Finance

Where Is Common Stock On Balance Sheet

Modified: December 30, 2023

Learn the basics of common stock on a balance sheet in finance. Understand the significance and where it is recorded on financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Common Stock

- Importance of Common Stock on the Balance Sheet

- Placement of Common Stock on the Balance Sheet

- Relationship between Common Stock and Shareholders’ Equity

- Valuation and Accounting Treatment of Common Stock

- Disclosure Requirements for Common Stock on the Balance Sheet

- Conclusion

Introduction

Welcome to our comprehensive guide on common stock and its placement on the balance sheet. In the world of finance, common stock plays a crucial role in understanding a company’s ownership structure and financial health.

Common stock represents a type of equity ownership in a corporation. Investors who purchase common stock become shareholders and have the potential to participate in the company’s profits and potential growth. As a result, common stock is an important component of a company’s balance sheet, providing insights into its capital structure and shareholder equity.

Understanding the placement and significance of common stock on the balance sheet is vital for investors, financial analysts, and anyone interested in assessing a company’s financial strength. In this article, we will explore the definition of common stock, its importance on the balance sheet, its relationship with shareholders’ equity, valuation and accounting treatment, disclosure requirements, and much more.

Whether you are new to the world of finance or looking to expand your knowledge, this guide will serve as a valuable resource in demystifying common stock and its role in financial statements. By the end, you will have a holistic understanding of common stock and be able to evaluate a company’s financial health with confidence.

So, let’s dive in and explore the fascinating world of common stock on the balance sheet.

Definition of Common Stock

Common stock, also known as ordinary shares or common equity, is a type of ownership interest in a corporation. When a company decides to go public and issue shares to raise capital, it typically offers common stock to investors. By purchasing common stock, investors become shareholders and acquire ownership rights and potential dividends in the company.

Unlike preferred stock, which has specific privileges and may have a fixed dividend, common stock represents the residual ownership interest in a company. This means that common stockholders have the potential for higher returns on their investment but also bear greater risk compared to preferred shareholders.

Each share of common stock represents a proportional ownership stake in the company. The total number of outstanding shares determines the ownership distribution among shareholders. For example, if a company has one million outstanding shares and an investor holds 10,000 shares, they own 1% of the company’s common stock.

Common stockholders are entitled to several rights, including:

- Voting Rights: Common stockholders have the right to vote on major company decisions, such as electing the board of directors and approving mergers and acquisitions.

- Dividend Rights: Common stockholders have the potential to receive dividends if the company distributes profits to shareholders. However, dividend payments are not guaranteed and depend on the company’s financial performance and management decisions.

- Residual Claim: In the event of a company’s liquidation or bankruptcy, common stockholders have a residual claim on the company’s assets. This means they are entitled to the remaining assets after other stakeholders, such as creditors and preferred shareholders, have been paid.

- Information Rights: Common stockholders have the right to receive regular financial statements, annual reports, and other important information about the company’s performance and operations.

The total value of a company’s common stock is reflected on its balance sheet under the shareholder equity section, specifically within the common stock account.

Now that we have a clear understanding of what common stock is, let’s explore its importance on the balance sheet.

Importance of Common Stock on the Balance Sheet

Common stock holds significant importance on a company’s balance sheet as it provides valuable insights into the financial health and ownership structure of the organization. Here are some key reasons why common stock is important on the balance sheet:

1. Capital Structure: The balance sheet is a financial snapshot that reflects a company’s assets, liabilities, and shareholders’ equity. Common stock represents the equity portion of the balance sheet and indicates the extent of the owners’ investment in the business. The presence of common stock demonstrates that the company has raised capital through the issuance of shares for public ownership.

2. Ownership and Control: The number of outstanding shares and the ownership distribution among shareholders is an essential aspect of the balance sheet. Common stockholders have voting rights, which allows them to participate in significant decision-making processes of the company. By analyzing the ownership structure through common stock, investors and analysts can evaluate the concentration of control and potential influence of major shareholders.

3. Stock Valuation: The balance sheet helps to determine the value of a company’s common stock. The book value per share, calculated by dividing total common shareholder equity by the number of outstanding shares, provides insights into the company’s net worth on a per-share basis. This information can be compared to the market price per share to assess whether the stock is overvalued or undervalued.

