Finance

How To Get Unlevered Free Cash Flow

Modified: December 29, 2023

Learn how to calculate and analyze unlevered free cash flow in finance. Understand its importance and use it to make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to evaluating the financial health and performance of a company, understanding its cash flow is essential. One important metric that investors and financial analysts look at is the Unlevered Free Cash Flow (UFCF). Unlevered Free Cash Flow provides insights into a company’s ability to generate cash from its operations, without considering the impact of debt or financial leverage.

In this article, we will explore the concept of Unlevered Free Cash Flow and its significance in financial analysis. We will delve into the components of UFCF, different calculation methodologies, and analyze its implications for assessing a company’s financial stability and growth potential. Additionally, we will discuss the limitations of UFCF and how it should be interpreted in conjunction with other financial metrics.

This article aims to provide a comprehensive understanding of Unlevered Free Cash Flow and its relevance in evaluating the financial performance of a company. Whether you are an investor, financial analyst, or business owner, having a solid grasp of UFCF will help you make informed decisions and assess the viability of a company’s operations.

Understanding Unlevered Free Cash Flow

Unlevered Free Cash Flow, also known as UFCF, is a measure of the cash generated by a company’s operations that is available to all stakeholders, including both equity and debt holders. It represents the cash that a company has generated after deducting operating expenses, taxes, and investments required to maintain its current operations.

Unlike levered free cash flow, which takes into account the impact of interest payments and debt, UFCF provides a clearer picture of a company’s cash-generating ability, independent of its capital structure. It allows investors and analysts to evaluate a company’s intrinsic value and its ability to reinvest in the business, pay dividends, or reduce debt.

UFCF serves as a reliable metric for assessing the financial health and operational efficiency of a company. By analyzing UFCF over a specific period, investors can gain insights into a company’s ability to generate sustainable and consistent cash flows.

It’s important to note that UFCF represents cash generated solely from core operations, excluding any financing-related activities. It focuses on the cash available to the company before any interest or debt-related expenses are considered. This makes UFCF a valuable metric for evaluating the true financial strength of a company and comparing its performance to its industry peers.

By understanding Unlevered Free Cash Flow, investors can assess a company’s ability to generate cash internally and determine if it has the potential to fund future growth initiatives, such as research and development, acquisitions, or capital expenditures.

Furthermore, UFCF allows investors to evaluate a company’s capacity to repay its debt obligations and assess its financial flexibility. It provides insights into whether a company is generating enough cash to cover its operating expenses, service its debt, and meet its financial obligations.

In summary, Unlevered Free Cash Flow is a crucial financial metric that provides a comprehensive view of a company’s cash-generation capabilities, independent of its capital structure. By understanding UFCF, investors can make informed investment decisions, assess a company’s financial health, and identify opportunities for growth and profitability.

Importance of Unlevered Free Cash Flow

Unlevered Free Cash Flow (UFCF) is a fundamental metric used by investors, analysts, and financial professionals to evaluate the financial performance and value of a company. It provides valuable insights into a company’s ability to generate cash from its operations and its capacity to reinvest in the business.

Here are some key reasons why UFCF is important in financial analysis:

- Assessing Financial Health: UFCF helps assess the financial health of a company by providing a clear picture of its cash-generating capabilities. It allows investors to evaluate the company’s ability to cover operating expenses, repay debt obligations, and support future growth initiatives.

- Evaluating Growth Potential: UFCF serves as a crucial metric for evaluating a company’s growth potential. Positive UFCF indicates that a company is generating enough cash to fund investments in research and development, acquisitions, and capital expenditures, which are essential for long-term growth.

- Comparing Companies and Industries: UFCF enables investors to compare the financial performance and cash-generating abilities of different companies within the same industry or across industries. This helps identify companies that are more efficient in generating cash and have a competitive advantage.

- Valuation and Investment Decision-making: UFCF plays a vital role in valuation models and investment decision-making. By considering the cash flows generated by a company’s core operations, investors can determine its intrinsic value, assess the attractiveness of an investment opportunity, and make informed decisions.

- Identifying Financial Risks: UFCF helps in identifying potential financial risks. Negative or declining UFCF may indicate liquidity issues, a high debt burden, or poor operational efficiency. By monitoring UFCF, investors can identify warning signs and manage their investment risks proactively.

Overall, Unlevered Free Cash Flow is a key metric that enables investors and financial analysts to gain insights into a company’s financial health, growth potential, and value. It provides a reliable measure of cash generation and helps in making informed investment decisions, assessing company performance, and identifying risks and opportunities.

