Home>Finance>Where To Find Net Sales On Financial Statements

Finance

Where To Find Net Sales On Financial Statements

Published: December 22, 2023

Looking for net sales on financial statements? Learn where to find this crucial information in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Financial statements are crucial tools used by businesses, investors, and analysts to assess a company’s financial performance and make informed decisions. Among the various components of financial statements, net sales holds significant importance. Net sales is a key metric that provides insights into a business’s revenue generation and growth potential.

In this article, we will delve into the concept of net sales, its components, and its significance in financial statements. We will also discuss where to find net sales on the income statement, as well as the importance of analyzing this metric. Lastly, we will touch upon the limitations of relying solely on net sales for evaluating a company’s financial health.

Understanding net sales is vital for anyone involved in finance, accounting, or investment decision-making. It provides essential information about a company’s revenue stream and its ability to generate sales from its core operations. Whether you are a business owner, an investor, or a financial professional, a thorough understanding of net sales will empower you to make informed decisions and evaluate a company’s financial performance effectively.

So, let’s dive into the world of net sales and discover its significance on financial statements.

Importance of Net Sales on Financial Statements

Net sales is a critical component of financial statements as it provides a measure of a company’s revenue from its core operations. It represents the total amount of sales generated by a company, minus any returns, allowances, and discounts. Net sales is a key indicator of a company’s ability to generate income and sustain growth. Here are some reasons why net sales hold significant importance on financial statements:

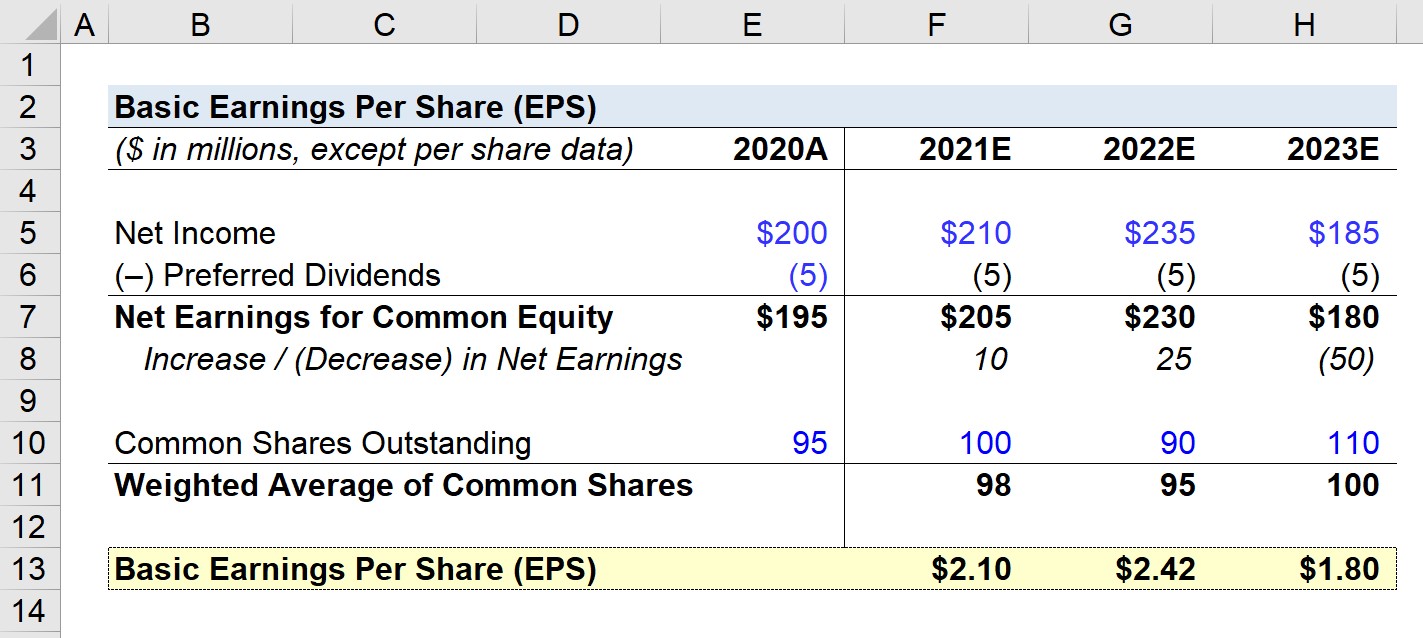

- Revenue Assessment: Net sales directly reflect a company’s ability to generate revenue. It provides valuable insights into the effectiveness of its sales strategies, product demand, and market penetration. By analyzing net sales over time, investors and stakeholders can gauge the company’s revenue growth trajectory and its ability to meet market expectations.

