Finance

How To Include Pension In Retirement Planning

Published: January 21, 2024

Learn how to incorporate pension in your retirement planning to secure your financial future. Explore essential finance strategies for a stress-free retirement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Including Pension in Retirement Planning

- Understanding Your Pension Benefits

- Evaluating the Financial Impact of Your Pension

- Strategies for Maximizing Your Pension Benefits

- Assessing Alternative Retirement Income Sources

- Budgeting and Managing Your Retirement Expenses

- Seeking Professional Advice for Retirement Planning with a Pension

- Conclusion

Introduction

Planning for retirement is a crucial step in securing your financial future. As you envision the golden years of your life, it is essential to consider various income sources that will sustain you during this phase. While traditional retirement planning often revolves around savings, investments, and Social Security benefits, one significant aspect tends to be overlooked – the inclusion of a pension.

A pension is a retirement benefit provided by many employers as a way to provide their employees with a steady income during their retirement years. Understanding how to effectively incorporate your pension into your retirement plan can make a substantial difference in your financial well-being and overall quality of life.

In this article, we will delve into the importance of including your pension in your retirement planning. We will also explore how to evaluate the financial impact of your pension, strategies for maximizing your pension benefits, and alternative income sources to supplement your retirement. Additionally, we will provide insights on budgeting and managing your retirement expenses, as well as the value of seeking professional advice in creating a comprehensive retirement plan.

By understanding the intricacies of pension planning and implementing effective strategies, you can ensure a more secure and comfortable retirement. So, without further ado, let’s explore how to include your pension in your retirement planning and make the most of this valuable income source.

Importance of Including Pension in Retirement Planning

When it comes to retirement planning, incorporating your pension into the equation is crucial for several reasons. Here’s why including your pension is of utmost importance:

- Steady and reliable income: A pension provides a stable and predictable income stream during your retirement years. Unlike other investment portfolios that may fluctuate in value, a pension offers a consistent monthly payment, giving you peace of mind and financial security.

- Supplementing other retirement income: Whether you have savings, investments, or rely on Social Security benefits, your pension acts as an additional source of income. It enhances your financial situation and helps cover expenses that may not be fully met by other retirement funds.

- Longevity protection: With increasing lifespans, it’s essential to plan for a retirement that could potentially span decades. A pension ensures that you have ongoing income throughout your retirement, even as you live longer and face rising living costs.

- Retaining company benefits: If you have worked for an organization that offers a pension plan, it’s important to understand the benefits and perks that come with it. By including your pension in your retirement planning, you can maximize the advantages offered by your employer and ensure you receive all the benefits you are entitled to.

- Reducing reliance on social programs: By having a pension as part of your retirement plan, you can reduce your reliance on government-sponsored social programs such as Medicaid or Supplemental Security Income. This frees up resources for those who may need them more, while you enjoy the financial security provided by your pension.

Incorporating your pension into your retirement plan is crucial for a well-rounded and sustainable financial future. It not only provides you with a stable income stream but also complements other retirement income sources while offering longevity protection and reducing dependence on social programs.

Understanding Your Pension Benefits

Before you can effectively include your pension in your retirement planning, it’s essential to have a clear understanding of your pension benefits. Here are some key factors to consider:

- Pension type: There are various types of pensions, including defined benefit pensions and defined contribution pensions. Defined benefit pensions provide a specified monthly benefit based on factors such as your salary history and years of service. Defined contribution pensions, on the other hand, are retirement accounts funded by both the employer and employee contributions, with the final benefit dependent on investment performance.

- Vesting period: The vesting period refers to the length of time you must work for an employer before you become eligible for pension benefits. Some pensions have a vesting period of a few years, while others may require more extended periods of service.

- Payment options: Understanding the different payment options available is crucial. You may have the option to receive a lifetime annuity, where you receive a set monthly payment for the rest of your life. Alternatively, you may choose a lump-sum payment upfront or opt for a combination of both.

- Cost-of-living adjustments: Consider if your pension benefits include cost-of-living adjustments (COLAs). COLAs help protect against inflation by adjusting your monthly payment to account for rising living expenses. Ensure you understand how COLAs work and what impact they can have on your retirement income.

