Home>Finance>Capital Expenditure (CapEx) Definition, Formula, And Examples

Finance

Capital Expenditure (CapEx) Definition, Formula, And Examples

Published: October 22, 2023

Learn the definition, formula, and examples of capital expenditure (CapEx) in finance. Explore how CapEx impacts businesses and financial decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What are Capital Expenditures (CapEx)?

If you are new to the world of finance or business, you may have come across the term “Capital Expenditure” or “CapEx” without fully understanding what it means. CapEx refers to the funds invested by a company into acquiring, upgrading, or maintaining fixed assets, such as property, buildings, equipment, or technology. These expenditures are essential for a company’s day-to-day operations, as well as for its future growth and profitability.

Key Takeaways:

- Capital Expenditures, or CapEx, are the funds invested by a company in acquiring, upgrading, or maintaining fixed assets.

- CapEx expenditures are vital for a company’s operations and long-term growth.

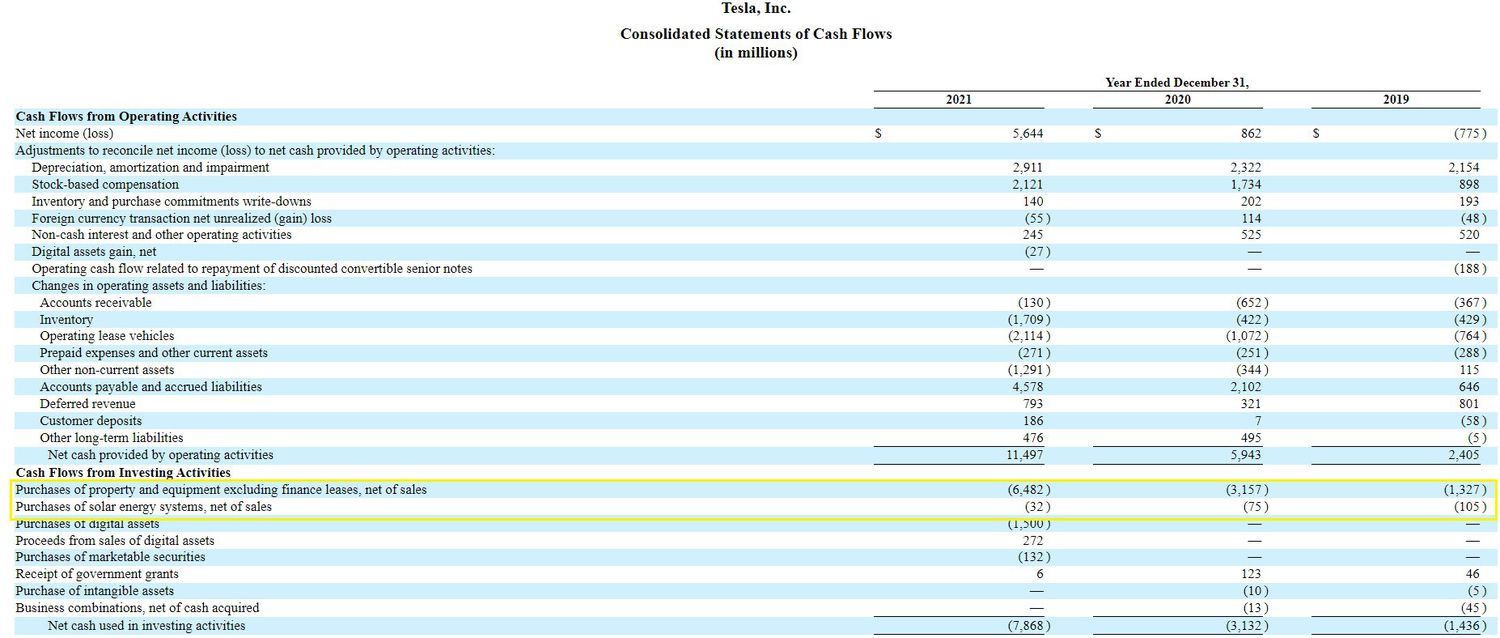

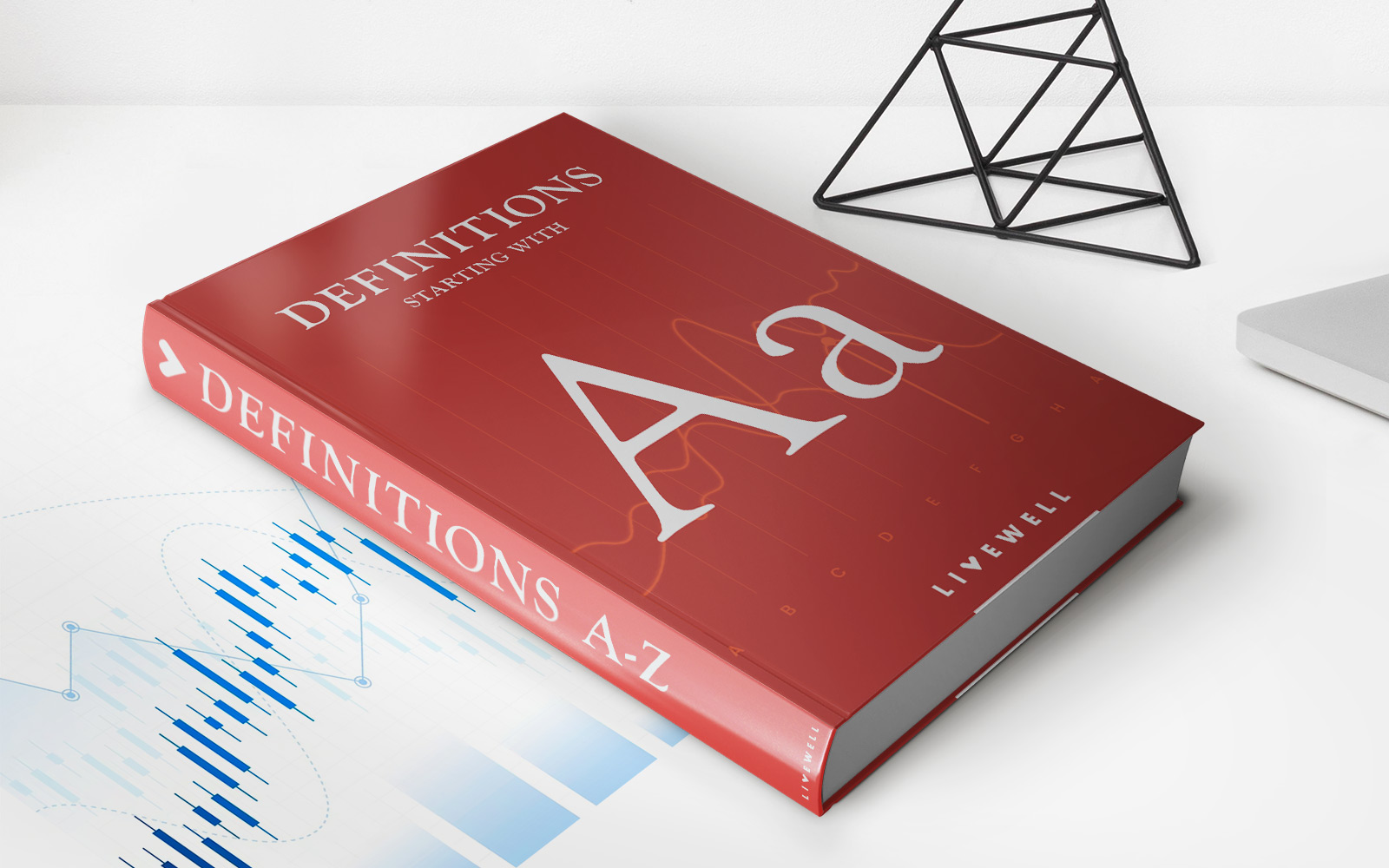

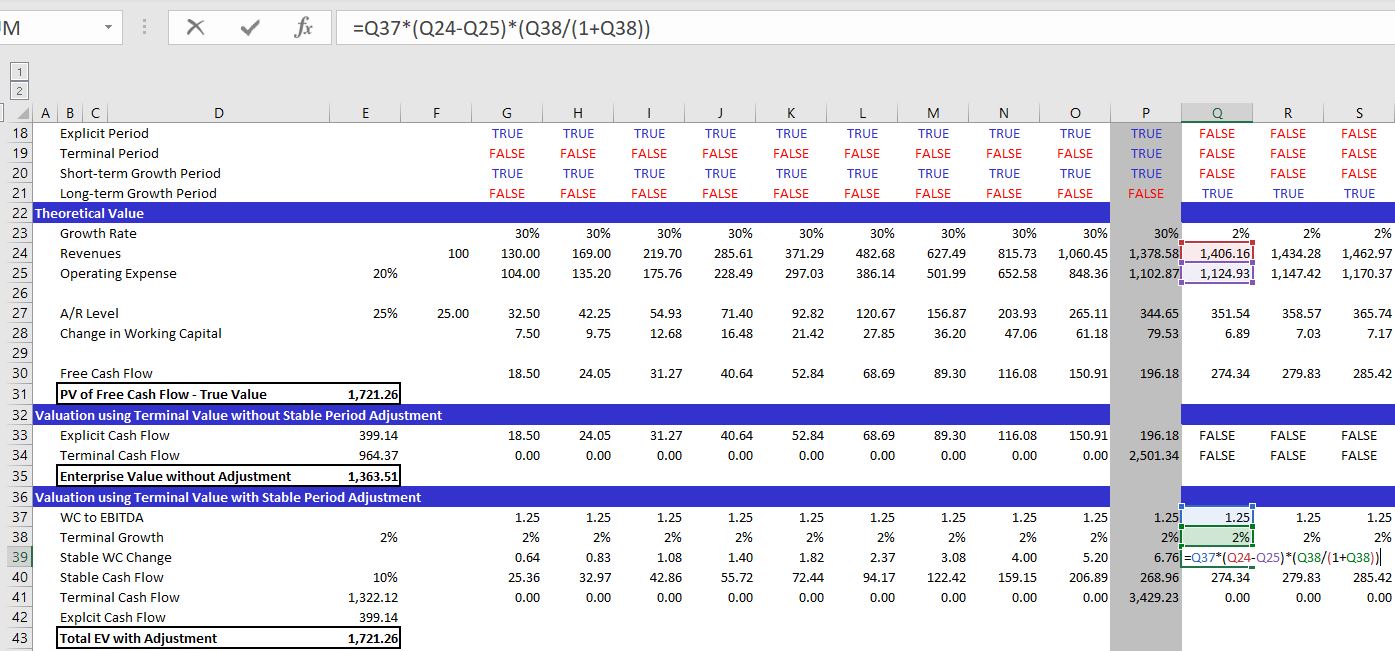

Understanding the Formula for Calculating CapEx

