Home>Finance>Commodity Trader: Definition, What They Do, Where They Trade

Finance

Commodity Trader: Definition, What They Do, Where They Trade

Published: October 30, 2023

Discover the definition and tasks of a commodity trader in the world of finance. Gain insights into where these traders trade and what they do to excel in their field.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Commodity Trader: Definition, What They Do, Where They Trade

If you’ve ever wondered about commodity trading and the role of a commodity trader, you’re in the right place. In this blog post, we’ll dive into what exactly a commodity trader does, where they trade, and why this field is so important. So grab a cup of coffee and let’s explore the exciting world of commodity trading!

Key Takeaways:

- A commodity trader buys and sells physical goods, such as commodities or raw materials, with the goal of making a profit.

- They typically work for financial institutions, trading firms, or commodity exchanges, utilizing their expertise in market analysis and risk management.

The Definition of a Commodity Trader

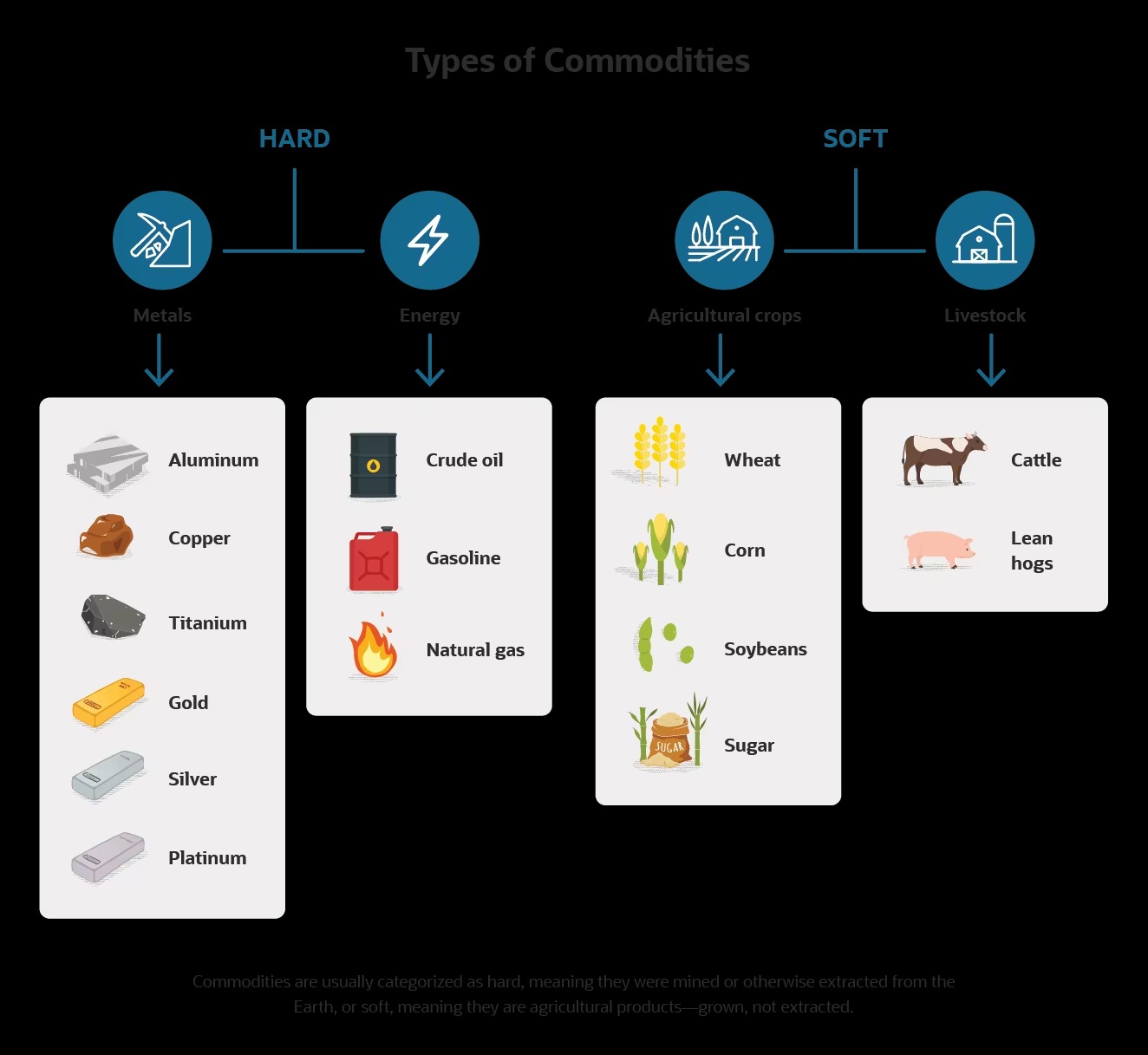

A commodity trader is a professional who buys and sells physical goods, known as commodities, in financial markets. These goods can include natural resources, agricultural products, energy products, and metals. Commodity traders play a vital role in ensuring the smooth functioning of global markets and facilitating price discovery.

Commodity traders are knowledgeable in market analysis and risk management. They utilize their expertise to anticipate market movements, spot trends, and identify potential trading opportunities. By closely monitoring market indicators, economic factors, and geopolitical events, they aim to maximize profits for themselves or the financial institutions they work for.

What Do Commodity Traders Do?

Commodity traders are constantly analyzing supply and demand dynamics, production figures, and market news to make informed trading decisions. Their day-to-day responsibilities may include:

- Research and Analysis: Commodity traders spend significant time researching and analyzing market data to identify trends and patterns. They closely follow economic news, government policies, and weather forecasts to assess the impact on commodity prices.

- Buy and Sell Commodities: Commodity traders execute trades based on their analysis, either by buying commodities at a lower price and selling them at a higher price or vice versa. They use various tools and techniques, such as futures contracts and options, to hedge risks and maximize profits.

- Risk Management: Managing risks is a crucial aspect of commodity trading. Traders employ risk mitigation strategies to protect themselves and their employers from unforeseen market fluctuations. This involves setting stop-loss orders, diversifying portfolios, and closely monitoring positions.

- Relationship Building: Commodity traders often work closely with brokers, suppliers, and other market participants to establish fruitful relationships. Building networks and maintaining strong connections within the industry can help traders gain valuable insights and access to market opportunities.

Where Do Commodity Traders Trade?

Commodity traders can operate on various platforms and exchanges across the globe. Some popular trading venues for commodities include:

- Commodity Exchanges: Commodity exchanges, such as the Chicago Mercantile Exchange (CME Group), London Metal Exchange (LME), and New York Mercantile Exchange (NYMEX), provide a centralized platform for traders to buy and sell futures contracts and options.

- Over-the-Counter (OTC) Markets: In addition to exchange trading, commodity traders also participate in over-the-counter markets, where transactions are conducted directly between two parties without the involvement of an exchange. This allows for more flexibility and customization in trading terms.

- Online Trading Platforms: With advancements in technology, many commodity traders now trade electronically through online platforms. These platforms offer real-time market data, advanced charting tools, and instant execution of trades.

Regardless of the trading platform, commodity traders always aim to capitalize on price movements and profit from their trading strategies.

In Conclusion

Commodity traders are essential players in the global financial markets. With their expertise in market analysis and risk management, they navigate the complex world of commodities to find profitable trading opportunities. Whether they trade on exchanges, over-the-counter, or online platforms, these professionals play a crucial role in ensuring the efficient functioning of commodity markets.

So, the next time you hear about commodity trading, you’ll have a good understanding of what commodity traders do, where they trade, and why they are an integral part of the finance industry.