Components of Unlevered Free Cash Flow

Unlevered Free Cash Flow (UFCF) is derived from a combination of financial and operational metrics that provide a comprehensive view of a company’s cash-generating abilities. Understanding the key components of UFCF is crucial for evaluating a company’s financial performance accurately. Here are the main components:

- Operating Cash Flow: The first component of UFCF is the operating cash flow, which represents the cash generated from a company’s core operations. It includes cash inflows from sales of products or services and cash outflows associated with operating expenses such as salaries, raw materials, and rent. Operating cash flow is an indicator of the company’s ability to generate cash from its day-to-day operations.

- Income Taxes: The second component of UFCF is income taxes. Companies are liable to pay taxes on their profits, and the amount of taxes paid directly affects the cash flow available to stakeholders. To calculate UFCF, income taxes are deducted from the operating cash flow.

- Capital Expenditures (Capex): A crucial component of UFCF is the capital expenditures incurred by a company in maintaining its current operations or investing in long-term assets. Capex includes expenses for purchasing and upgrading property, plant, and equipment. These expenditures are subtracted from the operating cash flow to account for the funds used for investments.

- Changes in Working Capital: Changes in working capital, such as inventory levels, accounts receivable, and accounts payable, have an impact on a company’s cash flow. Increases in working capital require additional cash to be invested, while decreases can release cash. These changes are factored into the calculation of UFCF.

- Non-recurring Items: Non-recurring items include one-time expenses or gains that are not part of a company’s regular operations. These can include costs associated with restructuring, legal settlements, or gains from the sale of assets. Non-recurring items are adjusted to reflect the company’s ongoing cash-generating abilities.

By considering these components, UFCF provides a comprehensive view of a company’s cash flow generation, factoring in operational performance, tax obligations, investments in assets, working capital changes, and non-recurring events. Analyzing these components helps investors understand the sustainability and quality of a company’s cash flow, allowing for more accurate financial evaluations.

Calculation Methodologies for Unlevered Free Cash Flow

Calculating Unlevered Free Cash Flow (UFCF) involves combining various financial figures to determine the cash generated by a company’s operations. While there are different methodologies to calculate UFCF, they all strive to measure the cash flow available to all stakeholders, regardless of a company’s capital structure. Here are two commonly used methods for calculating UFCF:

- Direct Method: The direct method is a straightforward approach to calculate UFCF. It involves summing up the cash inflows and subtracting cash outflows to derive the net cash generated by the company. The following components are considered in the direct method:

- Operating Cash Flow: The net cash generated from core operations is calculated by subtracting operating expenses (including operating taxes) from total revenues. This figure represents the cash flow before interest, taxes, and non-operating items.

- Capital Expenditures (Capex): Capex, which represents investments in property, plant, and equipment, is subtracted from the operating cash flow to account for the funds used for maintaining or expanding the company’s operations.

- Changes in Working Capital: The direct method also considers changes in working capital, such as inventory, accounts receivable, and accounts payable. Increases in working capital require additional cash, while decreases can free up cash.

After accounting for these components, the net cash generated by operations is adjusted for taxes, and then Capex and changes in working capital are subtracted to derive the UFCF.

- Indirect Method: The indirect method calculates UFCF by starting with the net income of the company and adjusting it for non-cash expenses and changes in working capital. The steps involved in the indirect method include:

- Net Income: The starting point is the net income of the company, which is obtained from the income statement.

- Add Back Non-cash Expenses: Non-cash expenses such as depreciation and amortization are added back to the net income as they do not impact cash flow.

- Adjust for Changes in Working Capital: Changes in working capital are accounted for by adjusting for any increases or decreases in current assets and liabilities.

- Subtract Capex: The final step involves subtracting capital expenditures to account for the funds used for maintenance or expansion of operations.

The result of these adjustments gives the UFCF.

Both the direct and indirect methods have their advantages and limitations. The direct method provides a more granular view of the cash flows generated by the company’s operations, while the indirect method starts with the net income, making it more aligned with the income statement. Ultimately, the choice of calculation methodology depends on the availability of data and the specific requirements of the analysis.

By utilizing these calculation methodologies, investors and financial analysts can accurately estimate the Unlevered Free Cash Flow of a company, providing valuable insights into its cash generation capabilities and financial performance.

Analyzing Unlevered Free Cash Flow

Analyzing Unlevered Free Cash Flow (UFCF) is crucial for gaining insights into a company’s financial performance and evaluating its value as an investment opportunity. By examining UFCF, investors can assess the sustainability and quality of a company’s cash flow, identify potential risks and opportunities, and make informed decisions. Here are key factors to consider when analyzing UFCF:

