Home>Finance>How To Calculate Capital Expenditures From Balance Sheet

Finance

How To Calculate Capital Expenditures From Balance Sheet

Modified: December 30, 2023

Learn how to calculate capital expenditures from the balance sheet in this comprehensive guide. Improve your finance skills and make smarter investment decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are Capital Expenditures?

- The Importance of Calculating Capital Expenditures

- Step 1: Gather Required Information

- Step 2: Identify Long-term Assets

- Step 3: Determine the Historical Cost

- Step 4: Account for Accumulated Depreciation

- Step 5: Calculate Net Book Value

- Step 6: Identify Additional Capital Expenditures

- Step 7: Calculate Total Capital Expenditures

- Conclusion

Introduction

Welcome to our guide on how to calculate capital expenditures from the balance sheet. Capital expenditures, often referred to as CapEx, are essential for businesses as they represent investments in long-term assets that will benefit the company well into the future. Understanding how to calculate and analyze CapEx is crucial for financial planning, budgeting, and decision-making.

CapEx includes expenditures made to acquire, improve, or extend the life of an asset. These assets can range from property and buildings to computer systems and manufacturing equipment. By accounting for capital expenditures, businesses can better assess their financial health, plan for future growth, and make informed investment decisions.

This article will walk you through the steps of calculating capital expenditures from the balance sheet, helping you gain a deeper understanding of how to evaluate the financial health of a company. We will explore the importance of calculating CapEx, the key components required for accurate calculations, and a step-by-step process to determine the total amount of capital expenditures. Let’s dive in!

What are Capital Expenditures?

Capital expenditures are investments made by businesses to acquire, upgrade, or improve long-term assets that will generate economic benefits over an extended period of time. These assets are essential for the operation and growth of a company and are not intended for immediate consumption or resale. Capital expenditures are different from operating expenses, which are incurred in the day-to-day functioning of a business.

Some examples of capital expenditures include:

- Construction or purchase of a new building or facility

- Upgrade or replacement of machinery and equipment

- Development of new technology or software

- Acquisition of land or real estate

- Investments in research and development

Capital expenditures are typically significant investments that require careful consideration and planning. These expenditures are expected to have long-term benefits and contribute to the overall growth and profitability of a company. They play a vital role in maintaining and expanding a company’s productive capacity, improving operational efficiency, and enhancing competitiveness in the market.

When calculating capital expenditures, it is important to focus on expenditures that increase the value or usefulness of the asset, extend its useful life, or improve its productivity or efficiency. Regular repairs and maintenance expenses, which are considered operating expenses, should not be included in capital expenditure calculations.

Understanding and tracking capital expenditures is crucial for businesses to make informed financial decisions. It helps management evaluate the return on investment (ROI) of different projects, assess the financial health of the company, and plan for future growth and expansion. By analyzing the capital expenditure data, companies can identify trends, make appropriate budget allocations, and ensure efficient utilization of resources.

The Importance of Calculating Capital Expenditures

Calculating capital expenditures is essential for businesses as it provides crucial insights into their financial health, investment decisions, and long-term planning. Let’s explore why it is important to accurately calculate and analyze capital expenditures:

1. Financial Planning and Budgeting: By determining the amount of capital expenditures, businesses can plan their budgets and allocate funds accordingly. It helps in forecasting future cash flow requirements and managing financial resources effectively.

2. Investment Analysis: Calculating capital expenditures allows companies to evaluate the potential return on investment of different projects. It helps in identifying profitable investments and assessing the feasibility and sustainability of proposed initiatives.

3. Asset Management: Capital expenditures help in monitoring and managing the company’s assets. By tracking the costs associated with acquiring, improving, and maintaining assets, businesses can make informed decisions regarding repairs, upgrades, or replacements.

4. Financial Performance Evaluation: Analyzing capital expenditures allows companies to assess their financial performance and identify areas of improvement. It helps in measuring the efficiency and profitability of capital investments and comparing them to industry benchmarks.

5. Forecasting Future Growth: Accurate capital expenditure calculations enable businesses to anticipate future growth and expansion. It assists in identifying opportunities for capacity expansion, technological advancements, and market penetration.

6. Compliance and Reporting: Calculating capital expenditures is necessary for compliance with accounting standards and reporting requirements. It ensures accurate financial reporting and transparency in financial statements.

