Finance

What Is Sales In Accounting

Published: October 12, 2023

Learn about sales in accounting and its role in finance. Understand the importance of sales for financial management and decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, sales play a vital role in accounting. Sales are the lifeblood of any business, representing the revenue generated from the products or services offered. Understanding the concept of sales in accounting is crucial for businesses to track and measure their financial performance accurately.

Sales refer to the monetary value of goods or services that a company sells to its customers. It is the primary source of income for businesses and serves as an indicator of their success. Sales transactions involve the exchange of goods or services for money or credit, creating a financial record that needs to be properly documented and accounted for.

Accounting for sales is essential because it allows businesses to keep track of their financial transactions, monitor their revenue streams, and make informed decisions based on accurate financial data. The accounting process for sales involves recording, recognizing revenue, and analyzing the performance of sales transactions.

This article will delve into the depths of sales in accounting, exploring its definition, role, and the various aspects involved in accounting for sales. We will discuss how sales transactions are recorded, how revenue is recognized, how sales returns and allowances are accounted for, and how sales discounts and other sales adjustments are handled. Additionally, we will explore the importance of monitoring sales performance and how it contributes to the overall financial health of a business.

By the end of this article, you will have a comprehensive understanding of the significance of sales in accounting and the necessary steps involved in appropriately accounting for sales transactions. So, let’s dive into the fascinating world of sales in accounting and discover how it impacts the financial landscape of businesses.

Definition of Sales

Sales, within the realm of accounting, refers to the process of exchanging goods or services for money or credit. It represents the monetary value generated when a company sells its products or services to customers. Sales are a crucial component of a company’s financial operations and are often used as a key performance indicator to evaluate business success.

Sales can take various forms, such as the sale of physical goods, such as electronics or clothing, or the provision of services, such as consulting or healthcare. Regardless of the nature of the transaction, each sale involves a transfer of value from the buyer to the seller.

