Home>Finance>Derived Demand: Definition, How It’s Calculated, And Uses

Finance

Derived Demand: Definition, How It’s Calculated, And Uses

Published: November 11, 2023

Learn about derived demand in finance, its definition, calculation methods, and its various uses in the industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Derived Demand: Definition, How It’s Calculated, and Uses

Have you ever wondered why some goods and services are in high demand while others struggle to find buyers? What drives this disparity in demand? The answer lies in the concept of derived demand. In this blog post, we will explore what derived demand is, how it’s calculated, and the various applications it has in the world of finance.

Key Takeaways:

- Derived demand refers to the demand for a product or service that arises from the demand for another product or service.

- Calculating derived demand involves analyzing the relationship between the final product and the components or factors required to produce it.

So, what exactly is derived demand? Derived demand is a concept that describes the demand for a particular product or service that arises from the demand for another product or service. In simpler terms, it is the demand for something that is not directly consumed but is required as an input in the production process of something else.

For example, let’s consider the demand for automobiles. The demand for automobiles is derived from the demand for transportation. When individuals or businesses have a need for transportation, they create a demand for automobiles. Similarly, the demand for steel is derived from the demand for construction. When there is a need for construction projects, there is a corresponding demand for steel as it is a primary input in the construction process.

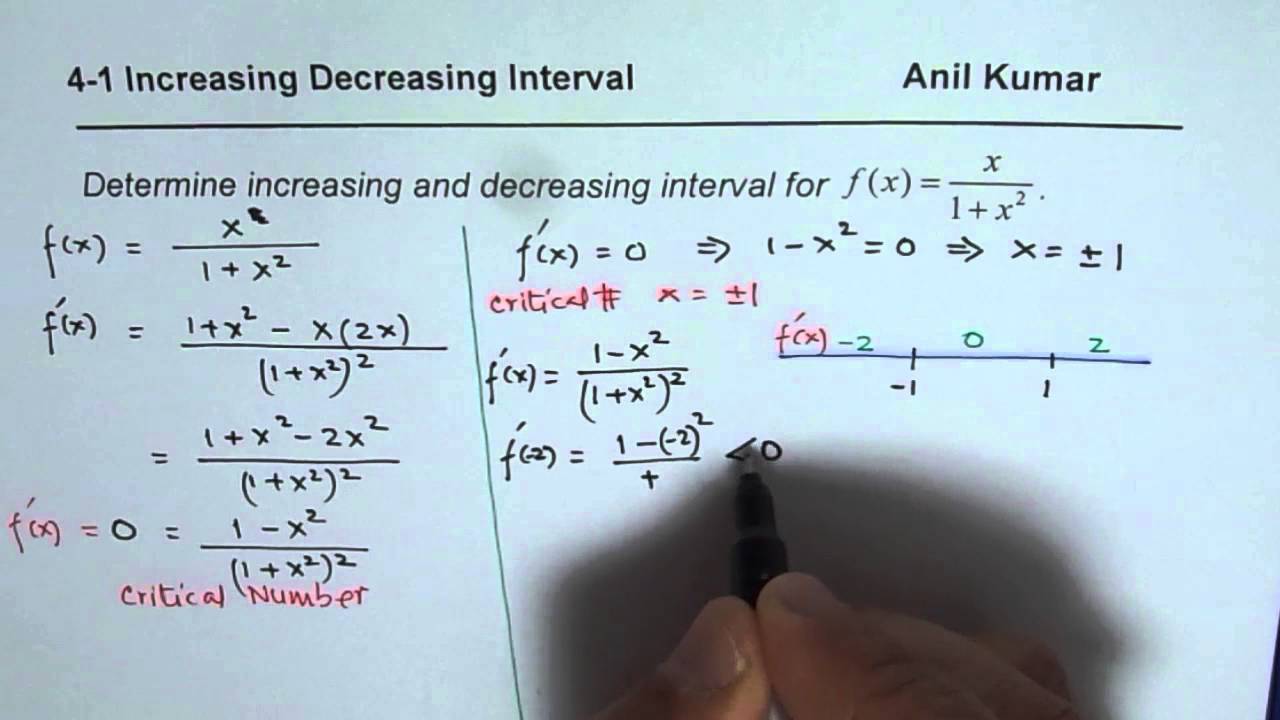

To calculate derived demand, analysts study the relationship between the final product and the various components or factors required to produce it. This involves understanding the factors of production, such as raw materials, labor, and technology, that go into creating the final product. By analyzing these relationships, businesses and economists can project the level of demand for a particular product or service.

Derived demand plays a vital role in various aspects of finance and business decisions. Here are a few key applications of derived demand:

- Supply Chain Management: Understanding derived demand is crucial for effective supply chain management. By analyzing the derived demand for different components, businesses can manage their inventory levels and ensure a seamless flow of inputs to meet the production requirements.

- Pricing Strategy: Derived demand also influences pricing strategies. Businesses need to consider the derived demand for their product when setting prices. The demand for the final product and its components may vary, which affects the pricing decisions accordingly.

- Investment Analysis: Investors need to consider derived demand when making investment decisions. By analyzing the derived demand for a particular industry or sector, investors can identify potential opportunities and evaluate the growth prospects of businesses operating within that sector.

In conclusion, derived demand is a fundamental concept in the field of finance. It explains the relationship between the demand for a final product and the inputs or components required to produce it. By understanding and analyzing derived demand, businesses can make informed decisions regarding supply chain management, pricing strategies, and investment opportunities. So, the next time you buy a product, remember that its demand might be derived from another source!