Home>Finance>Which Behavioral Factor Influences Auto Insurance Premiums?

Finance

Which Behavioral Factor Influences Auto Insurance Premiums?

Published: December 19, 2023

Discover how finance-related behavioral factors impact auto insurance premiums and learn how to lower your rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

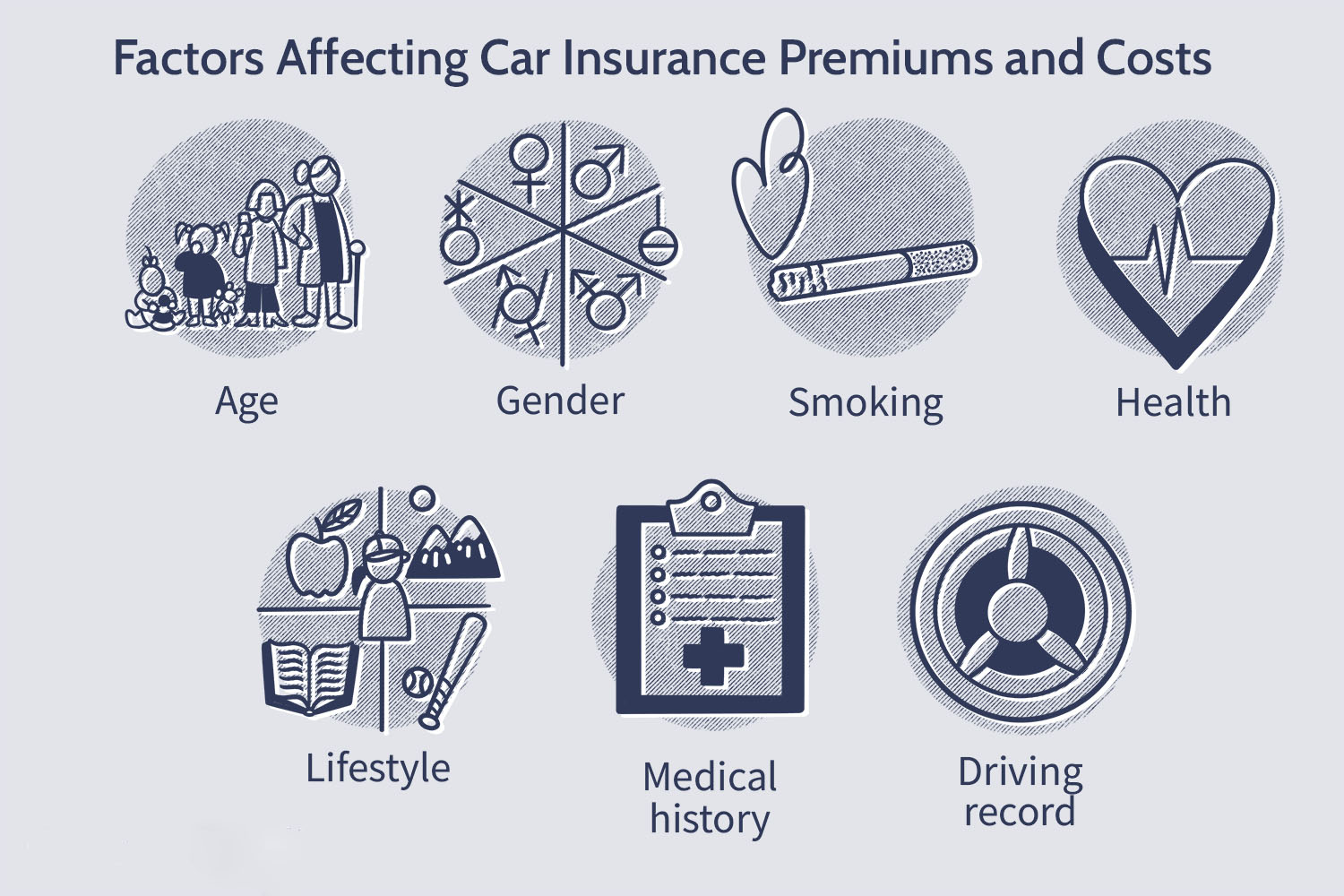

When it comes to auto insurance, many factors come into play when determining the premium rates. Insurance companies use a variety of factors to assess the risk associated with insuring a driver, and one significant variable that influences these rates is behavior. Behavior, in this context, refers to certain actions or characteristics of the driver that have been proven to impact the likelihood of accidents and insurance claims.

