Home>Finance>What Terms Commonly Used Under IFRS Are Synonymous With Common Stock On The Balance Sheet?

Finance

What Terms Commonly Used Under IFRS Are Synonymous With Common Stock On The Balance Sheet?

Published: December 27, 2023

Discover the common terms utilized in Finance under IFRS that are equivalent to common stock on balance sheets. Learn more about Finance and IFRS essentials.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance and accounting! In this article, we will explore the fascinating realm of International Financial Reporting Standards (IFRS) and its implications for common stock on the balance sheet. Understanding the terminology used under IFRS is crucial for individuals and organizations navigating the complexities of financial reporting.

IFRS provides a globally accepted framework for financial reporting, ensuring consistency and comparability across different jurisdictions. It is utilized by companies operating in over 140 countries, leveling the playing field and facilitating transparency in the global marketplace. With the adoption of IFRS, investors, analysts, and stakeholders can make informed decisions based on standardized financial information.

One significant aspect of financial reporting is the classification and presentation of common stock on the balance sheet. Common stock represents the ownership interest in a company and comes with voting rights and the potential for dividend payments. It is an essential component of a company’s capital structure.

However, common stock may be referred to by different terms under IFRS, depending on the region or specific accounting practices. These synonymous terms may seem confusing at first, but understanding their meaning and implications is crucial for correctly interpreting a company’s financial statements.

In the following sections, we will dive deeper into the world of IFRS and explore the various synonymous terms used for common stock on the balance sheet. By the end of this article, you will have a comprehensive understanding of these terms, giving you the confidence to analyze financial statements accurately.

Overview of IFRS

International Financial Reporting Standards (IFRS) is a globally recognized set of accounting standards developed and maintained by the International Accounting Standards Board (IASB). IFRS provides a standardized framework for reporting financial information, ensuring consistency, comparability, and transparency in financial statements across different countries and industries.

IFRS is designed to bring uniformity to financial reporting practices, allowing investors, analysts, and stakeholders to make informed decisions based on reliable and comparable financial information. It eliminates the need for companies to reconcile their financial statements when operating in multiple jurisdictions and enhances the overall efficiency of global financial markets.

One of the core principles of IFRS is the fair representation of a company’s financial position, performance, and cash flows. Under IFRS, financial statements must meet certain qualitative characteristics, such as relevance, reliability, comparability, and understandability.

IFRS covers a wide range of accounting topics, including revenue recognition, leases, financial instruments, business combinations, and more. It provides detailed guidelines on how these transactions should be recorded, measured, and disclosed in financial statements.

Furthermore, IFRS places emphasis on the conceptual framework of financial reporting, which includes fundamental concepts such as the accrual basis of accounting, going concern assumption, substance over form principle, and prudence.

IFRS is continuously evolving with ongoing updates and revisions to ensure its relevance and effectiveness in a dynamic business environment. Companies that adopt IFRS must keep up with these changes and adjust their financial reporting accordingly.

In summary, IFRS is a comprehensive and globally accepted set of accounting standards that provide a common language for financial reporting. Its adoption promotes consistency, comparability, and transparency in financial statements, facilitating cross-border investing and decision-making for stakeholders.

