Home>Finance>Which Factor Influences Health Insurance Premiums?

Finance

Which Factor Influences Health Insurance Premiums?

Modified: December 30, 2023

Discover how finance plays a crucial role in determining health insurance premiums. Uncover the key factors that impact your healthcare costs and make informed choices for a better financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Health insurance is a critical aspect of financial planning and well-being for individuals and families. It provides coverage for medical expenses, ensuring that individuals are not burdened with exorbitant healthcare costs in times of need. However, health insurance premiums can vary significantly depending on various factors. Understanding these factors can help individuals make informed decisions when opting for a health insurance plan.

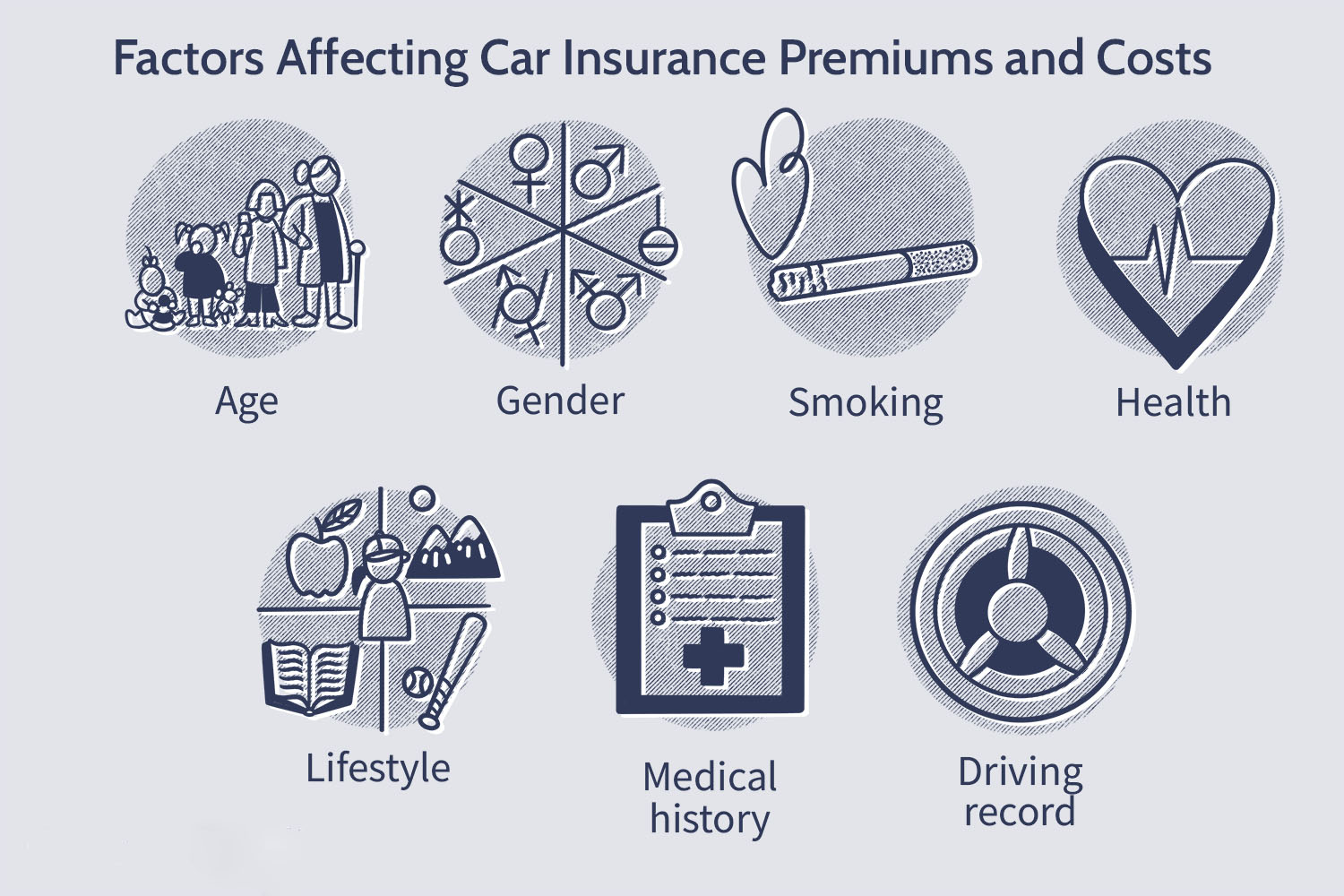

In this article, we will explore the key factors that influence health insurance premiums. From age and gender to lifestyle habits and pre-existing conditions, these factors play a crucial role in determining the cost of health insurance coverage. By understanding these factors, individuals can assess their own insurance needs and find the most cost-effective options.

It’s important to note that while these factors influence premiums, they do not necessarily determine eligibility for health insurance coverage. Insurance companies must adhere to certain regulations and cannot discriminate against individuals based on these factors alone. However, these factors are considered by insurance companies when calculating premiums, as they help assess the level of risk associated with providing coverage.

Age

One of the most significant factors that influence health insurance premiums is age. Generally, the older an individual is, the higher their insurance premiums tend to be. This is because older individuals typically require more frequent medical care and are more likely to develop chronic illnesses.

The reasoning behind this is straightforward – as we age, our bodies naturally go through changes and become more prone to health issues. This means that older individuals are more likely to require medical attention and incur higher healthcare costs. Insurance companies take this into account when calculating premiums to ensure that they can adequately cover the potential medical expenses of older policyholders.

Typically, health insurance premiums increase more significantly once an individual reaches their 40s and continue to rise as they progress into their 50s and beyond. This is known as “age rating,” which allows insurance companies to adjust the premiums based on the age of the individual.

For younger individuals, on the other hand, health insurance premiums tend to be comparatively lower. This is because younger individuals generally have fewer health issues and require less medical care. However, it’s important to note that the specific age ranges and premium variations can vary depending on the insurance company and the specific plan being considered.

