Finance

What Are Net Assets On A Balance Sheet

Modified: February 21, 2024

Learn about net assets on a balance sheet, an essential component of financial management. Explore the concept of finance and its significance within the context of net assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers rule and balance sheets reign supreme. In the realm of financial statements, one term that holds significant importance is “net assets.” Whether you’re a seasoned investor or just starting to dip your toes into the world of finance, understanding net assets is crucial for making informed financial decisions. In this article, we will delve into the concept of net assets and explore its implications on a balance sheet.

Net assets, in simple terms, represent the residual value of an organization after deducting its liabilities from its assets. It serves as a key indicator of a company’s financial health and its ability to meet its obligations. Investors and analysts pay close attention to net assets as it provides insights into the value of a company and its potential for generating profits.

To truly grasp the concept of net assets, we need to understand its components. A balance sheet consists of two main categories: assets and liabilities. Assets encompass everything a company owns, including cash, investments, inventory, equipment, and more. Liabilities, on the other hand, refer to the company’s debts and obligations, such as loans, accounts payable, and accrued expenses.

By subtracting the liabilities from the assets, we arrive at the net assets figure, which represents the company’s equity. Net assets provide a snapshot of how much of the company’s assets would be left over for shareholders if all liabilities were to be settled.

Understanding the composition of net assets requires examining the different types of assets and liabilities that make up a balance sheet. These can be further divided into current and noncurrent categories.

Current assets are those that are expected to be converted into cash within a year or the normal operating cycle of the business. They include cash, accounts receivable, inventory, and short-term investments. Noncurrent assets, on the other hand, are long-term investments that are expected to generate value for the company over an extended period. These include property, plant, and equipment, long-term investments, and intangible assets, such as patents and trademarks.

Similarly, current liabilities are those that are to be settled within a year or the operating cycle. These include accounts payable, short-term loans, and accrued expenses. Noncurrent liabilities, also known as long-term liabilities, are debts that are not expected to be settled within the next year. Examples include long-term loans, bonds, and lease payments.

Now that we have a basic understanding of net assets and its components, let’s explore how to calculate this crucial financial metric and why it is essential for both companies and investors.

Definition of Net Assets

Net assets, also known as shareholders’ equity or owner’s equity, is a financial metric that represents the residual value of a company after deducting its liabilities from its assets. It provides valuable insights into the financial health and value of an organization. Net assets are a key component of a company’s balance sheet and are crucial for evaluating its financial performance and potential for growth.

Net assets are calculated by subtracting the total liabilities of a company from its total assets. This calculation results in the net assets figure, which represents the value that would be left over for shareholders if all liabilities were to be settled. In simple terms, it is the equity that belongs to the owners or shareholders of the company.

Net assets are an important measure of a company’s solvency and financial stability. A higher net assets figure indicates that a company has more assets than liabilities, which signifies a strong financial position. On the other hand, a lower net assets figure could indicate higher levels of debt and potential financial risks.

Net assets serve as a critical performance indicator for shareholders, investors, and lenders. It provides them with valuable information about the company’s financial standing and its ability to generate profits. Investors may use the net assets figure to assess the intrinsic value of a company’s shares and make informed investment decisions.

Furthermore, net assets are also used to calculate important financial ratios, such as return on equity (ROE) and debt-to-equity ratio. ROE measures the profitability of a company by comparing its net income to its average shareholders’ equity. It helps investors gauge the efficiency of a company in generating profits using its equity. The debt-to-equity ratio, on the other hand, measures the level of debt financing as compared to the shareholders’ equity. This ratio is useful for assessing the company’s financial leverage and its ability to handle debt obligations.

In summary, net assets represent the equity or residual value of a company after deducting its liabilities from its assets. It is an important financial metric that provides insights into a company’s financial health, solvency, and value. Understanding net assets is crucial for investors, shareholders, and analysts to make informed decisions regarding investments, potential acquisition, and overall financial strategy.

Components of Net Assets

To fully understand net assets, it is important to grasp the components that make up this crucial financial metric. Net assets are derived from the balance sheet, which consists of two main categories: assets and liabilities. Let’s take a closer look at the components of net assets:

1. Current Assets: Current assets are those that are expected to be converted into cash within a year or the normal operating cycle of the business. These assets are highly liquid and readily available to support day-to-day operations. Common examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. These assets provide a snapshot of the company’s short-term liquidity and its ability to meet immediate obligations.