Understanding how behavioral factors influence auto insurance premiums is crucial for anyone looking to buy car insurance or trying to save money on their existing policy. By recognizing these factors, drivers can make informed decisions and take steps to mitigate any high-risk behaviors that might contribute to increased insurance rates.

In this article, we will explore the various behavioral factors that can influence auto insurance premiums and provide valuable insights into why insurance companies take these factors into account. By examining these factors, you will gain a better understanding of how insurance premiums are calculated and how you can potentially lower your rates through responsible driving habits and other behavioral adjustments.

Credit Score

Your credit score is not just important for obtaining credit cards or loans; it can also have a significant impact on your auto insurance premiums. Insurance companies often consider an individual’s credit score as an indicator of their financial responsibility and likelihood of filing insurance claims. Studies have shown a correlation between credit score and the frequency of insurance claims, which is why many insurers use credit-based insurance scores to determine rates.

Insurance providers believe individuals with higher credit scores are more likely to exhibit responsible behavior behind the wheel and, consequently, file fewer claims. On the other hand, those with lower credit scores may be viewed as higher-risk drivers, potentially leading to higher insurance premiums. This assessment is based on statistical data that reveals a link between credit history and accident risk.

It’s important to note that the use of credit scores in auto insurance varies by state and is subject to certain regulations. Some states have banned or limited the use of credit scores, while others allow insurance companies to consider this factor when calculating premiums. If you live in a state where credit score is taken into account, it’s advisable to monitor your credit and strive to maintain a good score to potentially enjoy lower insurance rates.

To improve your credit score and potentially lower your auto insurance premiums, there are several steps you can take. Start by paying your bills on time, reducing your outstanding debts, and regularly checking your credit report for any errors or inaccuracies. Additionally, avoid opening multiple new credit accounts within a short period, as this can lower your score temporarily. By building a strong credit history, you can not only save on your auto insurance but also benefit in other financial areas of your life.

Driving Record

One of the most significant behavioral factors that influence auto insurance premiums is your driving record. Insurance companies evaluate your past driving history to assess your risk of being involved in accidents and filing claims. A clean driving record with no accidents or traffic violations indicates responsible driving behavior and minimizes the likelihood of future claims. On the other hand, a history of accidents, speeding tickets, or other infractions can lead to higher insurance premiums.

Insurance companies typically look at the last three to five years of your driving record when determining your rates. They take into account various factors such as at-fault accidents, traffic violations, and license suspensions. The more infractions and accidents you have on your record, the higher the perceived risk, and consequently, the higher the premiums you are likely to pay.

If you have a poor driving record, there are steps you can take to improve it and potentially reduce your insurance rates. First, focus on improving your driving habits by obeying traffic laws, following speed limits, and avoiding distractions while driving. Enroll in defensive driving courses, which can not only help refresh your driving skills but also demonstrate your commitment to safe driving to insurance providers.

In addition, be mindful of the impact of minor traffic violations. Even seemingly insignificant infractions like speeding tickets can contribute to higher premiums. Avoid accumulating multiple tickets by being cautious on the road and adhering to traffic laws at all times.

It’s important to note that a clean driving record doesn’t just benefit your insurance premiums; it also helps maintain your personal safety and the safety of others on the road. Responsible driving should always be a priority, and the potential insurance savings can be an added incentive to maintain a good driving record.

Age and Gender

Age and gender are two demographic factors that significantly influence auto insurance premiums. Insurance companies rely on statistical data that indicates certain age groups and genders are more likely to be involved in accidents and file claims. These factors are considered as proxies for risk assessment.

