Finance

Where Do I Find Capital Structure On 10K

Modified: March 1, 2024

Discover where to find information about capital structure in a company's 10K filing. Explore the finance section for crucial insights into a firm's financial health and leverage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Capital structure plays a crucial role in the financial health and stability of a company. It refers to the way a company finances its operations through a combination of debt and equity. A well-structured capital base can provide a company with the necessary resources to fund its growth, while maintaining a healthy balance between risk and return.

For investors, understanding a company’s capital structure is essential as it provides insights into how a company is financed and the potential risks associated with its financial obligations. One key source of information for analyzing a company’s capital structure is its annual report, specifically the Form 10-K for companies listed in the United States. The Form 10-K is a comprehensive report filed by public companies with the Securities and Exchange Commission (SEC), which provides a detailed overview of a company’s financial performance and operations.

In this article, we will explore how to navigate through a company’s 10-K to find information related to its capital structure. We will discuss the components of capital structure, the key financial statements to look for, and where to locate specific capital structure information within the 10-K report. Understanding how to analyze a company’s capital structure can provide valuable insights for investors, creditors, and other stakeholders.

It’s important to note that while we will focus on the 10-K report for companies listed in the United States, many other countries have their own reporting requirements for publicly traded companies. However, the fundamental principles of capital structure analysis remain relevant regardless of the specific reporting standards.

Now, let’s dive into the key concepts and information you need to find in a company’s 10-K report to understand its capital structure.

Background

Before we delve into the intricacies of capital structure analysis, let’s first gain a basic understanding of what capital structure entails. Capital structure refers to the mix of different financing sources that a company uses to fund its operations and investment activities. These financing sources include both debt and equity.

Debt financing refers to funds borrowed by a company from external sources such as banks, bondholders, or other financial institutions. This can take the form of bank loans, corporate bonds, or other debt instruments. Debt financing allows a company to access capital without diluting ownership and control. However, it also comes with the obligation to repay the borrowed funds, along with interest, within a specified period of time.

Equity financing, on the other hand, represents ownership in the company. It is typically raised through the sale of shares of stock. Equity investors become partial owners and thus have a claim on the company’s assets and earnings. Unlike debt holders, equity investors do not have a predetermined repayment schedule. Instead, they share in the company’s profits and bear the risks associated with ownership.

The capital structure of a company can have a significant impact on its financial risk and cost of capital. A company that relies heavily on debt financing may have a higher financial risk due to the obligation to make interest payments and repay the principal amount. On the other hand, a company with a higher proportion of equity financing may have a lower financial risk but could face higher costs of capital due to the dilution of ownership and the expectations of equity investors.

Now that we have a basic understanding of capital structure, let’s explore the different components that make up a company’s capital structure and the importance of analyzing it for investors and other stakeholders.

Understanding Capital Structure

Capital structure is a reflection of how a company chooses to finance its operations and growth. It is essentially the composition of a company’s liabilities and shareholder’s equity. Understanding a company’s capital structure is crucial for investors as it provides insights into the company’s financial leverage, risk profile, and potential for growth.

The two primary components of capital structure are debt and equity. Debt represents the funds borrowed by the company from external sources, while equity represents the funds invested by shareholders. The proportion of debt to equity in a company’s capital structure can vary significantly and is influenced by factors such as industry norms, company size, growth prospects, and risk appetite.

When analyzing a company’s capital structure, it is important to consider the following key factors:

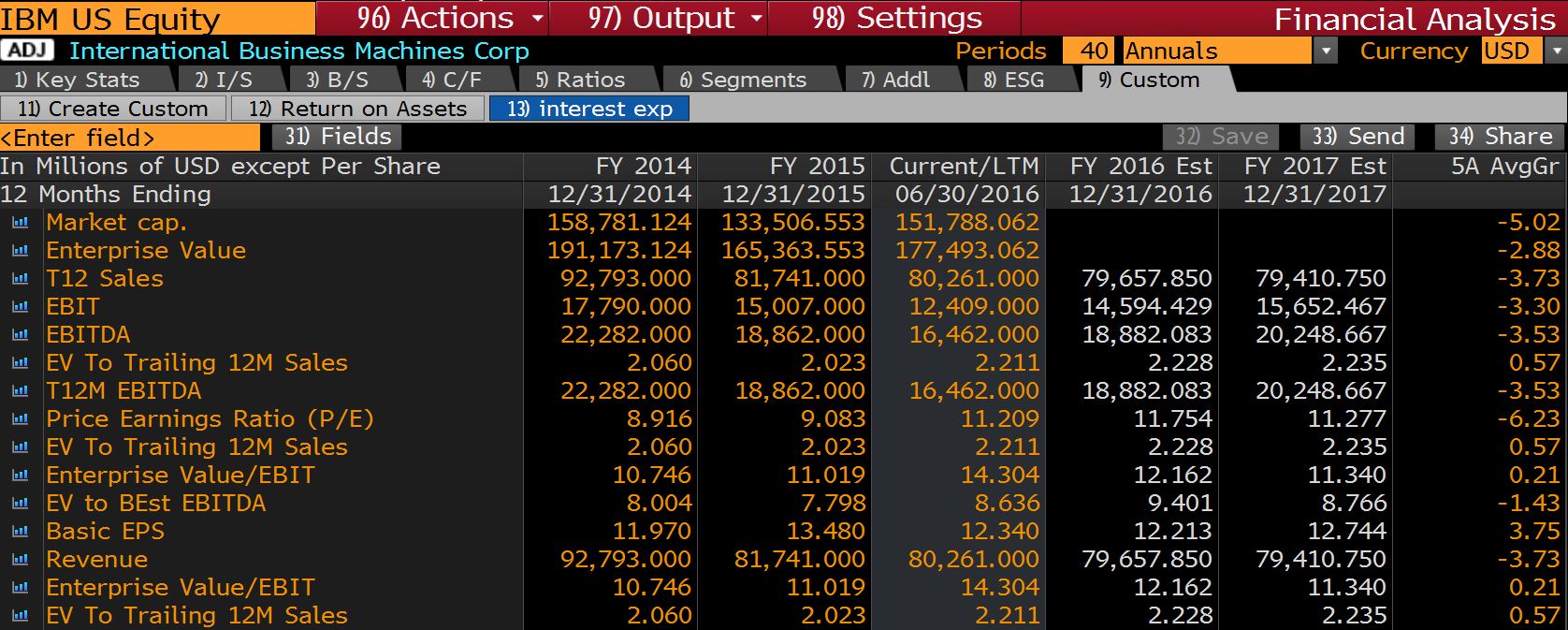

- Debt Ratio: This ratio measures the proportion of a company’s total assets that are financed by debt. A higher debt ratio indicates a higher level of financial leverage and potentially higher financial risk. It is calculated by dividing total debt by total assets.

- Equity Ratio: This ratio measures the proportion of a company’s total assets that are financed by equity. A higher equity ratio indicates a lower level of financial leverage and potentially lower financial risk. It is calculated by dividing total equity by total assets.

- Debt-to-Equity Ratio: This ratio compares the amount of debt to the amount of equity in a company’s capital structure. It provides insights into the balance between debt and equity financing. A higher debt-to-equity ratio indicates a higher level of debt relative to equity, indicating higher financial risk. It is calculated by dividing total debt by total equity.

- Interest Coverage Ratio: This ratio measures a company’s ability to service its interest payments on its outstanding debt. It indicates the company’s ability to generate sufficient operating income to meet its interest obligations. A higher interest coverage ratio implies a lower risk of defaulting on debt payments. It is calculated by dividing earnings before interest and taxes (EBIT) by interest expense.

By examining these factors, investors can assess a company’s financial stability and the level of risk associated with its capital structure. A company with a well-balanced capital structure that strikes a reasonable balance between debt and equity financing may indicate sound financial management and lower risk. On the other hand, a company with excessive debt or a heavy reliance on equity financing may raise concerns about solvency or dilution of ownership.