2. Noncurrent Assets: Noncurrent assets, also known as long-term assets, consist of assets that are not expected to be converted into cash within the next year. These assets generally provide value to the company over a longer period of time. Examples of noncurrent assets include property, plant, and equipment (PP&E), long-term investments, intangible assets such as patents and trademarks, and deferred tax assets. Noncurrent assets represent the company’s long-term investments and its ability to generate future value.

3. Current Liabilities: Current liabilities are obligations that are expected to be settled within a year or the normal operating cycle of the business. These liabilities include accounts payable, short-term loans, accrued expenses, and other current obligations. Current liabilities reflect the company’s short-term financial obligations and its ability to meet those obligations using its current assets.

4. Noncurrent Liabilities: Noncurrent liabilities, also known as long-term liabilities, are debts or obligations that are not expected to be settled within the next year. Examples include long-term loans, bonds, lease payments, and pension obligations. Noncurrent liabilities represent the company’s long-term financial commitments and its ability to manage and repay those obligations over an extended period.

Net assets are calculated by subtracting the total liabilities of a company from its total assets. The formula is as follows: Net Assets = Total Assets – Total Liabilities. The resulting net assets figure represents the company’s equity and represents the residual value that belongs to the shareholders or owners of the company.

These components of net assets provide a comprehensive view of a company’s financial position. They help investors, shareholders, and analysts assess the company’s liquidity, solvency, and overall financial health. By analyzing the composition of net assets, stakeholders can make informed decisions regarding investments, mergers and acquisitions, and strategic financial planning.

Current Assets

Current assets are a crucial component of a company’s balance sheet and play a significant role in assessing its short-term liquidity and financial health. These assets represent the resources that a company expects to convert into cash or use up within a year or the normal operating cycle of the business, whichever is longer. Current assets are highly liquid and play a key role in supporting day-to-day operations. Let’s take a closer look at some common types of current assets:

1. Cash and Cash Equivalents: Cash and cash equivalents refer to the most liquid of all assets. This includes physical cash, as well as funds held in checking accounts, savings accounts, and short-term investments that are easily convertible to cash. Cash and cash equivalents provide the company with immediate access to funds for operational expenses or investment opportunities.

2. Accounts Receivable: Accounts receivable represents funds owed to the company by its customers or clients for goods sold or services rendered on credit. These are short-term assets that are expected to be converted to cash within a normal operating cycle. Accounts receivable is an indication of the company’s ability to collect payments from its customers and manage its credit policies effectively.

3. Inventory: Inventory consists of the goods or products that a company holds for sale or production. It includes raw materials, work-in-progress, and finished goods. Inventory is a current asset because it is expected to be sold or used up within a year. Effective inventory management is crucial to ensure sufficient supply for customer demand and avoid excess or obsolete stock.

4. Short-Term Investments: Short-term investments are financial instruments with a maturity period of less than one year. These investments are readily convertible to cash and include treasury bills, certificates of deposit (CDs), money market funds, and marketable securities. Short-term investments provide a higher yield than cash but maintain a relatively high level of liquidity.

5. Prepaid Expenses: Prepaid expenses are expenses paid in advance but not yet consumed or utilized. Examples include prepaid rent, prepaid insurance premiums, and prepaid subscriptions. These expenses are recorded as assets until they are realized or used up, typically within a year.

Current assets are crucial for assessing a company’s ability to meet its short-term obligations and manage day-to-day operations. They provide insight into the company’s liquidity and its ability to convert assets into cash efficiently. By analyzing current assets, investors, lenders, and analysts can evaluate the company’s short-term financial health, cash flow management, and overall operational efficiency.

Noncurrent Assets

Noncurrent assets, also known as long-term assets, are a significant component of a company’s balance sheet. Unlike current assets that are expected to be converted into cash within a year or the normal operating cycle, noncurrent assets are long-term investments that provide value to the company over an extended period. These assets play a vital role in assessing a company’s long-term financial stability and ability to generate future value. Let’s explore some common types of noncurrent assets:

1. Property, Plant, and Equipment (PP&E): PP&E refers to the tangible assets held by a company for its operations. This includes land, buildings, machinery, equipment, vehicles, and furniture. These assets are used in the production or delivery of goods and services and are not intended for sale. PP&E represents a significant investment for a company and is recorded at its historical cost less accumulated depreciation.