It’s worth mentioning that age-related premium variations are not limited to individual policies; they also apply to group health insurance plans. Here, the average age of the group members is taken into consideration, and the premium rates are adjusted accordingly.

Overall, age plays a crucial role in determining health insurance premiums. It’s important for individuals to understand how age can impact their premiums and consider this factor when choosing a health insurance plan. Additionally, it’s essential to review and reassess coverage needs regularly as one’s age and healthcare needs change over time.

Gender

Gender is another factor that can influence health insurance premiums. Historically, women have tended to pay higher premiums compared to men. This is due to several factors related to healthcare utilization, including reproductive health and maternity care.

Insurance companies generally consider women to have higher healthcare costs over their lifetime due to factors such as pregnancy, childbirth, and regular gynecological care. These costs are factored into the premiums for women, leading to higher rates compared to men.

However, it’s important to note that in recent years, there have been regulatory changes prohibiting insurance companies from charging higher premiums based solely on gender. This means that insurance premium pricing cannot be solely determined by gender. Instead, other factors such as age, location, and plan type are taken into consideration.

While gender may no longer be the sole determinant of health insurance premiums, it can still indirectly impact costs. For example, women may have higher premiums if they opt for plans that offer comprehensive coverage for reproductive health or maternity care.

It’s essential for individuals to review their coverage needs and consider any potential gender-specific factors that may impact their health insurance premiums. Understanding the coverage options and associated costs can help individuals make informed decisions that align with their healthcare needs and budget.

Overall, while gender may not be the primary factor influencing health insurance premiums, there may still be variations based on reproductive health and maternity care coverage. Individuals should carefully evaluate their options and select a plan that best meets their needs while considering any potential gender-related considerations.

Health Condition

When it comes to health insurance premiums, an individual’s health condition plays a crucial role in determining the cost of coverage. Insurance companies assess the health status of individuals to evaluate the level of risk associated with providing coverage.

If an individual has a pre-existing health condition, insurance companies may consider them to be higher risk and, as a result, charge higher premiums. Pre-existing conditions can range from chronic illnesses such as diabetes or heart disease to previous surgeries or ongoing medical treatments.