Now that we have a clear understanding of the components and ratios associated with capital structure, let’s explore where to find this information within a company’s 10-K report.

Components of Capital Structure

The capital structure of a company is composed of various elements that reflect the mix of debt and equity financing. Understanding these components is essential for analyzing a company’s financial health and risk profile.

Here are the key components of capital structure:

- Long-term Debt: This component includes loans, bonds, and other debt instruments with a maturity of more than one year. Long-term debt represents the funds borrowed by a company that must be repaid over an extended period.

- Short-term Debt: Unlike long-term debt, short-term debt consists of obligations that are due within one year. It includes lines of credit, commercial paper, and other forms of short-term borrowing.

- Preferred Stock: Preferred stock represents a form of equity financing that gives shareholders certain preferential rights, such as priority in receiving dividends. It typically carries a fixed dividend rate and has features that differ from common stock.

- Common Stock: Common stock represents ownership in a company and provides shareholders with voting rights and the potential for dividends or capital gains. It is one of the primary sources of equity financing.

- Retained Earnings: Retained earnings refer to the accumulated profits that a company retains for reinvestment in the business instead of distributing them to shareholders as dividends. Retained earnings increase the company’s equity capital.

- Additional Paid-In Capital: This component represents the amount of capital raised by the company through the issuance of shares at a price higher than the nominal value. It reflects the premium paid by investors for acquiring shares.

These components collectively determine the overall capital structure of a company and play a crucial role in shaping its financial health and risk profile. The proportions in which these components are represented in a company’s capital structure can vary significantly based on factors such as industry dynamics, company size, growth prospects, and financial strategy.

When analyzing a company’s capital structure, it is important to consider the mix of these components and how they impact the company’s financial stability. A well-balanced capital structure should strike a reasonable equilibrium between debt and equity financing, taking into account the company’s risk tolerance and growth objectives.

Now that we have explored the components of capital structure, let’s move on to understanding how to locate capital structure information within a company’s 10-K report.

Key Financial Statements in the 10-K

The 10-K report is a comprehensive document filed by public companies with the Securities and Exchange Commission (SEC), providing detailed information about their financial performance and operations. To analyze a company’s capital structure, it is crucial to understand the key financial statements included in the 10-K report.

The following are the key financial statements that investors should pay attention to:

- Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and shareholders’ equity. To identify the components of a company’s capital structure, look for the breakdown of long-term debt, short-term debt, equity, and retained earnings in the liabilities and shareholders’ equity section of the balance sheet.

- Income Statement: The income statement, also known as the profit and loss statement, showcases a company’s revenues, expenses, and net income over a specific period. While it does not directly provide information on the capital structure, analyzing the income statement helps in understanding a company’s profitability, which has an indirect impact on its capital structure.

- Statement of Cash Flows: The statement of cash flows outlines the inflows and outflows of cash and cash equivalents during a given period. It provides insights into a company’s cash-generating abilities, liquidity position, and financing activities, which are relevant to understanding its capital structure.

- Statement of Shareholders’ Equity: The statement of shareholders’ equity tracks the changes in a company’s equity position over time. It demonstrates the impact of dividend payments, stock issuances, share repurchases, and other equity-related transactions. This statement can provide details on additional paid-in capital, retained earnings, and other components of equity financing.

- Notes to Financial Statements: The notes to the financial statements are an integral part of the 10-K report. They provide additional explanations, disclosures, and details about the financial statements. Look for notes that specifically mention the company’s capital structure, such as details about debt arrangements, preferred stock issuances, and other relevant information.

By thoroughly analyzing these financial statements and related disclosures in the 10-K report, investors can gain a comprehensive understanding of a company’s capital structure and its implications for the company’s financial health and risk profile.

Now that we know the key financial statements to examine in the 10-K report, let’s move on to discovering how to locate capital structure information within the report.