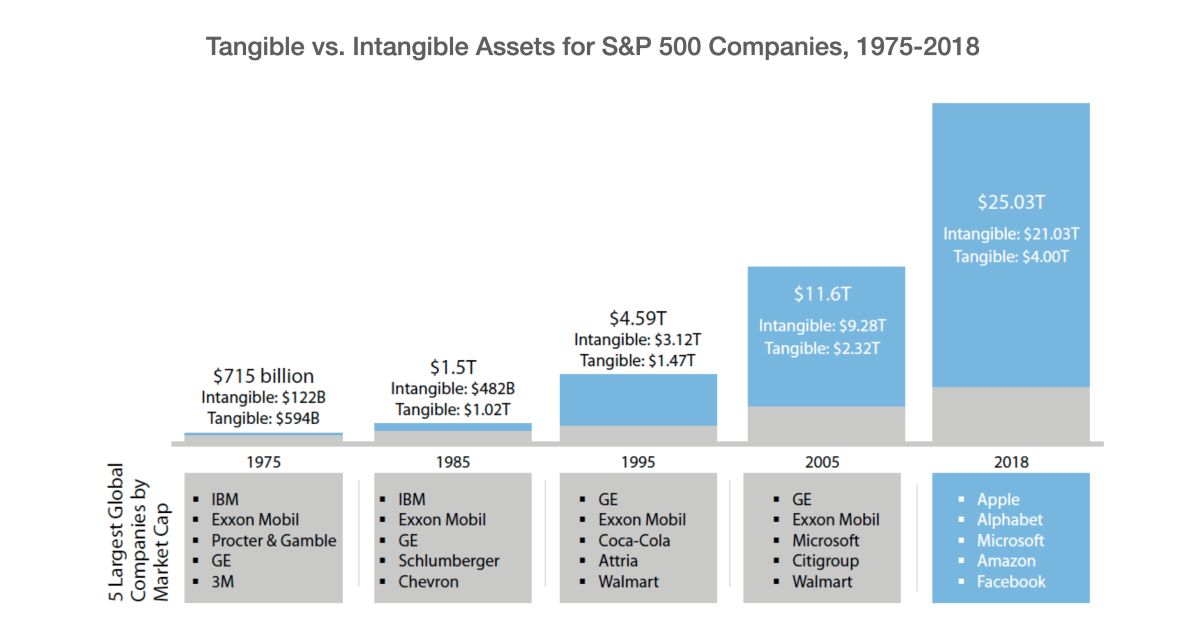

2. Intangible Assets: Intangible assets are nonphysical assets that lack a physical presence but still hold value for a company. Examples include copyrights, trademarks, patents, intellectual property, brand recognition, and customer lists. These assets provide competitive advantages and can contribute to a company’s long-term profitability and market position. Intangible assets are typically recorded at their historical cost less any accumulated amortization.

3. Long-Term Investments: Long-term investments represent a company’s investments in securities or other entities that it plans to hold for an extended period, typically more than a year. These investments may include stocks, bonds, mutual funds, and other financial instruments. Long-term investments can generate interest, dividends, or capital appreciation for the company over time.

4. Deferred Tax Assets: Deferred tax assets represent tax benefits that a company expects to realize in the future due to temporary differences in accounting treatment. These assets arise when expenses or losses are recognized for accounting purposes but are not yet deductible for tax purposes. Deferred tax assets are recorded when it is probable that the company will generate taxable income in the future to offset these assets.

5. Goodwill: Goodwill represents the excess of the purchase price of an acquired company over the fair value of its identifiable net assets. This intangible asset reflects the value of the acquired company’s reputation, brand, customer loyalty, and other nonphysical attributes. Goodwill is recognized in a company’s balance sheet when it acquires another company through a business combination.

Noncurrent assets provide insights into a company’s long-term investment strategy, growth potential, and competitive advantages. They play a crucial role in determining the company’s overall value and ability to generate future cash flows. By analyzing noncurrent assets, investors, analysts, and stakeholders can assess a company’s ability to sustain profitability, its level of capital investment, and its potential for long-term growth and value creation.