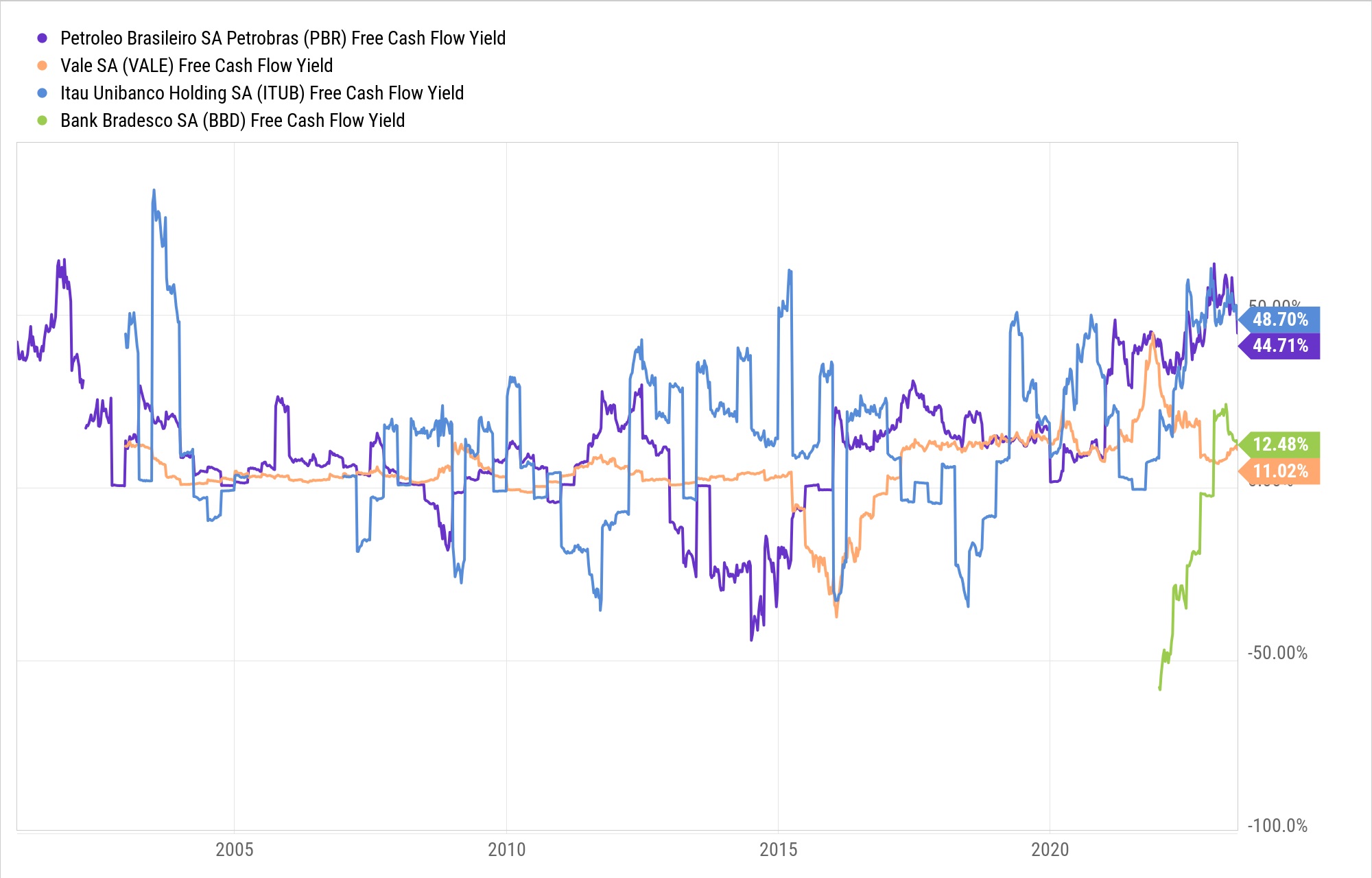

- Trend Analysis: Examining the trend of UFCF over multiple periods can reveal valuable information about a company’s cash flow stability and growth trajectory. Consistently positive UFCF or a growing trend indicates healthy cash generation and indicates that the company is efficiently utilizing its resources.

- Comparison with Industry Peers: Comparing a company’s UFCF with its industry peers provides insights into its relative financial performance and efficiency. A higher UFCF compared to peers could indicate that the company is outperforming its competitors in generating cash and may have a competitive advantage.

- Capital Expenditure Analysis: Assessing the relationship between UFCF and capital expenditures (Capex) is important. A company that consistently generates healthy UFCF while investing in strategic Capex projects indicates a sound cash flow management strategy and potential for future growth.

- Debt Repayment and Financial Obligations: UFCF can be used to evaluate a company’s ability to meet its debt repayment obligations. A healthy UFCF allows companies to service their debt, reducing the financial risk and improving their creditworthiness.

- Dividend Payments and Share Buybacks: Analyzing UFCF can provide insights into a company’s ability to distribute cash to shareholders through dividends or share repurchases. Adequate UFCF ensures that the company can reward its shareholders without compromising its cash flow needs for operations or future growth.

