Finance

In Which Category Do Commodities Belong

Published: October 27, 2023

Discover the role of commodities in the finance industry. Explore the category in which commodities belong and their significance for investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of commodities! When it comes to finance, commodities play a crucial role as a distinct asset class. From crude oil and gold to agricultural products and natural gas, commodities are essential raw materials that are traded in the global marketplace. Understanding the category in which commodities belong is essential for investors, traders, and anyone interested in the dynamics of the financial markets.

In simple terms, commodities refer to tangible goods that can be bought and sold. Unlike stocks or bonds, which represent ownership in companies or debt instruments, commodities are physical products that have intrinsic value. They are the essential building blocks of our daily lives, driving economies and influencing financial markets.

In this article, we will explore the concept of commodities, analyze their characteristics, and examine how they differ from other asset classes such as equities, fixed income securities, currencies, real estate, and derivatives. Understanding these distinctions will provide valuable insights into the role of commodities in portfolio diversification and potential investment opportunities.

So, whether you’re a seasoned investor looking to expand your portfolio or a curious individual interested in the world of finance, let’s dive into the fascinating realm of commodities and discover where they fit in the financial landscape.

Definition of Commodities

Commodities are physical goods that are commonly used in commerce and have standardized quality and quantity specifications. These goods can be traded on exchanges and their prices are influenced by supply and demand dynamics in the market.