Calculating Capital Expenditure is relatively straightforward. The formula to calculate CapEx is:

CapEx = Ending Fixed Assets – Beginning Fixed Assets + Depreciation Expense

Let’s break this formula down:

- Ending Fixed Assets: The value of all fixed assets owned by the company at the end of the specified accounting period.

- Beginning Fixed Assets: The value of all fixed assets owned by the company at the beginning of the specified accounting period.

- Depreciation Expense: The amount deducted from the value of fixed assets over their expected useful life.

The resulting CapEx value represents the net amount of money a company has invested in fixed assets during a specific accounting period.

Examples of Capital Expenditures

To gain a better understanding, let’s explore a few examples of capital expenditures:

- Building Construction or Renovation: If a company purchases a building or renovates an existing one to serve as its headquarters or production facility, the associated costs would be considered capital expenditures. This includes acquiring the property, construction expenses, and any necessary upgrades or improvements.

- Purchase of Equipment: When a company buys equipment or machinery required for its operations, such as manufacturing equipment, office furniture, or computer servers, the cost is considered a capital expenditure. This expense contributes to the long-term productivity and efficiency of the company.

- Research and Development: Although intangible, the costs associated with research and development (R&D) can also be considered capital expenditures. R&D activities aim to create new products, improve existing ones, or develop innovative technologies. These investments contribute to the company’s long-term growth and competitiveness.

These examples illustrate that companies make capital expenditures to acquire assets or improve existing ones in order to enhance their capabilities, expand their operations, or increase their competitive advantage in the marketplace.

Conclusion

Capital expenditures play a crucial role in a company’s growth and overall success. By investing in fixed assets, companies can improve their operations, become more efficient, and position themselves for long-term profitability. Understanding the formula for calculating CapEx, as well as the examples provided, gives you a better grasp of how these expenditures are measured and their importance in the financial world.