Home>Finance>How To Find Capital Expenditures In Financial Statements

Finance

How To Find Capital Expenditures In Financial Statements

Modified: March 1, 2024

Learn how to identify capital expenditures in financial statements and understand their impact on the overall financial health of a company. Enhance your finance skills with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When analyzing the financial health of a company, one crucial aspect to consider is its capital expenditures. Capital expenditures, also known as CapEx, refer to the investments a company makes in long-term assets such as property, equipment, or technology that will provide future benefits.

Understanding capital expenditures is essential for investors, financial analysts, and business owners as it directly impacts a company’s growth potential and financial performance. By identifying and analyzing capital expenditures in a company’s financial statements, stakeholders can gain insights into the company’s strategic priorities, expansion plans, and investment decisions.

This article aims to guide you through the process of finding capital expenditures in financial statements. We will explore various financial documents, including the balance sheet, cash flow statement, income statement, as well as footnotes and disclosures. By the end, you will have a comprehensive understanding of how to identify and interpret capital expenditures, allowing you to make informed financial decisions.

Understanding Capital Expenditures

Capital expenditures are investments made by a company to acquire or improve long-term assets that will be used in its ongoing operations. These assets typically have a useful life of more than one year and are expected to generate future benefits for the company. Examples of capital expenditures include the purchase of machinery, equipment, land, buildings, and technology infrastructure.

Capital expenditures differ from operational expenses, which are the day-to-day costs of running a business such as salaries, utilities, and office supplies. While operational expenses are deducted from revenue in the year they are incurred, capital expenditures are capitalized and recorded as assets on the company’s balance sheet. Over time, the assets are gradually depreciated or amortized, reflecting their declining value or use.

The decision to make capital expenditures is often based on strategic considerations, aiming to enhance the company’s competitive position, increase productivity, or expand its operations. By investing in long-term assets, companies can improve efficiency, reduce costs, and drive revenue growth in the long run.

It’s important to note that capital expenditures are different from revenue-generating investments, such as stocks or bonds. Capital expenditures involve acquiring tangible or intangible assets directly related to the company’s operations, whereas revenue-generating investments involve purchasing securities for the purpose of generating income through dividends, interest, or capital gains.

Additionally, it’s worth mentioning that capital expenditures can be categorized into two types:

- Expansion CapEx: These are investments specifically made with the intention of expanding the company’s operations, such as opening new branches, acquiring additional manufacturing facilities, or launching new product lines.

- Maintenance CapEx: These investments are made to maintain the existing infrastructure and assets of the company, ensuring that they continue to function optimally. Examples include routine repairs, equipment upgrades, and necessary maintenance activities.

Understanding the nature and purpose of capital expenditures is crucial for evaluating a company’s growth potential and financial stability. By analyzing the types and magnitude of capital expenditures, stakeholders can gain insights into the company’s strategic direction and assess the effectiveness of its investment decisions.

Importance of Capital Expenditures

Capital expenditures play a critical role in the long-term success and sustainability of a company. They have several key implications and benefits that highlight their importance:

- Growth and Expansion: Capital expenditures are often made with the objective of expanding the company’s operations and market presence. By investing in new equipment, technology, or infrastructure, companies can increase production capacity, improve efficiency, and meet growing customer demand. These investments can enable companies to seize market opportunities, penetrate new markets, and drive revenue growth.

- Competitive Advantage: Capital expenditures can provide companies with a competitive edge. Upgrading technology or acquiring state-of-the-art machinery can enhance productivity, quality, and innovation. By staying ahead of industry trends and investing in the latest tools and equipment, companies can differentiate themselves from competitors and offer superior products or services to customers.

- Operational Efficiency: Capital expenditures can lead to improved operational efficiency and cost savings. Investing in modern machinery or automation systems can streamline production processes, reduce labor costs, minimize waste, and increase output. By optimizing operations, companies can achieve higher profit margins and ultimately boost their financial performance.