- Survivor benefits: If you are married or have dependents, it’s crucial to understand the survivor benefits provided by your pension plan. These benefits ensure that your spouse or other designated beneficiaries continue to receive a portion of your pension even after your passing.

- Retirement age: Determine the age at which you can start receiving your pension benefits. Some pension plans allow for early retirement with reduced benefits, while others have a specified retirement age to receive full benefits. Understanding your retirement age helps you plan for the timing of your retirement and when you can start relying on your pension income.

By thoroughly understanding the details of your pension benefits, you can make informed decisions about how to incorporate them into your retirement planning. Take the time to review your pension documents, consult with your plan administrator, and seek professional advice if needed. This knowledge will serve as a solid foundation for an effective retirement strategy that maximizes the benefits of your pension.

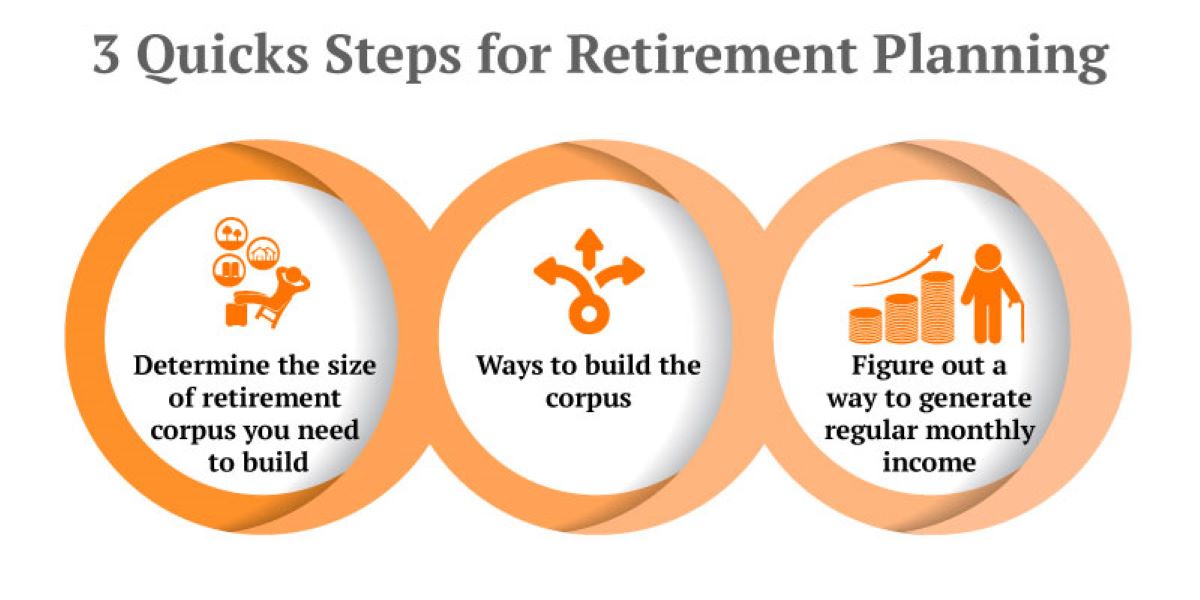

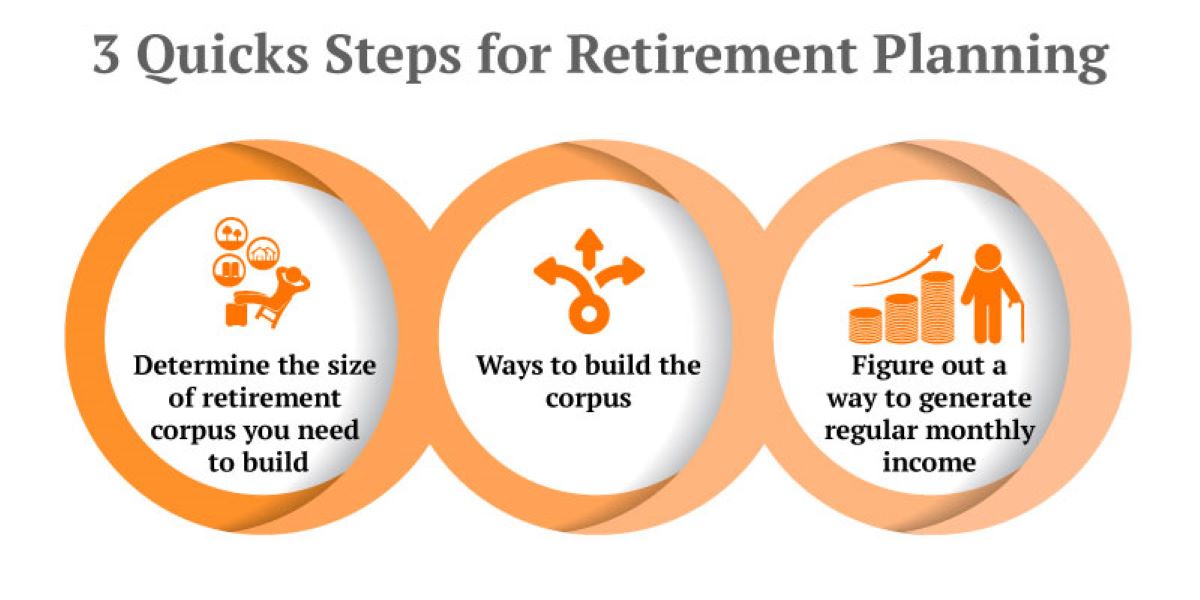

Evaluating the Financial Impact of Your Pension

Once you have a clear understanding of your pension benefits, the next step is to evaluate the financial impact it will have on your retirement. Assessing the financial aspects of your pension will help you make informed decisions and create a well-rounded retirement plan. Here are some factors to consider:

- Monthly income: Determine the amount of monthly income you will receive from your pension. This will be the foundation of your retirement budget and will help you plan for your day-to-day expenses.

- Longevity: Consider your life expectancy and how long you anticipate your retirement to last. This will help you determine the sustainability of your pension income over the long term.

- Healthcare costs: Assess the impact of healthcare costs on your retirement budget. Understand what healthcare expenses your pension covers and determine if you need to budget for additional healthcare coverage or long-term care insurance.