- Investment Opportunities and M&A Activities: Positive UFCF indicates that a company has the financial resources to pursue attractive investment opportunities, such as acquisitions or research and development. Analyzing UFCF can help assess a company’s potential for strategic expansion and its ability to generate long-term value.

- Consistency with Other Financial Metrics: UFCF should be evaluated in conjunction with other key financial metrics such as revenue growth, profitability ratios, and return on investment. Consistency or alignment between UFCF and these metrics reinforces the accuracy and reliability of the company’s financial performance.

When analyzing UFCF, it is important to consider the specific industry dynamics, company-specific factors, and the overall economic environment. A holistic analysis will provide a comprehensive understanding of the company’s financial health, growth prospects, and risk profile.

By evaluating Unlevered Free Cash Flow and its relationship with other financial indicators, investors and financial analysts can make informed decisions, assess the sustainability of a company’s cash flow, and identify opportunities for investment and growth.

Limitations of Unlevered Free Cash Flow

While Unlevered Free Cash Flow (UFCF) is a valuable metric for evaluating a company’s financial health and cash-generating capabilities, it is important to be aware of its limitations. Understanding these limitations allows investors and analysts to use UFCF appropriately and complement it with other financial metrics. Here are some key limitations of UFCF:

- Dependence on Assumptions: Calculating UFCF requires making certain assumptions about future cash flows, capital expenditures, and changes in working capital. These estimates may not always accurately reflect the actual outcomes, especially in uncertain or volatile market conditions.

- Focuses on the Past and Present: UFCF is based on historical financial information and reflects a company’s past and current performance. It may not fully capture potential changes in industry dynamics, competitive landscape, or future growth opportunities.

- Excludes Financing Activities: UFCF focuses solely on cash generated from operations and does not consider financing activities such as debt repayments, interest expenses, or equity issuances. While this provides a clearer view of a company’s operational performance, it does not reflect the impact of debt or financial leverage.

- International Accounting Differences: Accounting principles and practices can vary across countries, which may lead to inconsistencies in calculating UFCF for companies operating in different jurisdictions. It is essential to understand any variations and adjust the calculations accordingly for accurate comparisons.

- Does Not Account for Quality of Earnings: UFCF does not evaluate the quality of a company’s earnings. It is possible for a company to have positive UFCF but still face issues such as aggressive revenue recognition, declining profit margins, or poor management of expenses.

- Limited in Evaluating Growth Companies: UFCF may not provide a comprehensive assessment of the growth potential of companies in their early stages or high-growth industries. Start-ups or rapidly expanding firms may have negative UFCF due to high investment in operations and infrastructure for future growth.

- Does Not Capture Non-cash Benefits: UFCF does not consider non-cash benefits such as tax credits or the value of stock-based compensation. These non-cash benefits can have a significant impact on a company’s cash flow situation.

Despite these limitations, UFCF remains a valuable tool for investors and analysts to assess a company’s cash flow generation capabilities. It should be used alongside other financial metrics, industry analysis, and qualitative factors to provide a comprehensive evaluation of a company’s financial performance and potential.

By understanding the limitations and utilizing UFCF appropriately, investors can make well-informed investment decisions and gain a more holistic understanding of a company’s financial standing.

Conclusion

Unlevered Free Cash Flow (UFCF) is a vital metric for assessing the financial health, cash-generating abilities, and value of a company. By focusing on the cash generated from core operations and excluding the impact of debt and financial leverage, UFCF provides a clearer and more accurate view of a company’s underlying financial performance.

Throughout this article, we have explored the significance of UFCF in financial analysis, its components, calculation methodologies, and ways to analyze and interpret the metric. We’ve also discussed its limitations, highlighting the need for a comprehensive evaluation that includes other financial indicators, industry dynamics, and qualitative factors.

Understanding UFCF empowers investors and financial analysts to make informed decisions, assess the sustainability and quality of a company’s cash flow, and identify potential risks and opportunities. UFCF allows for comparisons with industry peers, evaluation of growth potential, assessment of debt repayment capabilities, and identification of investment opportunities.

However, it’s important to recognize that UFCF is not without its limitations. Assumptions, focus on the past and present, exclusion of financing activities, accounting differences, and other constraints can impact the accuracy and interpretability of the metric.

To overcome these limitations, investors should use UFCF in conjunction with other financial metrics and employ a holistic approach to evaluating a company’s financial performance. By considering multiple factors and utilizing qualitative and quantitative analysis, investors can gain a comprehensive understanding of a company’s financial health and potential for growth.

In conclusion, Unlevered Free Cash Flow is a powerful tool for evaluating a company’s cash generation capabilities. By understanding its importance, analyzing its components, and considering its limitations, investors can make better-informed investment decisions and navigate the complex world of finance with confidence.