Locating Capital Structure Information in the 10-K

When analyzing a company’s capital structure, it is essential to locate the relevant information within its 10-K report. The 10-K report is a comprehensive filing that contains a wealth of information about a company’s financials and operations. Here are some key sections and disclosures where you can find capital structure information:

- Item 1: Business: This section provides an overview of the company’s business operations, industry, and key competitors. While it may not directly mention capital structure, it can offer insights into the nature of the company’s operations, which can impact its choice of financing and capital structure.

- Item 2: Properties: In this section, a company typically provides details about its tangible assets, including buildings, land, equipment, and real estate. While not directly related to capital structure, understanding a company’s asset base can help assess its collateral for debt financing.

- Item 6: Selected Financial Data: This section provides a summary of the company’s financial performance over the past five years. Look for information related to long-term debt, short-term debt, equity, and other relevant financial metrics that contribute to the capital structure.

- Item 7: Management’s Discussion and Analysis (MD&A): The MD&A section is a narrative analysis of the company’s financial condition, results of operations, and future prospects. Look for discussions related to debt levels, equity financing, capital requirements, and any significant changes in the capital structure.

- Item 8: Financial Statements and Supplementary Data: This section includes the company’s financial statements mentioned earlier, including the balance sheet, income statement, statement of cash flows, and statement of shareholders’ equity. These statements provide crucial information about the components of the capital structure.

- Item 15: Exhibits and Financial Statement Schedules: The exhibits section includes relevant attachments such as debt agreements, convertible securities, and other important contracts that impact the company’s capital structure. These attachments can provide detailed information about specific debt instruments and equity issuances.

In addition to these sections, it’s important to thoroughly read the footnotes to the financial statements. The footnotes often contain detailed information about long-term debt, equity transactions, debt covenants, and other pertinent capital structure details.

While navigating the 10-K report may seem overwhelming at first, using the search function within the document can be helpful in locating specific sections or keywords related to capital structure. Additionally, companies may have summaries or executive summaries that provide a concise overview of their capital structure.

By examining these sections and disclosures within the 10-K report, investors can gather the necessary information to analyze a company’s capital structure and evaluate its financial stability and risk profile.

Now that we know where to find capital structure information in the 10-K report, let’s move on to analyzing and interpreting the implications of a company’s capital structure.

Analysis of Capital Structure

Once the relevant information regarding a company’s capital structure has been identified and located within the 10-K report, the next step is to analyze and interpret the implications of that structure. Capital structure analysis helps investors and stakeholders understand the financial risk, stability, and potential growth of a company. Here are some key aspects to consider:

Debt-to-Equity Ratio: This ratio provides insights into the proportion of debt relative to equity in a company’s capital structure. A higher debt-to-equity ratio indicates a higher degree of financial leverage and potentially increased financial risk. It is important to compare the company’s debt-to-equity ratio with industry peers to understand its relative position and risk profile.

Interest Coverage Ratio: This ratio indicates a company’s ability to cover its interest expenses using its operating income. A higher interest coverage ratio signifies a greater ability to meet interest obligations and suggests a lower risk of default. Conversely, a low interest coverage ratio may raise concerns about the company’s ability to service its debt.

Weighted Average Cost of Capital (WACC): The WACC is the average rate a company must earn on its investments to satisfy both debt and equity investors. It takes into account the cost of debt and the cost of equity based on their respective proportions in the capital structure. A higher WACC may indicate higher financial risk and increased cost of capital for the company.

Flexibility for Future Growth: Examining a company’s capital structure can provide insights into its flexibility for future growth initiatives. A company with a strong balance between debt and equity may have the ability to comfortably borrow funds or issue additional equity to finance expansion plans. On the other hand, a heavily leveraged company may face limitations in pursuing growth opportunities due to high debt levels and existing financial obligations.

Liquidity and Solvency: Assessing a company’s capital structure aids in understanding its liquidity and solvency positions. A mismatch between short-term debt and available cash flow can lead to liquidity challenges, while excessive debt levels relative to assets may raise concerns about solvency and the company’s ability to meet long-term obligations.

Risk and Return Trade-Off: Lastly, analyzing a company’s capital structure allows for an evaluation of the trade-off between risk and return. A higher proportion of debt may increase the financial risk of the company but can also lead to higher returns for equity investors if the company’s operations generate sufficient profits to service the debt.