Health insurance premiums are typically lower for individuals who are in good health and have no significant pre-existing conditions. This is because they are less likely to require frequent medical care or incur higher healthcare costs.

In some cases, insurance companies may require individuals to undergo a medical examination or provide detailed information about their health history before offering coverage. This allows them to assess the potential risks associated with providing coverage and adjust premiums accordingly.

Furthermore, an individual’s overall health habits can also influence health insurance premiums. Insurance companies may consider factors such as smoking habits, alcohol consumption, and body mass index (BMI) when calculating premiums. Individuals with unhealthy habits or a high BMI may be considered higher risk and may face higher premiums.

It’s important for individuals to disclose their health conditions accurately when applying for health insurance. Failing to disclose pre-existing conditions may lead to coverage denials or limitations in the future. Additionally, individuals with pre-existing conditions may need to explore options such as government-sponsored programs or employer-sponsored plans that offer coverage regardless of health status.

In summary, an individual’s health condition, including pre-existing conditions and overall health habits, can significantly impact health insurance premiums. Individuals should be transparent about their health status when applying for coverage and explore options that best suit their needs and budget.

Smoking Habits

One of the key factors that influence health insurance premiums is an individual’s smoking habits. Insurance companies consider smoking to be a significant risk factor for various health conditions, including cancer, heart disease, respiratory diseases, and more. As a result, smokers typically face higher health insurance premiums compared to non-smokers.

Smoking not only poses health risks but also increases healthcare costs in the long run. Smokers are more likely to require expensive medical treatments and ongoing care, which insurance companies take into account when calculating premiums.

Insurance companies may ask individuals to disclose their smoking status when applying for health insurance coverage. Those who are identified as smokers may be subject to higher premiums due to the increased health risks associated with smoking.

It’s important to note that insurance companies can require individuals to undergo a nicotine test as part of the underwriting process. If nicotine is detected in the individual’s system, they may be classified as a smoker, even if they only smoke occasionally.

However, some insurance companies differentiate between different smoking habits. For example, individuals who have recently quit smoking may be considered “non-smokers” after a certain period of time. This period can vary depending on the insurance company and the specific policy being considered.

In summary, smoking habits can have a significant impact on health insurance premiums. Smokers typically face higher premiums due to the increased health risks associated with smoking. Individuals who smoke should consider quitting not only for their overall health but also to potentially reduce their health insurance costs in the long run.

Geographic Location

The geographic location of an individual can also influence health insurance premiums. Insurance companies take into account factors such as healthcare costs, provider networks, and regional variations in health conditions when calculating premiums.

Healthcare costs can vary significantly from one region to another. For example, medical services in metropolitan areas tend to be more expensive compared to rural areas. This is due to factors such as higher operating costs for healthcare facilities, increased competition among providers, and the availability of specialized medical services.

Additionally, access to healthcare providers and facilities can differ based on geographic location. In areas with limited healthcare infrastructure, individuals may have fewer options when it comes to healthcare providers and services. Insurance companies consider these factors when determining premiums.

Regional variations in health conditions can also impact health insurance premiums. Certain regions may have a higher prevalence of specific health conditions, leading to increased healthcare costs for insurance providers. For example, areas with a higher incidence of chronic diseases like diabetes or obesity may experience higher insurance premiums as a result.

Furthermore, state-specific regulations and mandates can also have an impact on health insurance premiums. Each state has its own set of regulations governing insurance practices and requirements, which can affect the cost of coverage.

It’s important for individuals to be aware of the regional variations in health insurance premiums and consider these factors when selecting a health insurance plan. Comparing different plans and understanding the coverage options available in their specific geographic location can help individuals make informed decisions that align with their needs and budget.

In summary, geographic location can impact health insurance premiums. Healthcare costs, provider networks, regional health conditions, and state-specific regulations all play a role in determining premiums. It’s important for individuals to consider these factors when choosing a health insurance plan.

Type of Coverage

The type of coverage is a critical factor that influences health insurance premiums. Different types of health insurance plans offer varying levels of coverage and benefits. The more comprehensive the coverage, the higher the premiums tend to be.