Younger, less experienced drivers are generally charged higher premiums due to their higher risk of accidents. Statistics show that drivers under the age of 25 are more likely to engage in risky driving behaviors and have a higher rate of accidents compared to older, more experienced drivers. As a result, insurance companies typically assign higher rates to this age group.

Gender also plays a role in determining auto insurance premiums. Historically, male drivers were considered to have a higher accident risk, leading to higher premiums. However, recent studies have challenged this assumption, and many insurance companies now consider gender as just one of many factors in determining rates.

It’s important to note that while age and gender are considered as influential factors, they are not the sole determinants of premium rates. Other behavioral factors, such as driving record and credit score, also play significant roles in the calculation.

If you fall into a higher-risk age group and want to mitigate higher premiums, there are a few strategies you can employ. First, maintain a clean driving record and avoid accidents and traffic violations. Accumulating a history of responsible driving behavior can help offset the higher premium associated with your age.

Furthermore, consider taking defensive driving courses, as successfully completing these courses can sometimes result in lower premiums, particularly for young or inexperienced drivers. Additionally, some insurance companies offer discounts for good grades, so if you’re a student, maintain a high GPA to potentially qualify for such savings.

Remember that as you age, your insurance premiums may decrease. Once you reach a certain age and have more years of driving experience under your belt, you may become eligible for lower rates, provided you maintain a good driving record.

While age and gender are factors that you cannot control, responsible driving habits can help you mitigate the impact these factors have on your auto insurance premiums.

Marital Status

Believe it or not, your marital status can have an impact on your auto insurance premiums. Insurance companies often consider marital status as a factor when calculating rates, as statistical data suggests that married individuals tend to be involved in fewer accidents compared to single individuals.

According to studies and insurance industry data, married couples are perceived as being more responsible and less prone to risky driving behaviors. Factors such as having a stable family life, shared financial responsibilities, and potential additional driving experience from a partner may contribute to this perception.

As a result, married individuals often benefit from lower auto insurance rates compared to their single counterparts. The savings can be quite substantial, especially for young drivers who typically face higher premiums due to their age.

It’s important to note that some insurance companies may require proof of marriage, such as a marriage certificate or joint bank account, to receive the marital status discount. If you recently got married or changed your marital status, it’s advisable to inform your insurance provider to ensure you receive any applicable savings.

While marital status does play a role in determining your auto insurance premiums, it’s important to remember that it is just one of many factors considered by insurers. Other factors, such as driving record and credit score, also carry significant weight in rate calculations.

If you are single and looking to reduce your insurance premiums, there are still steps you can take. Focus on maintaining a clean driving record, improving your credit score, and exploring other available discounts, such as completing defensive driving courses or bundling your auto insurance policy with other types of coverage.

Overall, while marital status may have an impact on your auto insurance rates, it is just one piece of the puzzle. Responsible driving habits and maintaining other favorable factors, such as a good credit score, can help you achieve more affordable premiums and save money on your auto insurance.

Vehicle Type

The type of vehicle you drive is another significant behavioral factor that can influence your auto insurance premiums. Insurance companies take into account the make, model, and year of the vehicle when calculating rates. This is because different types of vehicles have different accident and theft rates, repair costs, and safety features.

Generally, high-performance or luxury vehicles tend to have higher insurance premiums due to their higher market value and expensive repair costs. These types of vehicles are often targeted by thieves and may be more prone to accidents due to their speed and power.

On the other hand, vehicles with good safety ratings and advanced safety features can potentially lead to lower insurance premiums. Insurance companies may consider factors such as the presence of antilock brakes, airbags, lane departure warning systems, and other safety technologies when determining rates.

It’s important to note that the cost of insurance can also vary based on the specific trim level and optional features of your vehicle. For example, a sports car with a powerful engine may have a higher premium than the same model with a less powerful engine.