- Profitability Analysis: Net sales is a crucial metric in determining a company’s profitability. By subtracting the cost of goods sold (COGS) from net sales, you arrive at the gross profit figure, which measures the profitability of a company’s core operations. Gross profit is often used to assess the efficiency of a company’s pricing strategy, production costs, and inventory management.

- Financial Health: Net sales is a key indicator of a company’s overall financial health. A consistent increase or strong net sales growth demonstrates a company’s ability to generate income and sustain its operations. This metric is closely watched by investors, creditors, and analysts as it reflects the company’s growth potential and ability to meet its financial obligations.

- Comparison and Benchmarking: Net sales allows for easy comparison of a company’s performance against its competitors and industry benchmarks. By examining net sales figures of similar businesses operating in the same industry, investors and analysts can determine whether a company is outperforming or underperforming its peers. This analysis can provide valuable insights for investment decisions and strategic planning.

- Forecasting and Projections: Net sales serves as a basis for forecasting future sales and revenue. By analyzing historical net sales data and considering market trends, industry outlook, and company-specific factors, financial professionals can make informed projections about a company’s future performance. These projections are valuable for budgeting, financial planning, and setting realistic sales targets.

In summary, net sales is a crucial component of financial statements that provides essential insights into a company’s revenue generation, profitability, financial health, and comparison to industry peers. By understanding and analyzing net sales, stakeholders can make informed decisions, assess a company’s growth potential, and evaluate its financial performance.

Understanding Net Sales

Net sales, also referred to as revenue or sales revenue, is a key financial metric that represents the total amount of sales generated by a company during a specific period. It is a vital indicator of a company’s ability to generate income from its core operations. Understanding the components of net sales is essential for accurately assessing a company’s financial performance.

Net sales is calculated by deducting certain items from gross sales. These deductions include returns, allowances, and discounts given to customers. Gross sales represent the total amount of revenue generated from the sale of goods or services before any adjustments. By subtracting these deductions, net sales provides a more accurate measure of a company’s revenue.

Net sales is typically reported on the income statement, also known as the profit and loss statement. It is presented as a separate line item, allowing stakeholders to easily identify and analyze the company’s revenue generation. Sharing net sales information allows for transparency and provides valuable insights into a company’s financial performance.

It’s important to note that net sales only include revenue generated from the company’s core operations and excludes any non-operating income or exceptional items. This focus on core operations enables stakeholders to assess a company’s ability to generate income from its primary business activities.

Furthermore, net sales is a gross figure and does not take into account the cost of goods sold (COGS), which represents the direct costs associated with producing or delivering the goods or services sold. By deducting COGS from net sales, companies can determine their gross profit, which measures the profitability of their core operations.

Ultimately, understanding net sales is crucial for evaluating a company’s revenue generation and growth potential. It provides a clear picture of a company’s ability to generate income from its core operations, and allows for comparisons across different periods or against industry benchmarks.

By analyzing net sales, investors, creditors, and analysts can assess a company’s financial health, profitability, and market position. Whether a company is experiencing steady growth or facing challenges, net sales offers valuable insights into its revenue generation and serves as a basis for making informed investment and strategic decisions.

Components of Net Sales

Net sales is derived from the total sales revenue generated by a company, adjusted for certain deductions. These deductions include returns, allowances, and discounts given to customers. Understanding these components is essential for a comprehensive analysis of a company’s net sales figure. Here are the key components of net sales:

- Returns: Returns refer to the products or services that customers return to the company after purchase. This could be due to product defects, dissatisfaction, or any other reason. The value of returned items is deducted from the gross sales figure to arrive at net sales.

- Allowances: Allowances are reductions in the selling price offered to customers as a result of various factors, such as damaged or defective products. These allowances are deducted from the gross sales amount to determine net sales.

- Discounts: Discounts are offered to customers as an incentive to encourage sales or to reward loyalty. These can take the form of percentage discounts, volume discounts, or promotional discounts. The value of these discounts is subtracted from the gross sales figure to arrive at net sales.

