Finance

Where To Include Merchant Fees On Taxes

Published: February 24, 2024

Learn where to include merchant fees on your taxes and optimize your finances with expert advice. Understand how to maximize deductions and minimize tax liabilities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of business, the quest for profitability often leads entrepreneurs to explore various avenues for revenue generation. One such avenue is the utilization of merchant services to facilitate electronic payments from customers. While these services offer convenience and efficiency, they are not without cost. Merchant fees, also known as credit card processing fees, are charges incurred by businesses for accepting electronic payments. Understanding the implications of these fees and their treatment in the realm of taxes is crucial for business owners and individuals alike.

Merchant fees encompass a range of charges, including transaction fees, interchange fees, and assessment fees, among others. These fees are typically calculated as a percentage of the transaction amount, along with a flat fee per transaction. Given their prevalence in modern commerce, it is essential for businesses to comprehend the impact of these fees on their financial operations, including tax obligations.

This article aims to provide a comprehensive guide to navigating the terrain of merchant fees in the context of taxes. By delving into the intricacies of merchant fee treatment for both business and personal tax purposes, readers will gain valuable insights into maximizing tax efficiency while ensuring compliance with relevant regulations. Whether you are a business owner seeking to optimize tax deductions or an individual looking to understand the implications of merchant fees on personal taxes, this guide is tailored to equip you with the knowledge needed to make informed financial decisions.

Join us as we unravel the complexities of merchant fees and their intersection with tax obligations, shedding light on the strategies and considerations that can empower you to navigate this aspect of financial management with confidence and clarity.

Understanding Merchant Fees

Merchant fees, often synonymous with credit card processing fees, encompass the charges imposed on businesses for accepting electronic payments from customers. These fees are levied by payment processors, such as banks or third-party payment service providers, as compensation for facilitating secure and efficient payment transactions. Understanding the components of merchant fees is essential for businesses to grasp the financial impact of electronic payment processing on their operations.

At the core of merchant fees are transaction fees, which are charged for each electronic payment processed. These fees typically consist of a percentage of the transaction amount, combined with a flat fee for each transaction. Additionally, interchange fees, determined by the card networks (e.g., Visa, Mastercard), are incurred for the privilege of accessing the card networks’ infrastructure and processing transactions. Assessment fees, imposed by the card networks as well, further contribute to the overall merchant fee structure.

Businesses may also encounter incidental fees related to chargebacks, which occur when customers dispute a transaction. Chargeback fees are imposed when the merchant is found liable for the disputed amount, and these fees can significantly impact the overall cost of processing electronic payments.

It is important to note that the specific fee structure and rates can vary based on factors such as the type of business, the volume of transactions, the average transaction size, and the negotiated terms with payment processors. As such, businesses must carefully evaluate and compare the fee schedules of different payment processors to make informed decisions regarding their electronic payment acceptance strategies.

By gaining a comprehensive understanding of the intricacies of merchant fees, businesses can effectively assess the impact of electronic payment processing on their bottom line. Moreover, this knowledge serves as a foundation for navigating the tax implications associated with merchant fees, a critical aspect of financial management for businesses of all sizes.

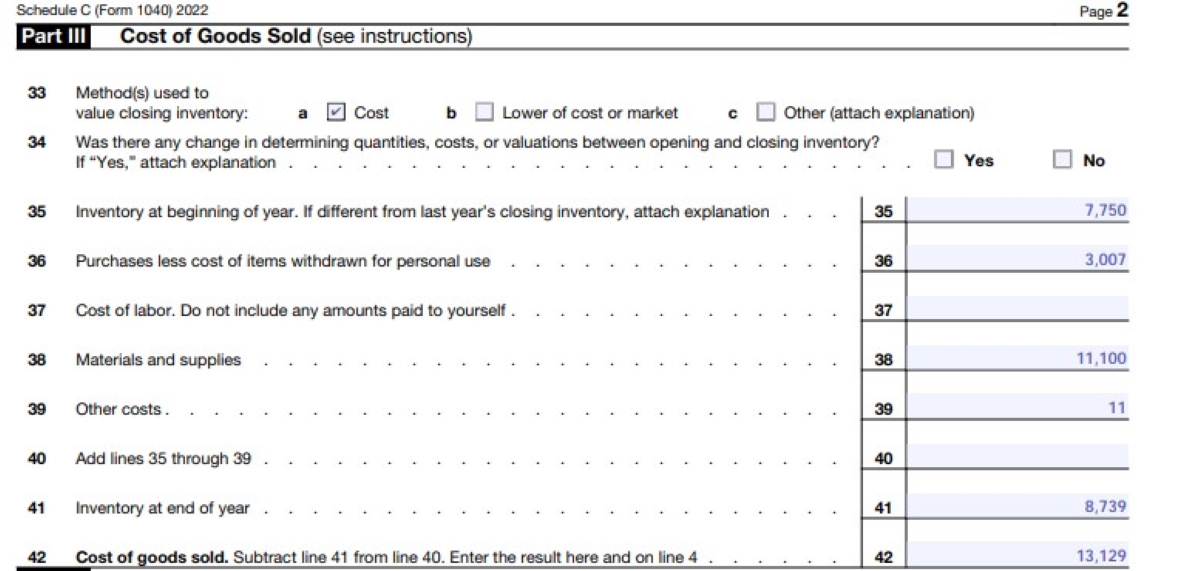

Including Merchant Fees on Business Taxes

When it comes to tax reporting for businesses, the treatment of merchant fees is a pivotal consideration that directly influences the accuracy of financial statements and tax obligations. In the context of business taxes, merchant fees are generally categorized as deductible expenses, offering a valuable opportunity for businesses to optimize their tax position.