If you’re in the market for a new car and want to keep your insurance premiums in check, consider the following tips:

1. Research the insurance costs of different vehicle models before making a purchase.

2. Opt for vehicles with good safety ratings and advanced safety features.

3. Avoid high-performance or luxury vehicles if you’re looking for more affordable insurance rates.

4. Take advantage of vehicle safety discounts offered by insurance companies.

5. Install anti-theft devices or tracking systems in your vehicle to deter theft and potentially qualify for additional discounts.

It’s essential to remember that insurance premiums are not solely determined by the vehicle type. Other factors, such as your driving record and location, also play a vital role. By selecting a vehicle that matches your needs and considering the insurance implications, you can make an informed decision that aligns with your budget and lifestyle.

Annual Mileage

The number of miles you drive in a year, commonly referred to as annual mileage, is another behavioral factor that can influence your auto insurance premiums. Insurance companies consider annual mileage because the more you drive, the higher the risk of being involved in an accident.

Generally, the higher your annual mileage, the higher your insurance premiums will be. This is because individuals who log more miles on the road have more exposure to potential accidents and increased wear and tear on their vehicles.

When providing information on your annual mileage to your insurance provider, be as accurate as possible. If you underestimate your mileage and then file a claim, your insurance company may consider it a misrepresentation, potentially leading to coverage denial or cancellation.

If you want to potentially reduce your auto insurance premiums based on your annual mileage, here are a few tips:

1. Carpool or use public transportation whenever possible to reduce the number of miles driven.

2. Consider working from home or adjusting your work schedule to avoid peak traffic times.

3. If you have multiple vehicles, designate one for longer trips or vacations to minimize the mileage on your primary vehicle.

4. Consolidate your errands to reduce the frequency of trips and miles driven.

5. Look into usage-based insurance programs that track your mileage and adjust your premiums accordingly.

It’s important to mention that driving fewer miles may not always result in substantial savings, especially if other high-risk factors such as a poor driving record or credit score are present. However, if you can reduce your annual mileage significantly, it may make a noticeable difference in your insurance rates.

Remember, accurate reporting of your annual mileage is essential to ensure you have the appropriate coverage and avoid any potential issues with your insurance policy. Be mindful of how many miles you drive each year and inform your insurance provider of any changes to adjust your premiums accordingly.

Location

Where you live plays a crucial role in determining your auto insurance premiums. Insurance companies consider the location where your vehicle is primarily driven and parked when assessing the risk associated with insuring you. Different areas have varying levels of traffic congestion, crime rates, and accident frequencies, which can impact insurance rates.

Urban areas with dense populations and heavy traffic tend to have higher insurance premiums. The increased number of vehicles on the road and higher probability of accidents in urban settings contribute to this. Additionally, urban areas may have more incidents of theft and vandalism, raising the risk of potential claims.

Rural areas generally experience less traffic congestion and lower accident rates, leading to potentially lower insurance premiums. However, rural areas may also have factors such as long distances and lack of nearby repair shops that could influence rates.

Furthermore, specific neighborhoods within a city can also affect insurance rates. Areas with high crime rates or a history of accidents may result in higher premiums due to the higher likelihood of filing claims.

When it comes to determining your insurance rates based on location, it’s essential to provide your insurance provider with your accurate address. Failing to disclose the correct location could result in the denial of a claim or cancellation of your policy.

If you’re looking to potentially save on your auto insurance based on your location, keep the following in mind:

1. Research the typical insurance costs associated with different areas when considering a move.

2. Be aware that moving from a rural area to an urban area, or vice versa, can significantly impact your premiums.

3. Install security features such as car alarms or tracking devices to mitigate the risk of theft or vandalism in high-crime areas.

4. Take advantage of any location-specific discounts or insurance programs that may be available in your area.

Overall, while you cannot change your physical location, understanding how it impacts your insurance premiums can help you make informed decisions and potentially find savings based on your specific circumstances.

Occupation

Your occupation is another factor that can influence your auto insurance premiums. While it may seem unrelated to driving behavior, certain professions have been found to be associated with different levels of risk on the road.