- Foreign Exchange Effects: For companies operating internationally, fluctuations in foreign exchange rates can impact their net sales. If the company’s financial statements are prepared in a different currency from its sales transactions, the effects of currency exchange rate changes need to be considered and adjusted accordingly.

- Sales Tax: Sales tax, also known as value-added tax (VAT) or goods and services tax (GST), is a percentage imposed by governments on the sale of goods and services. The sales tax amount collected from customers is not considered as revenue but rather a liability that is later remitted to the government. Therefore, it is not included in net sales.

By subtracting returns, allowances, discounts, and other deductions from the gross sales figure, companies calculate their net sales. This provides a more accurate representation of the revenue generated from the core operations of the business.

Understanding the components of net sales is vital for assessing the quality of a company’s revenue and identifying the factors that may impact its sales performance. By analyzing the components, stakeholders can gain insights into customer satisfaction, pricing strategies, product quality, and the effectiveness of sales promotions or discounts. These insights can help businesses make informed decisions to optimize their revenue streams and improve their financial performance.

Where to Find Net Sales on Income Statement

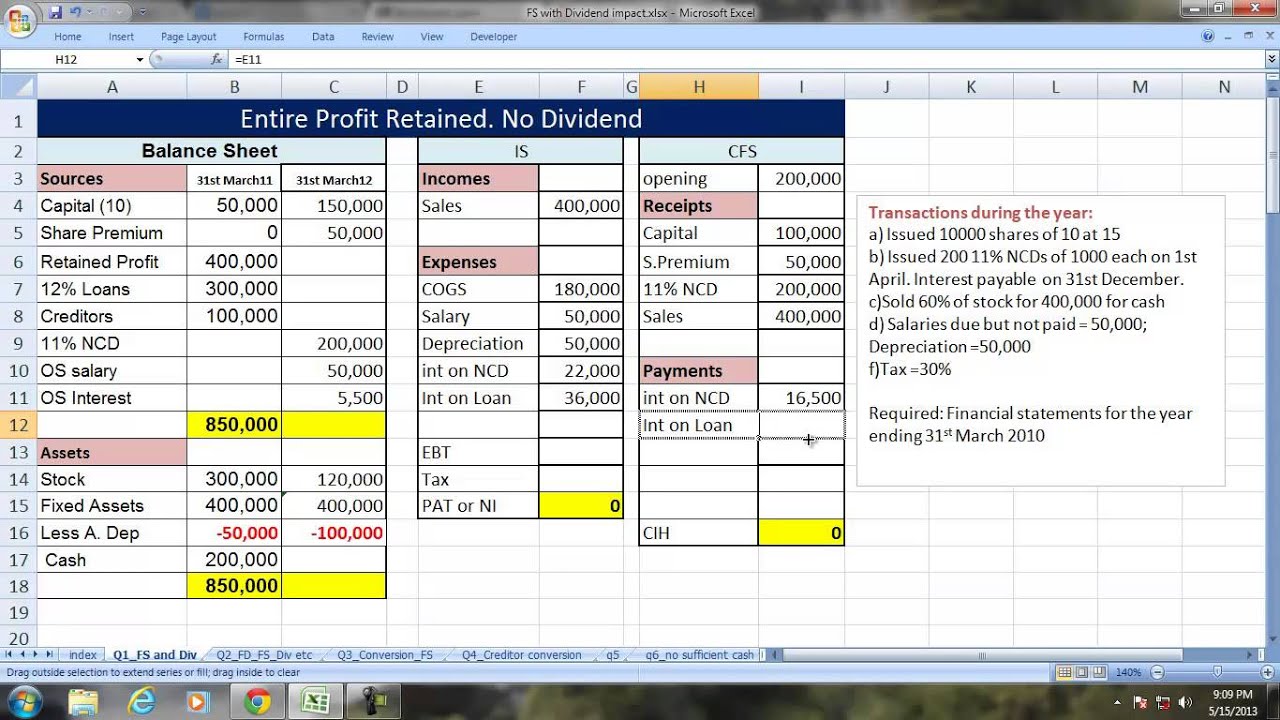

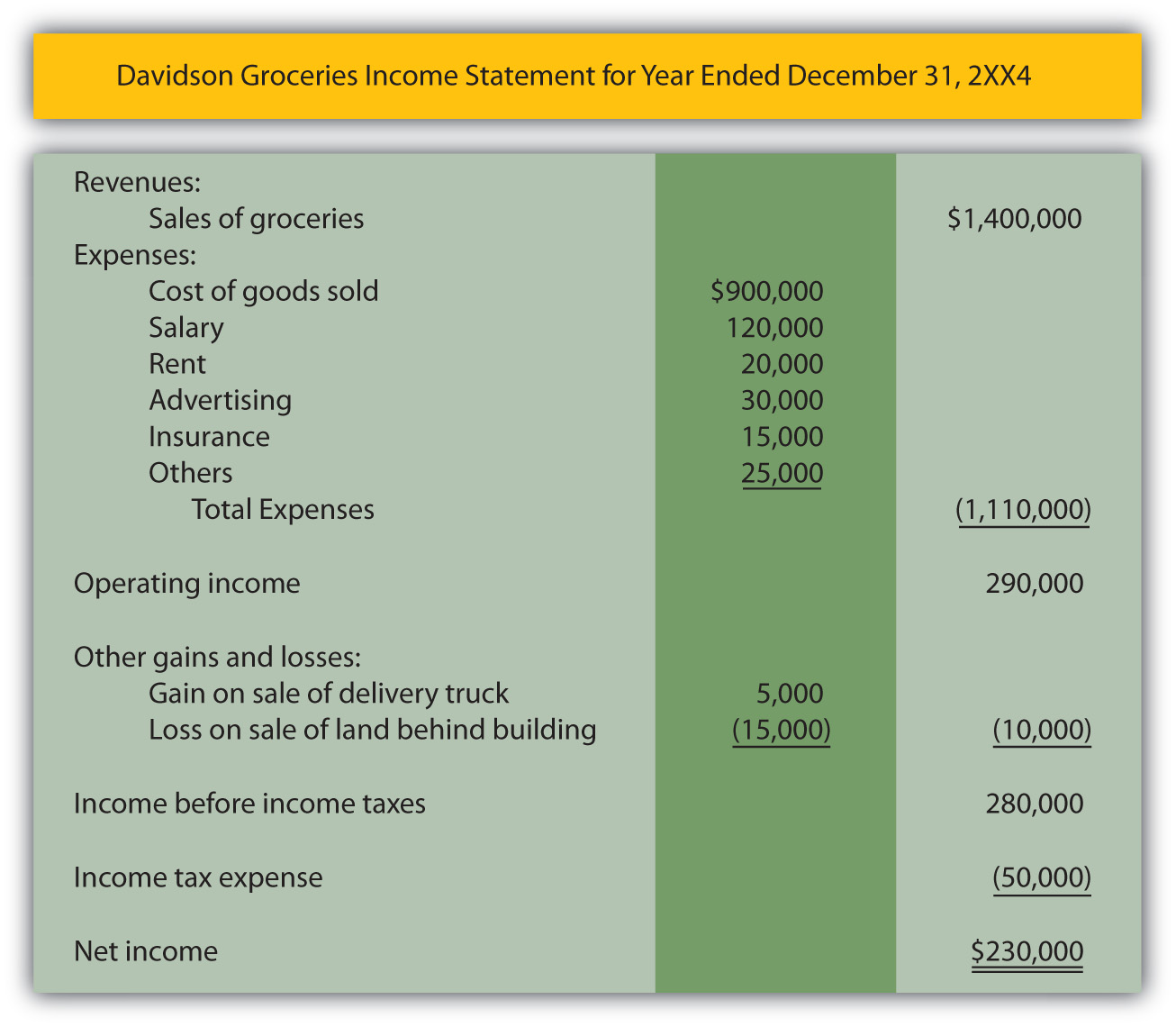

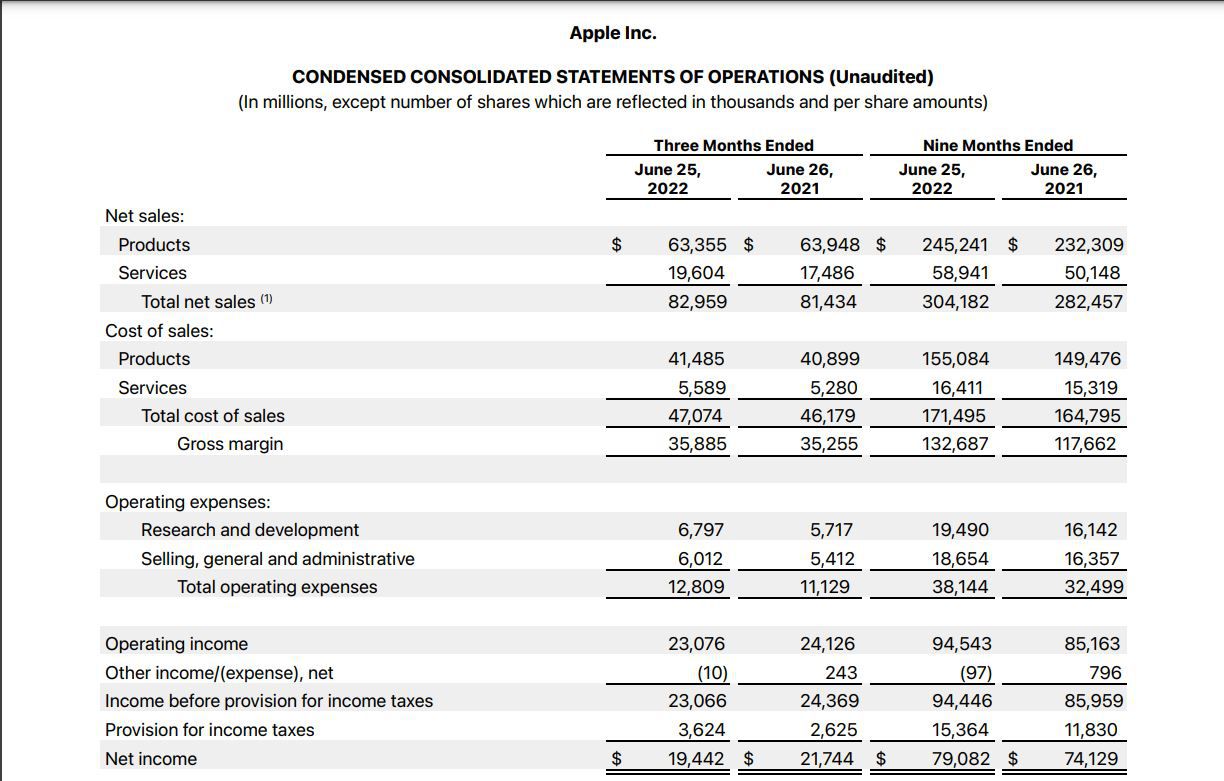

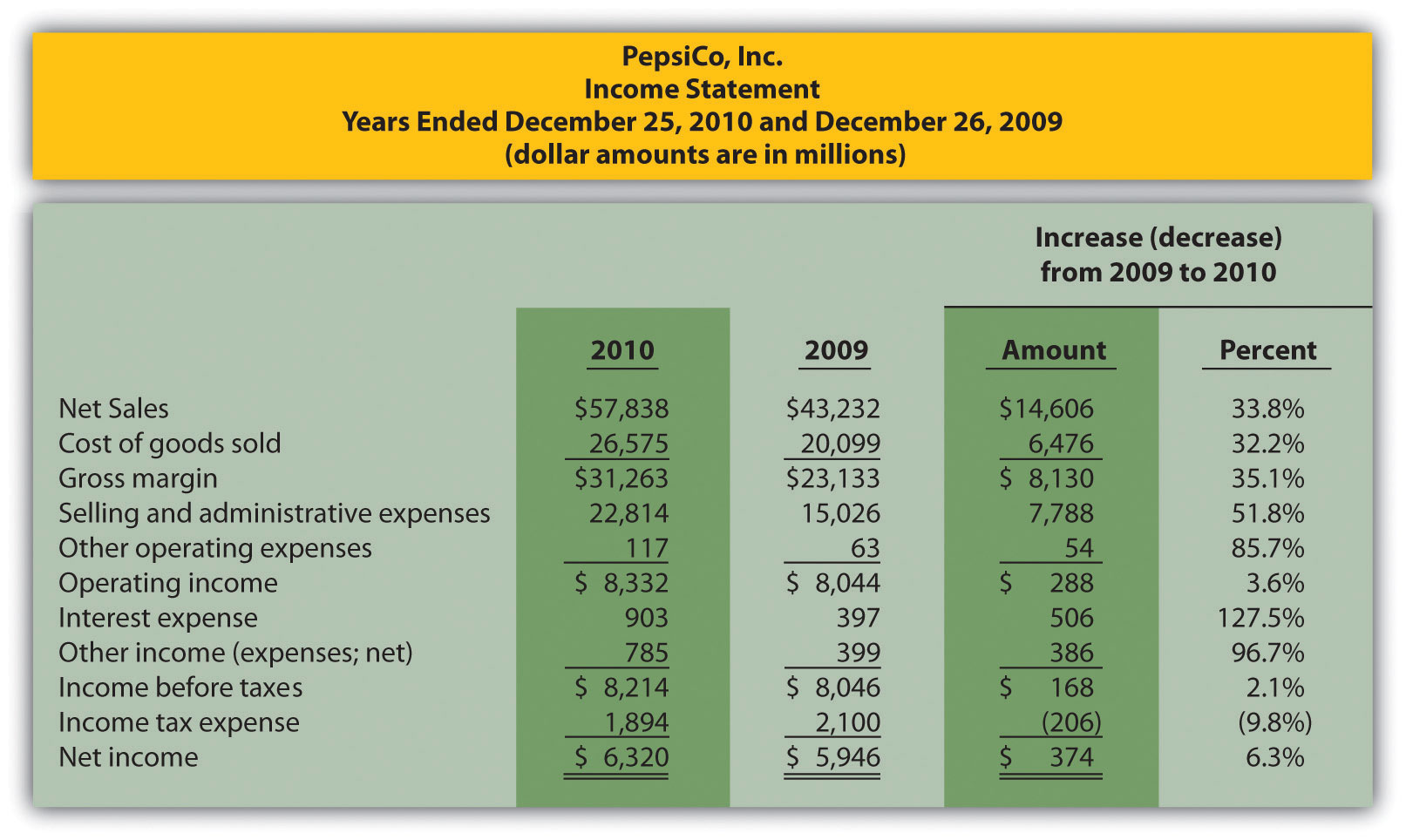

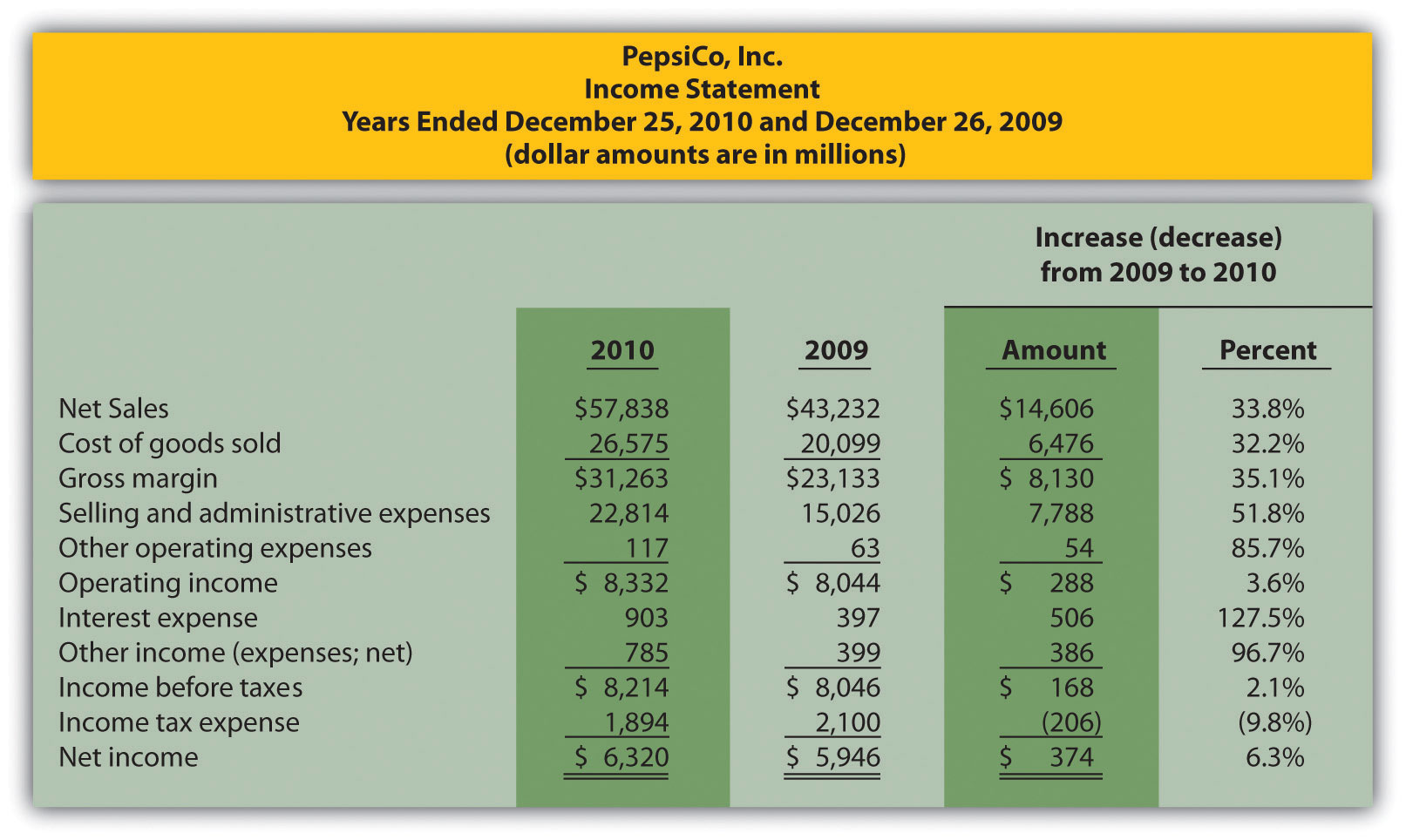

Net sales is a crucial line item on the income statement, also known as the profit and loss statement. It represents the revenue generated from a company’s core operations after deducting returns, allowances, and discounts. The specific location of net sales on the income statement may vary depending on the reporting format or accounting standards followed by the company. However, it is typically found near the top of the income statement. Here are some common ways to find net sales on the income statement:

- Sales Revenue: In some income statements, net sales may be listed as “Sales Revenue.” This line item represents the total revenue generated from the sale of goods or services before any deductions. Net sales can be obtained by subtracting returns, allowances, and discounts from this sales revenue figure.