- Debt and liabilities: Take into account any outstanding debts or liabilities you may have. Evaluate how your pension income can be utilized to pay off these obligations and ensure you have a debt-free retirement.

- Inflation: Account for the impact of inflation on your pension income over time. While some pension plans include cost-of-living adjustments (COLAs), others may not. It’s important to factor in the rising cost of living to ensure your pension income maintains its purchasing power.

- Investments and other income sources: Assess how your pension income fits into your overall retirement portfolio. Consider your other investments, such as savings, 401(k) plans, and Social Security benefits. Determine how your pension income can be supplemented by these sources to provide a well-rounded and diversified income stream.

- Flexibility of pension withdrawals: Check if your pension plan allows for a lump-sum withdrawal or partial withdrawals. This flexibility can be useful for major expenses or unexpected financial needs during retirement.

By thoroughly evaluating the financial impact of your pension, you can gain a comprehensive understanding of how it fits into your overall retirement plan. This assessment will allow you to make strategic decisions regarding your budget, investments, and sources of income to ensure a financially secure and comfortable retirement.

Strategies for Maximizing Your Pension Benefits

Maximizing your pension benefits is an essential aspect of retirement planning. Here are some strategies to help you make the most of your pension:

- Work longer: Consider extending your working years beyond the minimum retirement age. Working longer allows you to accumulate more years of service, increasing your pension benefits when you do ultimately retire.

- Delay pension withdrawals: If your pension plan allows, consider delaying the start of your pension withdrawals. By deferring your pension payments, you can potentially receive a higher monthly benefit when you do begin withdrawals.

- Explore pension enhancements: Some pension plans offer enhancements or buy-up options that allow you to increase your monthly benefit by making additional contributions. Evaluate if these options are available to you and consider their potential benefits.

