “Investor Relations” or “SEC Filings” page.

- Financial news platforms: Websites that cater to financial news, such as Yahoo Finance or Bloomberg, often provide access to 10-K reports. Search for the company’s ticker symbol or name, followed by “10-K.”

In conclusion, a 10-K is a crucial document for investors, analysts, and anyone interested in understanding a company’s financial performance and potential risks. By knowing what’s included in a 10-K, how to navigate it effectively, and where to find it, you can gain valuable insights to make informed decisions about your investments or business partnerships.

Have you ever explored a 10-K report? Share your experiences and insights in the comments below!