Here are some common types of health insurance plans:

- Health Maintenance Organization (HMO): HMO plans typically have lower premiums and require individuals to choose a primary care physician. Referrals are needed for specialist visits, and out-of-network coverage may be limited or not covered.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility in choosing healthcare providers. While they have higher premiums compared to HMO plans, individuals can see specialists without referrals and often have out-of-network coverage, although at a higher cost.

- Exclusive Provider Organization (EPO): EPO plans provide coverage only for in-network providers and do not require referrals. They generally have lower premiums compared to PPO plans but may have limited out-of-network coverage or none at all.

- Point of Service (POS): POS plans combine features of HMO and PPO plans. Individuals choose a primary care physician, but referrals are needed for specialist care. Out-of-network coverage may be available, but at a higher cost.

The specific type of coverage chosen will impact the cost of health insurance premiums. Plans with more comprehensive coverage and a broader network of providers tend to have higher premiums to account for the increased benefits offered.

Additionally, individuals can choose between different coverage levels within each plan type. For example, a high-deductible health plan (HDHP) typically has lower premiums but higher deductibles, meaning individuals will pay more out-of-pocket before insurance coverage kicks in.

It’s essential for individuals to assess their healthcare needs and budget when selecting a type of coverage. Evaluating factors such as anticipated medical expenses, preferred healthcare providers, and tolerance for out-of-pocket costs can help individuals choose a plan that strikes the right balance between coverage and affordability.

In summary, the type of coverage chosen significantly impacts health insurance premiums. Individuals should carefully consider their healthcare needs and budget when selecting a plan, weighing the level of coverage and associated costs.

Deductibles

Deductibles are a key component of health insurance plans and can have a significant impact on premiums. A deductible refers to the amount an individual must pay out-of-pocket for covered medical expenses before their insurance coverage starts.

In general, health insurance plans with higher deductibles tend to have lower premiums, while plans with lower deductibles have higher premiums. This is because individuals with higher deductibles are responsible for a larger portion of their healthcare costs before insurance coverage kicks in.

For example, a health insurance plan with a $1,000 deductible requires the policyholder to pay the first $1,000 of covered medical expenses before the insurance company starts providing coverage. On the other hand, a plan with a $500 deductible would require a lower out-of-pocket cost before insurance coverage begins.

Choosing a plan with a higher deductible can be beneficial for individuals who anticipate lower medical expenses throughout the year or are primarily looking for protection against catastrophic events. These plans often come with lower premiums, making them more affordable on a monthly basis.

However, it’s important to note that individuals should carefully consider their ability to pay the deductible in the event of a medical emergency or unforeseen healthcare expenses. While higher deductible plans can be cost-effective in terms of monthly premiums, they require individuals to have enough savings to cover the deductible when needed.

On the other hand, plans with lower deductibles typically have higher premiums. These plans may be suitable for individuals who anticipate more frequent medical needs and prefer to have a lower out-of-pocket cost for each visit or service.

It’s essential for individuals to evaluate their healthcare needs, budget, and risk tolerance when selecting a plan with a deductible. Assessing the potential out-of-pocket costs and the ability to cover the deductible is crucial for making an informed decision.

In summary, deductibles play a significant role in health insurance premiums. Plans with higher deductibles tend to have lower premiums, while plans with lower deductibles have higher premiums. Individuals should consider their healthcare needs and budget when choosing a plan with a deductible that aligns with their financial goals and risk tolerance.

Pre-existing Conditions

Pre-existing conditions can have a substantial impact on health insurance premiums. A pre-existing condition is a health condition or illness that an individual has before obtaining health insurance coverage. Examples of pre-existing conditions include diabetes, heart disease, asthma, cancer, and more.

In the past, insurance companies had the authority to deny coverage or charge significantly higher premiums to individuals with pre-existing conditions. However, with the implementation of the Affordable Care Act (ACA) in many countries, insurance companies are no longer allowed to deny coverage or charge higher premiums based on pre-existing conditions.

