Finance

Balance Reporting Definition

Published: October 13, 2023

Learn the meaning of balance reporting in finance and how it contributes to financial management. Understand its significance in maintaining accurate financial records.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to the Finance Category: Balance Reporting Definition

When it comes to managing your finances, understanding balance reporting is crucial. In simple terms, balance reporting refers to the process of documenting and presenting an accurate summary of the financial position of an individual, organization, or entity. This blog post aims to shed light on the importance of balance reporting and how it can help you make informed financial decisions.

Key Takeaways:

- Balance reporting is a critical component of financial management.

- It provides a snapshot of an entity’s financial health and helps in decision-making.

Now, let’s dive deeper into the world of balance reporting and its significance.

Why is Balance Reporting Important?

Balance reporting plays a pivotal role in the financial landscape, serving as the foundation for accurate financial planning and analysis. Here’s why it is so important:

- Financial Health Assessment: Balance reporting allows individuals and organizations to assess their financial health by providing a clear picture of their assets, liabilities, and equity. By analyzing this information, you can determine your net worth and identify areas where you may need to adjust your financial strategies.

- Informed Decision-Making: Having access to reliable balance reports enables informed decision-making. Whether it’s evaluating potential investment opportunities, applying for loans, or making budgetary decisions, balance reporting helps you understand the impact of your choices on your overall financial position.

- Compliance and Accountability: Organizations are often required by law to prepare regular balance reports for compliance and regulatory purposes. Accurate and transparent reporting ensures that businesses meet legal obligations while maintaining accountability to stakeholders.

- Relationship with Investors and Lenders: For businesses seeking investment or financing, balance reports are essential. Investors and lenders rely on these reports to assess the financial stability and creditworthiness of an organization before making any commitments.

Components of Balance Reporting

A balance report typically consists of three key components:

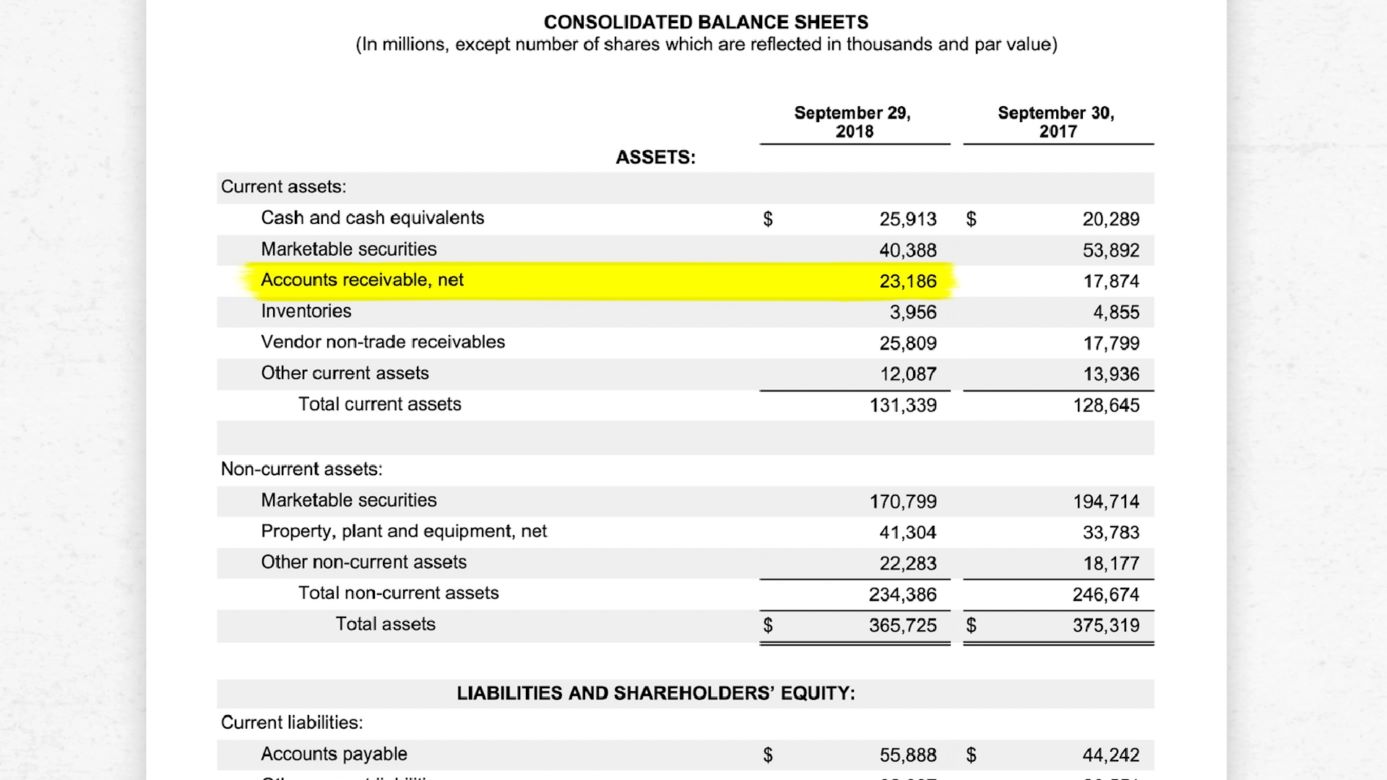

- Assets: Assets refer to anything of value that an individual or organization owns, such as cash, investments, property, or equipment.