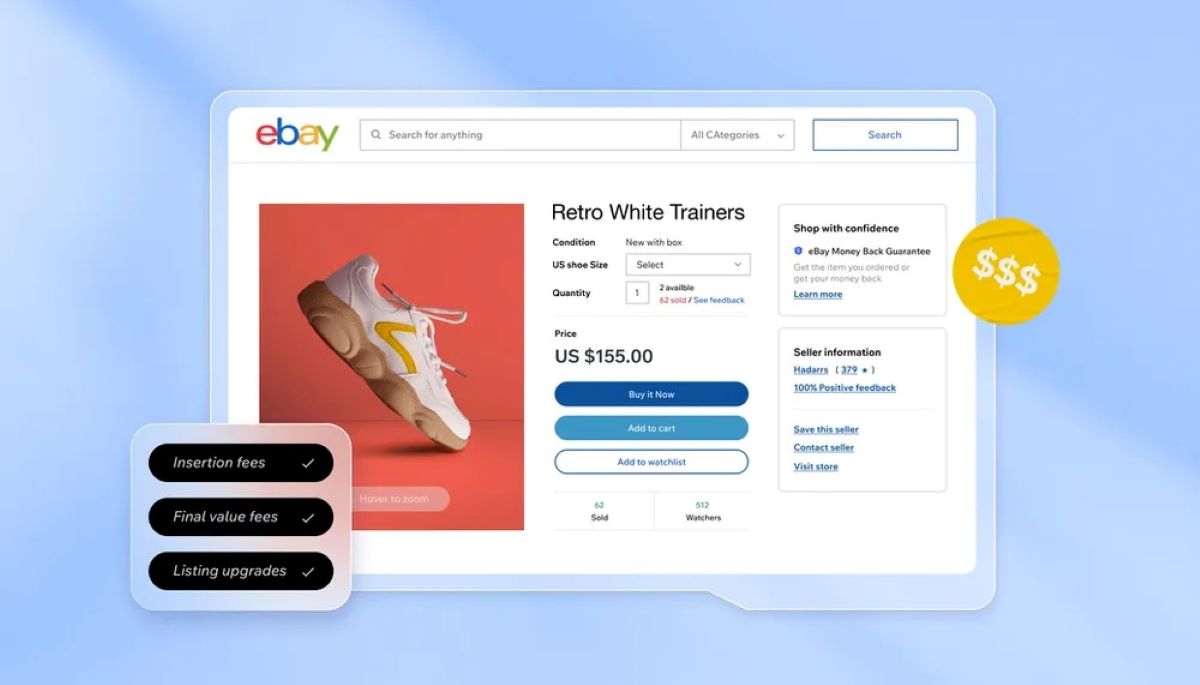

Within the accounting context, there are two main types of sales: cash sales and credit sales. Cash sales occur when a customer pays for a product or service immediately, typically in the form of cash, credit card, or debit card. In contrast, credit sales occur when a customer buys a product or service on credit, promising to pay the seller at a later date according to agreed-upon terms.

When a sale takes place, it triggers a financial transaction that needs to be accurately recorded in the books of the company. The recording of sales transactions is an essential part of the accounting process, as it enables businesses to track their revenue streams, evaluate profitability, and comply with financial reporting requirements.

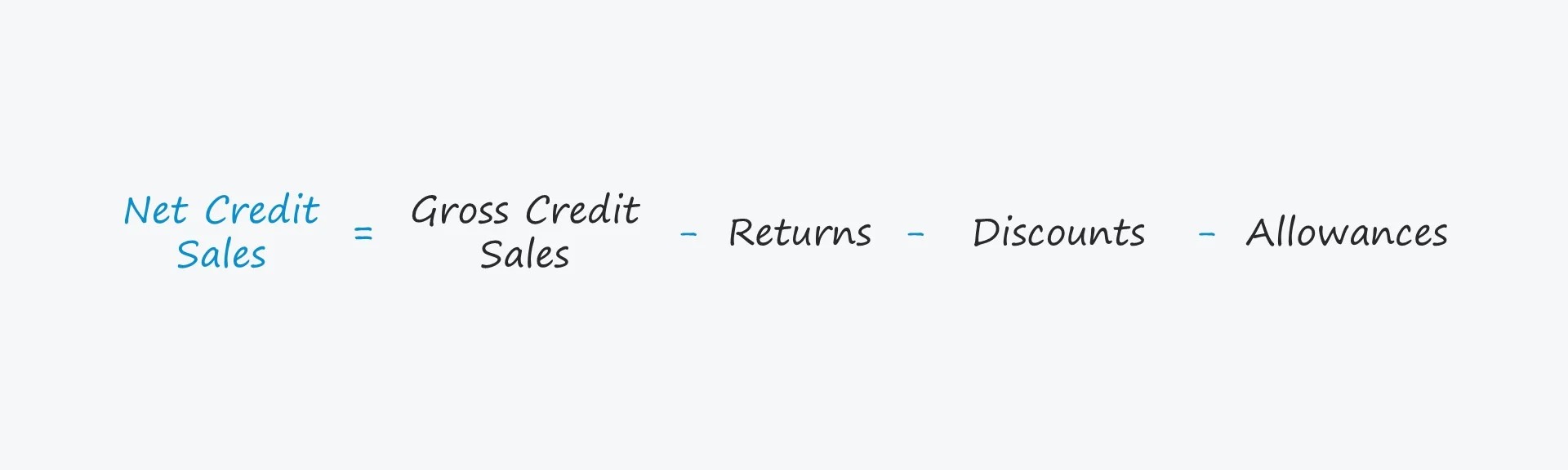

It is important to note that sales are distinct from revenue. While sales represent the total value of goods or services sold, revenue refers to the portion of sales that a company recognizes as earnings on its income statement. Revenue recognition depends on various factors, including the terms of the sale, the delivery of goods or services, and any potential future obligations or contingencies.