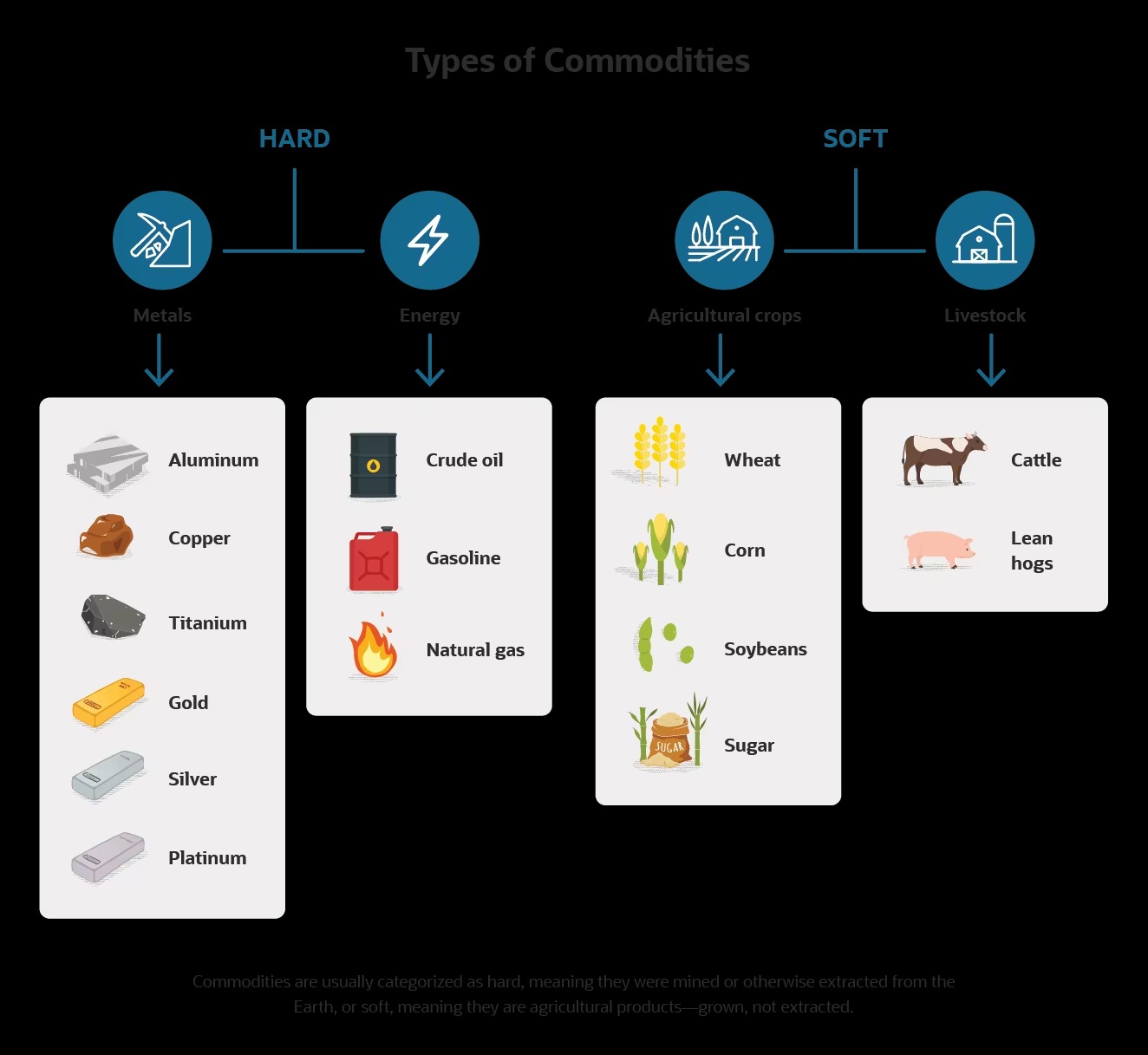

Commodities can be broadly classified into four main categories: energy, metals, agriculture, and livestock. Within each category, there are specific commodities that fall under it. For example, within the energy category, we have crude oil, natural gas, and gasoline. Under the metals category, we have gold, silver, copper, and platinum. Agriculture includes commodities such as corn, wheat, soybeans, and coffee, while livestock includes cattle, hogs, and poultry.

One important aspect of commodities is that they are typically fungible, which means that each unit of a specific commodity is equivalent to any other unit of the same commodity. For example, one ounce of gold is interchangeable with any other ounce of gold. This fungibility allows for standardized trading and ensures that the quality and quantity of the commodity are consistent.

Commodities also have a physical delivery component, meaning that if you trade a commodity futures contract, there is a possibility of the contract being settled through a physical exchange of the underlying asset. However, it’s important to note that most commodity trading in financial markets is done through futures contracts, which are settled in cash rather than physical delivery.

Overall, commodities are tangible goods that have significant economic value and are traded in the global marketplace. Their prices are influenced by supply and demand factors, geopolitical events, weather conditions, and other macroeconomic indicators. Understanding the fundamental drivers of commodity prices is crucial for effectively navigating and investing in this asset class.

Characteristics of Commodities

Commodities possess several key characteristics that distinguish them from other asset classes. Understanding these characteristics is essential for investors and traders navigating the commodities market. Let’s explore some of the important features of commodities:

- Tangible and Physical: Unlike stocks or bonds, which are intangible assets, commodities are tangible goods. They are physical products that can be touched, stored, and transported. This physical nature of commodities makes them unique and contributes to their intrinsic value.

- Standardization: Commodities have standardized quality and quantity specifications. This means that each unit of a specific commodity is equivalent to any other unit of the same commodity. This standardization enables easy trading and facilitates price discovery in the market.

- Global Market: Commodities are traded on a global scale, with buyers and sellers located around the world. This global market provides opportunities for investors to access a wide range of commodities and benefit from the price fluctuations across different regions.

- Price Volatility: Commodities are known for their price volatility. The prices of commodities can be influenced by various factors such as supply and demand imbalances, global economic conditions, geopolitical events, weather patterns, and technological advancements. This volatility presents both opportunities and risks for investors.

- Seasonality: Many commodities exhibit seasonal price patterns due to the nature of their production and consumption cycles. For example, agricultural commodities like corn or wheat may have higher demand during certain planting or harvesting seasons. Understanding these seasonal trends can be beneficial for traders and risk management strategies.

- Limited Supply: Commodities are finite resources, and their supply is often limited. Factors such as extraction costs, production capacity, and geopolitical situations can impact the availability of certain commodities. This limited supply can contribute to price fluctuations and potential investment opportunities.

