Home>Finance>Owner Financing: Definition, Example, Advantages, And Risks

Finance

Owner Financing: Definition, Example, Advantages, And Risks

Published: January 5, 2024

Learn about owner financing and its advantages, risks, and examples in the world of finance. Explore the definition and benefits of this alternative financing method.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is Owner Financing?

Are you looking to buy a home or property but struggling to secure a traditional mortgage loan? If so, owner financing may be the solution you’ve been searching for. Owner financing, also known as seller financing, is a real estate transaction in which the seller acts as the lender and provides financing to the buyer. This means that the buyer makes monthly payments directly to the seller, rather than obtaining a loan from a traditional lender.

Key Takeaways:

- Owner financing is a real estate transaction where the seller acts as the lender, providing financing to the buyer.

- The buyer makes monthly payments directly to the seller, avoiding the need for a traditional lender.

How Does Owner Financing Work?

Owner financing works by eliminating the need for a traditional mortgage lender. Instead, the buyer and seller negotiate the terms of the financing arrangement, including the purchase price, down payment, interest rate, and repayment schedule. Once the terms are agreed upon, a promissory note is created, outlining the details of the agreement.

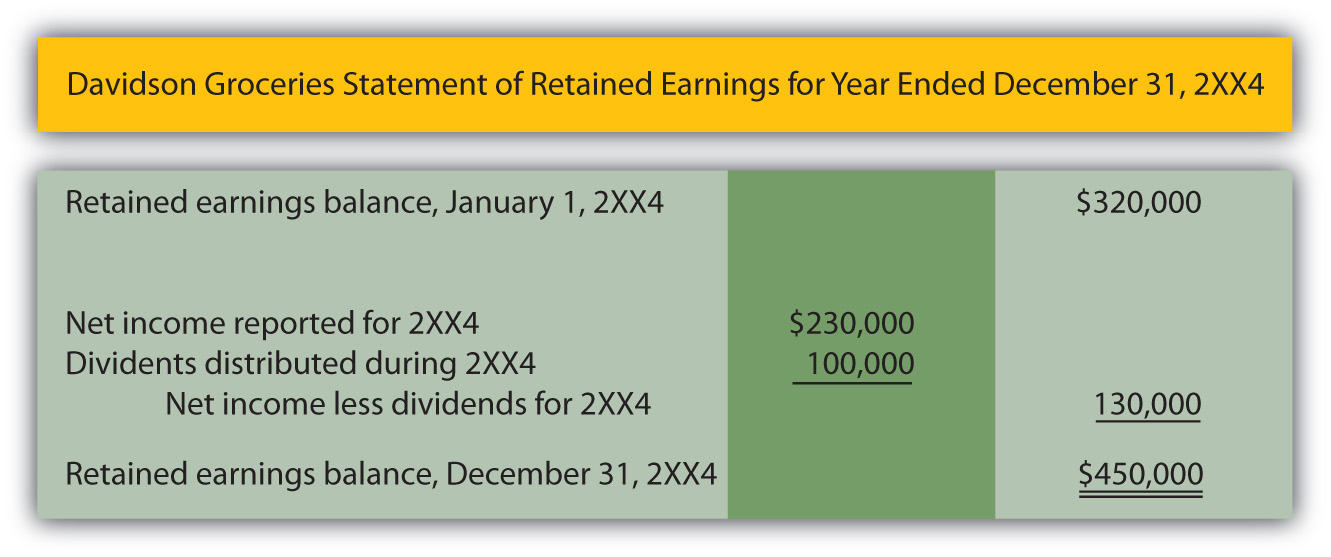

Here’s an example to help illustrate how owner financing works:

Imagine you’re interested in purchasing a home that is listed for $300,000. However, you don’t have the funds to make a traditional down payment or qualify for a mortgage loan. In this scenario, the seller may agree to provide owner financing, allowing you to make monthly payments directly to them.

The terms of the financing arrangement could be as follows:

- Purchase price: $300,000

- Down payment: $10,000

- Interest rate: 5%

- Repayment schedule: Monthly payments of $1,800 for 10 years

With owner financing, you would make monthly payments of $1,800 directly to the seller for the next 10 years, until the property is paid off in full.

Advantages of Owner Financing

Owner financing offers several advantages for both buyers and sellers:

- Flexible Terms: Unlike traditional lenders who have strict lending criteria, owner financing allows buyers and sellers to negotiate terms that work best for both parties. This flexibility can be especially beneficial for individuals who may not meet the strict requirements of traditional lenders.

- Quick and Easy: The process of obtaining owner financing is typically quicker and less complex than obtaining a traditional mortgage loan. This can save both time and money for buyers and sellers alike.

Risks of Owner Financing

While owner financing can be a viable option for many individuals, it’s important to consider the potential risks involved:

- Higher Interest Rates: Since sellers are taking on the role of the lender, they may charge higher interest rates compared to traditional lenders. Buyers should carefully review the terms and calculations to ensure they can afford the monthly payments.

- Unforeseen Challenges: Just like any financial agreement, owner financing comes with its own set of risks. If the buyer fails to make the monthly payments, the seller could potentially foreclose on the property and take possession. Additionally, any issues with the property that arise after the sale will become the buyer’s responsibility.

Conclusion

Owner financing can be an alternative financing option for buyers who are unable to secure a traditional mortgage loan. By eliminating the need for a traditional lender, owner financing offers flexibility and a simplified process. However, it’s important for both buyers and sellers to carefully consider the terms and potential risks involved before entering into an owner financing agreement.