- Risk Mitigation: Maintaining and upgrading existing assets through capital expenditures can help mitigate operational risks. Regular equipment maintenance and necessary repairs can prevent breakdowns and disruptions in production, avoiding costly downtime and potential loss of revenue. By investing in asset integrity, companies can ensure the reliability and longevity of their infrastructure.

- Long-term Value Creation: Capital expenditures contribute to the creation of long-term value for shareholders. By making strategic investments in assets that generate future cash flows, companies can increase their intrinsic value and attract investors. Well-executed capital expenditure projects can result in higher profitability, increased cash flows, and improved return on investment.

Overall, capital expenditures are a vital component of a company’s growth strategy, operational efficiency, and competitive advantage. They represent a commitment to long-term success and sustainability by investing in the assets and infrastructure necessary to drive future growth and profitability.

How to Identify Capital Expenditures in Financial Statements

Identifying capital expenditures in financial statements requires a careful analysis of various documents and disclosures. Here are the key sources to consider:

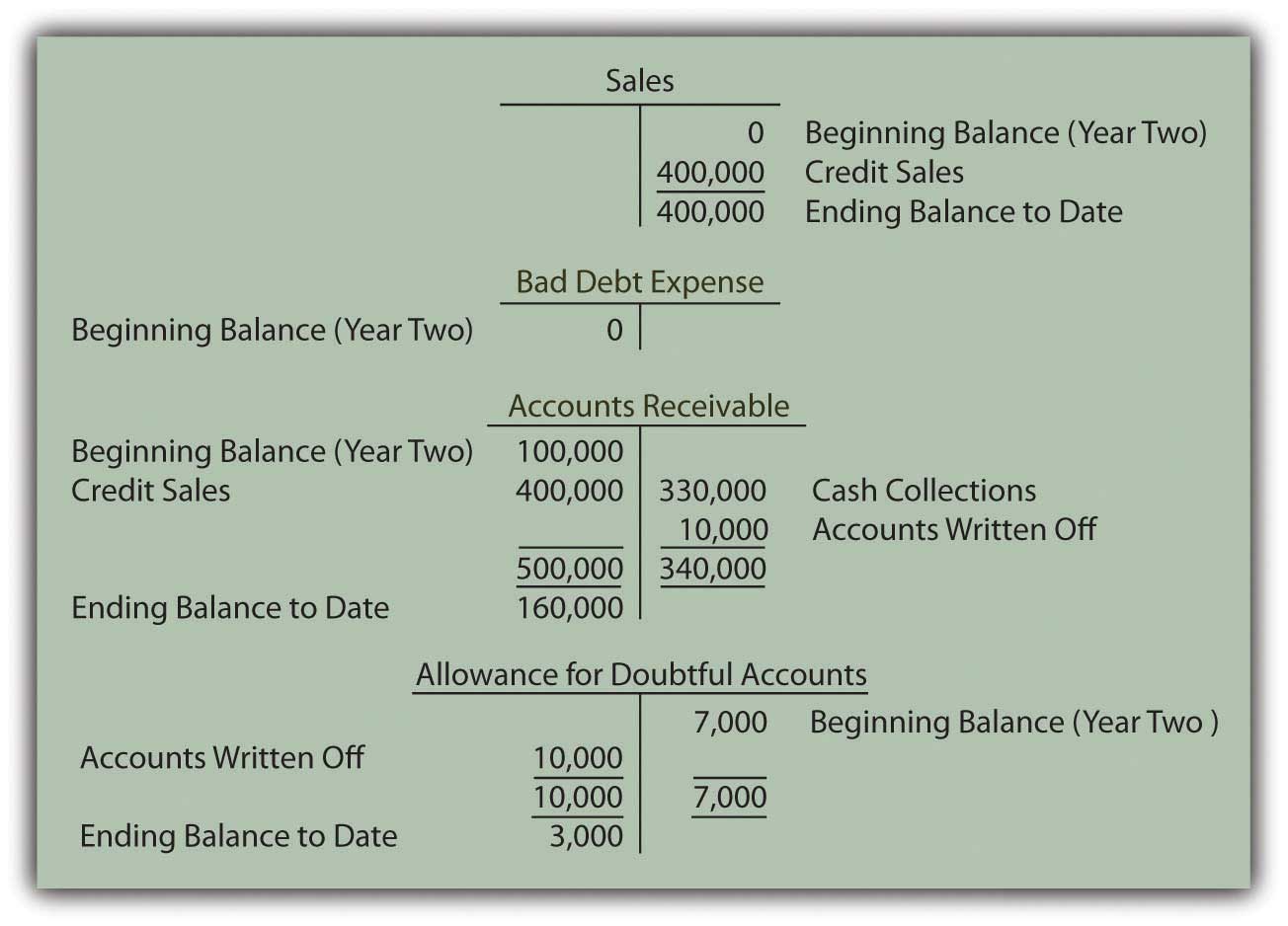

- Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. Look for increases in long-term assets, such as property, plant, and equipment (PP&E) or intangible assets. These assets are likely to represent capital expenditures.

- Cash Flow Statement: The cash flow statement shows the inflows and outflows of cash for a given period. Look for cash outflows categorized under “Investing Activities.” Capital expenditures are typically included in this section as they represent significant cash outflows used to acquire or improve long-term assets.

- Income Statement: While capital expenditures are not directly reported on the income statement, you can indirectly identify them by examining related expenses. Large depreciation or amortization expenses often indicate the presence of significant capital expenditures in prior periods.