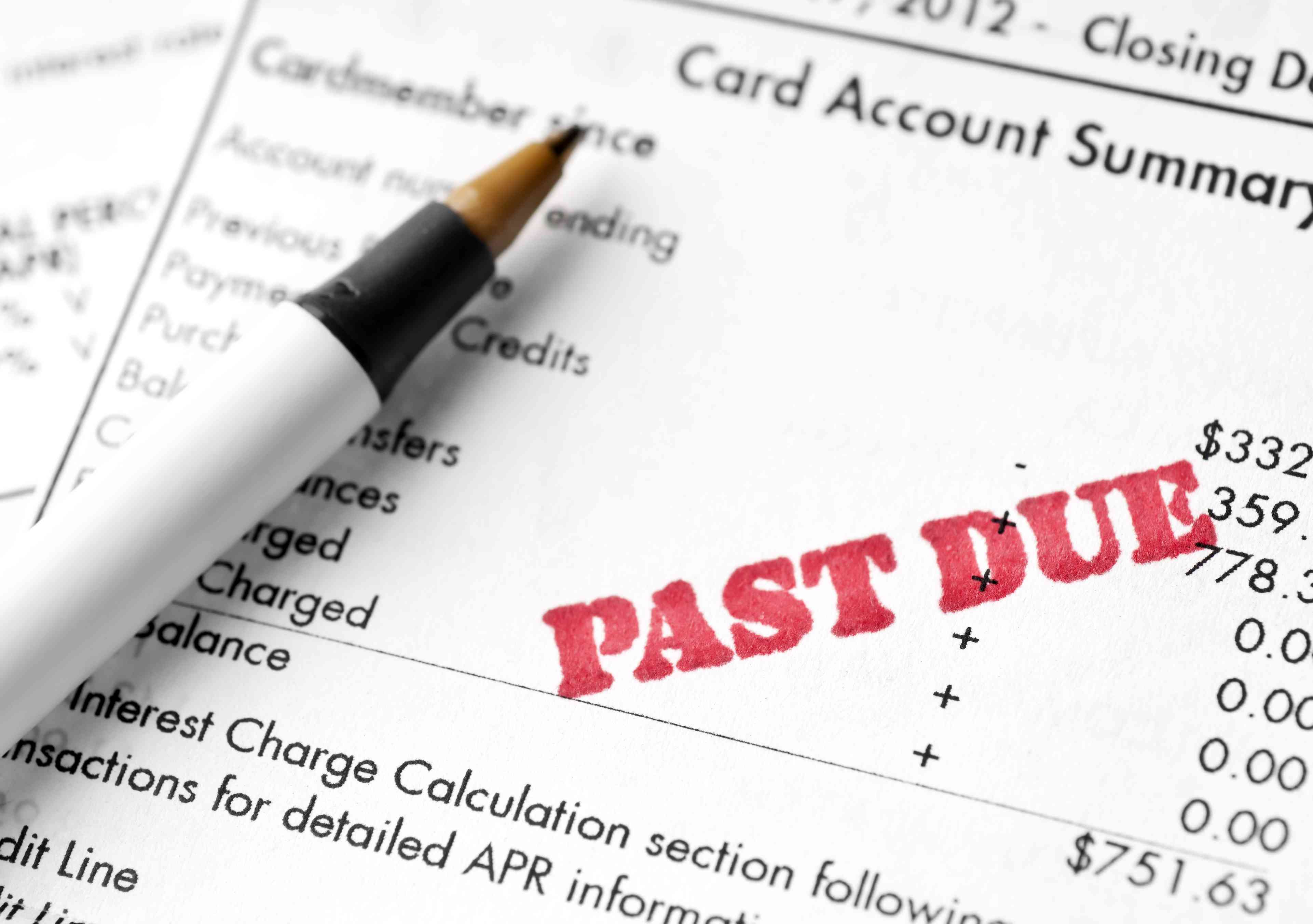

- Liabilities: Liabilities are the debts and obligations owed by an individual or organization, including loans, credit card balances, or outstanding bills.

- Equity: Equity represents the ownership interest in an entity and is calculated as the difference between assets and liabilities. It reflects the net worth of an individual or the ownership stake held by shareholders in a company.

Wrapping Up

Understanding balance reporting is crucial for effective financial management. It provides valuable insights into an individual’s or organization’s financial health, informs decision-making, ensures compliance, and fosters trust with investors and lenders. By consistently monitoring and analyzing your balance reports, you can plan for a secure financial future and achieve your goals.

Take control of your finances today by staying informed through balance reporting!