- Coordinate pensions with other retirement income: Take a holistic approach to your retirement by coordinating your pension benefits with other sources of retirement income, such as Social Security and investment accounts. This will help you create a balanced income plan that optimizes your overall financial situation.

- Consider tax implications: Understand the tax implications of your pension income. Depending on your jurisdiction, pension benefits may be subject to income tax. Consult with a tax professional to minimize your tax liability and maximize your after-tax income.

- Review survivor benefit options: If you have a spouse or dependents, carefully assess the survivor benefit options available with your pension plan. Ensure that you choose the option that provides the most financial support and security for your loved ones in the event of your passing.

- Consult with a financial advisor: Seek guidance from a financial advisor who specializes in retirement planning. They can assist you in evaluating your pension benefits, exploring different strategies, and tailoring a retirement plan that aligns with your goals and aspirations.

By employing these strategies, you can optimize your pension benefits and make the most of this valuable income source. Remember, every individual’s financial situation is unique, so it’s important to assess your specific circumstances and consult with experts who can provide personalized advice based on your needs.

Assessing Alternative Retirement Income Sources

While a pension can play a significant role in your retirement plan, it’s crucial to consider additional income sources to provide a more robust financial cushion during your retirement years. Here are some alternative retirement income sources to assess:

- Savings and investments: Evaluate your savings and investment accounts to determine how they can supplement your pension income. Explore different investment options that align with your risk tolerance and long-term financial goals.

- 401(k) and IRAs: If you have a 401(k) plan or individual retirement accounts (IRAs), review and maximize your contributions. These retirement accounts provide tax advantages and can give your retirement savings a significant boost.

- Social Security benefits: Understand your eligibility for Social Security benefits and evaluate how they will contribute to your retirement income. Determine the optimal age to begin claiming benefits to maximize your monthly payments.

- Part-time or freelance work: Consider the possibility of engaging in part-time or freelance work during your retirement. This can not only provide additional income but also keep you mentally engaged and socially connected.

- Rental income: If you own real estate properties, assess the potential for rental income. Renting out a portion of your property or investing in rental properties can generate an additional stream of cash flow.

- Dividends and interest: If you have invested in dividend-paying stocks or interest-bearing accounts, factor in the income generated from these sources. Dividends and interest can provide a steady income stream to supplement your pension.

- Health savings accounts (HSAs): Evaluate the potential benefits of HSAs in managing healthcare expenses during retirement. HSAs offer tax advantages and can be used to cover medical costs not included in your pension or other retirement income sources.

- Annuities: Explore the option of purchasing annuities to provide a guaranteed income stream during retirement. Annuities can provide additional stability and supplement your pension income.

By assessing and incorporating these alternative retirement income sources, you can create a well-rounded and diversified income portfolio. This approach not only enhances your financial security but also provides flexibility in managing your expenses and achieving your retirement goals.

Budgeting and Managing Your Retirement Expenses

Once you have assessed your pension and alternative retirement income sources, it’s crucial to create a budget and effectively manage your retirement expenses. Here are some tips to help you budget and manage your expenses during your retirement:

- Estimate your expenses: Begin by estimating your anticipated expenses during retirement. Consider factors such as housing, healthcare, transportation, groceries, leisure activities, and any outstanding debts or financial obligations. Be realistic and factor in potential increases in prices due to inflation.

- Track your spending: Maintain a record of your expenses to track how much you are actually spending in retirement. This will help you identify any areas of overspending and adjust your budget accordingly.

- Create a retirement budget: Develop a comprehensive retirement budget that outlines your income sources and assigns specific amounts for each expense category. Be mindful of your pension income, as well as the income from other retirement sources, to ensure that your expenses are well within your means.

- Consider downsizing: Assess your housing needs and consider downsizing if appropriate. Moving to a smaller home or relocating to an area with lower living costs can significantly reduce your housing expenses, freeing up money for other priorities.

- Review your healthcare coverage: Healthcare costs can be a significant part of your retirement expenses. Evaluate your healthcare coverage and consider supplemental insurance, Medicare, or long-term care insurance to protect against unexpected medical expenses.