7. Risk Management: Understanding the capital expenditures allows businesses to assess the risks associated with their investments. It helps in managing financial risks, avoiding unnecessary debt accumulation, and ensuring the sustainability of the company.

In summary, calculating capital expenditures is an integral part of financial analysis and decision-making for businesses. It provides valuable insights into the financial health of the company, helps in budgeting and financial planning, assesses investment opportunities, and supports long-term growth strategies. By accurately calculating and analyzing capital expenditures, businesses can optimize their resource allocation, improve operational efficiency, and drive sustainable growth.

Step 1: Gather Required Information

Before you can calculate capital expenditures from the balance sheet, it’s important to gather the necessary information. Here are the key pieces of information you’ll need:

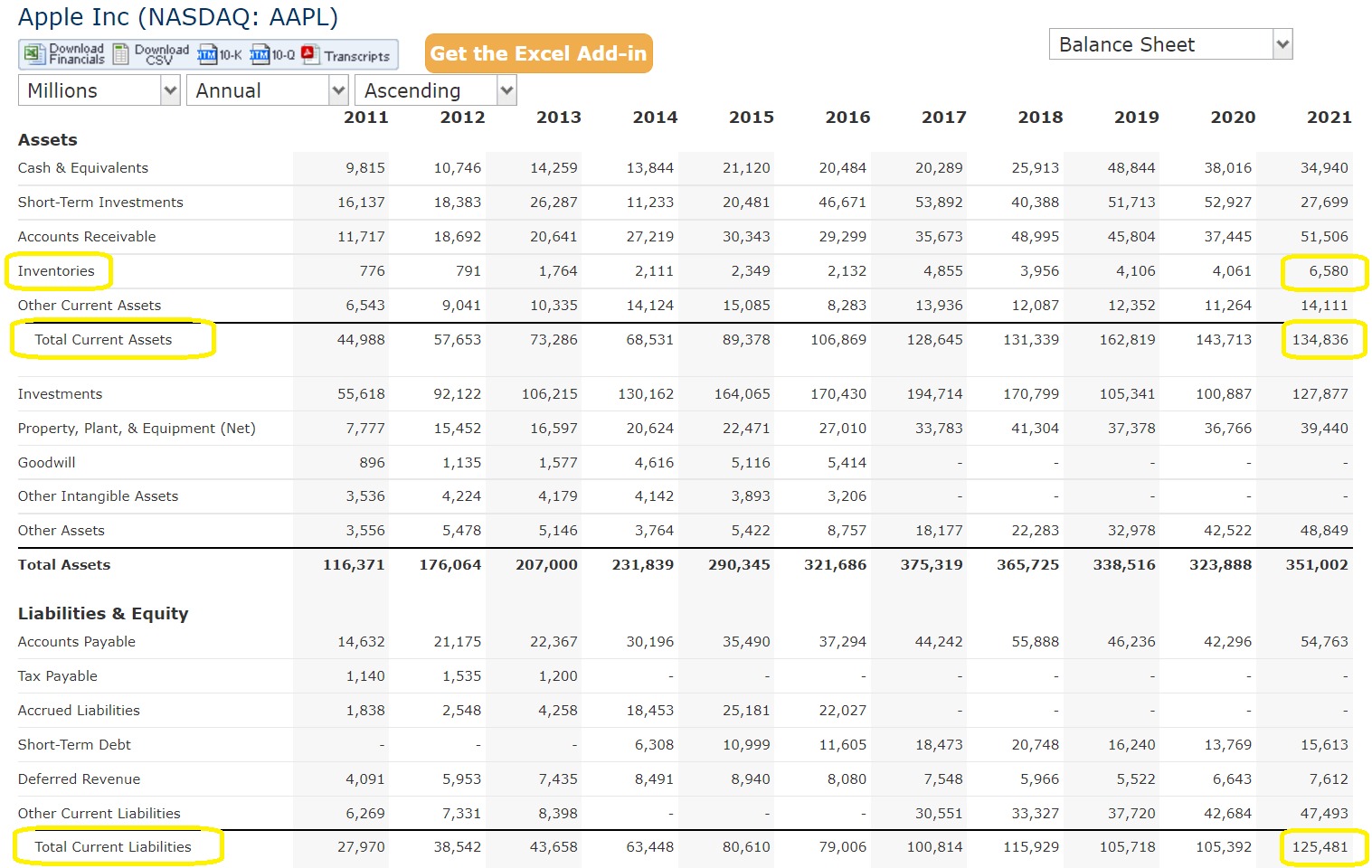

- Financial Statements: Obtain the latest balance sheet of the company you are analyzing. The balance sheet provides a snapshot of the company’s financial position, including its assets, liabilities, and shareholders’ equity.