In summary, sales in accounting encompass the process of exchanging goods or services for money or credit. They are a fundamental aspect of a company’s financial operations and are crucial for measuring and evaluating business performance.

Role of Sales in Accounting

Sales play a pivotal role in accounting, serving as a critical component in a company’s financial activities. Let’s explore the key roles that sales fulfill within the accounting realm:

1. Revenue Generation: Sales are the primary source of revenue for businesses. They represent the income that a company earns from selling its products or services. Revenue generated from sales is essential for covering expenses, generating profits, and fueling business growth.

2. Financial Reporting: Sales are a fundamental part of a company’s financial statements, namely the income statement or profit and loss statement. The income statement showcases the revenue generated from sales alongside the expenses incurred, resulting in the net income or loss for a given period. This information helps stakeholders assess the financial health and performance of the business.

3. Performance Evaluation: Sales are a key performance indicator used to assess a company’s success. By analyzing sales data, businesses can determine their market share, identify trends, and evaluate their competitiveness. Sales figures provide insights into product demand and customer preferences, enabling companies to make informed decisions regarding inventory management, pricing strategies, and marketing efforts.

4. Cash Flow Management: Sales directly impact a company’s cash flow. Cash sales generate immediate cash inflow, while credit sales result in future cash inflow. By monitoring sales patterns, businesses can forecast cash flow and manage working capital efficiently. This ensures that the company has sufficient funds to cover expenses, investments, and debt obligations.

5. Taxation and Compliance: Sales figures are crucial in determining tax liabilities. Many jurisdictions impose sales taxes or value-added taxes (VAT) based on the value of goods or services sold. Accurate recording and reporting of sales transactions are essential for complying with tax laws, avoiding penalties, and maintaining good standing with tax authorities.

6. Business Planning and Forecasting: Sales data is a vital input for business planning and forecasting. By analyzing past sales trends, businesses can project future sales volumes, estimate revenue, and set achievable financial goals. This information helps in budgeting, resource allocation, and strategic decision-making.

In summary, the role of sales in accounting is multifaceted. Sales are instrumental in revenue generation, financial reporting, performance evaluation, cash flow management, taxation, and business planning. Accurate and timely accounting for sales transactions is essential for businesses to maintain transparency, make informed decisions, and achieve long-term financial success.

Accounting for Sales

Accounting for sales involves a series of steps to properly record and report sales transactions in a company’s financial statements. Let’s explore the key aspects of accounting for sales:

1. Recording Sales Transactions: The first step in accounting for sales is to record the sales transactions accurately. This includes documenting the date of the sale, the customer’s information, the products or services sold, and the amount of the sale. This information is typically recorded in the sales journal or the general ledger.

2. Tracking Accounts Receivable: For credit sales, it is important to track the accounts receivable balance, which represents the amount owed by customers for goods or services provided on credit. This information is essential for managing cash flow and monitoring customer payments.

3. Recognizing Revenue: Revenue recognition is a critical aspect of accounting for sales. Revenue should be recognized when it is earned, and there is a reasonable expectation of receiving payment. The two primary methods of revenue recognition are the accrual basis and the cash basis. Under the accrual basis, revenue is recognized when it is earned, regardless of when payment is received. Under the cash basis, revenue is recognized when payment is received.

4. Sales Returns and Allowances: Sales returns and allowances occur when customers return products or request a reduction in the purchase price due to defects, dissatisfaction, or other reasons. These returns and allowances need to be properly accounted for and deducted from the sales revenue. It is important to track these transactions separately to evaluate the impact on profitability and customer satisfaction.

5. Sales Discounts and Adjustments: Sales discounts are offered to customers as an incentive for prompt payment. It is important to record these discounts accurately to reflect the reduced sale amount and track the impact on revenue. Additionally, other sales adjustments, such as discounts for bulk orders or promotional campaigns, should also be properly accounted for.