- Inflation Hedge: Commodities are often considered as a potential hedge against inflation. In times of rising inflation, the prices of commodities tend to increase, protecting the purchasing power of investors’ portfolios. This inflation-hedging characteristic makes commodities an attractive asset class for diversifying investment portfolios.

These characteristics make commodities a distinct asset class with their own unique dynamics and considerations. It is important for investors and traders to carefully analyze these features in order to make informed decisions and effectively manage risks in the commodities market.

Classification of Commodities

Commodities can be classified into different categories based on their characteristics and uses. Understanding these classifications can provide valuable insights into how commodities are traded and the factors that impact their prices. Here are the main categories of commodities:

- Energy: This category includes commodities that are used as sources of energy, such as crude oil, natural gas, gasoline, heating oil, and coal. Energy commodities play a crucial role in powering industries, transportation, and households around the world. Their prices are heavily influenced by global demand, geopolitical events, and production levels.

- Metals: Metals are another important category of commodities. They can be further classified into precious and industrial metals. Precious metals like gold, silver, platinum, and palladium are often used as stores of value and safe-haven assets in times of economic uncertainty. Industrial metals like copper, aluminum, nickel, and zinc are vital for manufacturing and construction activities, making them sensitive to global economic trends and trade dynamics.

- Agriculture: Agricultural commodities include crops, livestock, and other agricultural products. This category encompasses commodities like corn, wheat, soybeans, coffee, sugar, cotton, and livestock such as cattle and hogs. Agriculture commodities’ prices are influenced by factors such as weather conditions, global demand for food, government policies, and supply chain disruptions.

- Livestock: Livestock commodities specifically refer to animals raised for food production, including cattle, hogs, poultry, and dairy products. The prices of livestock commodities are influenced by factors such as disease outbreaks, feed costs, consumer demand, and regulatory policies related to animal welfare and food safety.

Each category of commodities has its own supply and demand dynamics, market participants, and factors that impact prices. For example, energy commodities are influenced by geopolitical events, OPEC production decisions, and global energy demand. On the other hand, agricultural commodities are sensitive to climate patterns, crop diseases, and changing dietary preferences.

It’s important to note that these classifications are not exhaustive, and there are commodities that may fall outside these categories. Additionally, there can be subcategories within each category that further differentiate commodities based on their specific characteristics or uses.

Understanding the classification of commodities provides a framework for analyzing and trading these assets. It allows investors to focus on specific sectors or commodities that align with their investment objectives and risk appetite. Additionally, diversifying across different categories of commodities can help mitigate risk and potentially capture opportunities from varied market conditions.

Equities vs. Commodities

Equities and commodities are two distinct asset classes that offer different investment characteristics and opportunities. Understanding the differences between the two can help investors make informed decisions when constructing their portfolios. Let’s delve into the comparison between equities and commodities:

Liquidity and Trading

Equities, also known as stocks, represent ownership in a company. They are highly liquid and traded on stock exchanges. Investors can easily buy and sell equities throughout the trading day. On the other hand, commodities trade on specialized exchanges and have specific trading hours. Some commodities, like gold or oil, have highly active futures markets, while others may have lower trading volume and liquidity.

Price Drivers

The price of equities is driven by company-specific factors such as earnings, revenue, management decisions, and market sentiment. Economic factors and market conditions also play a role. In contrast, commodity prices are influenced by supply and demand dynamics specific to each commodity. Factors such as weather conditions, geopolitical events, production disruptions, and changes in global demand heavily impact commodity prices.

Investment Purpose

Equities are often considered growth-oriented investments. Investors purchase stocks in the hopes that the company’s value increases, leading to capital appreciation and potential dividends. Equities also provide an opportunity for investors to participate in the company’s success and share in the profits. Commodities, on the other hand, are often used for diversification and as a hedge against inflation. Investors may allocate a portion of their portfolio to commodities to reduce overall risk and preserve purchasing power.

Risk and Volatility

Equities are subject to market volatility, and the prices can fluctuate significantly in response to news, market conditions, and economic indicators. Individual companies may also face risks specific to their industry or operations. Commodities, on the other hand, have their own set of risks and are known for their price volatility. Factors such as supply disruptions, changes in demand, and geopolitical events can lead to significant price swings in commodity markets.