- Minimize debt: Prioritize paying off any outstanding debts before retirement. Minimizing debt reduces your monthly expenses and allows you to allocate more funds towards enjoying your retirement.

- Plan for leisure activities: Don’t forget to set aside a portion of your budget for leisure activities and hobbies you enjoy. Retirement is meant to be a time of enjoyment, so ensure you have funds allocated for travel, hobbies, entertainment, and other activities that bring you joy.

- Revisit and adjust your budget periodically: Your retirement budget is not set in stone. As circumstances change, such as healthcare costs or fluctuations in other expenses, review and adjust your budget accordingly. Flexibility is key in managing your retirement expenses effectively.

By creating a realistic budget and diligently managing your retirement expenses, you can comfortably live within your means and enjoy the retirement lifestyle you desire. Regularly review your budget, stay mindful of your spending, and make adjustments as needed to ensure long-term financial stability.

Seeking Professional Advice for Retirement Planning with a Pension

Retirement planning can be complex, especially when it involves the inclusion of a pension. Seeking professional advice from financial advisors and retirement planners can provide valuable insights and guidance to help you make informed decisions. Here’s why seeking professional advice is essential:

- Expertise and knowledge: Financial advisors specializing in retirement planning have extensive knowledge and experience in navigating the complexities of pension plans. They can help you understand the intricacies of your pension benefits, evaluate different strategies, and create a customized retirement plan tailored to your unique needs and goals.

- Optimizing pension benefits: A professional advisor can assist you in maximizing the benefits of your pension. They can provide insights into strategies such as timing withdrawals, coordinating pensions with other income sources, and making informed choices regarding survivor benefit options.

- Risk management: Retirement planning involves assessing and managing financial risks. A professional advisor can help you evaluate risks associated with investment portfolios, budgeting, and long-term financial planning. They will guide you in creating contingency plans and implementing risk management strategies to safeguard your retirement income.

- Tax planning: Tax implications can significantly impact your retirement income. By working with a tax professional, you can minimize your tax liability and ensure that your pension benefits and other income sources are tax-efficient. They can advise you on utilizing tax-advantaged accounts and help you navigate the complexities of tax laws and regulations.

- Keeping up with changes: Retirement planning, including pensions, is subject to evolving regulations and policies. A professional advisor can stay up to date with these changes and help you adapt your retirement plan accordingly. They can provide guidance on how changes in legislation may affect your pension benefits and assist you in making well-informed decisions.

- Peace of mind: Retirement planning can be overwhelming, and having a professional advisor by your side can provide peace of mind. They offer reassurance and support throughout the process, helping you navigate the complexities and ensuring that you are on track to achieve your retirement goals.

When seeking professional advice, look for certified financial planners or advisors with expertise in retirement planning and experience working with individuals with pensions. Consider their qualifications, credentials, and track record in helping clients create successful retirement plans. A professional advisor can provide invaluable guidance and expertise to ensure that you make the most of your pension benefits and achieve a financially secure and fulfilling retirement.

Conclusion

Incorporating your pension into your retirement planning is a critical step towards ensuring a secure and comfortable financial future. By understanding your pension benefits, evaluating their financial impact, and implementing effective strategies, you can make the most of this valuable income source.

It is important to remember that your pension is just one piece of the retirement income puzzle. Assessing alternative income sources, budgeting and managing your expenses, and seeking professional advice are essential components of a comprehensive retirement plan.

By maximizing your pension benefits, exploring other retirement income sources, and creating a well-rounded budget, you can build a solid foundation for a financially secure retirement. Professional advisors can provide expertise, guidance, and peace of mind throughout the planning process.

Remember, retirement planning is a dynamic and evolving process. Regularly review and reassess your plan as your circumstances change. Stay proactive and adaptable, and make adjustments as needed to ensure that your retirement goals are met.

With careful planning, financial literacy, and the support of professionals, you can embark on a fulfilling and worry-free retirement journey, knowing that your pension and other income sources will sustain you throughout your golden years.