- Footnotes and Disclosures: Companies often provide detailed footnotes and disclosures alongside their financial statements. Pay close attention to these sections, as they may contain specific information related to capital expenditures. Look for disclosures about major acquisitions, property purchases, or investments in new technology or equipment.

- Management Discussion and Analysis (MD&A): The MD&A section is an important part of the company’s annual report or quarterly filings. Management may discuss capital expenditure plans, projects, or initiatives that are currently underway or planned for the future. This section can provide valuable insights into the company’s investment decisions and priorities.

It’s important to note that the identification of capital expenditures may vary depending on the accounting standards and policies followed by the company. Some companies may provide detailed breakdowns of their capital expenditures, while others may only provide aggregate figures. Additionally, it’s essential to consider the context and industry norms when analyzing financial statements.

By utilizing these sources and conducting a thorough analysis of financial statements, footnotes, and management discussions, you can identify and assess the magnitude and impact of capital expenditures on a company’s financial performance and future prospects.

Balance Sheet

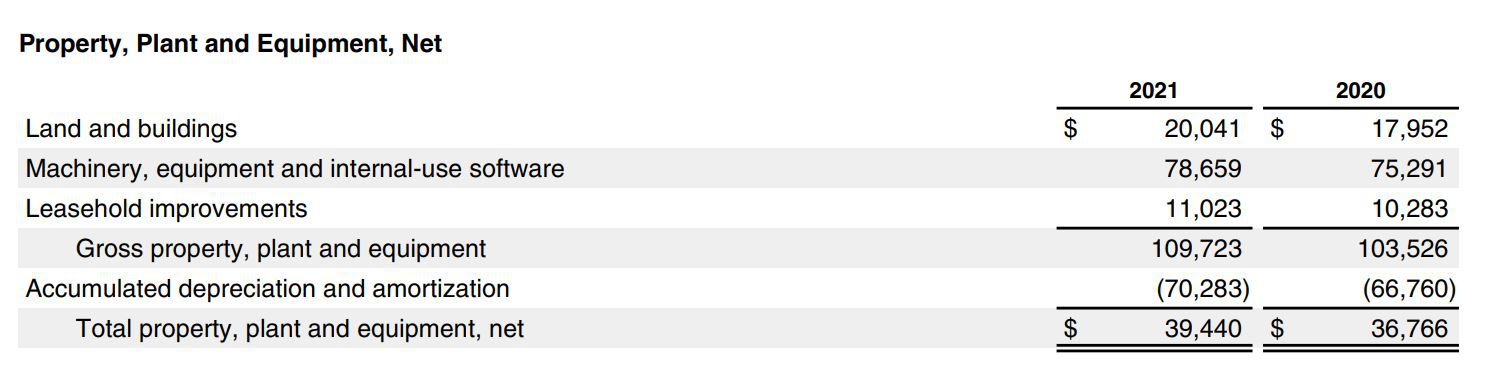

The balance sheet is a key financial statement that provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. When analyzing the balance sheet to identify capital expenditures, there are specific sections and line items to focus on:

- Property, Plant, and Equipment (PP&E): Look for increases in the value of PP&E on the balance sheet. This category includes tangible assets such as buildings, machinery, vehicles, and land. These increases may indicate capital expenditures made by the company to acquire or improve long-term assets.