Common Stock on the Balance Sheet

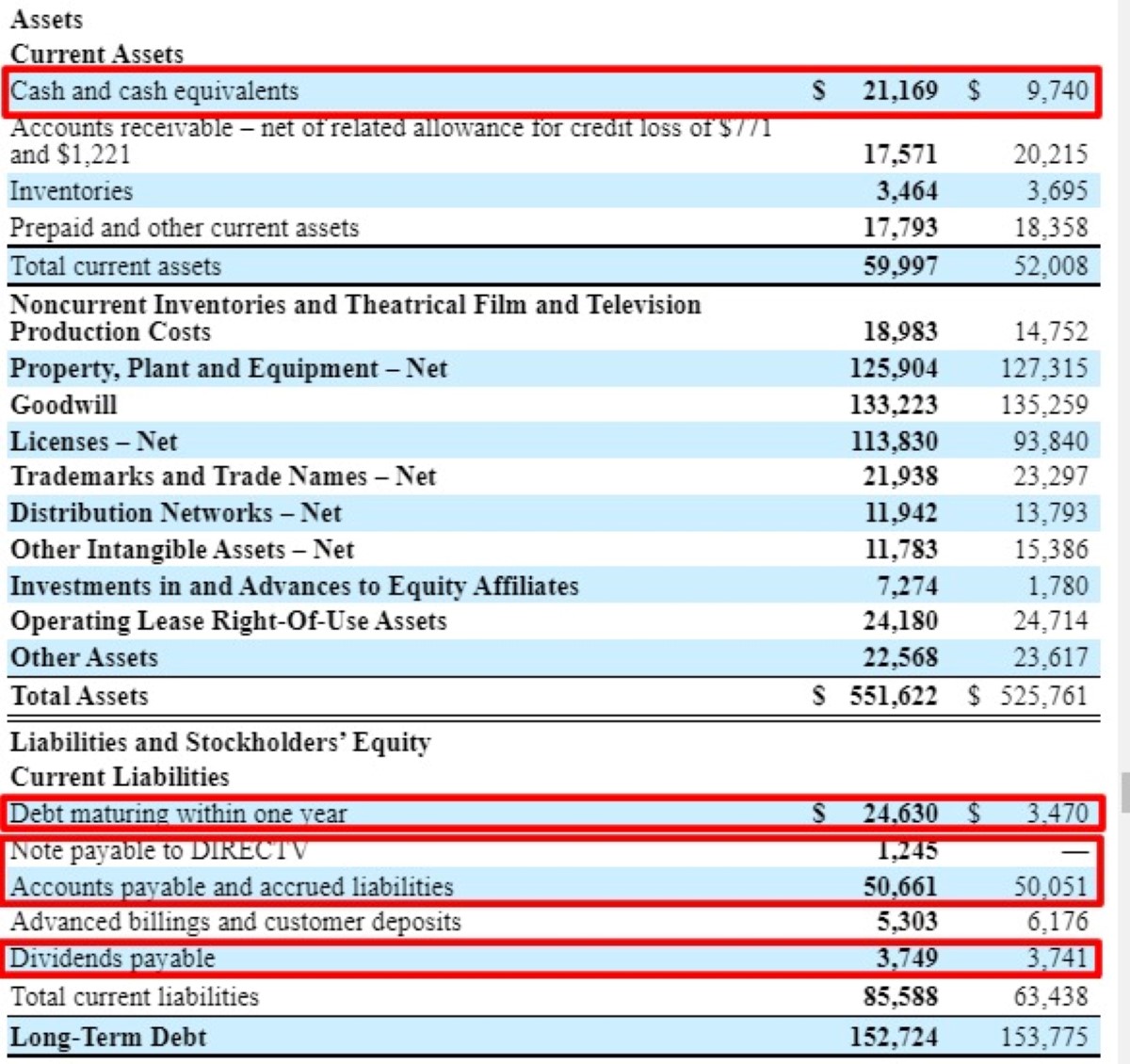

When analyzing a company’s balance sheet, common stock represents the equity ownership interest held by shareholders. It signifies the portion of the company’s capital structure that is attributable to common shareholders.

Common stockholders have voting rights in corporate matters and may receive dividends if the company distributes profits. However, in the event of liquidation or bankruptcy, common stockholders have the lowest priority in the distribution of assets, as they are the residual claimants after debt holders and preferred stockholders.

On the balance sheet, common stock is typically classified under the “Shareholders’ Equity” or “Stockholders’ Equity” section. It is presented alongside other components of equity, such as retained earnings, additional paid-in capital, and treasury stock.

The value of common stock reported on the balance sheet represents the par value or nominal value assigned to each share. Par value is a nominal value set by the company at the time of issuing the stock and has no direct correlation with the market value of the stock.