- Historical Cost: Identify the historical cost of the assets that you want to calculate the capital expenditures for. The historical cost is the original cost of acquiring or constructing the asset, including any expenses directly attributable to its acquisition or construction.

- Accumulated Depreciation: Determine the accumulated depreciation for the assets. Accumulated depreciation represents the total depreciation expense recognized for the assets over their useful lives. It reflects the decline in value and the wear and tear that the assets have experienced since their acquisition.

- Useful Life: Determine the estimated useful life of the assets. The useful life is the period over which the asset is expected to contribute to the company’s operations. It is typically determined based on industry standards, manufacturer’s recommendations, or internal assessments.

- Additions and Disposals: Identify any additional capital expenditures made during the reporting period. This includes any investment in new assets or improvements made to existing assets. It is important to distinguish between capital expenditures and regular repairs and maintenance expenses that are considered operating expenses.

By gathering this information, you will have the necessary data to accurately calculate the capital expenditures from the balance sheet. The next steps will involve analyzing and manipulating this data to determine the total capital expenditures and gain insights into the company’s investment activities.

Step 2: Identify Long-term Assets

Once you have gathered the required information for calculating capital expenditures, the next step is to identify the long-term assets that are relevant to your analysis. Long-term assets are the assets that a company expects to use or hold for more than one accounting period. These assets play a crucial role in the company’s operations and contribute to its long-term value.