Current Liabilities

Current liabilities are a vital component of a company’s balance sheet and represent its short-term financial obligations. These obligations are expected to be settled within a year or the normal operating cycle of the business, whichever is longer. Current liabilities provide insight into a company’s short-term financial health, its ability to meet upcoming obligations, and manage its day-to-day operations. Let’s explore some common types of current liabilities:

1. Accounts Payable: Accounts payable refer to the amounts owed by a company to its suppliers or vendors for goods or services received on credit. These payables typically have a short payment term, often within 30 to 90 days. Accounts payable allow companies to maintain positive relationships with their suppliers while managing their working capital efficiently.

2. Short-Term Loans: Short-term loans represent borrowings that are due within a year or the normal operating cycle. These loans are typically used to meet immediate financing needs or bridge short-term cash flow gaps. Companies may obtain short-term loans from banks or other financial institutions to fund their operational activities or finance temporary capital requirements.

3. Accrued Expenses: Accrued expenses are expenses that have been incurred but not yet paid by the company. These expenses include salaries and wages, utilities, rent, interest, and taxes. Accrued expenses are recorded as liabilities when they are accrued or recognized according to the company’s accounting policies. They represent financial obligations that will be settled in the near term.

4. Customer Deposits: Customer deposits refer to advance payments received from customers for goods or services that will be delivered in the future. These deposits represent an obligation for the company to fulfill the customer’s order or provide the agreed-upon service. Customer deposits are recognized as liabilities until the company fulfills its obligations or returns the deposit.

5. Unearned Revenue: Unearned revenue, also known as deferred revenue or advance payments, represents funds received by a company for goods or services that are yet to be delivered. These funds are classified as liabilities until the company fulfills its obligations or provides the agreed-upon services. Unearned revenue reflects the company’s obligation to provide value to its customers in the future.

Current liabilities are important for assessing a company’s short-term financial obligations and its ability to manage working capital. They provide insights into a company’s ability to meet its current obligations using its current assets. By analyzing current liabilities, investors, creditors, and stakeholders can evaluate a company’s cash flow management, liquidity position, and its overall financial stability in the short term.

Noncurrent Liabilities

Noncurrent liabilities, also known as long-term liabilities, are a significant component of a company’s balance sheet. Unlike current liabilities that are expected to be settled within a year or the normal operating cycle, noncurrent liabilities represent the company’s long-term financial obligations that are not due for payment in the near future. These liabilities play a crucial role in assessing a company’s long-term financial stability and debt management. Let’s explore some common types of noncurrent liabilities:

1. Long-Term Loans: Long-term loans are debt obligations that are not due for payment within the next year. These loans are typically used to finance large-scale projects, acquisitions, capital expenditures, or other long-term investment needs of the company. Long-term loans provide companies with access to capital while spreading the repayment over an extended period, often with fixed interest rates.

2. Bonds Payable: Bonds payable are long-term debt instruments issued by the company to investors or bondholders. Bonds allow companies to raise capital by borrowing money from investors. The company agrees to pay periodic interest to bondholders and repay the principal amount at the bonds’ maturity date. Bonds payable involve complex terms and conditions and are typically utilized for large capital requirements.

3. Lease Obligations: Lease obligations represent the long-term rental agreements between a company and a lessor. These lease agreements can include leases for buildings, equipment, vehicles, or other assets. Lease obligations can be classified as operating leases or finance leases, depending on the terms and conditions specified in the lease agreement. Lease obligations are recognized as noncurrent liabilities as they are not due for payment in the near term.

4. Pension Liabilities: Pension liabilities are financial obligations arising from employee retirement benefit plans. Companies that offer pension plans are responsible for providing retirement benefits to their employees. The present value of the future pension payments to employees is recorded as a noncurrent liability. Pension liabilities can fluctuate based on factors such as changes in interest rates, employee workforce demographics, and investment returns.

5. Deferred Tax Liabilities: Deferred tax liabilities represent the future tax obligations that a company will incur due to temporary differences between accounting and tax rules. These liabilities arise when expenses or losses are deductible for tax purposes before they are recognized for accounting purposes. Deferred tax liabilities are recognized when it is probable that the company will generate taxable income in the future, resulting in higher tax payments.

Noncurrent liabilities provide important insights into a company’s long-term financial commitments and its ability to manage debt obligations over an extended period. By analyzing noncurrent liabilities, investors, creditors, and stakeholders can evaluate a company’s long-term debt sustainability, financial leverage, and overall risk profile. Understanding the composition and management of noncurrent liabilities is crucial for assessing a company’s long-term financial stability and its ability to fulfill its long-term obligations.