6. Reconciling Sales with Cash: For cash sales, it is crucial to reconcile the amount of sales recorded with the actual cash received. This ensures that there are no discrepancies between recorded sales and the cash received, allowing for accurate financial reporting.

7. Compliance with Accounting Standards: When accounting for sales, it is important to adhere to accounting standards, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These standards provide guidelines for revenue recognition, disclosure requirements, and other aspects of accounting for sales.

By accurately accounting for sales, businesses can ensure the integrity of their financial reporting, maintain compliance with accounting standards, and make informed decisions based on reliable and comprehensive data. It is crucial to have proper internal controls and accounting systems in place to facilitate the accurate recording and reporting of sales transactions.

Recording Sales Transactions

Recording sales transactions accurately is a crucial step in the accounting process, as it provides a clear record of the revenue generated by a company. Let’s explore the key aspects of recording sales transactions:

1. Sales Journal: A sales journal is a specialized accounting journal used to record sales transactions. It typically includes columns for the date of the sale, the customer’s name or account number, a description of the product or service sold, the quantity sold, the unit price, and the total sales amount. Each sale is recorded as a separate entry in the sales journal.

2. Invoice Generation: When a sale occurs, it is common practice to generate an invoice for the customer. The invoice serves as a formal document outlining the details of the sale, including the products or services purchased, the sale amount, any applicable taxes or discounts, and the terms of payment. Invoices are usually numbered sequentially for easy tracking and reference.

3. Accounts Receivable Tracking: For credit sales, it is important to track the accounts receivable balance. This involves creating a separate accounts receivable ledger or utilizing accounting software to monitor the outstanding balances owed by customers. Each credit sale should be recorded in the accounts receivable ledger, linking it to the respective customer’s account.

4. Debit and Credit Entries: Proper recording of sales transactions involves making appropriate debit and credit entries in the accounting system. When a sale is recorded, the accounts receivable account is debited, representing the amount owed by the customer. Simultaneously, the sales revenue account is credited, reflecting the increase in revenue generated by the sale.

5. Sales Tax Considerations: If applicable, sales tax should be accounted for separately from the sales revenue. Depending on the jurisdiction and the nature of the goods or services, sales tax may need to be collected from customers and remitted to the appropriate tax authorities. It is important to accurately record and track sales tax liabilities to ensure compliance with tax regulations.

6. Timeliness and Documentation: Recording sales transactions should be done in a timely manner to ensure the accuracy and completeness of financial records. Maintaining supporting documentation, such as invoices, sales orders, and payment receipts, is crucial in providing evidence of the sale and facilitating future audits or inquiries.

7. Reconciliation: Regular reconciliation of recorded sales transactions with other financial records, such as bank statements, is essential to identify and resolve discrepancies. This process helps ensure that the recorded sales accurately reflect the actual cash inflows and that there are no errors or omissions in the accounting entries.

By carefully recording sales transactions, businesses can maintain an accurate and comprehensive record of their revenue streams. This enables them to evaluate profitability, monitor accounts receivable balances, comply with tax regulations, and make informed financial decisions. It is important to establish robust internal controls and utilize reliable accounting software to facilitate the efficient and accurate recording of sales transactions.

Recognizing Revenue from Sales

Recognizing revenue from sales is a critical aspect of accounting that determines when and how a company records revenue in its financial statements. Proper revenue recognition is essential for accurately reflecting the financial performance of a business. Let’s explore the key considerations in recognizing revenue from sales:

1. Revenue Recognition Principles: Revenue recognition is guided by specific principles, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These principles provide guidelines for when revenue should be recognized and how it should be measured. The core principle is that revenue should be recognized when it is earned and can be reliably measured.