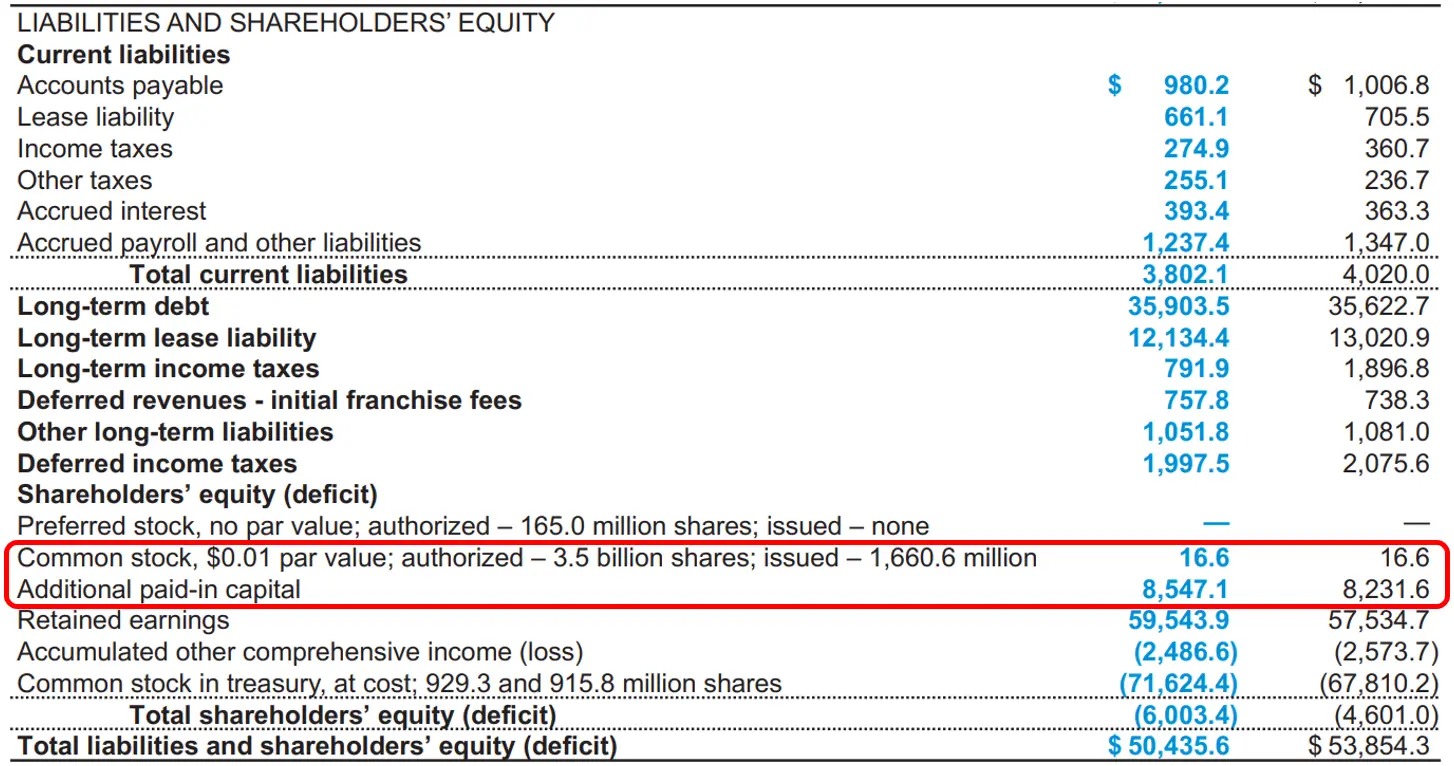

To identify the long-term assets, review the balance sheet and focus on the asset section. Look for assets that are not meant for immediate consumption, resale, or conversion into cash within a year. Some common examples of long-term assets include:

- Property, Plant, and Equipment (PP&E): This includes land, buildings, machinery, vehicles, and other fixed assets that are used in the production or service delivery process.

- Intangible Assets: These are assets that lack physical substance but hold value for the company. Examples include patents, trademarks, copyrights, and goodwill.

- Investments: Long-term investments in other companies or entities, including stocks, bonds, and long-term loans.

- Long-term Receivables: These are amounts due from customers or other entities that are expected to be collected over a period longer than one year.

It’s important to carefully review the balance sheet and identify all relevant long-term assets for your analysis. Exclude any assets that are considered short-term or current assets, as they are not relevant to calculating capital expenditures.

By identifying the long-term assets, you will have a clear understanding of the assets that will be included in the calculation of your capital expenditures. This step sets the foundation for the subsequent steps, where you will determine the historical cost, accumulated depreciation, and net book value of these assets.

Step 3: Determine the Historical Cost

Now that you have identified the long-term assets for calculating capital expenditures, the next step is to determine the historical cost of these assets. The historical cost represents the original cost of acquiring or constructing the assets, including any directly attributable expenses.