- Net Sales: Other income statements may explicitly state “Net Sales” as a separate line item. This makes it easier for stakeholders to identify and analyze the company’s revenue generated from its core operations.

- Gross Sales: Some income statements may include both gross sales and net sales as separate line items. Gross sales represent the total amount of revenue generated from the sale of goods or services before any adjustments. Net sales can be calculated by subtracting returns, allowances, and discounts from the gross sales figure.

- Operating Revenue: In certain cases, net sales may be listed under “Operating Revenue” or “Operating Income.” This category includes all revenue generated from the company’s core operations, including sales revenue, service fees, and other operating activities.

It is important to carefully review the income statement and look for the specific line item that represents net sales. This information allows stakeholders to assess the company’s revenue generation and its ability to generate income from its core operations.

In addition to locating net sales on the income statement, it is also beneficial to examine the notes to the financial statements. These notes provide additional details and explanations regarding the composition of net sales, any significant changes or adjustments made, and any additional information relevant to understanding the company’s revenue generation.

By identifying the line item for net sales on the income statement and analyzing the accompanying notes, stakeholders can gain a comprehensive understanding of a company’s revenue generation, profitability, and financial performance.

Importance of Analyzing Net Sales

Analyzing net sales is crucial for gaining insights into a company’s revenue generation, growth potential, and financial performance. By examining this key metric, stakeholders can assess various aspects of a company’s operations and make informed decisions. Here are some reasons why analyzing net sales is important:

- Revenue Trends: Analyzing net sales over time allows stakeholders to identify trends and patterns in a company’s revenue generation. Increasing net sales may indicate strong demand for products or services, effective sales strategies, or market growth. On the other hand, declining net sales may highlight challenges or shifts in the industry or company-specific issues that need to be addressed.

- Market Position: Net sales analysis provides insights into a company’s market position and competitiveness. Comparing net sales with industry averages or competitors’ sales figures enables stakeholders to assess how well a company is performing within its sector. This analysis can help identify areas of strength or weakness and inform strategic decisions.

- Product Performance: Analyzing net sales by product or product category allows companies to evaluate the performance of specific offerings. This information can help identify best-selling products, assess the contribution of each product to overall revenue, and guide product development or marketing strategies.

- Customer Behavior: Analyzing net sales data can provide insights into customer behavior and preferences. By understanding which products or services are driving sales and identifying customer segments that contribute the most to revenue, companies can tailor their marketing efforts, improve customer targeting, and enhance customer satisfaction and retention.