Diversification Benefits

Both equities and commodities offer diversification benefits to a portfolio. Adding equities from different industries or regions can help spread risk and potentially enhance returns. Commodities, with their low correlation to other asset classes like stocks and bonds, can further diversify a portfolio and provide a hedge against inflation. By including both equities and commodities in a portfolio, investors can potentially reduce risk and improve overall performance.

In summary, while equities represent ownership in companies and offer growth potential, commodities are tangible goods that provide diversification and inflation hedging benefits. Both asset classes have their own unique features and can play a role in a well-balanced investment portfolio. The decision to invest in equities, commodities, or a combination of both depends on an individual’s investment goals, risk tolerance, and market outlook.

Fixed Income vs. Commodities

Fixed income and commodities are two distinct asset classes that offer different investment characteristics and serve different purposes in a portfolio. Understanding the differences between fixed income and commodities can help investors make well-informed decisions when constructing their investment strategy. Let’s explore the comparison between fixed income and commodities:

Income and Yield

Fixed income investments, such as bonds and bond funds, provide investors with regular interest payments. The yield of fixed income investments is relatively predictable, with coupon payments typically paid at predetermined intervals. On the other hand, commodities do not provide a regular income stream. They are primarily focused on capturing price appreciation or hedging against inflation.

Risk and Return

Fixed income investments are generally considered lower risk compared to commodities. Bonds are contractual obligations, promising to repay the invested principal amount at maturity, with interest paid on a regular basis. The risk associated with fixed income investments is primarily credit risk (the risk of default by the issuer) and interest rate risk (the sensitivity of bond prices to changes in interest rates). Commodities, on the other hand, can be more volatile and susceptible to various factors like supply and demand dynamics, geopolitical events, and natural disasters.

Relation to Interest Rates

Fixed income investments, particularly bonds, are directly influenced by changes in interest rates. As interest rates rise, the prices of existing bonds decrease, and vice versa. This relationship is known as interest rate risk. Commodities, on the other hand, are not directly affected by changes in interest rates, although they can indirectly be impacted by broader economic conditions influenced by interest rate changes.

Inflation Protection

Fixed income investments generally do not provide direct inflation protection. While bond yields may increase over time, the fixed coupon payments of bonds do not adjust for inflation. Commodities, however, have historically served as a hedge against inflation. As the prices of commodities tend to rise with inflation, holding commodities can help preserve purchasing power over the long term.

Diversification Benefits

Both fixed income and commodities offer diversification benefits to a portfolio. Fixed income investments have traditionally been included in portfolios to provide stability and income, particularly during periods of stock market volatility. Commodities, with their low correlation to stocks and bonds, offer diversification benefits by providing an alternative investment that may perform differently under certain market conditions.

In summary, fixed income investments are focused on regular income, lower risk, and potential capital preservation. They offer stability and can be an important component of a conservative or income-focused portfolio. Commodities, on the other hand, are driven by price appreciation, provide potential inflation protection, and offer diversification benefits. Including both fixed income and commodities in a well-diversified portfolio allows investors to balance risk and potentially enhance returns by tapping into different asset classes.

Currencies vs. Commodities

Currencies and commodities are two distinct asset classes that play important roles in global financial markets. While currencies represent the medium of exchange between countries, commodities are physical goods that have intrinsic value. Understanding the differences between currencies and commodities can provide valuable insights for investors and traders. Let’s explore the comparison between currencies and commodities:

Medium of Exchange vs. Tangible Goods

Currencies serve as the medium of exchange for economic transactions and are used to facilitate trade between countries. They represent a claim on the issuing government or central bank. Commodities, on the other hand, are tangible goods that have inherent value and are traded in physical or financial markets. They include natural resources, agricultural products, metals, and energy sources.

Price Determinants

The value of currencies is primarily determined by supply and demand dynamics in the foreign exchange market. Factors such as interest rates, economic indicators, geopolitical events, and monetary policies influence currency prices. Commodities, however, are influenced by factors such as supply and demand fundamentals, production levels, weather conditions, geopolitical events, and global economic trends.