The ACA made it illegal for insurance companies to discriminate against individuals with pre-existing conditions. This means that insurance companies cannot deny coverage, charge higher premiums, or impose waiting periods for individuals seeking health insurance coverage, regardless of their pre-existing conditions.

However, it’s important to note that the regulations regarding pre-existing conditions can vary by country and jurisdiction. It’s recommended for individuals to review the specific requirements and protections in their respective location.

While insurance companies cannot charge higher premiums based on pre-existing conditions, it’s essential to understand that health insurance premiums can still vary based on other factors such as age, geographic location, and the type of coverage selected.

Furthermore, it’s important for individuals with pre-existing conditions to disclose their health status accurately when applying for health insurance coverage. Failing to disclose pre-existing conditions can lead to coverage denials or limitations in the future.

For individuals with pre-existing conditions who are unable to obtain affordable coverage through traditional private insurance options, there may be government-sponsored programs or marketplaces that provide access to health insurance coverage. These programs offer coverage options specifically designed for individuals with pre-existing conditions.

In summary, while insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions due to regulations in many countries, it’s important for individuals to understand their rights and options. Transparency and proper disclosure of pre-existing conditions are crucial when applying for health insurance coverage.

Lifestyle Factors

Lifestyle factors can play a role in determining health insurance premiums. Insurance companies consider certain habits or behaviors as risk factors that can contribute to poor health and increased healthcare costs. As a result, individuals with certain lifestyle factors may face higher health insurance premiums.

One significant lifestyle factor that insurance companies take into account is smoking. As mentioned earlier, smoking is associated with various health conditions and increased healthcare costs. Smokers typically face higher health insurance premiums compared to non-smokers.

Another lifestyle factor that can impact health insurance premiums is alcohol consumption. Excessive or heavy drinking can lead to a range of health issues, including liver disease, cardiovascular problems, and mental health disorders. Insurance companies may view individuals who consume alcohol heavily as higher risk and charge higher premiums as a result.

Insurance companies may also consider an individual’s body mass index (BMI) when calculating premiums. A higher BMI is associated with an increased risk of chronic health conditions such as diabetes, heart disease, and certain cancers. Individuals with a higher BMI may be subject to higher health insurance premiums due to the potential risks associated with obesity.

Furthermore, engagement in high-risk activities or hobbies such as extreme sports, skydiving, or motor racing can also impact health insurance premiums. Individuals involved in such activities may be seen as higher risk and may face higher premiums to account for the associated increased likelihood of injuries and medical costs.

It’s important to note that not all lifestyle factors directly impact health insurance premiums. Factors such as exercise habits, dietary choices, or stress management practices may not be explicitly considered when calculating premiums. However, these lifestyle factors can still have a significant impact on an individual’s overall health and well-being.

Individuals have the power to make positive changes to their lifestyle to improve their health and potentially reduce health insurance costs. By adopting healthy habits such as regular exercise, maintaining a balanced diet, and avoiding risky behaviors, individuals can reduce their risk of chronic illnesses and potentially lower their health insurance premiums over time.

In summary, lifestyle factors such as smoking, alcohol consumption, BMI, and engagement in high-risk activities can influence health insurance premiums. Adopting healthy habits and making positive lifestyle changes can not only improve overall health but also potentially lead to cost savings on health insurance in the long run.

Occupation

Occupation can also have an impact on health insurance premiums. Insurance companies may consider certain occupations to be associated with higher health risks, leading to potentially higher premiums for individuals in those occupations.

Jobs that involve hazardous or physically demanding work, such as construction, mining, or firefighting, may be deemed higher risk by insurance companies. These occupations are more prone to workplace injuries and accidents, resulting in increased healthcare costs for insurance providers.

Similarly, occupations that involve high levels of stress or exposure to specific health hazards, such as healthcare workers or first responders, can also affect health insurance premiums. The nature of these occupations may increase the likelihood of certain health conditions or mental health disorders, which can impact insurance premiums.

Insurance companies assess the risks associated with different occupations based on statistical data and historical claims information. They consider factors such as injury rates, prevalence of occupational diseases, and the overall health risks associated with specific job roles.