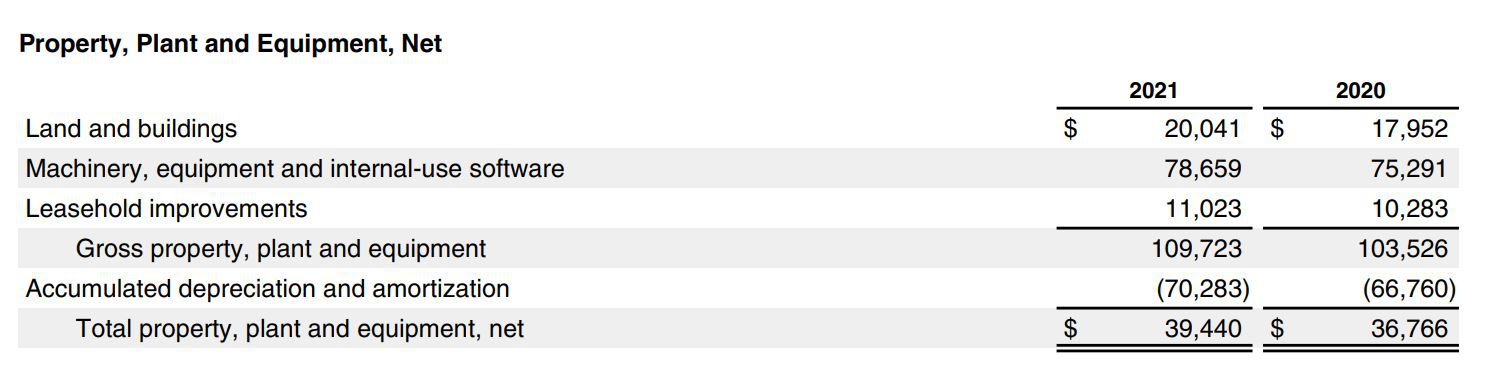

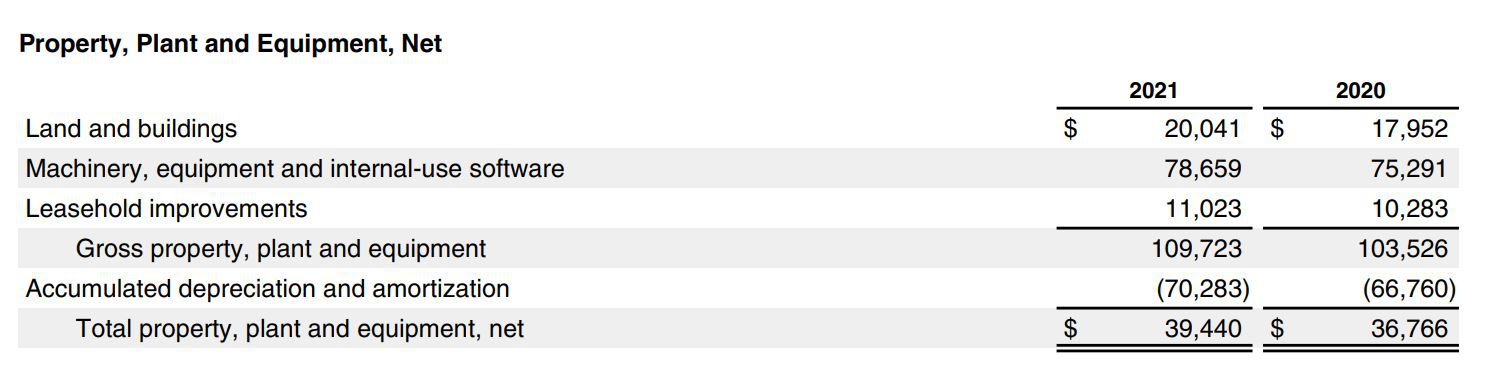

To determine the historical cost, refer to the balance sheet and locate the values for each long-term asset. The historical cost information can usually be found in the asset section or in related footnotes. It is important to analyze each asset individually and record its historical cost.

In some cases, the historical cost may not be readily available on the balance sheet. In such situations, you may need to consult additional sources such as company financial statements, audited reports, or management discussions and disclosures.

It’s important to note that the historical cost does not change over time, even if the market value of the asset fluctuates. This is because the historical cost represents the amount actually paid or incurred when the asset was acquired or constructed.

Once you have determined the historical cost for each long-term asset, record these values for further calculations. This information will be used in the subsequent steps to calculate the net book value and total capital expenditures.

Accurately determining the historical cost of long-term assets is crucial for calculating capital expenditures. It forms the basis for understanding the initial investment made by the company and provides a starting point for evaluating the financial performance and return on investment of these assets. By establishing the historical cost, you can proceed to the next step and account for accumulated depreciation.

Step 4: Account for Accumulated Depreciation

After determining the historical cost of the long-term assets, the next step is to account for accumulated depreciation. Accumulated depreciation represents the total depreciation expense that has been recorded for an asset over its useful life.

To account for accumulated depreciation, you will need to refer to the balance sheet and identify the corresponding value for each long-term asset. The accumulated depreciation can typically be found as a separate line item or as a deduction from the historical cost of the asset.

Depreciation is a method of allocating the cost of an asset over its useful life. It reflects the reduction in value and the wear and tear that the asset experiences as it is used in the company’s operations. The depreciation expense is recorded periodically, usually on an annual basis, and accumulated over time.

To calculate the net book value, subtract the accumulated depreciation from the historical cost of each long-term asset. The net book value represents the remaining value of the asset after accounting for the accumulated depreciation. It indicates the approximate current worth of the asset in the company’s books.

It’s important to accurately account for accumulated depreciation as it reflects the aging and decline in value of the long-term assets. Proper depreciation accounting allows companies to spread the cost of the assets over their useful lives, ensuring accurate financial reporting and evaluation of the asset’s performance.

By considering accumulated depreciation, you gain a more accurate understanding of the true value of the long-term assets and their contribution to the company’s financial position. This information is crucial for calculating the total capital expenditures and assessing the financial health of the company.