Businesses can typically deduct merchant fees as a cost of doing business, thereby reducing their taxable income. This deduction is instrumental in reflecting the true economic cost of generating sales through electronic payment methods. By subtracting these fees from the gross income, businesses arrive at their net income, which serves as the basis for determining the tax liability.

It is crucial for businesses to meticulously track and document their merchant fees throughout the tax year, ensuring that all relevant expenses are accurately recorded for tax reporting purposes. This entails maintaining detailed records of each electronic transaction, along with associated fees, to support the deduction claimed on the tax return. Additionally, businesses should retain documentation of their agreements with payment processors, as well as any statements or reports that provide a breakdown of the incurred merchant fees.

Moreover, the proper classification of merchant fees as deductible expenses necessitates adherence to the guidelines outlined by the tax authorities. Businesses should consult with tax professionals or utilize accounting software that caters to their specific industry and transaction volume, as this can streamline the process of tracking and categorizing merchant fees for tax purposes.

By including merchant fees as deductible expenses on their tax returns, businesses can mitigate their tax burden and optimize their financial performance. This strategic approach not only aligns with sound financial management but also underscores the significance of leveraging available deductions to enhance overall tax efficiency.

Understanding the nuances of including merchant fees on business taxes empowers entrepreneurs to leverage this aspect of tax planning to their advantage, ultimately contributing to the sustainable growth and financial well-being of their businesses.

Deducting Merchant Fees on Personal Taxes

For individuals engaged in freelance work, self-employment, or other entrepreneurial endeavors, the treatment of merchant fees on personal taxes warrants careful consideration. When processing payments for goods or services rendered, individuals often incur merchant fees associated with electronic transactions. Understanding the implications of these fees within the context of personal tax reporting is essential for optimizing tax efficiency and accurately reflecting the true cost of generating income.

Self-employed individuals and freelancers can typically deduct merchant fees as a business expense on their personal tax returns. These fees are categorized as part of the cost of generating income and are subtracted from the gross income, thereby reducing the taxable income. By leveraging this deduction, individuals can align their tax reporting with the economic reality of their business operations, ultimately minimizing their tax liability.

It is imperative for individuals to maintain meticulous records of their merchant fees, documenting each electronic transaction and the associated fees incurred. This level of record-keeping serves as a critical foundation for substantiating the deduction of these expenses on the personal tax return. Additionally, individuals should retain documentation of their agreements with payment processors and any relevant financial statements that provide a comprehensive overview of the incurred merchant fees.

Given the dynamic nature of tax regulations and the nuances surrounding the treatment of business expenses on personal tax returns, individuals are encouraged to seek guidance from tax professionals or leverage user-friendly tax preparation software. By doing so, they can navigate the complexities of deducting merchant fees with confidence, ensuring compliance with tax laws while optimizing their tax position.

The strategic deduction of merchant fees on personal tax returns underscores the significance of leveraging available tax benefits to enhance overall tax efficiency. By aligning tax reporting with the economic realities of self-employment and entrepreneurial endeavors, individuals can effectively manage their tax obligations while maximizing the financial rewards of their efforts.

Understanding the process of deducting merchant fees on personal taxes equips individuals with the knowledge needed to leverage this aspect of tax planning to their advantage, fostering a proactive approach to optimizing tax efficiency and financial well-being.

Conclusion

As businesses and individuals navigate the landscape of electronic payment processing, the treatment of merchant fees on taxes emerges as a critical facet of financial management. The understanding of merchant fees, encompassing transaction fees, interchange fees, and assessment fees, is foundational to comprehending their impact on tax obligations. By recognizing these fees as deductible expenses, businesses and individuals can strategically optimize their tax position while accurately reflecting the true cost of generating income.

For businesses, the inclusion of merchant fees as deductible expenses on tax returns serves as a means of mitigating tax liability and enhancing overall financial performance. Meticulous record-keeping and adherence to tax guidelines are pivotal in substantiating these deductions, underscoring the importance of proactive tax planning and compliance.

Similarly, individuals engaged in self-employment or freelance work can leverage the deduction of merchant fees on their personal tax returns to align tax reporting with the economic realities of their entrepreneurial endeavors. By maintaining detailed records and seeking professional guidance, individuals can capitalize on available tax benefits and optimize their tax efficiency.

Ultimately, the strategic treatment of merchant fees on taxes embodies the intersection of financial prudence and regulatory compliance. It empowers businesses and individuals to navigate the complexities of tax reporting with confidence, fostering a proactive approach to maximizing tax benefits and enhancing financial well-being.

By unraveling the intricacies of merchant fees and their implications for tax reporting, this guide equips readers with the knowledge needed to make informed financial decisions. Whether optimizing tax deductions for business expenses or leveraging tax benefits for self-employment income, the strategic handling of merchant fees on taxes underscores the value of proactive tax planning in achieving financial objectives.

As businesses and individuals harness the insights gleaned from this guide, they are poised to navigate the terrain of merchant fees and taxes with clarity and precision, fostering financial resilience and sustainable growth.