Volatility and Risk

Currencies can be subject to significant price volatility, especially in response to geopolitical events, economic indicators, or shifts in investor sentiment. The volatility of currencies can present both opportunities and risks for traders. Commodities, on the other hand, are known for their price volatility, influenced by factors such as global supply and demand imbalances, geopolitical tensions, and disruptions in production or transportation.

Investment Purpose

Currencies are often considered as a means of preserving wealth, providing liquidity, or taking positions on global economic or political developments. Currency trading, also known as forex trading, involves speculating on the value of one currency against another. Commodities, on the other hand, are used for various investment purposes, including portfolio diversification, hedging against inflation, or taking speculative positions based on supply and demand dynamics or global economic trends.

Market Accessibility

Currency markets are highly liquid and accessible, with round-the-clock trading. Investors can easily buy and sell currencies through various financial instruments, including currency futures, options, and exchange-traded funds (ETFs). Commodities also have actively traded markets but may have specific trading hours and fewer accessible investment instruments compared to currencies.

In summary, currencies serve as a medium of exchange between countries and are influenced by a variety of economic and geopolitical factors. Commodities, on the other hand, are tangible goods with inherent value, affected by supply and demand dynamics, geopolitical events, and global economic trends. Both currencies and commodities have their own unique characteristics and play important roles in diversified investment portfolios. Understanding their differences can help investors navigate the complexities of global financial markets and make informed investment decisions.

Commodities vs. Real Estate

Commodities and real estate are two distinct asset classes that offer different investment opportunities and characteristics. Understanding the differences between commodities and real estate can help investors make informed decisions when diversifying their portfolios. Let’s explore the comparison between commodities and real estate:

Tangible vs. Intangible

Commodities are tangible goods that have intrinsic value. They include natural resources, agricultural products, metals, and energy sources. Real estate, on the other hand, refers to land and any physical structures built on it, such as residential or commercial properties. While both are physical assets, commodities are traded in global marketplaces, whereas real estate is typically bought, sold, and leased within specific geographic areas.

Income Generation and Cash Flow

Commodities do not generate regular income or cash flow on their own. Investors in commodities often anticipate capital appreciation or use commodities as a hedge against inflation. Real estate, on the other hand, can provide rental income from tenants, generating regular cash flow for owners. Real estate investments are often valued based on their ability to generate consistent income in the form of rent payments.

Liquidity and Accessibility

Commodity markets provide liquidity, with commodities being actively traded on various exchanges around the world. Investors can easily buy and sell commodity futures or invest in commodity-related funds. Real estate, however, is considered a relatively illiquid asset class. Buying or selling real estate properties typically involves a longer time horizon and can be subject to transaction costs and market conditions.

Diversification Benefits

Both commodities and real estate offer diversification benefits to investment portfolios. Commodities have historically had a low correlation with other asset classes, such as stocks and bonds, making them an attractive addition to achieve portfolio diversification. Similarly, real estate investments can provide diversification by offering different risk and return characteristics compared to traditional financial assets.

Market Dynamics

Commodity prices are influenced by global supply and demand factors, geopolitical events, weather conditions, and macroeconomic indicators. Real estate, on the other hand, is influenced by local market conditions, population trends, interest rates, and economic activity. Real estate investments are also influenced by factors such as property location, market demand, and property management practices.

In summary, commodities and real estate are distinct asset classes with their own unique characteristics. Commodities are tangible goods traded on global markets and often serve as a hedge against inflation. Real estate, on the other hand, refers to land and physical properties, providing potential rental income and long-term appreciation. Both can offer diversification benefits and have the potential to be attractive investment opportunities in a well-diversified portfolio, depending on an investor’s objectives, risk tolerance, and time horizon.