Calculation of Net Assets

The calculation of net assets is a straightforward process that involves subtracting the total liabilities of a company from its total assets. This calculation provides valuable insights into a company’s equity or residual value. By understanding how to calculate net assets, investors, analysts, and stakeholders can assess a company’s financial health and potential for generating profits. Below is the formula and steps for calculating net assets:

Net Assets = Total Assets – Total Liabilities

To calculate net assets, follow these steps:

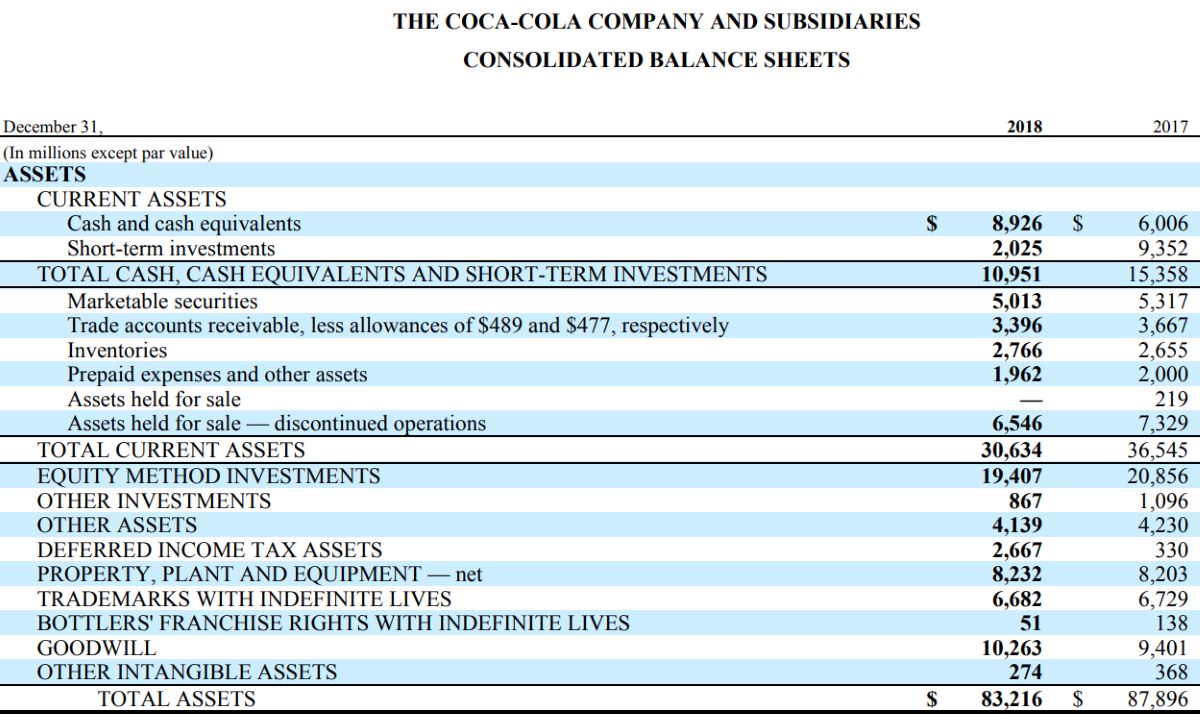

1. Gather the Balance Sheet: Obtain the company’s balance sheet, which provides a snapshot of its assets and liabilities at a given point in time. The balance sheet is divided into two main categories: assets and liabilities.

2. Identify Total Assets: Locate the total assets section on the balance sheet. This includes current assets, such as cash, accounts receivable, inventory, and noncurrent assets, such as property, plant, and equipment, and intangible assets. Sum up all the individual asset values to obtain the total assets figure.

3. Identify Total Liabilities: Find the total liabilities section on the balance sheet. This includes current liabilities, such as accounts payable, short-term loans, and noncurrent liabilities, such as long-term loans and bonds payable. Add up all the individual liability values to obtain the total liabilities figure.

4. Calculate Net Assets: Subtract the total liabilities figure (step 3) from the total assets figure (step 2). The resulting value is the net assets of the company. This represents the equity or residual value that belongs to the shareholders or owners of the company.