2. Accrual Basis vs. Cash Basis: Businesses typically follow either the accrual basis or cash basis of accounting. Under the accrual basis, revenue is recognized when it is earned, regardless of when payment is received. This means that revenue is recognized when goods are delivered, services are provided, or milestones in long-term contracts are met. In contrast, the cash basis recognizes revenue when payment is received. It is important to determine the appropriate basis for revenue recognition based on accounting standards and the nature of the business.

3. Performance Obligation: Revenue recognition requires the identification of performance obligations within a sales agreement. These obligations represent commitments to transfer goods or services to customers. Revenue is recognized as these obligations are satisfied. It is crucial to assess the nature and timing of performance obligations to ensure accurate revenue recognition.

4. Direct and Indirect Revenue: Revenue can be generated through various sources, including the sale of products, rendering of services, licensing of intellectual property, or interest on loans. Each source of revenue may have specific criteria for recognition. It is important to consider the specific nature of the revenue and adhere to the relevant accounting standards for proper recognition.

5. Multiple Deliverables: In some cases, a sales agreement may involve multiple deliverables, such as bundled products or services. It is vital to appropriately allocate the total consideration received to each deliverable based on their relative standalone selling prices. Revenue is then recognized for each deliverable as the associated performance obligations are satisfied.

6. Estimates and Adjustments: Revenue recognition may require the use of estimates, especially for long-term contracts or uncertain revenue streams. It is important to regularly evaluate these estimates and make necessary adjustments to ensure accurate revenue recognition.

7. Disclosure Requirements: Depending on accounting standards, there may be specific disclosure requirements regarding revenue recognition. This includes providing clear and transparent information about the nature of revenue, significant revenue streams, and any potential constraints or contingencies.

By following the appropriate revenue recognition principles and guidelines, businesses can accurately reflect their financial performance. Proper revenue recognition ensures transparency, compliance with accounting standards, and the provision of reliable financial information to stakeholders. It is crucial to stay abreast of accounting standards and consult with accounting professionals to ensure proper recognition of revenue from sales.

Accounting for Sales Returns and Allowances

Accounting for sales returns and allowances is an essential aspect of the financial management process. Sales returns and allowances occur when customers return products or request a reduction in the purchase price. Properly accounting for these transactions allows businesses to accurately track revenue, manage customer relationships, and assess the impact on profitability. Let’s delve into the key considerations in accounting for sales returns and allowances:

1. Sales Returns: When a customer returns a product due to defects, dissatisfaction, or other reasons, it is important to record the return in the accounting records. A separate account, such as “Sales Returns” or “Allowances,” is typically used to track the value of returned products. The original sale amount is deducted from the sales revenue, reducing the overall revenue earned.

2. Allowances: Allowances refer to the reduction in the purchase price granted to customers for various reasons, such as product defects, shipping delays, or customer dissatisfaction. These allowances are recorded separately from sales returns but have a similar impact on revenue. The value of the allowance is deducted from the sales revenue to reflect the reduced sale amount.

3. Product Valuation: Accounting for sales returns and allowances may require businesses to reassess the value of returned products. The value of returned goods is often lower than their original sale price due to wear and tear, obsolescence, or other factors. Proper evaluation of returned products allows for the appropriate adjustment to the inventory value and the recognition of potential losses.

4. Timing of Recognition: Sales returns and allowances should be recognized in the same period in which the original sale occurred. This ensures accurate reporting of revenue for a specific accounting period. It is crucial to record the returns and allowances promptly to reflect the true financial impact on sales revenue and profitability.

5. Customer Refunds: When a sales return is approved, businesses often issue customer refunds. These refunds are typically made in the form of cash, credit to the customer’s account, or replacement of the product. The refund amount needs to be accurately recorded, linking it to the original sales transaction and properly reflecting the adjustment in the accounting records.

6. Monitoring and Analysis: Accounting for sales returns and allowances involves ongoing monitoring and analysis. Monitoring return rates, reasons for returns, and trends help identify areas for improvement in product quality, customer service, or marketing efforts. Analyzing return data allows businesses to assess the impact of returns on profitability, evaluate customer satisfaction, and make informed decisions to reduce returns and improve customer retention.