Insurance companies analyze data and statistical trends to assess the risk associated with various occupations. Some occupations, such as first responders, delivery drivers, or individuals who frequently use their vehicles for work purposes, may be considered higher risk due to the nature of their job. These occupations often involve driving in heavy traffic, working late hours, or traveling long distances, which can increase the likelihood of accidents.

On the other hand, individuals with low-risk occupations, such as office workers or teachers, may enjoy lower insurance premiums. These professions are typically associated with less time spent on the road during peak traffic hours and lower accident rates.

It’s important to note that not all insurance companies consider occupation as a significant factor in determining premiums. Some may give it more weight than others, while others may not factor it in at all. Additionally, the impact of occupation on rates can vary by region and insurance provider.

To potentially save on your auto insurance based on your occupation, consider the following tips:

1. Check if your insurance provider offers occupational discounts or specialized policies for certain professions.

2. If your occupation is associated with higher risk, explore options to improve other factors that insurers consider, such as maintaining a clean driving record or completing defensive driving courses.

3. If you’re self-employed and use your vehicle for business purposes, consider a commercial auto insurance policy that specifically covers business-related use.

While occupation can influence your auto insurance premiums, it’s essential to remember that it is just one component of the overall rate calculation. Other factors, such as driving record, credit score, and vehicle type, also play significant roles in determining your insurance costs.

Always provide accurate information regarding your occupation to your insurance provider and inquire about any potential discounts or policies that may be available based on your profession.

Education Level

Believe it or not, your level of education can influence your auto insurance premiums. Insurance companies have found correlations between education level and risk factors associated with driving behavior. While education is not a direct indicator of driving skills, studies have shown that individuals with higher levels of education tend to have fewer accidents and file fewer insurance claims.

Insurance providers consider education level as a proxy for responsible behavior and risk assessment. Individuals with higher education are often perceived as more conscientious, detail-oriented, and less likely to engage in risky driving behaviors.

It’s important to note that the impact of education level on insurance premiums may vary across insurance companies and regions. Some insurers may consider education level as a significant factor, while others may weigh it less heavily or not consider it at all.

If you have a higher education level, it’s worth mentioning to your insurance provider to see if it can potentially lead to lower premiums. Insurers may offer occupational or educational discounts that take into account your level of education.

While education is an influential factor in determining your insurance rates, it is not the only factor. Other behavioral factors, such as your driving record and credit score, still carry significant weight in rate calculations.

That said, even if you don’t have a higher education level, you can still take steps to potentially reduce your auto insurance premiums. Maintain a clean driving record, improve your credit score, and explore other available discounts, such as completing defensive driving courses or bundling your auto insurance policy with other types of coverage.

Remember, insurance companies assess risk based on a wide range of factors, and every individual’s situation is unique. While education level is considered by some insurers, it is just one component of the overall picture. Responsible driving behavior and other positive factors can contribute to more affordable auto insurance rates, regardless of educational background.

Insurance History

Your insurance history, specifically your previous auto insurance coverage and claims history, can significantly impact your auto insurance premiums. Insurance companies assess your insurance history to determine the level of risk associated with insuring you and to estimate the likelihood of you filing future claims.

If you have a history of maintaining continuous auto insurance coverage without any lapses, insurance companies view you as a responsible and reliable policyholder. This can result in lower premiums, as it indicates that you have been proactive in protecting yourself and your vehicle.

On the other hand, if you have a history of multiple claims or frequent changes in insurance coverage, insurance companies may perceive you as a higher risk. Having a high number of claims suggests a higher likelihood of future claims, which can lead to higher premiums.

Moreover, if you have a history of lapses in insurance coverage, insurers may consider you a riskier driver. Continuous coverage demonstrates a sense of financial responsibility and compliance with legal requirements, while gaps in coverage indicate instability or potential non-compliance.

