Finance

Common Stock Fund Definition

Published: October 30, 2023

Learn the meaning and benefits of a common stock fund in finance. Discover how this investment vehicle can help grow your wealth and diversify your portfolio.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Common Stock Funds: A Key to Building Your Wealth

When it comes to building wealth and achieving financial stability, a solid understanding of different investment options is essential. One such investment avenue is the common stock fund. In this blog post, we will delve into the details of what common stock funds are, how they work, and why they can be a valuable addition to your investment portfolio.

Key Takeaways:

- Common stock funds are investment vehicles that pool money from multiple investors to buy stocks of publicly traded companies.

- Investing in common stock funds allows individual investors to gain exposure to a diversified portfolio of stocks, reducing risk and providing potential for long-term growth.

What are Common Stock Funds?

Common stock funds are investment vehicles that pool money from multiple individual investors and use that money to buy shares of publicly traded companies. These funds are managed by professional fund managers who make investment decisions with the goal of achieving capital appreciation for the fund’s shareholders.

Unlike other types of investment funds, such as bond funds or money market funds, common stock funds primarily invest in the equity securities of companies. This means that by investing in a common stock fund, you are essentially buying a stake in a broad range of companies across different industries and sectors.

How do Common Stock Funds Work?

When you invest in a common stock fund, your money is combined with money from other investors, and this pool of funds is used to purchase shares of multiple companies. The value of your investment in the fund is determined by the performance of the underlying stocks held by the fund.

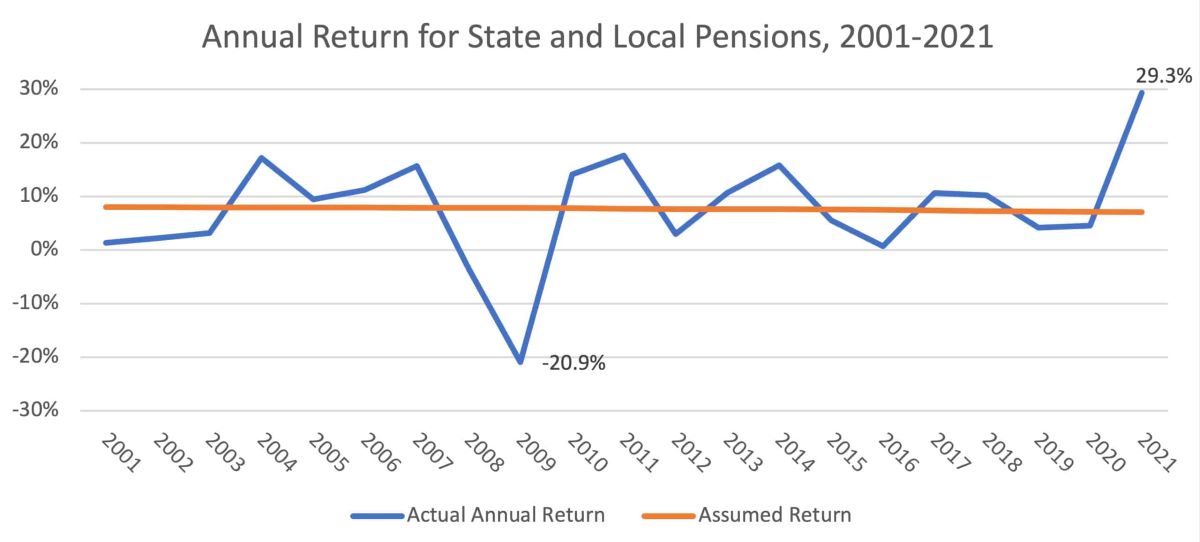

Common stock funds aim to provide investors with long-term capital growth. They achieve this by investing in a diversified portfolio of stocks, spreading the risk across different companies and sectors. This diversification helps to minimize the impact of any single stock’s performance on the overall fund’s value.

It’s important to note that common stock funds do not guarantee a specific rate of return. The value of your investment may fluctuate based on market conditions and the performance of the underlying stocks.

Why Consider Investing in Common Stock Funds?

Investing in common stock funds has several potential benefits that make them an attractive option for individuals looking to grow their wealth:

- Diversification: By investing in a common stock fund, you gain exposure to a broad range of companies and sectors, spreading the risk across multiple investments.

- Potential for Growth: Common stock funds have historically delivered strong long-term returns, outperforming many other investment options over time.

- Professional Management: These funds are managed by experienced fund managers who conduct thorough research and make informed investment decisions on behalf of their investors.

Moreover, common stock funds offer the flexibility to invest a wide range of investment amounts, making them accessible to individual investors with varying financial capabilities.

Conclusion

Common stock funds provide individual investors with the opportunity to participate in the potential growth of a diversified portfolio of stocks. By investing in these funds, you can benefit from the expertise of professional fund managers and gain exposure to a wide range of companies and sectors.

While investing in common stock funds involves risks, such as market volatility and the potential for loss of principal, the potential for long-term growth and the benefits of diversification make them an attractive option for those looking to build their wealth over time.

So, if you are considering expanding your investment portfolio and are in it for the long haul, exploring common stock funds could be a wise decision to achieve your financial goals.