Home>Finance>Commodity Futures Contract: Definition, Example, And Trading

Finance

Commodity Futures Contract: Definition, Example, And Trading

Published: October 30, 2023

Discover the definition, example, and trading of commodity futures contracts in the exciting world of finance. Learn how to invest and profit in this dynamic market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Commodity Futures Contracts: A Beginner’s Guide

When it comes to the world of finance, there are numerous investment options available. One such investment tool that has gained significant popularity among traders and investors is the commodity futures contract. In this article, we will provide a beginner’s guide to understanding what commodity futures contracts are, give an example, and explore how trading works in this market.

Key Takeaways:

- A commodity futures contract is a legally binding agreement between a buyer and a seller to trade a specific quantity of a commodity at a predetermined price on a future date.

- These contracts allow producers, consumers, and speculators to hedge against price volatility and potentially profit from price movements in commodities.

What is a Commodity Futures Contract?

A commodity futures contract is a standardized agreement to buy or sell a specific quantity of a commodity at a future date, with the price for the transaction predetermined at the time of contract initiation. These commodities can include agricultural products (such as wheat, corn, or soybeans), precious metals (like gold or silver), energy products (such as crude oil or natural gas), or even financial instruments (like stock market indexes).

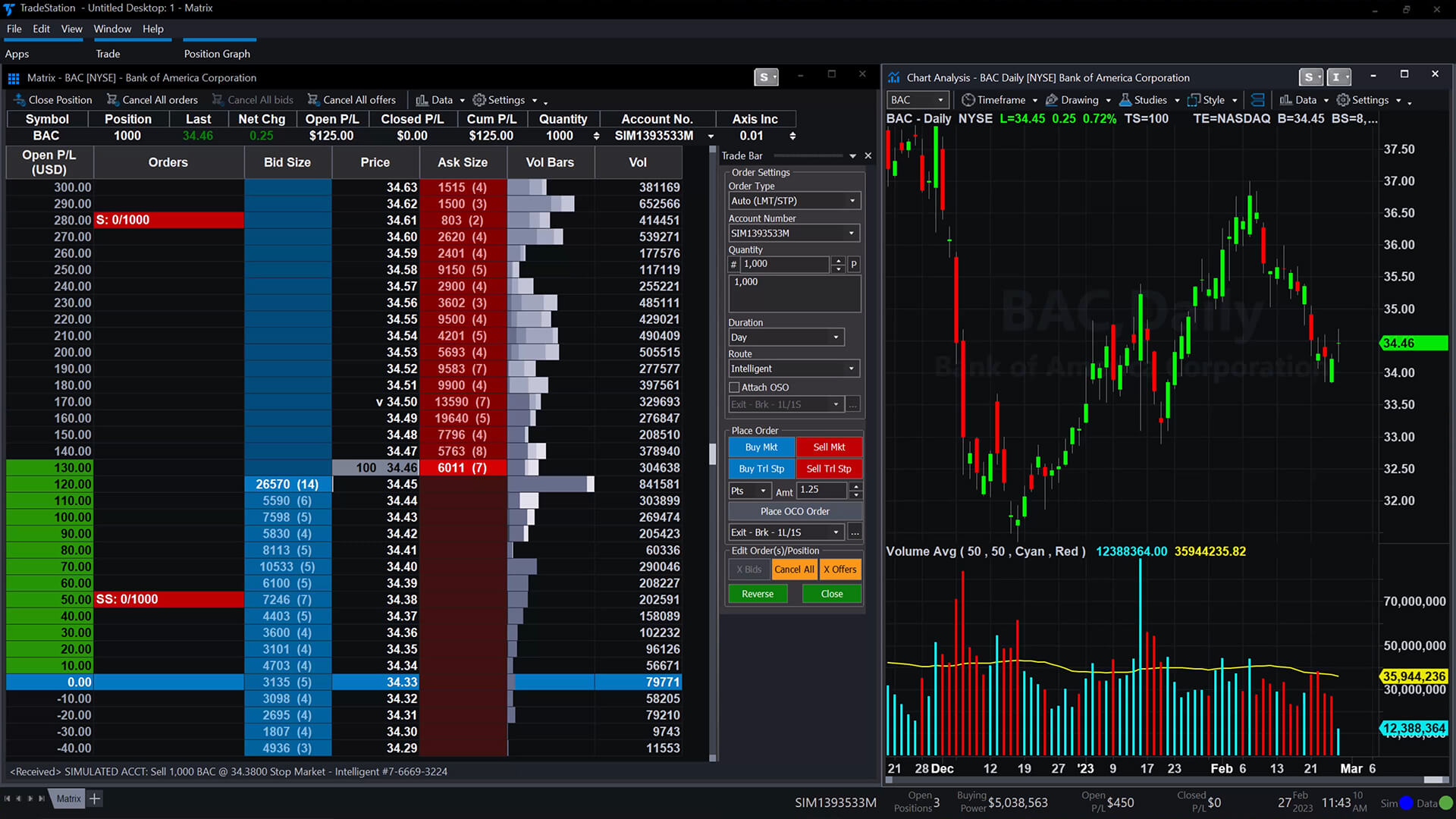

Commodity futures contracts serve as a way for market participants to manage price risk or speculative opportunities. These contracts are traded on regulated exchanges, facilitating a transparent and orderly marketplace.

How Does a Commodity Futures Contract Work?

Let’s consider an example to understand how a commodity futures contract works:

Imagine a farmer who grows corn. The farmer is concerned about potential price volatility in the future, which could harm his profits. To protect against that risk, the farmer can enter into a commodity futures contract to sell a certain quantity of corn at a predetermined price on a specified date in the future.

On the other side of the contract, a buyer, such as a corn processor or distributor, agrees to purchase that quantity of corn at the agreed-upon price and date. By entering into the futures contract, both parties are protected from potential losses due to price fluctuations.

Commodity futures contracts are traded on exchanges like the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). These exchanges act as intermediaries, ensuring that both parties fulfill their obligations under the contract. Traders and investors can participate in buying or selling futures contracts through brokerage firms that are members of these exchanges.

Benefits and Risks of Commodity Futures Trading

Commodity futures trading offers several benefits:

- Hedging: Producers and consumers of commodities can use these contracts to hedge against price volatility, locking in prices to ensure stability.

- Price Discovery: The futures market provides a platform for price discovery, reflecting market sentiments, supply, and demand factors.

- Liquidity: The commodity futures market enables easy entry and exit, allowing traders to buy or sell contracts quickly.

- Speculation: Traders can also speculate on price movements to potentially earn profits by taking positions in futures contracts based on their market analysis.

However, it’s crucial to understand the risks involved in commodity futures trading:

- Volatility: Commodity prices are notoriously volatile, and futures trading amplifies these price movements, leading to the potential for substantial gains or losses.

- Margin Calls: Traders must maintain a certain level of margin in their trading accounts to cover potential losses or price fluctuations.

- Contract Expiration: Futures contracts have expiration dates, and traders need to roll over or close their positions before expiration to avoid physical delivery.

- Market Risk: While futures contracts provide opportunities, they also come with the risk of unforeseen market events affecting commodity prices.

Conclusion

Commodity futures contracts are a vital part of the financial market, allowing traders and investors to hedge against price fluctuations or speculate on future price movements. Whether you are a farmer, a consumer, or a market speculator, understanding the ins and outs of commodity futures trading can open up a world of opportunities.

Before venturing into commodity futures trading, it’s important to educate yourself about the market dynamics, risks associated, and develop a robust trading strategy. With proper knowledge and risk management, commodity futures contracts can be a valuable addition to your investment portfolio.