4. Financial Performance: Changes in the common stock section of the balance sheet can indicate trends in a company’s financial performance. For example, an increase in common stock may suggest that the company has issued new shares to raise additional capital, potentially for expansion or investment in new projects. Conversely, a decrease in common stock may indicate share buybacks or the company returning capital to shareholders.

5. Solvency and Liquidity: The common stock section of the balance sheet, in conjunction with other financial statements, provides insights into a company’s solvency and liquidity. By analyzing the proportion of common stock to total assets and liabilities, investors and analysts can assess the company’s ability to meet its long-term obligations and evaluate its overall financial stability.

Overall, the presence and details of common stock on the balance sheet are crucial for understanding a company’s ownership structure, capitalization, and financial performance. This information allows investors, stakeholders, and financial professionals to make informed decisions about investing, valuing the company, and assessing its overall financial health.

Now that we understand the importance of common stock on the balance sheet, let’s move on to exploring its placement within the financial statement.

Placement of Common Stock on the Balance Sheet

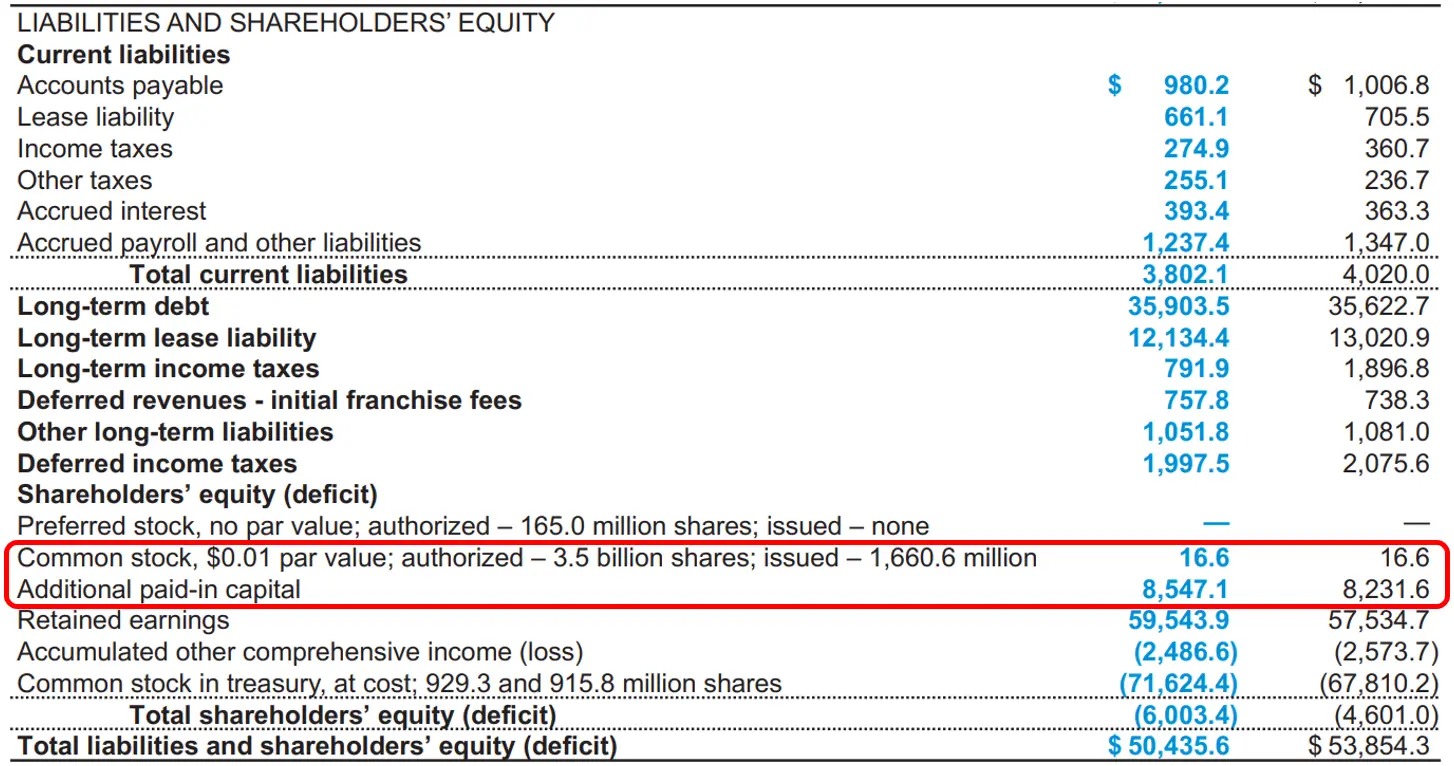

Common stock is typically located within the shareholders’ equity section of a company’s balance sheet. The shareholders’ equity section represents the residual interest in the company’s assets after deducting liabilities, and it showcases the ownership and investment made by the shareholders.

Common stock is typically listed under the “Stockholders’ Equity” or “Shareholders’ Equity” section, along with other components such as preferred stock, retained earnings, and additional paid-in capital. The balance sheet provides a snapshot of the company’s financial position at a specific point in time, and the placement of common stock within the equity section helps to understand how invested capital is structured.

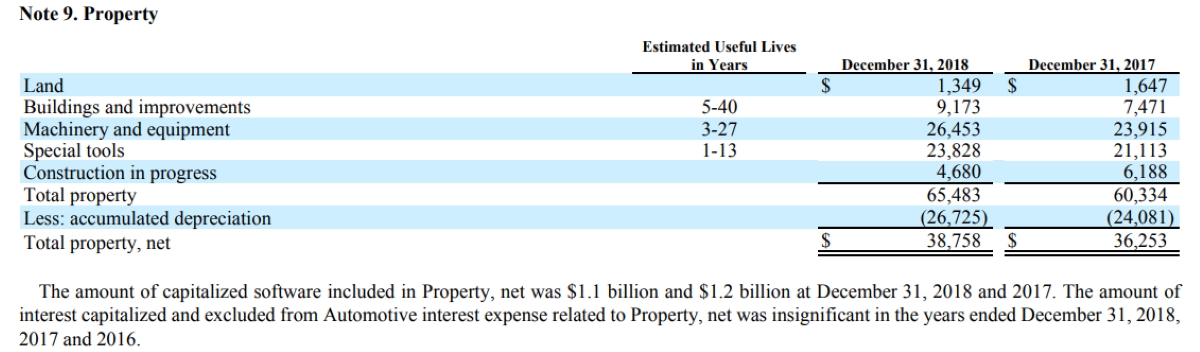

On the balance sheet, common stock is typically displayed as follows:

- Common Stock: This represents the par value or stated value of the company’s common shares. Par value is a nominal value assigned to each share and does not reflect the current market price of the stock.

- Additional Paid-in Capital: Also known as contributed surplus, this account shows the amount received from investors that exceeds the par value of the common stock. It represents the additional capital paid by shareholders above the nominal value of the shares.

- Treasury Stock: In some cases, if the company has repurchased its own shares from the market, those shares are recorded under the treasury stock account. This account represents the stock the company holds as an investment in its own shares.

It’s important to note that the balance sheet lists these accounts in a specific order, typically following a hierarchy. Common stock is usually presented first, followed by additional paid-in capital and then treasury stock, if applicable. This order reflects the chronological order in which these accounts are established.

Additionally, the balance sheet may include footnotes or disclosures related to the common stock. These footnotes provide additional details and information about any restrictions on the common stock, any voting rights or preferences associated with the stock, any issuance of stock options or warrants, and any potential dilutive effects of convertible securities.

The placement and presentation of common stock on the balance sheet are essential for investors, analysts, and other stakeholders to analyze the company’s capital structure, evaluate the company’s ownership interests, and assess the financial health and stability of the organization.

Now that we understand where common stock is placed on the balance sheet, let’s explore the relationship between common stock and shareholders’ equity.

Relationship between Common Stock and Shareholders’ Equity

The relationship between common stock and shareholders’ equity on a company’s balance sheet is integral to understanding the ownership structure and financial position of the organization. Common stock is a key component of shareholders’ equity and represents the equity stake held by investors in the company.