In some cases, the common stock value may be reported as a lump sum under a single line item. However, more detailed balance sheets may break down the common stock value by the number of issued shares and the par value per share.

It’s important to note that the common stock value on the balance sheet may not reflect the market value of the shares. Market value is determined by the forces of supply and demand in the stock market and can fluctuate based on various factors, such as investor sentiment, company performance, industry trends, and economic conditions.

Understanding the common stock’s presentation on the balance sheet is essential for investors and analysts to assess a company’s capital structure, ownership interests, and potential shareholder returns. It provides valuable insights into a company’s financial position and its ability to generate future earnings and distribute profits to shareholders.

Now that we’ve gained a clear understanding of common stock on the balance sheet, let’s explore the synonymous terms used under IFRS for common stock in the following section.

Synonymous Terms under IFRS

Under International Financial Reporting Standards (IFRS), common stock on the balance sheet may be referred to by various synonymous terms, depending on different regions or specific accounting practices. Although these terms may vary, their meaning remains consistent, representing the equity ownership interest held by shareholders. Let’s explore some of the common synonymous terms used under IFRS:

- Treasury Shares: This term refers to common stock that has been repurchased by the issuing company. These shares are held in the company’s treasury and are not considered outstanding or owned by external shareholders. The company may choose to sell these treasury shares in the future or use them for employee stock option plans.

- Ordinary Shares: This term is widely used in the United Kingdom and certain other countries. It is synonymous with common stock and represents the ownership interest held by shareholders.

- Equity Shares: Equity shares encompass both common stock and other types of equity instruments issued by a company. It represents the residual interest in the company’s assets after deducting liabilities.

- Share Capital: Share capital refers to the total value of shares issued by a company, including both common and preferred shares. It represents the initial funding received from shareholders in exchange for their ownership interest.

- Common Equity: This term is commonly used in the United States and refers to the ownership interest held by common shareholders. It includes the par value of the shares and any additional paid-in capital.

While these terms may differ linguistically, they all represent the same concept of common stock on the balance sheet. It is important to understand these synonymous terms to effectively interpret a company’s financial statements and analyze its capital structure.

However, it’s worth noting that not all countries or regions have synonymous terms for common stock. Some jurisdictions simply use the term “common stock” universally. It is essential to consider the specific accounting standards and practices of the country or region when examining financial statements.

By familiarizing ourselves with these synonymous terms, we can navigate the financial reporting landscape under IFRS with confidence and accurately interpret the equity ownership represented by common stock on the balance sheet.

Conclusion

Understanding the terminology and concepts related to common stock on the balance sheet is vital for anyone involved in finance and accounting. International Financial Reporting Standards (IFRS) provides a standardized framework for financial reporting, ensuring consistency and comparability across different jurisdictions.

Common stock represents the equity ownership interest held by shareholders in a company and is a crucial component of a company’s capital structure. It is presented on the balance sheet under various synonymous terms like treasury shares, ordinary shares, equity shares, share capital, and common equity.

By comprehending these terms and their meaning, stakeholders can accurately interpret a company’s financial statements and assess its financial position. Whether it’s analyzing the percentage of ownership, understanding voting rights, or evaluating potential shareholder returns, a clear understanding of common stock on the balance sheet is essential.

IFRS ensures transparency and comparability in financial reporting, allowing investors, analysts, and stakeholders to make informed decisions based on standardized and reliable information. It eliminates the complexities that arise from reconciling financial statements across multiple jurisdictions and promotes a level playing field in the global marketplace.

As the world of finance continues to evolve, staying up-to-date with the latest changes and developments in IFRS is crucial. Companies and individuals must adapt their financial reporting practices to remain compliant with these standards and provide accurate and reliable information to stakeholders.

In conclusion, familiarizing oneself with the principles and terminology of IFRS, particularly in relation to common stock on the balance sheet, is essential for financial professionals and those involved in decision-making processes. By understanding the synonymous terms used under IFRS and their implications, individuals can confidently navigate the complex world of financial reporting and effectively analyze a company’s financial position.