- Intangible Assets: In addition to tangible assets, companies may invest in intangible assets such as patents, copyrights, and trademarks. Look for changes in the value of intangible assets on the balance sheet, as they may represent capital expenditures related to the acquisition or development of these assets.

- Accumulated Depreciation: The balance sheet may also provide information about the accumulated depreciation of the company’s assets. Depreciation is an accounting method that allocates the cost of an asset over its useful life. Higher accumulated depreciation suggests significant capital expenditures made in prior periods.

- Capital Leases: Companies may enter into capital leases to acquire long-term assets. Look for any capital lease obligations or related assets on the balance sheet. These may indicate capital expenditures made by the company.

It’s important to compare balance sheets over multiple periods to identify trends in these categories. Significant increases or fluctuations in asset values may indicate substantial capital expenditures by the company.

However, it’s crucial to exercise caution when interpreting balance sheet data. Increases in asset values may not always indicate capital expenditures, as other factors like acquisitions or revaluations can influence the figures. To validate that an increase in asset value represents a capital expenditure, it’s important to cross-reference with other financial statements and disclosures.

By analyzing the balance sheet and related line items, investors and analysts can gain insights into the company’s capital expenditure activities, which can provide valuable information about its asset investments, growth strategies, and long-term prospects.

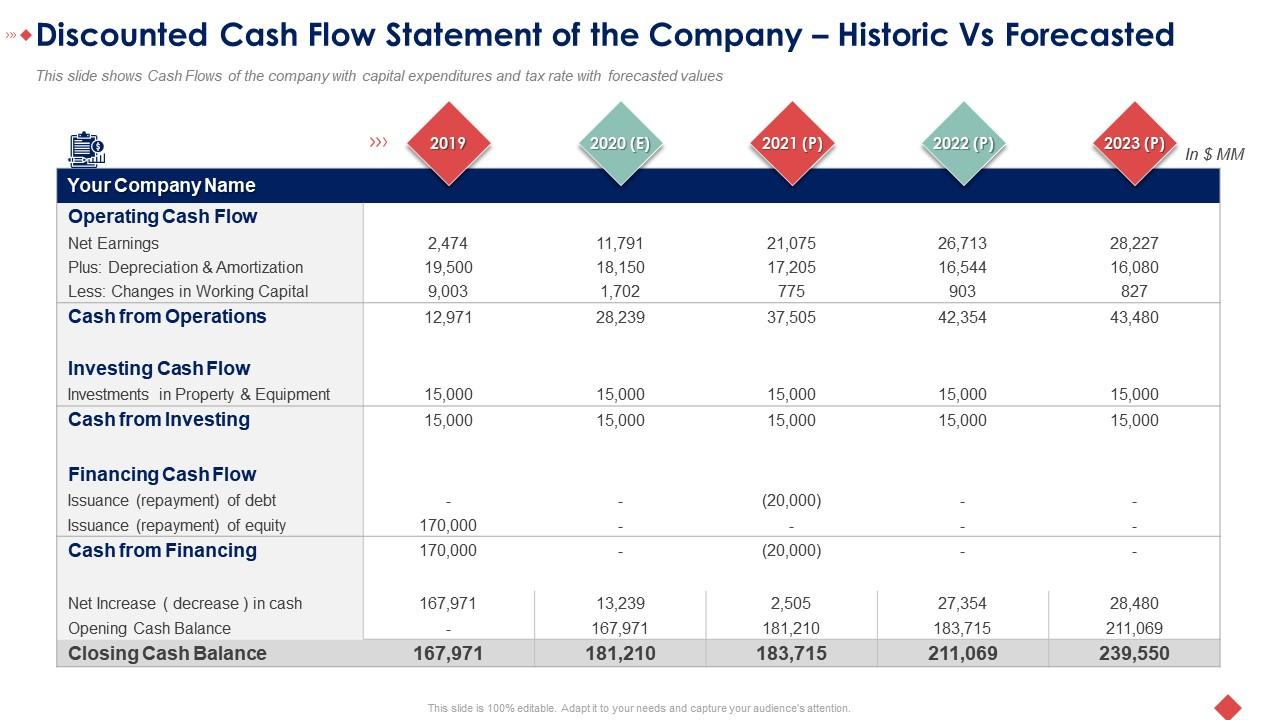

Cash Flow Statement

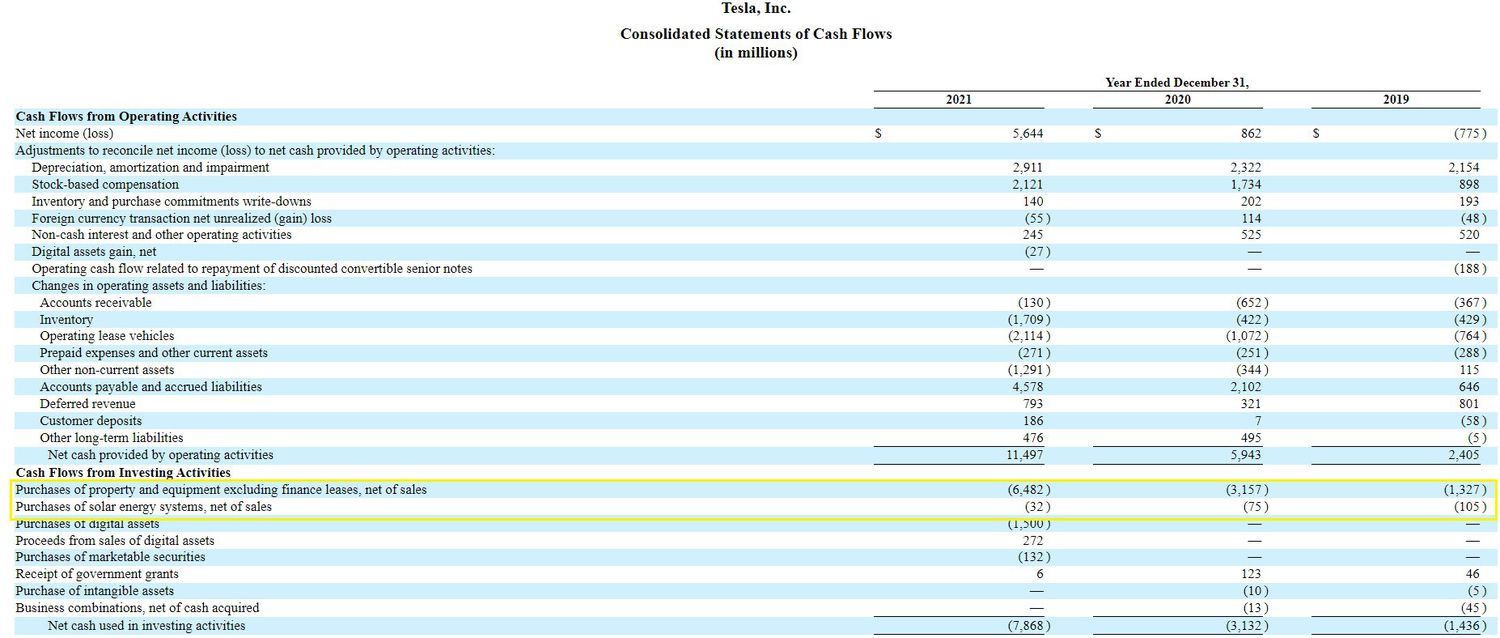

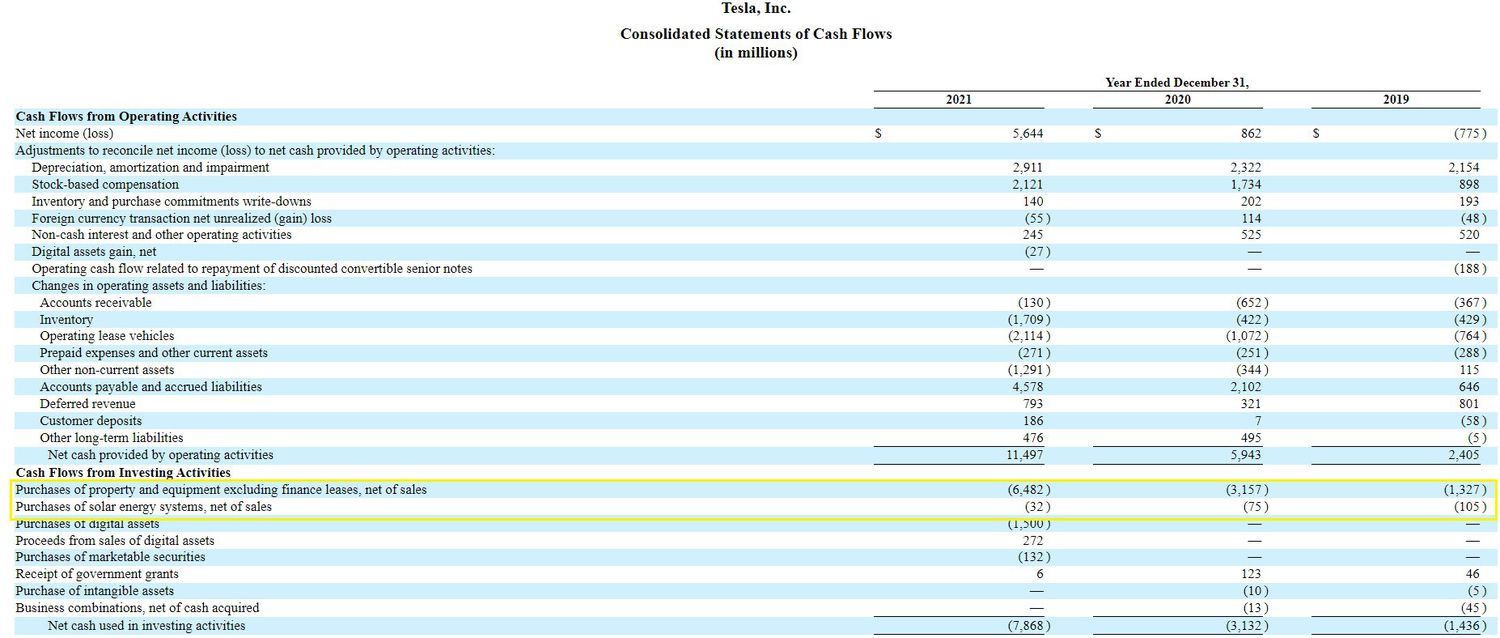

The cash flow statement is a financial statement that shows the inflows and outflows of cash for a specific period. It provides insights into the sources and uses of cash, including the cash impact of a company’s capital expenditures. When analyzing the cash flow statement to identify capital expenditures, consider the following:

- Investing Activities: The cash flow statement segregates cash flows into three main categories, one of which is “Investing Activities.” This category includes cash flows related to the purchase or sale of long-term assets. Look for cash outflows under this section, as they may indicate capital expenditures made by the company.

- Purchase of Property, Plant, and Equipment: Companies may disclose the specific cash amount spent on acquiring property, plant, and equipment (PP&E) in the cash flow statement. This line item provides a direct insight into the capital expenditures made during the reporting period.

- Depreciation and Amortization: While not directly related to capital expenditures, the cash flow statement may include a line item for depreciation and amortization. Since capital expenditures are capitalized and then gradually depreciated or amortized over time, a significant amount of depreciation or amortization expense may indicate substantial capital expenditures in prior periods.