When it comes to maintaining a favorable insurance history, there are a few tips to consider:

1. Ensure you have continuous auto insurance coverage without any lapses.

2. Avoid filing small or unnecessary claims, as they may contribute to a higher perceived risk.

3. Prioritize safe driving to minimize the likelihood of accidents and claims.

4. If you’re considering switching insurance providers, make sure to compare policies and premiums carefully before making a decision.

Building a positive insurance history takes time, but being a responsible policyholder can potentially lead to lower insurance premiums over time. Additionally, being proactive in maintaining continuous coverage and avoiding unnecessary claims can demonstrate your commitment to responsible driving behavior.

Insurance companies use historical data to assess risk, so it’s important to be aware of and accountable for your insurance history. By being proactive and responsible, you can potentially benefit from more affordable auto insurance rates in the long run.

Deductible Amount

The deductible amount you choose for your auto insurance policy can impact both your premium rates and out-of-pocket expenses in the event of a claim. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in.

When it comes to deductibles, there is an inverse relationship between the deductible amount and your premiums. In general, the higher your deductible, the lower your premium, and vice versa. Choosing a higher deductible means you are taking on more financial responsibility in the event of an accident or damage, but it may result in lower premium costs.

When deciding on a deductible amount, consider your financial situation and risk tolerance. If you have enough savings to cover a higher deductible in case of an accident, opting for a higher deductible can potentially lead to lower insurance premiums. On the other hand, if you prefer a lower out-of-pocket expense after an incident, choosing a lower deductible will result in higher premium costs.

It’s important to note that the deductible amount can vary depending on the type of coverage within your auto insurance policy. For example, collision and comprehensive coverage typically have separate deductibles.

When reviewing your auto insurance policy and considering deductible options, keep the following in mind:

1. Assess your financial situation and determine how much you can comfortably afford to pay out of pocket in the event of a claim.

2. Consider the age and value of your vehicle. If you have an older vehicle with a lower market value, selecting a higher deductible may be more cost-effective.

3. Compare premium costs with different deductible amounts to find the right balance between premium savings and out-of-pocket expenses.

4. Review your personal risk factors. If you live in an area prone to accidents or have a history of frequent claims, a lower deductible might be more suitable.

Keep in mind that the deductible amount is a personal decision, and there is no one-size-fits-all approach. It’s essential to carefully evaluate your options and choose a deductible amount that aligns with your financial capabilities and risk tolerance.

Coverage Limits

When selecting an auto insurance policy, one crucial factor to consider is the coverage limits. Coverage limits refer to the maximum amount your insurance provider will pay for specific types of claims. These limits are typically split into two categories: bodily injury liability and property damage liability.

Bodily injury liability coverage provides financial protection if you cause an accident that results in injury or death to another person. It covers medical expenses, legal fees, and potential settlements or judgments against you. The coverage limit sets a maximum amount the insurance company will pay per person injured or per accident.

Property damage liability coverage, on the other hand, covers the cost of damages to someone else’s property resulting from an accident for which you are at fault. Similar to bodily injury liability, there is a set coverage limit that specifies the maximum amount the insurance company will pay for property damage per accident.

Choosing the right coverage limits is vital to ensure you have adequate financial protection in the event of an accident. While it may be tempting to select lower coverage limits to save on premiums, it’s crucial to carefully consider the potential financial consequences of not having enough coverage.

When determining the appropriate coverage limits for your auto insurance policy, keep the following factors in mind:

1. State requirements: Understand the minimum coverage limits mandated by your state. It’s important to note that the minimum requirements may not provide sufficient protection in a serious accident.

2. Asset protection: Consider the value of your assets and the potential financial impact if you were to be involved in an accident and held liable for significant damages.

3. Personal circumstance: Evaluate your personal risk factors, such as commuting distance, driving habits, and the frequency of passengers in your vehicle.

4. Financial capacity: Assess your ability to comfortably pay higher premiums in exchange for broader coverage limits.

By carefully assessing these factors and discussing your specific needs with an insurance professional, you can make informed decisions about the appropriate coverage limits for your auto insurance policy.

