Finance

Black Box Accounting Definition

Published: October 16, 2023

Learn the definition and importance of black box accounting in finance. Understand how this method affects financial reporting and analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Black Box Accounting: Definition and Importance in Finance

Finance is a vast field that encompasses various aspects related to money management, investment, and business operations. One crucial component in finance is accounting, which involves the recording, analyzing, and reporting of financial transactions. Within accounting, there are different methodologies and techniques used to ensure accurate and transparent financial information. In this blog post, we will delve into the concept of *Black Box Accounting* and explore its definition and importance within the finance industry.

Key Takeaways:

- Black Box Accounting refers to a sophisticated financial reporting approach that conceals the complex internal workings of financial calculations and algorithms, making it difficult for outsiders to comprehend.

- The importance of Black Box Accounting lies in its ability to protect proprietary financial models and formulas, limit potential fraud, and promote an efficient and unbiased decision-making process.

What is Black Box Accounting?

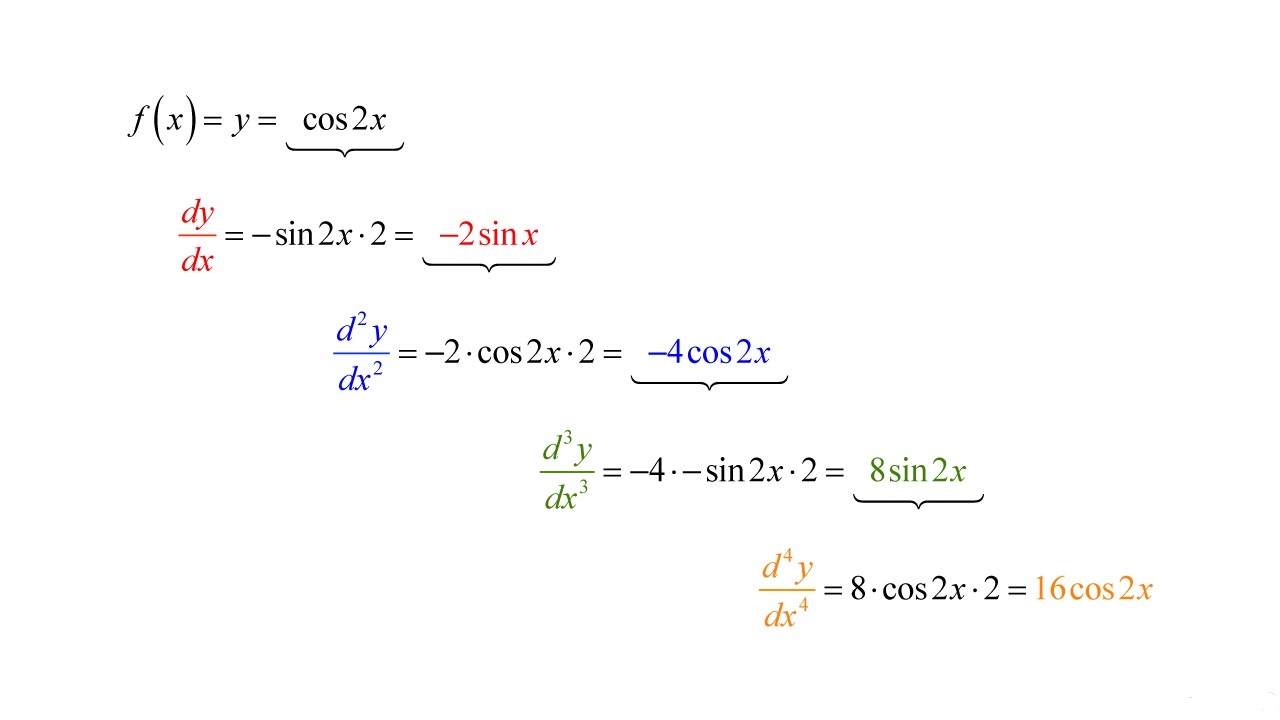

Black Box Accounting, also known as opaque accounting or algorithmic accounting, refers to a method of financial reporting where the underlying processes, calculations, and formulas used to arrive at the disclosed results are not easily transparent or understood by outsiders. In simpler terms, it’s like looking at a black box; you know what goes in and what comes out, but you have very little insight into what happens inside the box.

This accounting method often involves the use of complex algorithms and proprietary software systems to process financial data and generate financial statements or reports. The inner workings of these algorithms and systems remain undisclosed, making it challenging for external parties to understand how the reported numbers were calculated.

While the concept of Black Box Accounting may raise concerns about transparency, it is essential to recognize that it is primarily used in specific areas of finance where proprietary knowledge and competitive advantage play significant roles.

Importance of Black Box Accounting in Finance

1. Protecting Proprietary Financial Models: Companies invest significant resources in developing financial models that give them a competitive edge. Black Box Accounting helps safeguard these proprietary models by keeping the intricate details hidden from competitors, preventing unauthorized duplication or reverse engineering.

2. Limiting Potential Fraud and Manipulation: By concealing the inner workings of financial calculations, Black Box Accounting reduces the risk of manipulation or tampering with financial data. It limits the likelihood of fraudulent activities by making it difficult for individuals to exploit vulnerabilities within the system.

3. Promoting Efficient and Unbiased Decision-making: Black Box Accounting ensures that financial decisions are based on objective, data-driven information. It eliminates potential biases that may arise if detailed algorithms were transparent, preventing subjective interpretation and promoting fairness in decision-making.

It is worth noting that while Black Box Accounting serves specific purposes in certain finance sectors, transparency and disclosure remain critical in financial reporting overall. Regulatory bodies and industry standards ensure that companies strike the right balance between proprietary knowledge protection and transparency to maintain stakeholders’ trust.

In conclusion, Black Box Accounting is a specialized technique used in finance to protect proprietary financial models, limit fraud, and promote unbiased decision-making. While it may seem complex and lacking transparency to outsiders, its utilization plays a crucial role in maintaining competitive advantage and ensuring the integrity of financial information within certain sectors of the finance industry.