Step 5: Calculate Net Book Value

Once you have accounted for accumulated depreciation, the next step is to calculate the net book value of the long-term assets. The net book value represents the remaining value of the asset after deducting the accumulated depreciation from the historical cost.

To calculate the net book value for each long-term asset, subtract the accumulated depreciation from the historical cost. The formula is as follows:

Net Book Value = Historical Cost – Accumulated Depreciation

The net book value provides an approximation of the current worth of the asset on the company’s books. It represents the value that the asset retains after accounting for the depreciation that has been recorded.

By calculating the net book value, you gain insights into the current value and remaining useful life of the long-term assets. It helps in evaluating the financial performance and return on investment of these assets. A higher net book value indicates assets with a longer useful life and a lower level of depreciation over time.

It’s important to note that the net book value is specific to each individual long-term asset. Therefore, you will need to calculate the net book value for each asset separately. This will provide a comprehensive overview of the company’s asset portfolio and allow for more accurate financial analysis.

The net book value is a key component in determining the total capital expenditures, as it represents the value of the assets that have been invested in and still have a useful life ahead. By calculating the net book value, you can proceed to the next step and identify any additional capital expenditures made during the reporting period.

Step 6: Identify Additional Capital Expenditures

After calculating the net book value of the long-term assets, the next step is to identify any additional capital expenditures made during the reporting period. Additional capital expenditures refer to the investments made in acquiring new assets or improving existing assets.

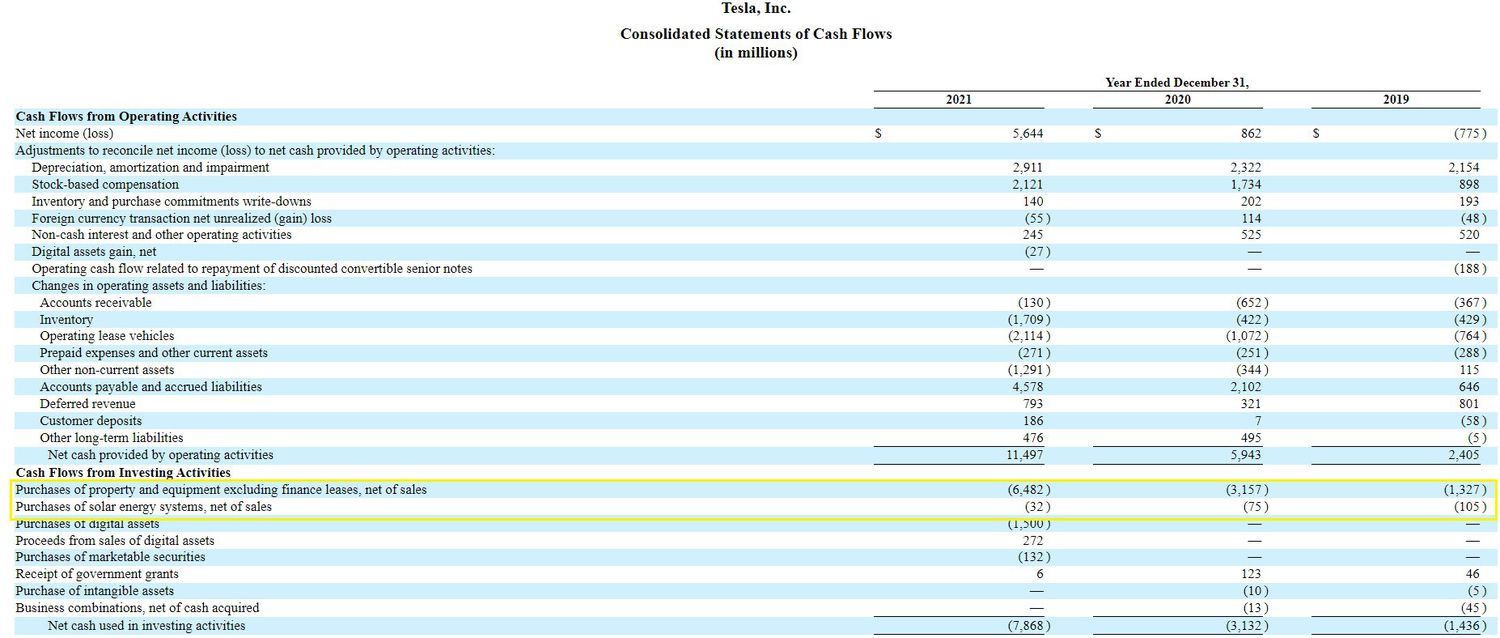

To identify additional capital expenditures, you will need to review the company’s financial records, statements, and related disclosures. Look for any transactions or activities that indicate significant investments in long-term assets.

