Home>Finance>Free Cash Flow Yield: Definition, Formula, And How To Calculate

Finance

Free Cash Flow Yield: Definition, Formula, And How To Calculate

Modified: December 29, 2023

Discover the definition, formula, and how to calculate Free Cash Flow Yield in finance. Enhance your understanding of this important financial metric.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to the world of Finance!

Finance is a fascinating subject that covers a wide range of topics, from personal budgeting to investment strategies and everything in between. One important concept that investors often use to evaluate the financial health of a company is free cash flow yield. In this blog post, we’ll dive deep into what free cash flow yield is, how to calculate it, and why it’s a significant metric to consider when making investment decisions.

Key Takeaways:

- Free cash flow yield is a financial metric used to measure the amount of cash generated by a company relative to its market value.

- It is an important indicator for investors, as it provides insights into a company’s ability to generate excess cash for its shareholders.

Now, let’s break down the concept of free cash flow yield and understand its significance in more detail.

What is Free Cash Flow Yield?

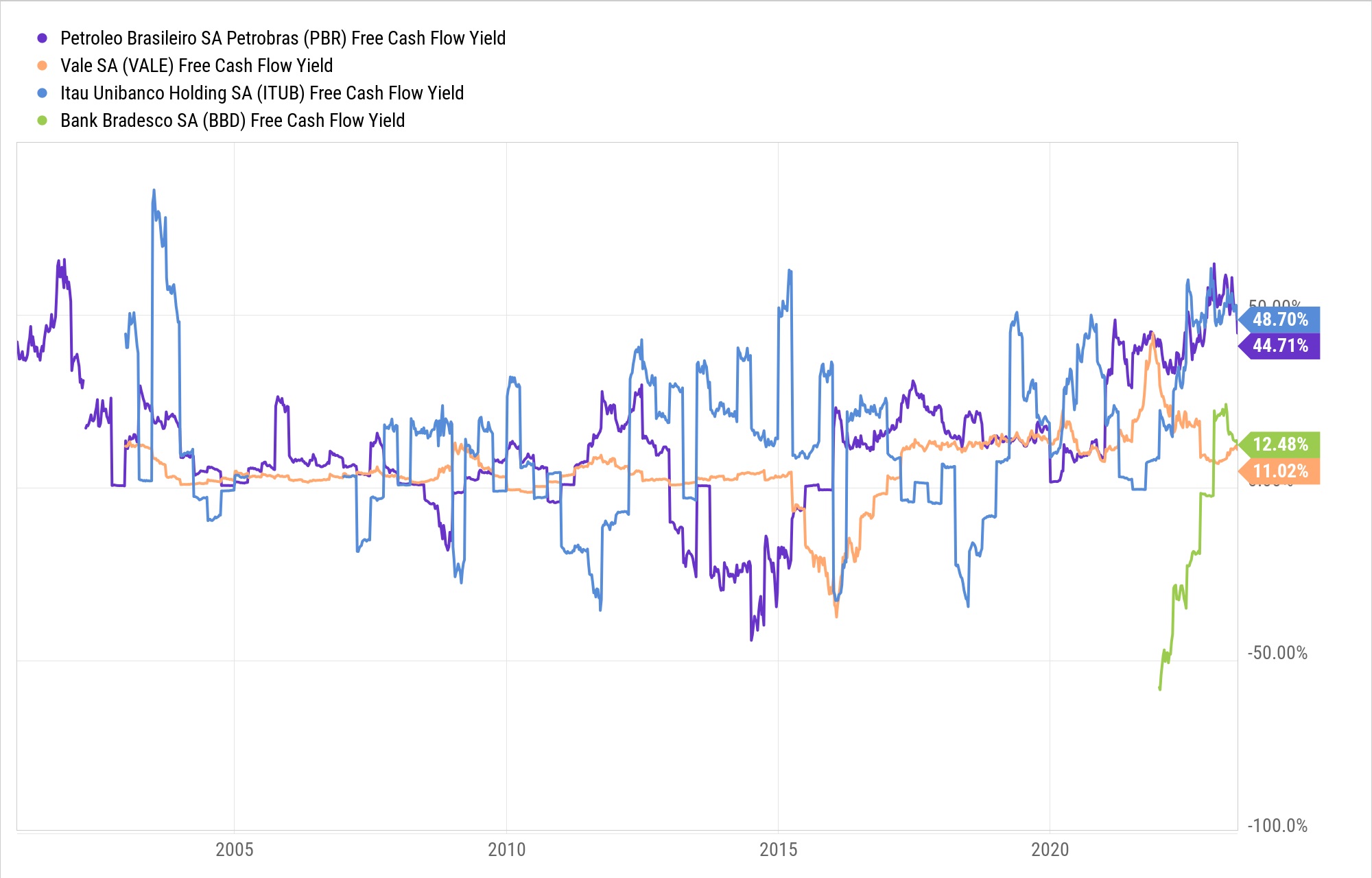

In simple terms, free cash flow yield is a financial ratio that measures the amount of cash a company generates relative to its market value. It provides investors with a clear view of how efficiently a company generates cash flow and rewards its stakeholders.

To calculate free cash flow yield, you need two key pieces of information:

- The free cash flow of the company.

- The market value of the company (typically measured by its market capitalization).

The formula for free cash yield is as follows:

Free Cash Flow Yield = Free Cash Flow / Market Value

By dividing the free cash flow by the market value, we can determine the percentage of cash a company generates relative to its market value. This percentage can be a strong indicator of the company’s financial health and its ability to generate excess cash.

How to Calculate Free Cash Flow Yield

Let’s walk through a step-by-step example to better understand how to calculate free cash flow yield:

- Find the company’s free cash flow for a given period. This can usually be found in the company’s financial statements or annual reports.

- Determine the market value of the company. This can be obtained by multiplying the current share price by the total number of shares outstanding.

- Divide the free cash flow by the market value to calculate the free cash flow yield.

Once you have calculated the free cash flow yield, you can compare it to other companies or industry benchmarks to gauge its performance. A higher free cash flow yield indicates a more favorable investment opportunity, as the company is generating a greater amount of cash relative to its market value.

Why is Free Cash Flow Yield Important?

Free cash flow yield is an essential metric for investors for several reasons:

- It measures the amount of cash a company generates, which is a fundamental driver of value for shareholders.

- It provides insights into a company’s ability to generate excess cash, which can be used for reinvestment, debt repayment, dividend payments, or other value-creating activities.

- It helps investors compare companies within the same industry or sector and identify potential investment opportunities.

By considering the free cash flow yield of a company, investors can make more informed investment decisions and choose companies with strong cash flow generation potential.

Conclusion

Understanding free cash flow yield is a valuable tool for investors in assessing the financial health and investment potential of a company. By calculating this ratio and comparing it to industry benchmarks, investors can gauge a company’s ability to generate excess cash and make informed investment decisions. So remember, the next time you’re evaluating an investment opportunity, don’t forget to consider the free cash flow yield!