Commodities vs. Derivatives

Commodities and derivatives are two distinct components of the financial market, each serving different purposes and offering unique characteristics. Understanding the differences between commodities and derivatives is essential for investors and traders. Let’s explore the comparison between commodities and derivatives:

Underlying Assets

Commodities are physical goods that have intrinsic value and can be traded in the global marketplace. They include natural resources, agricultural products, metals, and energy sources. Derivatives, on the other hand, are financial contracts whose value is derived from an underlying asset, such as commodities, stocks, bonds, or indices. While commodities themselves have tangible value, derivatives are financial instruments that derive their value from the price movement of the underlying asset.

Investment Purpose

Investing in commodities allows investors to gain exposure to the physical assets themselves. Investors may choose to invest in commodities to diversify their portfolios, hedge against inflation, or speculate on price movements. Derivatives, on the other hand, are often used for risk management, speculation, and leveraged trading. Investors can use derivatives to take positions on the price movement of the underlying asset without actually owning the asset itself.

Liquidity and Accessibility

Commodity markets provide liquidity, with commodities being actively traded on various exchanges worldwide. Investors can buy and sell commodity contracts through futures exchanges or invest in commodity-related funds. Derivatives, including commodity derivatives, are traded on futures exchanges and over-the-counter (OTC) markets. Derivatives can provide liquidity and accessibility to financial markets, offering opportunities for investors to engage in various trading strategies.

Risk and Volatility

Commodities are known for their price volatility, influenced by factors such as supply and demand dynamics, geopolitical events, and natural disasters. Investing in commodities involves exposure to the inherent risks associated with price fluctuations in the physical markets. Derivatives, on the other hand, can introduce additional risks, such as counterparty risk and leverage. Derivatives allow investors to take leveraged positions, magnifying potential profits or losses. Understanding and managing these risks are crucial when dealing with commodities and derivatives.

Contract Structure

Commodity contracts are typically standardized, representing a specific quantity and quality of the underlying asset. These contracts specify delivery terms, settlement procedures, and expiration dates. Derivatives, on the other hand, can have various contract structures, including futures, options, swaps, and forward contracts. These structures allow for different risk exposures, hedging strategies, and flexibility in trading and investment approaches.

In summary, commodities are physical assets with intrinsic value, while derivatives are financial instruments derived from underlying assets such as commodities. Investing in commodities provides exposure to the physical market, while derivatives allow investors to speculate on price movements or hedge risks associated with commodities. Understanding the characteristics and differences between commodities and derivatives is crucial for investors and traders aiming to effectively navigate the financial markets.

Conclusion

Commodities are a unique asset class that plays a vital role in global financial markets. They are tangible goods with intrinsic value, traded in global marketplaces. Understanding the characteristics and distinctions of commodities is essential for investors and traders seeking to diversify their portfolios and capitalize on investment opportunities.

In this article, we explored the definition of commodities, their classification into categories such as energy, metals, agriculture, and livestock, and their unique characteristics such as tangibility, standardization, and price volatility. We compared commodities to other asset classes, including equities, fixed income securities, currencies, real estate, and derivatives, highlighting their differences and potential benefits.

Equities offer growth potential, while commodities provide diversification and potential for inflation protection. Fixed income securities generate regular income, while commodities aim for capital appreciation. Currencies serve as a medium of exchange, while commodities are tangible goods with inherent value. Real estate offers income generation and long-term appreciation, while commodities provide diversification and potential inflation hedging benefits. Derivatives derived their value from an underlying asset, such as commodities, offering trading opportunities and risk management strategies.

Investors can benefit from including commodities in their investment portfolios to increase diversification, hedge against inflation, and potentially capture unique investment opportunities. Commodities have historically demonstrated low correlation with traditional asset classes, making them a valuable addition for diversifying risk across different market conditions.

As with any investment, it is important for investors to understand the risks associated with commodities, such as price volatility and exposure to global supply and demand factors. Conducting thorough research, staying informed about market trends, and consulting with financial professionals can help mitigate risks and maximize the potential benefits of investing in commodities.

In conclusion, commodities represent a tangible and distinct asset class that offers investors the opportunity to participate in global marketplaces. By understanding their characteristics, classifications, and interactions with other asset classes, investors can make informed decisions and utilize commodities as a valuable component of their investment portfolios.