Remember, having sufficient coverage limits provides peace of mind and ensures that you are adequately protected financially in the event of an accident or liability claim.

Additional Factors to Consider

While the behavioral factors discussed earlier play a significant role in determining auto insurance premiums, there are additional factors that you should consider when evaluating your insurance options.

Driving Habits: Your driving habits have a direct impact on your risk level. Factors such as the length of your daily commute, the frequency of long-distance travel, and the hours you spend on the road can influence your premiums. Insurance companies may offer discounts for low-mileage drivers or those who use their vehicles primarily for pleasure rather than daily work commutes.

Multi-Vehicle or Multi-Policy Discounts: If you have multiple vehicles or would like to bundle your auto insurance policy with other types of coverage, such as home or renter’s insurance, you may be eligible for discounts. Insurance companies often offer lower rates for customers who insure multiple vehicles or have multiple policies with them. This can result in significant savings on your overall insurance costs.

Age of the Vehicle: The age and condition of your vehicle can affect your coverage options and premiums. Newer vehicles may require comprehensive and collision coverage, while older vehicles may only need liability coverage. Additionally, some insurance providers offer discounts for vehicles equipped with safety features such as anti-lock brakes, airbags, or advanced driver-assistance systems.

Insurance Company Reputation: When selecting an insurance provider, consider their reputation for customer service, claims handling, and financial stability. A reliable and reputable insurance company is essential to ensure a smooth claims process and timely resolution of any issues that may arise.

Discounts and Rewards Programs: Many insurance companies offer various discounts and rewards programs that can help lower your premiums. Common discounts include safe driver discounts, good student discounts for students with excellent academic performance, and discounts for completing defensive driving courses. These discounts can add up and result in significant savings over time.

Comparison Shopping: It’s essential to shop around and compare quotes from multiple insurance companies. Rates can vary significantly between insurers, so taking the time to compare policies and pricing can help you find the most affordable coverage that meets your needs.

Reviewing and updating your auto insurance policy regularly is also crucial. Life circumstances change, and your insurance needs may evolve over time. Regularly reassessing your coverage options and discussing any changes with your insurance provider can ensure that you have the right coverage at the best possible price.

By considering these additional factors and staying informed about the various offerings in the insurance market, you can make informed decisions about your auto insurance coverage and potentially save money on your premiums.

Conclusion

Understanding the behavioral factors that influence auto insurance premiums is essential for anyone looking to secure affordable coverage. Insurance companies take into account various factors to assess risk and calculate premiums. By recognizing these factors and their impact on insurance rates, you can make informed decisions to potentially lower your premiums and ensure adequate coverage.

From credit scores and driving records to age, gender, and marital status, each factor provides insights into your behavior and risk level as a driver. Factors such as vehicle type, annual mileage, location, occupation, education level, insurance history, deductible amount, and coverage limits also play significant roles in determining auto insurance costs.

To mitigate the impact of these factors and potentially enjoy lower premiums, consider implementing the following strategies:

1. Maintain a good credit score by managing your finances responsibly.

2. Focus on responsible driving habits and maintain a clean driving record.

3. Research vehicle models and safety features to select a vehicle that aligns with your insurance budget.

4. Minimize annual mileage by carpooling, using public transportation, or consolidating your errands.

5. Choose appropriate coverage limits and deductibles based on your financial situation and risk tolerance.

Additionally, take advantage of available discounts and rewards programs, such as multi-vehicle or multi-policy discounts, safe driver discounts, good student discounts, and completion of defensive driving courses.

Remember, responsible driving behavior, continuous insurance coverage, and regular policy reassessment are key to maintaining affordable auto insurance premiums. It’s also recommended to periodically review your insurance needs and compare quotes from different insurance providers to ensure you’re receiving the best coverage at a competitive price.

By considering all these behavioral factors and implementing the suggested strategies, you can save money on your auto insurance premiums while maintaining the necessary level of coverage to protect yourself and your vehicle on the road.