While occupations may impact health insurance premiums, it’s important to note that insurance companies cannot deny coverage or charge higher premiums based solely on occupation due to anti-discrimination regulations. However, they can consider occupation as one factor among many in determining premiums.

It’s important for individuals in higher-risk occupations to explore options for comprehensive health insurance coverage that meets their specific needs. Some employers may provide specialized group insurance plans or occupational health programs that cater to the unique health risks associated with certain occupations.

In summary, occupation can be a factor that influences health insurance premiums. Jobs with higher risks of injury or exposure to health hazards may lead to potentially higher premiums. It’s crucial for individuals in such occupations to assess their coverage needs and explore options that provide adequate protection for their specific occupational health risks.

Marital Status

Marital status is a factor that can influence health insurance premiums, although its impact may vary depending on the insurance company and the specific plan being considered.

In some cases, insurance companies offer family health insurance plans that cover both the policyholder and their spouse. These plans typically have higher premiums compared to individual plans due to the increased coverage for multiple individuals.

Married individuals may have the option to include their spouse in their health insurance coverage, which can provide comprehensive protection for both individuals. The premium for a family plan is typically higher than that of an individual plan, reflecting the additional coverage.

However, it’s important to note that marital status alone may not significantly impact health insurance premiums. Other factors, such as age and type of coverage, may have a more substantial influence on premium calculations.

Furthermore, the impact of marital status on health insurance premiums can vary by country and jurisdiction. Some countries have regulations that prohibit insurance companies from considering marital status and charge the same premiums regardless of marital status.

It’s essential for individuals to review their options and assess the coverage needs of both themselves and their spouse when selecting a health insurance plan. While family plans may offer comprehensive coverage, they may not always be the most cost-effective option. Comparing premiums and coverage between individual and family plans can help individuals make an informed decision.

Additionally, in cases of divorce or separation, it’s important to review and update health insurance coverage accordingly. Understanding the eligibility rules and options for coverage after a change in marital status is crucial to ensure continued access to healthcare.

In summary, marital status can play a role in health insurance premiums, particularly when considering family coverage options. However, its impact may vary, and other factors such as age and type of coverage may have a more significant influence on premiums. It’s important for individuals to assess their coverage needs and consider the costs when selecting a health insurance plan.

Family Medical History

Family medical history is an important factor that insurance companies may consider when determining health insurance premiums. Family medical history refers to the health conditions and illnesses that are prevalent among an individual’s immediate family members, such as parents, siblings, and children.

Insurance companies view family medical history as an indicator of the potential genetic risks for certain health conditions. If an individual has a family history of chronic diseases, such as heart disease, diabetes, or certain types of cancer, insurance companies may deem them to be at a higher risk for developing these conditions themselves.

As a result, individuals with a significant family medical history of certain health conditions may face higher health insurance premiums. Insurance companies take into account the potential healthcare costs associated with managing and treating these conditions when calculating premiums.

However, it’s important to note that family medical history is just one factor among many that insurance companies consider. Other factors, such as age, gender, and lifestyle habits, also come into play when determining premiums.

Furthermore, regulations may exist that limit the extent to which insurance companies can consider family medical history for premium calculations. In some countries, regulations prohibit insurance companies from charging higher premiums based solely on family medical history.

It’s important for individuals to be aware of their family medical history and disclose it accurately when applying for health insurance coverage. Failing to disclose relevant family medical history can lead to coverage denials or limitations in the future.

Understanding one’s family medical history can also be beneficial in terms of proactive healthcare. Individuals with a family history of certain health conditions may choose to undergo regular screenings or take preventative measures to manage their risk factors.

In summary, family medical history can impact health insurance premiums, as it is seen as an indicator of potential genetic risks. However, the extent to which it influences premiums can vary, and regulations may limit the consideration of family medical history for premium calculations. It’s essential for individuals to be aware of their family medical history and disclose it accurately when applying for coverage.

Medical Inflation

Medical inflation is a significant factor that influences health insurance premiums. Medical costs tend to rise over time due to various factors, including advancements in medical technology, increasing drug prices, and the overall demand for healthcare services.