- Non-Cash Investing and Financing Activities: Companies might also disclose non-cash transactions related to investing activities. These can include the issuance or retirement of debt to finance capital expenditures or the acquisition of assets through capital leases. These disclosures can provide additional insights into the company’s capital expenditure activities.

It’s important to consider the context and industry norms when analyzing the cash flow statement. Different industries have varying capital expenditure requirements, and comparing a company’s cash flow statement to its industry peers can provide valuable insights.

By carefully examining the investing activities section of the cash flow statement, investors and analysts can identify the cash impact of a company’s capital expenditures and evaluate its ability to finance and sustain its asset investments over time.

Income Statement

The income statement, also known as the profit and loss statement, provides a summary of a company’s revenues, expenses, and net income or loss for a specific period. While capital expenditures are not directly reported on the income statement, there are several indicators to consider when analyzing this statement:

- Depreciation and Amortization: Capital expenditures are capitalized as assets and then gradually depreciated or amortized over their useful lives. Therefore, higher depreciation or amortization expenses on the income statement can indicate significant capital expenditures made by the company in prior periods.

- Cost of Goods Sold (COGS): Significant changes in the cost of goods sold can indirectly reflect capital expenditures. If the company has made investments in new equipment or technology to improve production efficiency or quality, it could lead to lower COGS. This scenario suggests that capital expenditures have positively impacted the company’s operational performance.

- Research and Development (R&D) Expenses: While R&D expenses are not directly classified as capital expenditures, they can be an indication of a company’s investments in developing new products or technologies. These investments often contribute to long-term value creation and should be considered alongside traditional capital expenditures.

- Impairment Charges: Impairment charges occur when the value of an asset declines below its carrying value. This can happen if a company’s capital expenditures do not generate the expected future benefits. The presence of impairment charges on the income statement may suggest that prior capital expenditures were not successful in contributing to the company’s financial performance.

It’s important to note that capital expenditures are not directly reported on the income statement, but their impact is reflected in other line items. Therefore, a comprehensive analysis of the income statement, along with other financial statements and disclosures, is necessary to identify the effects of capital expenditures on a company’s financial performance.

By examining key indicators such as depreciation and amortization, COGS, R&D expenses, and impairment charges, analysts and investors can gain insights into the impact of capital expenditures on a company’s profitability and long-term growth potential.

Footnotes and Disclosures

Footnotes and disclosures accompanying a company’s financial statements can provide valuable information about its capital expenditures. These additional notes and explanations give context and detail to the numbers presented in the financial statements. When analyzing footnotes and disclosures, consider the following:

- Capital Expenditure Breakdown: Some companies provide detailed breakdowns of their capital expenditures in the footnotes or management discussion and analysis (MD&A) section. These breakdowns can reveal how much was spent on different categories of assets, such as property, plant, and equipment or intangible assets. This information can offer insights into the company’s investment priorities and strategies.

- Significant Acquisitions: Footnotes may disclose significant acquisitions made by the company during the reporting period. These acquisitions often involve the purchase of long-term assets or entire businesses and may represent substantial capital expenditures. Understanding the details of these acquisitions can shed light on the company’s investment activities.

- Capital Leases: Companies may disclose information about capital leases in the footnotes. These leases involve the acquisition of long-term assets through lease agreements. Disclosures about capital leases can provide insights into the company’s capital expenditure activities, as well as its long-term contractual obligations.

- Impairment Disclosures: Companies may disclose impairments of assets in their footnotes. These impairments occur when the value of an asset declines below its carrying value, indicating that prior capital expenditures may not have been successful. Impairment disclosures can give insights into the company’s evaluation of the future economic benefits resulting from its capital expenditure projects.

- Future Capital Expenditure Plans: Companies may provide forward-looking information about their capital expenditure plans and projections in the footnotes or MD&A section. These disclosures can reveal the company’s strategic intentions and the expected level of future capital expenditures. Understanding these plans can help assess the company’s growth prospects and investment strategies.

Footnotes and disclosures provide important details beyond the numbers presented in the financial statements. By carefully examining these sections, investors and analysts can gather additional insights into a company’s capital expenditure activities, significant acquisitions, impairments, and future investment plans.