7. Disclosure Requirements: Financial reporting standards may have disclosure requirements surrounding sales returns and allowances. These requirements aim to provide stakeholders with relevant information about the company’s sales performance, return policies, and the impact of returns on financial statements. Compliance with disclosure standards enhances transparency and provides a complete picture of a company’s financial position.

By properly accounting for sales returns and allowances, businesses can accurately reflect revenue, manage customer relationships effectively, and make informed decisions to improve profitability. It is crucial to establish internal controls, maintain clear return policies, and regularly review return data to ensure accurate recording and reporting of sales returns and allowances.

Sales Discounts and Other Sales Adjustments

In the realm of accounting, sales discounts and other sales adjustments are important factors to consider when recording and reporting sales transactions accurately. These adjustments can impact the total revenue earned and provide insights into the pricing strategies and performance of a business. Let’s explore the key aspects of sales discounts and other sales adjustments:

1. Sales Discounts: Sales discounts are offered to customers as an incentive for prompt payment. These discounts are typically expressed as a percentage or a fixed amount and are deducted from the original sale price. The purpose of sales discounts is to encourage customers to pay early and improve cash flow for the business. It is important to record sales discounts accurately to reflect the reduced sale amount and track their impact on revenue.

2. Trade Discounts: Trade discounts are common in business-to-business transactions, where volume or bulk purchases are involved. Unlike sales discounts, trade discounts are not dependent on the timing of payment. Instead, they are applied before or during the negotiation of the sale, resulting in a lower list price. Trade discounts are usually expressed as a percentage and are not separately recorded in the accounting books.

3. Rebates and Incentives: Rebates and incentives are offered to customers as a form of post-sale discount. These arrangements may involve a refund or credit to the customer after the sale is completed. Rebates and incentives need to be properly recorded to accurately reflect the net sale amount and assess their impact on revenue and profitability.

4. Sales Adjustments: Other sales adjustments may include price adjustments, product returns, cancellations, or other specific scenarios that impact the original sale. These adjustments may result in changes to the sales revenue or the cost of goods sold. Proper accounting for these adjustments is crucial to maintain accurate financial records and reflect the true financial impact on the business.

5. Proper Documentation: To ensure accurate recording of sales discounts and other sales adjustments, it is important to maintain proper documentation. This includes sales agreements, invoices, credit notes, and any additional supporting information related to adjustments made. Clear documentation provides evidence of the adjustments and assists with audits, analysis, and compliance with accounting regulations.

6. Impact on Financial Statements: Sales discounts and other sales adjustments have direct implications for a company’s financial statements. These adjustments affect the revenue figure reported in the income statement and may impact the overall profitability of the business. Additionally, disclosure requirements may exist regarding the nature and extent of sales discounts and other sales adjustments in the financial statements.

7. Analysis and Evaluation: Regular analysis and evaluation of sales discounts and other sales adjustments are essential. This includes monitoring discount rates, understanding the impact on sales volume and revenue, and assessing the effectiveness of discount and pricing strategies. Analyzing these adjustments provides insights into customer behavior, market trends, and the overall financial performance of the business.

By accurately accounting for sales discounts and other sales adjustments, businesses can track revenue effectively, evaluate pricing strategies, manage cash flow, and make informed decisions to enhance profitability. Internal controls, clear policies, and accurate documentation are necessary to ensure the proper recording and reporting of these sales adjustments.

Monitoring Sales Performance

Monitoring sales performance is crucial for businesses to evaluate their financial health, assess the effectiveness of their sales strategies, and make informed decisions to drive growth. By closely monitoring sales data and key performance indicators, companies can identify trends, measure progress, and adjust their strategies accordingly. Here are the key aspects of monitoring sales performance:

1. Sales Metrics: Tracking and analyzing sales metrics provide insights into the performance of the sales team and the overall sales process. Common sales metrics include total sales revenue, sales growth rate, average order value, customer acquisition cost, conversion rate, and sales pipeline conversion rate. Monitoring these metrics enables businesses to assess their performance against targets, identify areas for improvement, and implement effective sales strategies.