- Pricing Strategy: Net sales analysis enables companies to evaluate the effectiveness of their pricing strategies. By comparing net sales with pricing changes or discounting initiatives, companies can assess the impact of different pricing approaches on revenue generation and profitability. This information can guide pricing decisions and optimize profitability.

- Forecasting and Planning: Analyzing net sales data provides a basis for forecasting future revenue and setting realistic sales targets. By examining historical sales patterns, considering market trends, and assessing internal and external factors, companies can make informed projections for budgeting, financial planning, and resource allocation.

By conducting a thorough analysis of net sales, stakeholders can gain valuable insights into a company’s revenue generation, market position, customer behavior, and profitability. This information aids in strategic decision-making, identifying areas for improvement, and capitalizing on growth opportunities.

It is worth noting that net sales analysis should not be considered in isolation but should be combined with other financial and operational metrics to gain a comprehensive understanding of a company’s overall performance.

Limitations of Net Sales

While net sales is an essential metric for assessing a company’s revenue generation and financial performance, it also has its limitations. It’s important to be aware of these limitations when analyzing net sales and to consider additional factors for a more comprehensive evaluation. Here are some key limitations of net sales:

- Doesn’t Capture Profitability: Net sales alone do not provide insights into a company’s profitability. It does not take into account the cost of goods sold (COGS) or other operating expenses. To understand the profitability of a company’s core operations, it is necessary to analyze gross profit or operating profit margins in conjunction with net sales.

- Excludes Non-Operating Income: Net sales only focuses on revenue generated from the company’s core operations and excludes non-operating income. Non-operating income includes sources such as investment gains, interest income, or one-time gains from the sale of assets. Neglecting non-operating income may result in an incomplete picture of the company’s overall financial performance.

- Doesn’t Consider Timing of Revenue Recognition: Net sales may not always reflect the timing of revenue recognition. Different accounting methods, such as cash basis or accrual basis, can affect when revenue is recognized. A company may have high net sales figures in a specific period due to the timing of revenue recognition, but this might not accurately represent the company’s ongoing revenue generation capabilities.

- Doesn’t Reflect Sales Mix: Net sales alone may not provide insights into the performance of different products, services, or customer segments. It is important to analyze the sales mix to understand which products or customer segments are driving revenue. By doing so, companies can better allocate resources and tailor strategies to maximize profitability.

- External Factors: Net sales can be influenced by external factors such as changes in the economy, market conditions, or industry trends. These factors may impact a company’s net sales figures and may need to be taken into consideration when analyzing performance. Understanding the external landscape is essential in interpreting net sales data accurately.

- Potential Manipulation: Net sales figures can be manipulated by companies to present a more favorable picture of their financial performance. This can be done through aggressive revenue recognition practices, channel stuffing, or other unethical means. Investors and analysts should exercise caution and perform due diligence to ensure the accuracy and reliability of reported net sales figures.

While net sales provides valuable insights into a company’s revenue generation, it is essential to consider its limitations and analyze additional financial and operational metrics to gain a comprehensive understanding of a company’s overall financial health, profitability, and growth potential. Net sales should be used in conjunction with other key performance indicators to make informed decisions and assess a company’s performance accurately.

Conclusion

Net sales is a critical component of financial statements that provides valuable insights into a company’s revenue generation, growth potential, and financial performance. By understanding net sales and analyzing its components, stakeholders can make informed decisions and assess a company’s overall health.

Net sales is not just a simple number on the income statement; it represents the revenue generated from a company’s core operations after deducting returns, allowances, and discounts. Analyzing net sales helps to identify revenue trends, evaluate pricing strategies, assess market position, and understand customer behavior. It also aids in forecasting and planning, allowing companies to set realistic sales targets and allocate resources effectively.

However, it is important to recognize the limitations of net sales. It does not provide insights into a company’s profitability, the timing of revenue recognition, the sales mix, or external factors that may impact sales. It is crucial to consider these factors and analyze additional financial and operational metrics for a comprehensive evaluation of a company’s performance.

Ultimately, a thorough analysis of net sales, along with other key performance indicators, assists stakeholders in making informed decisions, understanding a company’s revenue generation capabilities, and evaluating its financial health and growth potential. By utilizing this information, stakeholders can gain valuable insights and navigate the complexities of the business world with confidence.

Net sales serves as a vital tool for businesses, investors, and analysts alike, providing a foundation for assessing a company’s financial performance and making informed decisions. It is a metric that goes beyond the numbers, offering a window into a company’s revenue story and potential for continued success.