Management Discussion and Analysis (MD&A)

The Management Discussion and Analysis (MD&A) section is a crucial part of a company’s annual report or quarterly filings. It provides an explanation and analysis of the company’s financial performance, results of operations, and overall business outlook. When reviewing the MD&A section to identify capital expenditures, consider the following:

- Capital Expenditure Plans: Companies often discuss their capital expenditure plans and initiatives in the MD&A section. This includes projects currently underway or planned for the future. Management may provide insights into the rationale behind these capital expenditures, their expected benefits, and the resources allocated to them.

- Project Progress and Milestones: In the MD&A, management may provide updates on the progress of specific capital expenditure projects. This can include significant milestones achieved, the timing of completion, and any deviations from initial plans. Monitoring project progress can help assess the effectiveness and execution of the company’s capital expenditure initiatives.

- Investment Priorities: Management may discuss the company’s investment priorities and how capital expenditures align with its strategic objectives. Understanding the company’s focus areas can provide insights into the types of assets being invested in and the expected impact on future growth and profitability.

- Financing and Capital Structure: The MD&A section may also address the financing of capital expenditures. Management may discuss the company’s approach to funding these investments, including the use of internally generated funds, debt issuance, or equity financing. Understanding the capital structure and financing choices can provide insights into the financial implications of capital expenditure decisions.

- Risks and Uncertainties: Management may outline the risks and uncertainties associated with capital expenditures in the MD&A. This can include factors such as cost overruns, changes in market conditions, or technological disruptions that could impact the success of capital expenditure projects. Evaluating the risks involved can help assess the potential impact on the company’s financial performance and future prospects.

The MD&A section provides a narrative overview of the company’s capital expenditure activities and their implications. By thoroughly analyzing this section, investors and analysts can gain a deeper understanding of the company’s investment strategies, project progress, financing considerations, and the associated risks and uncertainties.

Conclusion

Identifying and understanding capital expenditures in financial statements is crucial for investors, financial analysts, and business owners. Through a comprehensive analysis of various financial documents and disclosures, stakeholders can gain insights into a company’s investment decisions, growth potential, and long-term prospects.

By examining the balance sheet, analysts can identify increases in long-term assets such as property, plant, and equipment or intangible assets, indicating capital expenditures. The cash flow statement provides insights into the cash impact of capital expenditures through the “Investing Activities” section, where significant cash outflows for acquiring or improving long-term assets are recorded.

While not directly reported on the income statement, indicators such as depreciation and amortization expenses, changes in the cost of goods sold, and impairments can indirectly reflect capital expenditure activities. Adding to the analysis, footnotes and disclosures provide valuable details about specific capital expenditure breakdowns, significant acquisitions, capital leases, and future investment plans.

Lastly, the Management Discussion and Analysis (MD&A) section offers insights into the company’s capital expenditure plans, project progress, investment priorities, financing considerations, and associated risks and uncertainties. This section provides a narrative overview that complements the numbers in the financial statements and enhances understanding.

By integrating these various sources of information and conducting a thorough analysis, stakeholders can form a comprehensive view of a company’s capital expenditure activities. This understanding is essential for making informed investment decisions, evaluating a company’s growth prospects, and assessing its financial performance and stability.

References

1. Herbohn, K. (2018). Financial Accounting: A Practical Approach. Cengage Learning Australia.

2. Warren, C., Reeve, J., Duchac, J., & Fess, P. (2017). Financial Accounting. Cengage Learning.

3. Kieso, D., Weygandt, J., & Warfield, T. (2019). Intermediate Accounting (16th ed.). Wiley.

4. Financial Accounting Standards Board (FASB). (2021). Accounting Standards Codification. Retrieved from https://asc.fasb.org/home

5. International Financial Reporting Standards (IFRS). (2021). International Accounting Standards. Retrieved from https://www.ifrs.org/issued-standards/list-of-standards/

Please note that these references are for general informational purposes only. It is always recommended to consult authoritative sources, such as accounting textbooks, accounting standards, and official regulatory bodies, for specific and up-to-date information on capital expenditures and financial statement analysis.