Home>Finance>Credit Balance Definition, Meaning And Examples

Finance

Credit Balance Definition, Meaning And Examples

Published: November 5, 2023

Looking to explore the credit balance definition in finance? Understand its meaning and get examples to better manage your financial transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Credit Balance: Understanding the Definition, Meaning, and Examples

When it comes to managing your finances, it’s important to have a clear understanding of different financial terms. One such term is credit balance. But what exactly is a credit balance? This blog post aims to provide you with a comprehensive overview of the definition, meaning, and examples of credit balance.

Key Takeaways:

- Credit balance refers to the excess amount of funds that you have in your account. It usually occurs when your payments or deposits exceed the total amount you owe.

- A credit balance can result from various financial transactions, including refunds, overpayments, or rewards earned from credit cards or loyalty programs.

So, let’s delve deeper and explore the concept of credit balance.

Understanding Credit Balance

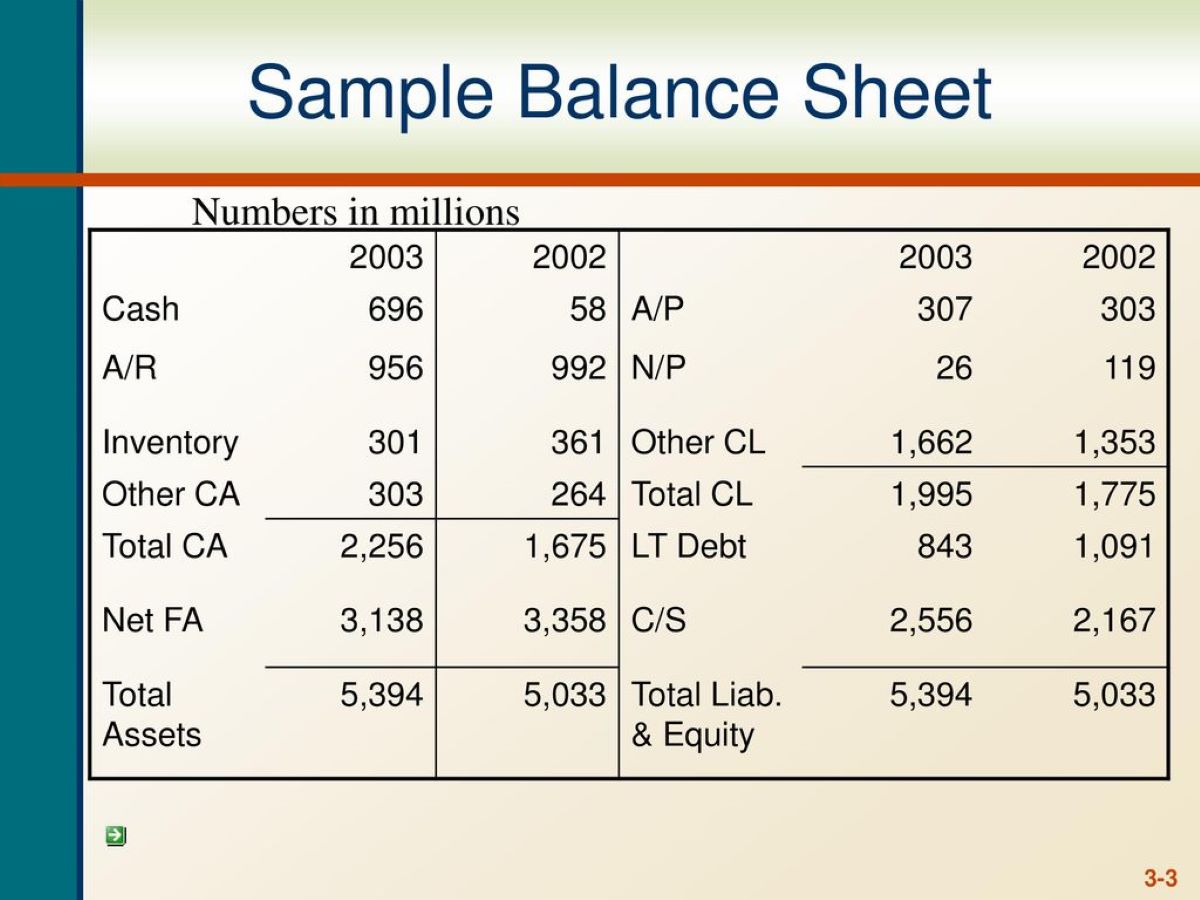

In simple terms, a credit balance occurs when the funds in your account exceed the amount you owe. It is essentially the opposite of a debit balance, where you owe more money than you have. A credit balance is typically found in a variety of financial accounts, including bank accounts, credit cards, and store credit.

Now, let’s look at a few common examples of credit balance:

- Overpayment: Let’s say you made a payment toward a credit card bill, but the actual bill amount was lower than what you paid. This excess amount will create a credit balance in your credit card account.

- Returns and Refunds: When you return a product or receive a refund for a service you previously paid for, the refunded amount will create a credit balance in your bank account or credit card statement.

- Rewards and Cashback: Many credit cards and loyalty programs offer rewards or cashback on purchases. These rewards accumulate as a credit balance, which can be redeemed or used for future purchases.

It’s important to note that a credit balance may not always be a positive thing. While it indicates that you have excess funds, it can also have implications on your financial health depending on the context. For example, in some cases, a credit balance on a credit card could mean missed opportunities for earning interest on your savings.

What to do with a Credit Balance?

When you have a credit balance, you have a few options on how to utilize it:

- Request a refund: If the credit balance is due to an overpayment, you can contact the respective financial institution and request a refund of the excess amount.

- Keep it for future use: In some cases, it may be beneficial to keep the credit balance for future transactions. This is particularly relevant for store credits or rewards earned through loyalty programs.

- Transfer funds: If the credit balance is in a bank account, you can choose to transfer the funds to another account or use it to offset future payments.

However, it’s important to review the terms and conditions of your financial accounts to understand how they handle credit balances. Different institutions may have varying policies and may impose certain restrictions on the utilization of credit balances.

In Conclusion

In summary, a credit balance represents the surplus amount of funds in your account. It can result from a variety of financial transactions, including overpayments, refunds, and rewards. While a credit balance can provide certain advantages and options for managing your finances, it’s important to understand the implications and make informed decisions.

By having a clear understanding of credit balance, you can effectively manage your finances and make the most of your financial resources. So, the next time you come across a credit balance, you’ll know what it means and how to navigate it.