Insurance companies must account for these rising medical costs when determining premium rates. As medical expenses increase, insurance companies adjust premiums to ensure they can cover the rising healthcare costs of their policyholders.

Medical inflation can vary from year to year and can be influenced by factors such as changes in government regulations, shifts in healthcare policies, and economic conditions. It’s important to note that medical inflation typically outpaces general inflation rates, making healthcare costs a growing concern for individuals and insurance providers alike.

Medical inflation impacts not only the cost of health insurance premiums but also the overall affordability of healthcare services. As healthcare costs continue to rise, individuals may face higher out-of-pocket expenses, including deductibles, copayments, and coinsurance.

Insurance companies closely monitor medical inflation and make adjustments to premium rates to keep up with the increasing costs. However, it’s important for individuals to understand that insurance premiums may rise over time to reflect the rising cost of healthcare.

Additionally, individuals can take steps to manage their healthcare costs by choosing cost-effective providers, exploring generic drug options, and being proactive with preventive care. Understanding healthcare pricing and utilizing available resources, such as employer-provided wellness programs or discounted network providers, can also help individuals navigate medical inflation.

In summary, medical inflation is a significant factor that impacts health insurance premiums. As medical costs continue to rise, insurance companies adjust premiums to cover the increasing expenses. It’s important for individuals to stay informed about healthcare costs and take steps to manage their healthcare expenses effectively.

Healthcare Utilization

Healthcare utilization is a key factor that influences health insurance premiums. It refers to the frequency and extent to which individuals use healthcare services and resources. Higher healthcare utilization often leads to increased healthcare costs, which in turn impact insurance premiums.

Insurance companies assess healthcare utilization to determine the level of risk and potential expenses associated with providing coverage to individuals. Those who require more frequent medical care or utilize a broader range of healthcare services are considered higher risk and may face higher premiums.

Healthcare utilization can vary significantly from person to person. Some individuals may seldom require medical care and have relatively low utilization rates, while others may have pre-existing conditions or chronic illnesses that require ongoing medical attention and increase their healthcare utilization.

Certain factors can contribute to higher healthcare utilization, such as age, underlying health conditions, and lifestyle habits. For example, older individuals tend to have higher healthcare utilization rates due to age-related health concerns, while individuals with chronic illnesses require ongoing medical monitoring and treatment.

Furthermore, having comprehensive health insurance coverage may incentivize individuals to utilize healthcare services more frequently. With insurance coverage in place, individuals may be more likely to seek medical care for minor ailments or preventive screenings, which can increase healthcare utilization.

It’s important for individuals to consider their own healthcare needs and utilization patterns when selecting an insurance plan. If an individual anticipates higher healthcare utilization, they may need to choose a plan with broader coverage and higher premiums to adequately cover their medical expenses.

However, it’s also crucial to strike a balance and not overinsure for healthcare services that may not be necessary. Carefully evaluating healthcare needs, considering potential costs, and comparing different insurance plans can help individuals make informed decisions that align with their healthcare utilization patterns and financial goals.

In summary, healthcare utilization significantly impacts health insurance premiums. Individuals with higher healthcare utilization rates, such as those with pre-existing conditions or chronic illnesses, may face higher premiums. It’s important for individuals to consider their anticipated healthcare needs when selecting a plan that provides adequate coverage at a cost-effective price.

Government Regulations

Government regulations play a significant role in shaping health insurance premiums. Regulations and policies set by the government can affect how insurance companies operate, the coverage options available, and the rates at which premiums are determined.

One important government regulation that influences health insurance premiums is the Affordable Care Act (ACA) in many countries. The ACA introduced several reforms, including prohibiting insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This regulation ensures that individuals with health conditions have access to affordable health insurance.

The ACA also implemented community rating, which prevents insurance companies from charging different premiums based on health status or gender. This regulation aims to ensure that premiums are fair and accessible to individuals, regardless of their health conditions or demographics.

