Finance

Withdrawal Penalty Definition

Published: February 18, 2024

Learn the meaning of withdrawal penalty in finance and how it affects your financial decisions. Discover how these penalties can impact your savings and investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Withdrawal Penalty?

Welcome to our finance blog! Today, we will be discussing an important concept that every investor should be aware of: withdrawal penalties. If you’re wondering what a withdrawal penalty is and how it can impact your finances, you’ve come to the right place.

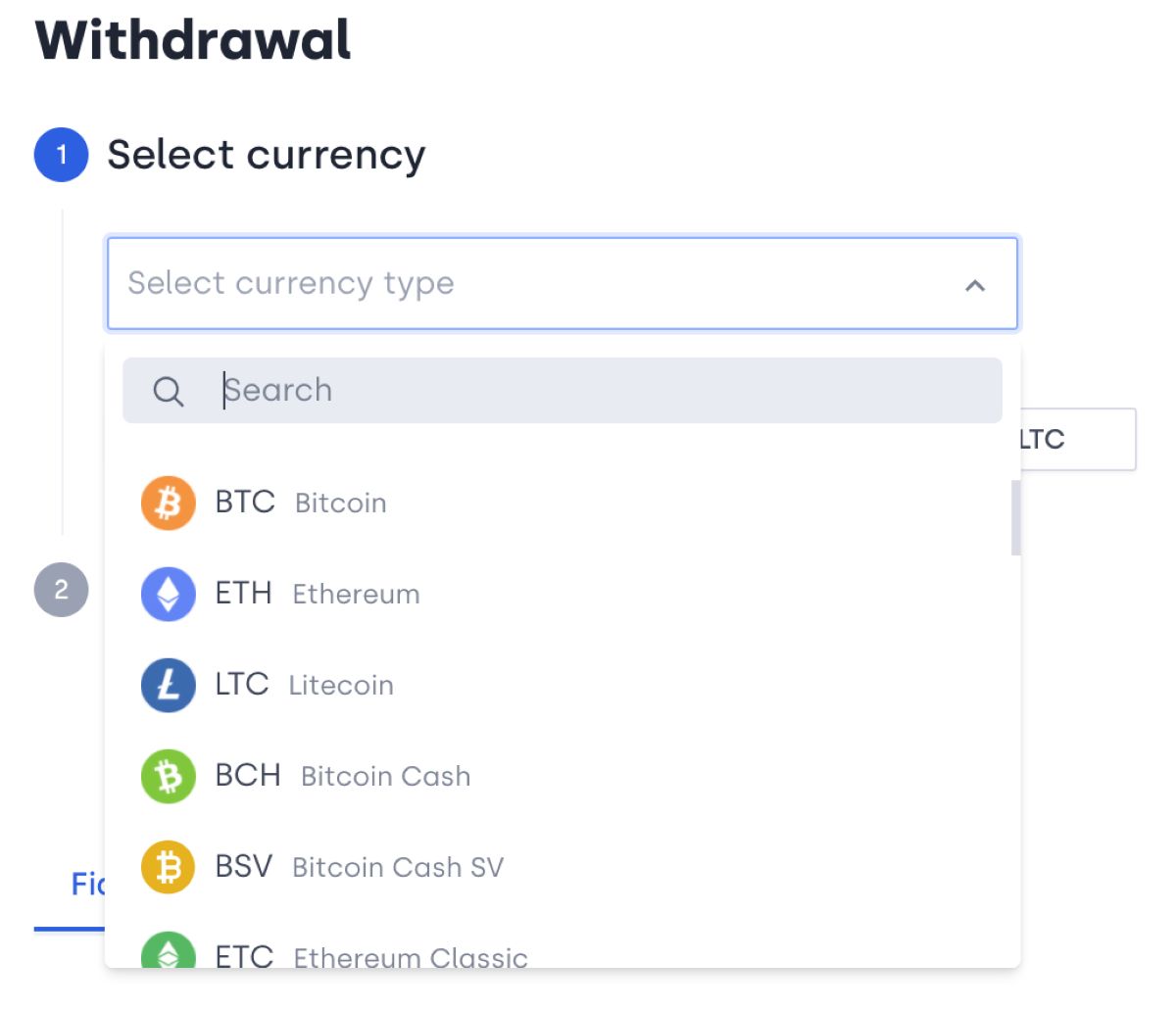

A withdrawal penalty is a fee or charge imposed on individuals who withdraw funds from certain financial accounts before a specified period of time. This penalty acts as a deterrent, encouraging account holders to keep their funds invested for a longer period. While withdrawal penalties can apply to various types of accounts, such as retirement accounts and certificates of deposit (CDs), we will focus on their implications for retirement savings in this post.

Key Takeaways:

- Withdrawal penalties are fees charged when individuals withdraw funds from a financial account before a predetermined time.

- These penalties are commonly associated with retirement accounts and CDs.

Now, let’s delve deeper into the world of withdrawal penalties and explore their significance in retirement planning.

The Significance of Withdrawal Penalties in Retirement Planning

Withdrawal penalties play a crucial role in retirement planning as they act as a safeguard, discouraging individuals from tapping into their retirement savings prematurely. Here are a few key points to consider:

- Encourages Long-Term Saving: By imposing a withdrawal penalty, retirement account providers aim to promote long-term saving habits. The penalty acts as a disincentive for account holders to dip into their retirement funds before reaching a certain age or specific milestones.

- Tax Implications: Withdrawal penalties may also have tax implications. In some cases, early withdrawals from retirement accounts may be subject to both the penalty and income tax. It’s crucial to understand the potential tax consequences before making any early withdrawals.

- Protection Against Impulsive Decisions: Retirement planning requires discipline and careful consideration. Withdrawal penalties serve as a safeguard against impulsive financial decisions, ensuring that individuals think twice before tapping into their retirement savings prematurely.

Understanding withdrawal penalties and their implications can help you make informed decisions about your retirement savings. It’s always advisable to consult with a financial advisor who can provide personalized guidance based on your individual circumstances.

We hope this blog post has shed some light on the concept of withdrawal penalties and their significance in retirement planning. Remember, it’s important to weigh the potential consequences before making any early withdrawals from retirement accounts. Stay tuned for more informative articles on our finance blog!