Shareholders’ equity, also known as stockholders’ equity or net worth, is the residual interest in a company’s assets after deducting liabilities. It represents the ownership claim on the company’s assets and reflects the cumulative value of investments made by both common and preferred shareholders.

Common stock contributes to shareholders’ equity in the following ways:

- Par Value: The par value of common stock is the nominal value assigned to each share. As discussed earlier, it is listed under the common stock account on the balance sheet. The sum of the par value of all outstanding common shares represents the initial contributed capital by common shareholders.

- Additional Paid-in Capital: The additional paid-in capital account represents the amount of capital raised by the company from investors that exceeds the par value of the common stock. It includes any amount paid by shareholders through the issuance of shares above the nominal value. This account reflects how much additional capital has been infused into the company through the sale of common shares.

Together, the par value and additional paid-in capital constitute the total common stockholders’ equity on the balance sheet. The common stockholders’ equity represents the owners’ residual claim on the company’s assets if all liabilities were settled.

In addition to common stock, shareholders’ equity may include other components such as retained earnings, which represent the accumulated profits of the company not distributed as dividends, and treasury stock, if the company has repurchased its own shares.

The sum of all components within the shareholders’ equity section reflects the total contributed capital and accumulated profits of the company. It represents the value that would be distributed to shareholders if the company ceased operations and liquidated its assets after settling its liabilities.

Understanding the relationship between common stock and shareholders’ equity is crucial for evaluating the financial position and ownership structure of a company. It helps investors and analysts assess the level of financing provided by common shareholders, the potential for dilution of ownership through issuances of additional shares, and the overall value of the company’s equity.

Now that we understand the connection between common stock and shareholders’ equity, let’s delve into the valuation and accounting treatment of common stock.

Valuation and Accounting Treatment of Common Stock

The valuation and accounting treatment of common stock are key considerations for companies and investors. Proper accounting and valuation practices provide transparency regarding the worth of common stock and help in making informed financial decisions. Here is an overview of the valuation and accounting treatment of common stock:

1. Valuation: The valuation of common stock involves determining its intrinsic value. The intrinsic value is based on various factors such as the company’s financial performance, growth prospects, industry dynamics, and market conditions. Valuation methods commonly used for common stock include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, discounted cash flow (DCF) analysis, and comparable company analysis.

2. Accounting Treatment: The accounting treatment of common stock involves recording the issuance and subsequent changes in ownership and equity. Here are the key accounting considerations:

- Issuance: When common stock is initially issued to investors, the company records the transaction by debiting the cash or other asset received and crediting the common stock account. The common stock account reflects the par value of the shares and serves as the nominal value assigned to each share.

- Additional Paid-in Capital: The additional amount received from investors above the par value is recorded as additional paid-in capital. It represents the excess capital acquired from shareholders over and above the nominal value of the common stock. This amount is credited to the additional paid-in capital account.

- Dividends: When a company distributes dividends to common shareholders, the amount is debited from retained earnings and credited to the common stock dividends payable account. This helps track the dividends owed to common stockholders.

- Treasury Stock: If a company repurchases its own shares, those shares are recorded as treasury stock. The cost of the repurchased shares is debited to the treasury stock account, reducing the shareholders’ equity section. These treasury shares can be reissued or retired at a later date.

- Changes in Value: Any changes in the value of common stock, such as appreciation or depreciation in the market price, are not directly recorded on the balance sheet. Such changes are reflected in the company’s market capitalization and its impact on shareholders’ equity.

The accounting treatment of common stock ensures accurate reporting of the company’s financial position and stakeholder interests. It provides clarity on the company’s equity structure, the funds raised from shareholders, and any dividends paid or to be paid in the future.

It is crucial for companies to adhere to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) when accounting for common stock. These standards align accounting practices globally and enhance transparency and comparability among financial statements of different companies.

Investors and analysts rely on the accurate valuation and accounting treatment of common stock to assess the financial performance, profitability, and growth prospects of a company. These factors, coupled with the overall market conditions and investor sentiment, influence the perceived value of common stock in the marketplace.

