Home>Finance>Credit Report: Definition, Contents, And How To Get It For Free

Finance

Credit Report: Definition, Contents, And How To Get It For Free

Published: November 5, 2023

Learn about credit reports, what they contain, and how to obtain a free copy. Unlock your financial potential with our comprehensive guide on finance and credit reporting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Credit Reports: Definition, Contents, and How to Get It for Free

When it comes to your personal finances, staying informed can make a significant difference in your financial well-being. One essential tool for managing your finances is your credit report. In this blog post, we will explore the definition of a credit report, its contents, and how you can obtain it for free. So, let’s dive in and demystify this important aspect of personal finance!

Key Takeaways:

- A credit report is a comprehensive document that provides information about an individual’s creditworthiness and financial history.

- It contains details such as personal information, credit accounts, payment history, inquiries, and public records.

What is a Credit Report?

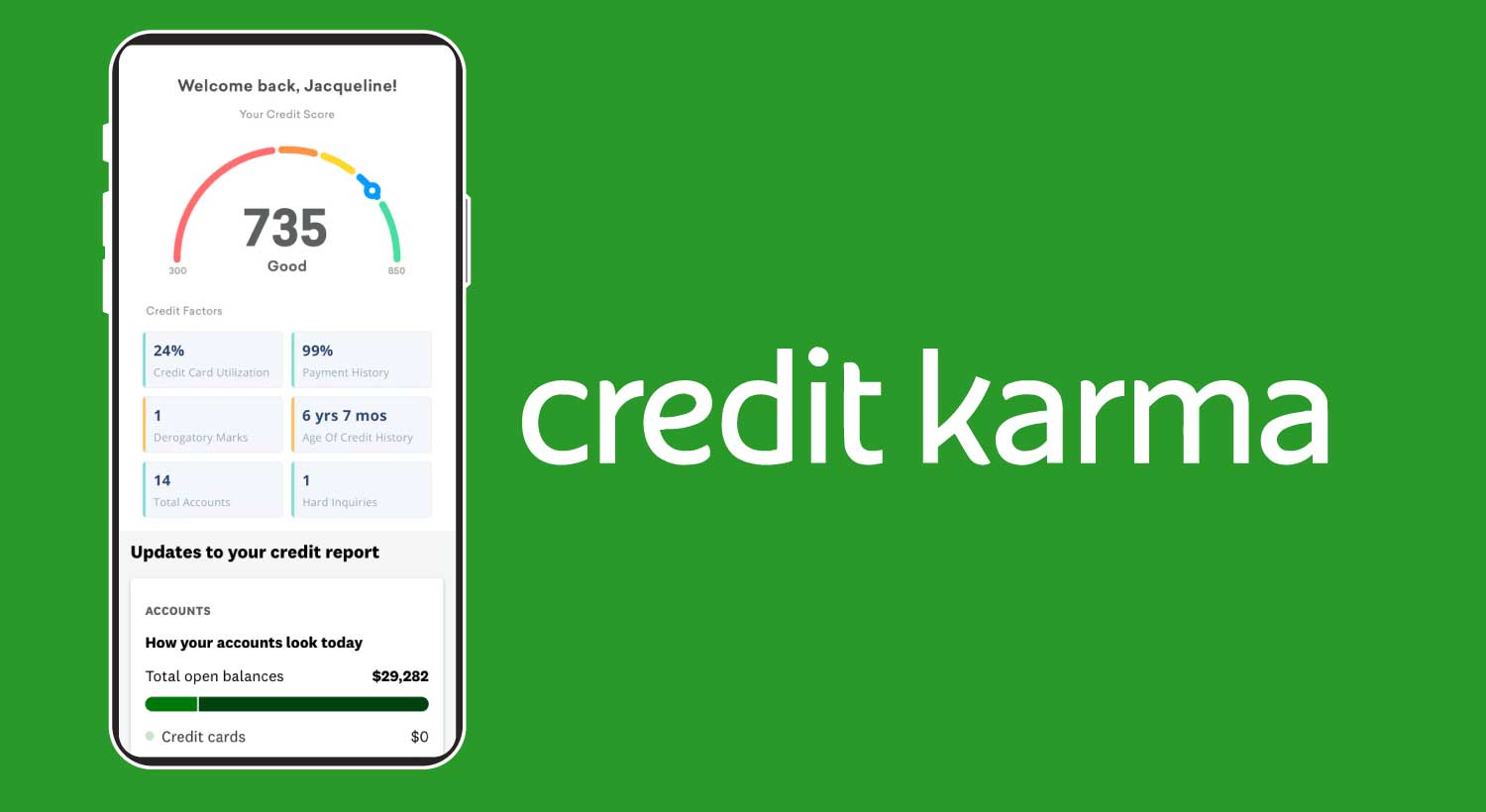

A credit report is a compilation of information that helps financial institutions, lenders, and creditors assess your creditworthiness. It provides a comprehensive summary of your financial history, including your payment habits, outstanding debts, credit accounts, and public records such as bankruptcies or tax liens.

Your credit report plays a vital role in determining your credit score, which is a numerical representation of your creditworthiness. A higher credit score usually indicates a lower credit risk, making it easier for you to qualify for loans, secure better interest rates, and gain access to various financial opportunities.

What Does a Credit Report Contain?

A credit report typically consists of several sections that provide a detailed overview of your financial history. Here are the key components of a credit report:

- Personal Information: This section includes your name, address, date of birth, and Social Security number. Accuracy of this data is crucial, as any errors could affect your credit applications.

- Credit Accounts: Here, you will find a list of your credit accounts, including mortgages, credit cards, personal loans, and student loans. It includes details such as the creditor’s name, account balance, credit limit, and payment history.

- Payment History: This section provides a record of your past payment behavior, distinguishing between on-time payments, late payments, and defaults. Consistently making payments on time can positively impact your credit score.

- Inquiries: Inquiries refer to the instances where someone, typically a lender or creditor, has requested to view your credit report. There are two types of inquiries: hard inquiries, which occur when you apply for credit, and soft inquiries, which occur when companies pre-approve you for offers or when you check your own credit.

- Public Records: If you have any public records that could impact your creditworthiness, such as bankruptcies, tax liens, or court judgments, they will be listed in this section. Public records can have a significant negative impact on your credit score.

How Can You Get Your Credit Report for Free?

Thanks to the Fair Credit Reporting Act (FCRA), consumers are entitled to a free copy of their credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) every 12 months. Here’s how you can obtain your credit report for free:

- AnnualCreditReport.com: Visit the official website, AnnualCreditReport.com, which allows you to request your credit report online from each bureau. This is the only website authorized to provide free credit reports as required by law.

- Phone or Mail: If you prefer, you can request your credit report by phone or mail by following the instructions on AnnualCreditReport.com.

By regularly reviewing your credit report, you can stay informed about your financial standing and catch any errors or fraudulent activities that may impact your creditworthiness. It’s crucial to verify the accuracy of the information and notify the credit bureau of any discrepancies to ensure a clean credit report.

In conclusion, understanding your credit report is essential for managing your personal finances effectively. By knowing what is included in your credit report and how to obtain it for free, you can take control of your financial health and make informed decisions that positively impact your credit score.

Key Takeaways:

- A credit report is a comprehensive document that provides information about an individual’s creditworthiness and financial history.

- It contains details such as personal information, credit accounts, payment history, inquiries, and public records.

Now that you’re equipped with the knowledge about credit reports, take the necessary steps to obtain your free credit report and embark on your journey toward financial success!