Other government regulations and policies can also impact health insurance premiums. For example, regulations related to mandatory coverage of specific services, such as maternity care or mental health treatment, can influence premium rates.

Moreover, government subsidies and assistance programs can help lower premiums for individuals who meet certain eligibility criteria. These programs aim to make health insurance more affordable and accessible for those who may struggle to afford coverage on their own.

Government regulations may also affect the pricing and availability of insurance products in the market. Insurance companies must comply with regulations related to premium rate adjustments, documentation requirements, and consumer protection measures.

It’s important for individuals to stay informed about government regulations and policies that shape health insurance premiums. Understanding the impact of these regulations can help individuals make informed decisions when selecting a health insurance plan and evaluating their coverage options.

In summary, government regulations play a pivotal role in shaping health insurance premiums. Regulations related to pre-existing conditions, community rating, mandatory coverage, subsidies, and consumer protection measures all impact how premiums are determined and the accessibility of health insurance coverage.

Insurance Company Policies

Insurance company policies are another important factor that influences health insurance premiums. Each insurance company has its own set of policies and guidelines that determine how premiums are calculated and what factors are considered during the underwriting process.

Insurance companies may have specific policies regarding the age range for premium adjustments. They may apply age rating, which means that premiums increase with age. The premium increase may occur at specific age milestones or gradually over time.

Additionally, insurance companies may have different approaches when it comes to pricing premiums based on gender. While regulations may prohibit gender-based premiums, insurance companies may still consider gender as a factor when determining the cost of coverage.

Insurance companies may also have specific policies related to deductibles, copayments, and coinsurance. These policies determine the share of healthcare costs that individuals must pay out-of-pocket before insurance coverage kicks in. Higher deductibles or cost-sharing requirements can lead to lower premiums, while lower deductibles typically result in higher premiums.

Moreover, insurance companies may have restrictions on network providers. They may offer different pricing tiers based on the network of doctors, hospitals, and healthcare facilities available. Utilizing in-network providers can lead to lower costs for both the insurance company and the policyholder.

Insurance companies may also consider their own claims experience and financial performance when establishing premium rates. If an insurance company experiences higher-than-expected claims costs, they may adjust premiums accordingly to mitigate financial risk.

It’s important for individuals to carefully review the policies and guidelines of different insurance companies when considering health insurance coverage. Comparing the policies and offerings of different insurers can help individuals choose a plan that aligns with their needs and provides the most value for their premiums.

In summary, insurance company policies significantly impact health insurance premiums. Policies related to age rating, gender, deductibles, network providers, claims experience, and financial performance can all influence premium rates. It’s crucial for individuals to review and understand these policies when selecting a health insurance plan.

Conclusion

Health insurance premiums are influenced by a variety of factors that assess the level of risk and potential healthcare costs associated with providing coverage. Understanding these factors can help individuals make informed decisions when selecting a health insurance plan that best suits their needs and budget.

Age and gender are important determinants, with older individuals and women generally facing higher premiums. Health condition and smoking habits also play a significant role, as those with pre-existing conditions or who smoke may have higher healthcare costs. Geographic location can impact premiums due to variations in healthcare costs and regional health conditions.

The type of coverage and deductibles chosen by individuals can affect premiums, with more comprehensive coverage and lower deductibles typically leading to higher premiums. Family medical history and lifestyle factors, such as occupation and certain habits, may impact premiums to some extent as well.

External factors like medical inflation and government regulations shape the overall landscape of health insurance premiums. Medical inflation, which reflects rising healthcare costs, can result in increased premiums over time.

Government regulations, such as those implemented under the Affordable Care Act, have sought to protect individuals from discrimination based on factors like pre-existing conditions and gender. However, insurance company policies also have a notable influence on premiums, including their approaches to age rating, deductibles, network providers, and overall claims experience.

In conclusion, health insurance premiums are determined by a complex interplay of various factors. Individuals should carefully evaluate their healthcare needs, budget, and the associated premium costs to select a health insurance plan that offers optimal coverage and affordability. Staying informed about the factors that impact premiums and reviewing different insurance options can help individuals make informed decisions to protect their health and financial well-being.