2. Comparisons and Benchmarks: To gain a clear understanding of sales performance, it is important to compare results to industry averages, previous periods, or competitors. This facilitates benchmarking and helps identify areas where performance is lagging or excelling. By analyzing the gaps, businesses can make necessary adjustments and set realistic sales goals.

3. Sales Forecasting: Sales forecasting involves predicting future sales based on historical data, market trends, and other factors. By accurately forecasting sales, businesses can set realistic targets, allocate resources effectively, and make informed decisions regarding production, inventory management, and marketing strategies. Regularly monitoring actual sales against forecasted sales helps measure performance and refine forecasting methods.

4. Customer Feedback and Satisfaction: Tracking customer feedback and satisfaction levels is essential for improving sales performance. Customer surveys, reviews, and feedback channels provide valuable insights into customer satisfaction, preferences, and pain points. By actively listening to customers and incorporating their feedback into sales strategies, businesses can enhance customer satisfaction, loyalty, and retention.

5. Sales Team Performance: Monitoring the performance of the sales team is vital for identifying areas of improvement and providing necessary training and support. Key performance indicators for sales team evaluation may include individual sales targets, conversion rates, average deal size, and sales activity metrics. Regular performance reviews, coaching sessions, and feedback sessions help align the sales team with company goals and motivate them to achieve better results.

6. Market and Competitive Analysis: Staying informed about market trends and competitors is critical for sales performance monitoring. Monitoring market changes, customer preferences, and competitive strategies allows businesses to adapt and stay ahead. Analyzing competitors’ pricing, product positioning, and marketing tactics helps identify opportunities to differentiate and gain a competitive edge.

7. Continuous Improvement: The process of monitoring sales performance should be continuous. Regular analysis, review, and adjustment of sales strategies and tactics are essential for driving continuous improvement. By identifying strengths, weaknesses, and opportunities, businesses can refine their approach, implement new sales techniques, and optimize their sales efforts.

By diligently monitoring sales performance, businesses can proactively identify challenges, capitalize on opportunities, and improve overall sales effectiveness. Regular evaluation and refinement of sales strategies, combined with continuous training and development for the sales team, contribute to sustainable business growth and profitability.

Conclusion

Accounting for sales is a critical aspect of financial management for businesses across various industries. Sales represent the primary source of revenue and play a vital role in evaluating business performance. Properly accounting for sales transactions enables businesses to track revenue accurately, make informed decisions, and comply with financial reporting requirements.

In this article, we explored the definition of sales in accounting and highlighted their significance as the monetary value generated from the exchange of goods or services for money or credit. We discussed the role of sales in financial reporting, performance evaluation, cash flow management, taxation, and business planning.

Furthermore, we examined the key steps involved in accounting for sales, including recording sales transactions, tracking accounts receivable, recognizing revenue, accounting for sales returns and allowances, and handling sales discounts and other adjustments. Each of these steps contributes to maintaining accurate financial records and providing transparent information to stakeholders.

Monitoring sales performance was also emphasized as a crucial aspect of accounting for sales. By tracking sales metrics, measuring performance against benchmarks, forecasting future sales, evaluating customer feedback, and analyzing market trends, businesses can make data-driven decisions to improve sales strategies and achieve long-term growth.

In conclusion, accounting for sales is a complex process that requires attention to detail, adherence to accounting standards, and continuous monitoring. Accurate accounting for sales ensures the reliability of financial statements, supports effective decision-making, and enhances the overall financial health of a business. By understanding and implementing the principles and best practices discussed in this article, businesses can optimize their sales processes, maximize revenue, and achieve sustainable success.