Home>Finance>Cash Flow Financing: Definition, How It Works, And Advantages

Finance

Cash Flow Financing: Definition, How It Works, And Advantages

Published: October 24, 2023

Learn how cash flow financing works and its advantages. Get a clear definition of finance and explore different aspects of cash flow management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to the World of Cash Flow Financing!

Are you in need of funding for your business? Do you want to maintain a steady stream of cash to fuel your company’s growth? If so, then cash flow financing might just be the solution for you. In this article, we’ll explore the definition, how it works, and the advantages of cash flow financing, and why it’s a great choice for businesses looking to optimize their financial stability and growth potential.

Key Takeaways:

- Cash flow financing allows businesses to access immediate funding by leveraging their anticipated cash flow.

- It provides a convenient alternative to traditional loans, especially for businesses with irregular revenue patterns.

Defining Cash Flow Financing

Cash flow financing is a method of securing funding by borrowing against a business’s anticipated future cash flows. It focuses on a company’s cash inflows and outflows over a specific period, usually a projected timeframe of one to three years. Unlike traditional financing methods that primarily consider the value of collateral, cash flow financing primarily relies on the projected cash flow generation capacity of a business.

This type of financing is particularly beneficial for businesses that experience cyclical or seasonal fluctuations in revenue or have a high level of working capital tied up in accounts receivables or other non-liquid assets. Cash flow financing provides a lifeline to these businesses by providing the necessary funding to bridge the gap between cash outflows and inflows.

How Cash Flow Financing Works

Now that we have a basic understanding of cash flow financing, let’s dive into how it works.

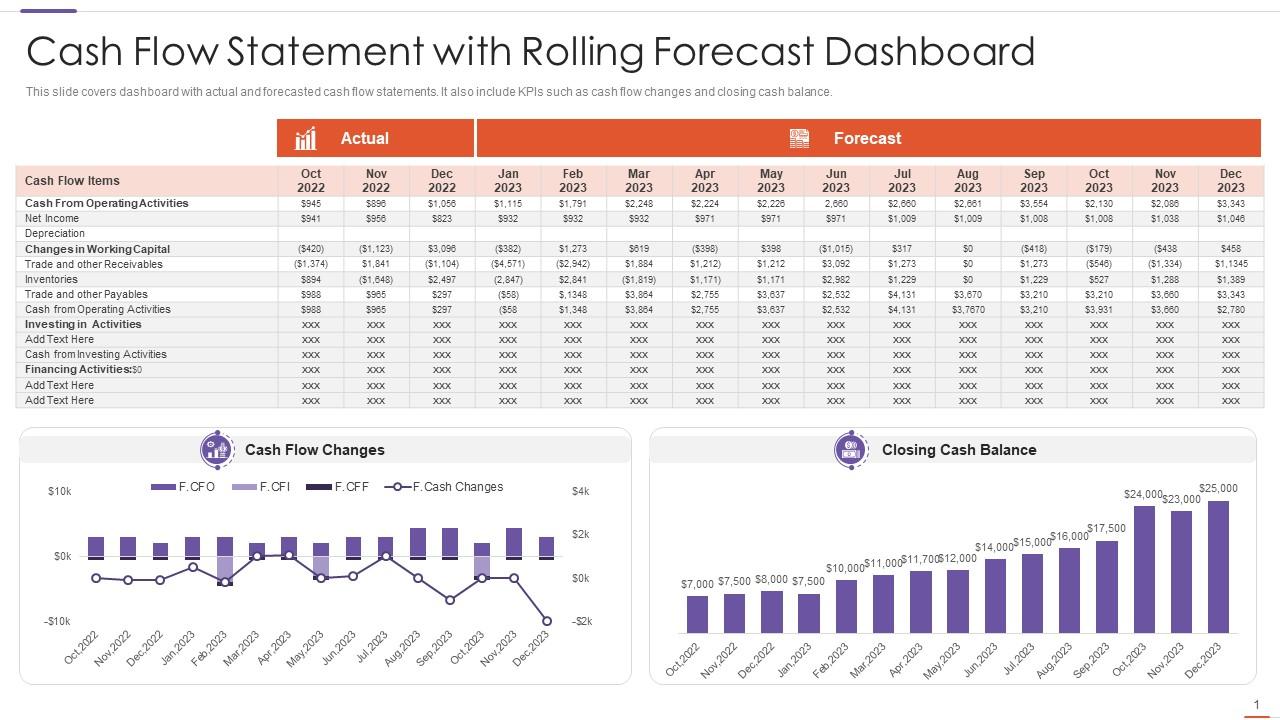

- Evaluating Cash Flow: When applying for cash flow financing, lenders analyze your historical cash flow statements, projected cash flow forecasts, and other relevant financial documents to assess the stability and consistency of your cash inflows. This evaluation helps lenders gauge the risk associated with the financing.

- Loan Approval: Once the lender determines that your business has a strong cash flow capacity, they will approve your cash flow financing request. The terms and conditions of the loan will be based on factors such as the projected cash flow, repayment capabilities, and any existing debt obligations.

- Repayment: Repayment terms for cash flow financing vary depending on the agreement. Some loans require regular fixed payments, while others offer more flexibility. It’s essential to choose a repayment structure that aligns with your business’s cash flow pattern and financial goals.

The Advantages of Cash Flow Financing

Cash flow financing offers several advantages that make it an attractive option for businesses:

- Flexible Financing: Cash flow financing provides flexibility in terms of usage. You can utilize the funds for any business-related expense, such as expanding operations, purchasing inventory, or investing in new equipment.

- No Collateral Required: Unlike traditional loans that require collateral, cash flow financing is typically an unsecured form of financing. This reduces the risk for businesses that might not have substantial assets to pledge as collateral.

- Enhanced Cash Flow Stability: By securing funding based on your anticipated cash flow, cash flow financing helps businesses maintain a consistent cash flow stream. This stability enables you to meet your financial obligations, pay employees and suppliers on time, and seize growth opportunities.

- Shorter Approval Process: Cash flow financing often has a quicker approval process compared to traditional loans. This makes it an excellent solution for businesses that need quick access to funds to address immediate financial needs or capitalize on time-sensitive opportunities.

Now that you have a deeper understanding of cash flow financing, you can evaluate whether it’s the right financing option for your business. Remember, cash flow financing is not a one-size-fits-all solution, but it can undoubtedly provide the boost your business needs to thrive and grow.