Net assets provide insights into the financial health, solvency, and value of a company. A positive net assets figure indicates that the company has more assets than liabilities, signifying a strong financial position. Conversely, a negative net assets figure suggests that the company has more liabilities than assets, indicating potential financial risks.

It is important to note that net assets alone may not provide a comprehensive assessment of a company’s financial health. It is necessary to consider other financial metrics, such as profitability ratios and cash flow analysis, for a complete evaluation. However, calculating net assets is a fundamental step in understanding the financial position and equity of a company.

Importance of Net Assets

Net assets play a crucial role in assessing the financial health and value of a company. This metric provides valuable insights into the equity or residual value that belongs to the shareholders or owners. Understanding the importance of net assets is vital for investors, analysts, and stakeholders in making informed decisions and evaluating a company’s financial performance. Below are some key reasons why net assets are significant:

1. Financial Health Assessment: Net assets serve as a key indicator of a company’s financial health. A higher net assets figure indicates a stronger financial position, as it signifies that the company has more assets than liabilities. It demonstrates the company’s ability to cover its debts and meet its financial obligations. Investors and lenders use this information to evaluate the company’s risk profile and financial stability.

2. Business Valuation: Net assets are essential in determining the value of a company. The net assets figure represents the equity that belongs to the shareholders or owners. Investors and analysts often calculate various valuation ratios, such as price-to-book ratio (P/B ratio), which compares the market value per share to the net assets per share. This ratio helps assess whether a company’s stock is undervalued or overvalued relative to its net assets.

3. Debt Coverage Analysis: Net assets play a vital role in assessing a company’s ability to cover its debts. Investors and creditors look at the debt-to-equity ratio, which compares a company’s total debt to its net assets. A lower debt-to-equity ratio indicates that the company relies more on equity financing, which may be viewed as a positive sign of financial stability and lower risk.

4. Investor Confidence: Net assets provide important information to investors, influencing their investment decisions. Investors typically prefer companies with a strong net assets position, as it indicates a greater cushion of assets that can be utilized to generate returns on investments. A healthy net assets figure can instill confidence in investors and attract potential shareholders or strategic partners.

5. Potential for Growth: Net assets can indicate a company’s potential for future growth. A positive net assets figure implies that the company has a solid foundation and resources to support its growth initiatives. It suggests that the company may have the ability to invest in research and development, acquisitions, or capital expenditures to fuel expansion and enhance long-term profitability.

6. Benchmarking and Comparisons: Net assets enable benchmarking and comparisons within an industry or sector. By comparing the net assets of different companies, investors and analysts can assess relative financial strength and stability. This comparative analysis helps determine which companies are better positioned to weather economic downturns, pursue growth opportunities, or withstand market volatility.

Overall, net assets provide a comprehensive snapshot of a company’s financial position, equity, and potential for generating profits. By considering the importance of net assets alongside other financial metrics, investors, analysts, and stakeholders can make informed decisions regarding investments, acquisitions, and overall financial strategy.

Conclusion

Understanding net assets is essential for navigating the complex world of finance. Net assets represent the equity or residual value that belongs to the shareholders or owners of a company, and they serve as a key indicator of the company’s financial health and value. By considering the components of net assets, including current and noncurrent assets, as well as current and noncurrent liabilities, investors, analysts, and stakeholders can gain valuable insights into a company’s financial position and performance.

The calculation of net assets, which involves subtracting total liabilities from total assets, provides a snapshot of the equity that would be left over for shareholders if all liabilities were settled. This metric is crucial for assessing a company’s financial stability, debt coverage, and potential for growth. It also plays a significant role in determining the value of a company and influencing investment decisions.

Net assets are not only important for evaluating individual companies, but they also provide a basis for benchmarking and comparisons within an industry or sector. By analyzing net assets alongside other financial metrics, investors and analysts can make informed decisions, identify opportunities, mitigate risks, and assess the long-term prospects of a company.

It is important to note that net assets should not be viewed in isolation. They should be considered alongside other financial indicators, such as profitability ratios, cash flow analysis, and industry trends, to gain a comprehensive understanding of a company’s financial position and prospects.

In conclusion, net assets play a vital role in evaluating the financial health, value, and growth potential of a company. By understanding net assets and its implications on a balance sheet, investors and stakeholders can make informed decisions, assess risks, and identify opportunities in the dynamic world of finance.