Now that we have covered the valuation and accounting treatment of common stock, let’s explore the disclosure requirements for common stock on the balance sheet.

Disclosure Requirements for Common Stock on the Balance Sheet

When presenting common stock on the balance sheet, companies are required to meet certain disclosure requirements to ensure transparency and provide relevant information to stakeholders. These disclosures help investors and analysts understand the nature, risks, and potential impact of common stock on the company’s financial position. Here are the key disclosure requirements for common stock on the balance sheet:

1. Par Value or Stated Value: Companies are typically required to disclose the par value or stated value of their common stock. This represents the nominal value assigned to each share and provides information about the minimum legal capital requirements and initial investment made by shareholders.

2. Number of Outstanding Shares: Companies should disclose the total number of outstanding shares of common stock on the balance sheet. This helps investors and analysts understand the ownership distribution and potential voting power held by common shareholders.

3. Voting Rights and Restrictions: If there are any special voting rights or restrictions associated with the common stock, such as different classes of shares or provisions limiting voting rights, companies must disclose them. This ensures transparency regarding the decision-making power held by common shareholders.

4. Dividends: Companies should disclose any dividend policies, including the frequency and amount of dividends declared or paid to common stockholders. This information helps investors assess the potential income generated from holding common stock and evaluate the company’s dividend policy.

5. Stock Option and Share-Based Compensation: If the company offers stock options or share-based compensation plans to employees or executives, it must disclose these details. This includes information about the number of stock options outstanding, their exercise price, and any relevant vesting periods. These disclosures enhance transparency regarding potential dilution of common stock and the potential impact on shareholders’ equity.

6. Related Party Transactions: Companies are required to disclose any significant transactions involving common stock with related parties, including major shareholders, directors, or executives. These disclosures ensure transparency around potential conflicts of interest and help assess the fairness and impact of such transactions on common stockholders.

7. Earnings per Share (EPS): Companies are required to disclose the calculation and presentation of earnings per share on the balance sheet. This information provides insights into the profitability and potential returns per share for common stockholders.

These disclosure requirements may vary depending on the regulatory framework and accounting standards followed by the company. It is crucial for companies to comply with these requirements and provide accurate and comprehensive information to stakeholders.

By meeting these disclosure requirements, companies demonstrate their commitment to transparency, corporate governance, and accountability. This allows investors, analysts, and other stakeholders to make informed decisions about the value, risks, and future prospects associated with common stock investments.

Now that we have explored the disclosure requirements for common stock on the balance sheet, let’s conclude our comprehensive guide.

Conclusion

Common stock plays a vital role in understanding a company’s ownership structure and financial health. It represents the equity ownership interest that investors hold in a corporation and provides them with certain rights and potential dividends. The placement of common stock on the balance sheet, within the shareholders’ equity section, reflects the capital contributed by shareholders and helps evaluate the company’s ownership structure.

Common stock holds significant importance on the balance sheet, as it provides insights into the company’s capital structure, the concentration of control, and its financial performance. Understanding the relationship between common stock and shareholders’ equity allows investors and analysts to assess the company’s ownership interests and overall financial stability.

The valuation and accounting treatment of common stock are essential for accurate financial reporting and transparent representation of a company’s financial position. Proper valuation practices help determine the intrinsic value of the stock, while appropriate accounting treatment ensures accurate recording and disclosure of shares issued, changes in ownership, and equity components.

Companies are required to meet disclosure requirements regarding common stock on the balance sheet to provide transparency and relevant information to stakeholders. These disclosures help investors and analysts evaluate the nature, risks, and potential impact of common stock investments.

In conclusion, understanding common stock and its placement on the balance sheet is crucial for assessing a company’s financial health and ownership structure. Investors, financial analysts, and other stakeholders can make informed decisions by analyzing the valuation, accounting treatment, and disclosure of common stock. By comprehending the intricacies of common stock, one can better navigate the world of finance and gain insights into the stability and profitability of companies.

As you continue your journey in the realm of finance, remember that common stock on the balance sheet is more than just numbers and figures. It represents the ownership and potential for growth in the businesses that drive our economy.