Examples of additional capital expenditures include:

- Purchases of new equipment or machinery

- Construction of new buildings or facilities

- Upgrades or renovations to existing assets

- Investments in technology or research and development

It is important to differentiate capital expenditures from regular repairs and maintenance expenses that are considered operating expenses. Capital expenditures involve significant investments with long-term benefits, while repairs and maintenance expenses are incurred to keep the assets in good working condition but do not significantly increase their value or extend their useful life.

By identifying additional capital expenditures, you can gain a comprehensive understanding of the investments made by the company during the reporting period. These additional capital expenditures contribute to the overall calculation of the total capital expenditures.

It is worth noting that identifying additional capital expenditures may require careful analysis and judgment. Some expenditures may be related to ongoing projects or be part of a larger investment plan. Therefore, it is important to review the relevant information and consult with management or financial experts if necessary.

By accurately identifying additional capital expenditures, you can proceed to the final step and calculate the total amount of capital expenditures for the reporting period.

Step 7: Calculate Total Capital Expenditures

After gathering all the required information and identifying the additional capital expenditures, you are now ready to calculate the total capital expenditures for the reporting period. The total capital expenditures represent the overall investment made by the company in long-term assets during that specific timeframe.

To calculate the total capital expenditures, you will need to add up the following components:

- The net book value of the long-term assets identified in Step 5.

- The value of any additional capital expenditures made during the reporting period, as identified in Step 6.

The formula for calculating the total capital expenditures is as follows:

Total Capital Expenditures = Net Book Value of Existing Assets + Value of Additional Capital Expenditures

By summing the net book value of existing assets with the value of additional capital expenditures, you will arrive at the total amount invested in long-term assets during the reporting period.

The total capital expenditures provide valuable insights into the company’s investment activities and financial commitment to acquiring or improving long-term assets. It allows you to evaluate the scale of investment, assess the effectiveness of asset management, and understand the company’s strategic priorities.

An accurate calculation of the total capital expenditures is crucial for financial planning, budgeting, and decision-making. It helps businesses assess the return on investment of different projects, make informed investment decisions, and ensure proper resource allocation.

It’s important to note that the total capital expenditures should be analyzed in relation to the company’s overall financial performance, industry benchmarks, and long-term growth objectives. It provides a foundation for evaluating the efficiency and effectiveness of capital deployment and contributes to strategic decision-making.

By completing Step 7 and calculating the total capital expenditures, you have gained a comprehensive understanding of the company’s investment in long-term assets for the reporting period.

Conclusion

Calculating capital expenditures from the balance sheet is a crucial process for businesses to assess their financial health, plan for the future, and make informed investment decisions. By following the step-by-step guide outlined in this article, you can accurately determine the total amount of capital expenditures and gain valuable insights into the company’s investment activities.

Throughout this guide, we discussed the importance of calculating capital expenditures and the key components required for accurate calculations. We explored how to gather the necessary information, identify long-term assets, determine historical costs, account for accumulated depreciation, calculate the net book value, identify additional capital expenditures, and ultimately calculate the total capital expenditures.

By understanding and analyzing capital expenditures, businesses can better evaluate their financial performance, allocate resources effectively, and plan for future growth and expansion. It provides a foundation for financial planning, budgeting, investment analysis, and decision-making.

Remember, capital expenditures are essential investments in long-term assets that generate economic benefits for the company. By accurately calculating and analyzing these expenditures, businesses can make informed decisions about capital allocation, asset management, and strategic planning.

As you embark on your journey of calculating capital expenditures, it is important to continually review and update your analysis. Regularly monitoring and evaluating capital expenditures will help you stay informed about the financial health of your company and navigate the ever-changing business landscape.

In conclusion, by understanding the process of calculating capital expenditures and leveraging the insights gained from this analysis, businesses can make sound financial decisions and build a solid foundation for long-term success.