By conducting a thorough examination of these factors, investors can assess a company’s capital structure and make informed decisions about its financial stability, risk profile, and growth potential. It is crucial to consider the industry dynamics, economic conditions, and other contextual factors while interpreting capital structure analysis.

Now that we have analyzed the capital structure of a company, let’s explore the importance of capital structure in financial decision-making.

Importance of Capital Structure

The capital structure of a company holds great significance for various stakeholders, including investors, creditors, and management. It plays a crucial role in determining the financial risk, cost of capital, and growth prospects of a company. Here are some reasons why understanding and analyzing capital structure is important:

Assessing Financial Risk: Capital structure analysis allows investors and creditors to evaluate a company’s financial risk. A company with a higher proportion of debt in its capital structure may be more vulnerable to economic downturns and interest rate fluctuations. On the other hand, a balanced and well-managed capital structure can mitigate financial risk and enhance a company’s resilience.

Determining Cost of Capital: The capital structure has a direct impact on a company’s cost of capital. A higher debt-to-equity ratio typically results in a lower cost of debt due to tax benefits but may increase the cost of equity due to higher perceived risk. Finding the optimal balance between debt and equity financing is vital for minimizing the overall cost of capital and maximizing shareholder value.

Facilitating Growth and Expansion: A well-structured capital base provides a company with the necessary resources to fuel its growth initiatives. It allows the company to access external funds through debt or equity offerings to invest in research and development, acquisitions, new projects, and market expansion. The capital structure determines a company’s ability to seize growth opportunities and adapt to changing market conditions.

Maximizing Shareholder Returns: A company’s capital structure influences the distribution of earnings among shareholders. Debt financing, with its fixed interest payments, can magnify the returns for equity holders when a company performs well. However, excessive debt and interest obligations can limit the company’s ability to distribute dividends or repurchase shares, potentially impacting shareholder returns negatively.

Influencing Business Strategy: Capital structure considerations can also shape a company’s strategic decisions. The financing options available and their associated costs can influence choices regarding mergers and acquisitions, capital investments, debt refinancing, dividend policy, and share repurchases. A well-crafted capital structure aligns financing decisions with the company’s long-term objectives and enhances its strategic position in the market.

Building Credibility and Trust: A sound capital structure enhances a company’s credibility and instills trust among investors, creditors, and other stakeholders. It demonstrates effective financial management, transparency, and the ability to honor financial commitments. A robust capital structure can result in improved credit ratings, lower borrowing costs, and enhanced business relationships.

Overall, understanding and analyzing a company’s capital structure is fundamental to assessing its financial health, risk profile, cost of capital, growth potential, and alignment with strategic objectives. It enables informed investment decisions and facilitates effective financial planning and management by both the company and its stakeholders.

Now, let’s summarize the key insights discussed in this article.

Conclusion

Analyzing a company’s capital structure is integral to understanding its financial health, risk profile, and growth potential. The complexity of capital structure necessitates a comprehensive examination of a company’s 10-K report, including key financial statements and relevant disclosures.

By assessing a company’s debt ratios, interest coverage ratio, weighted average cost of capital (WACC), and flexibility for future growth, investors can make informed decisions about the company’s financial stability and risk exposure. Additionally, analyzing a company’s capital structure allows for evaluating the trade-off between risk and return.

The importance of capital structure lies in assessing financial risk, determining the cost of capital, facilitating growth and expansion, maximizing shareholder returns, influencing business strategy, and building credibility and trust among stakeholders.

Understanding a company’s capital structure is crucial for investors, creditors, and management in making informed financial decisions and evaluating the company’s financial stability and potential for growth.

In conclusion, conducting a thorough analysis of a company’s capital structure provides valuable insights that drive decision-making and promote long-term financial success.

Now that you have a comprehensive understanding of capital structure and its significance, you are equipped to navigate through a company’s 10-K report and make informed assessments about its financial health and risk profile.