Finance

How Are Derivatives Used In Real Life

Published: October 5, 2023

Discover how derivatives are utilized in real-life finance scenarios. Explore their practical applications, benefits, and risks in this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

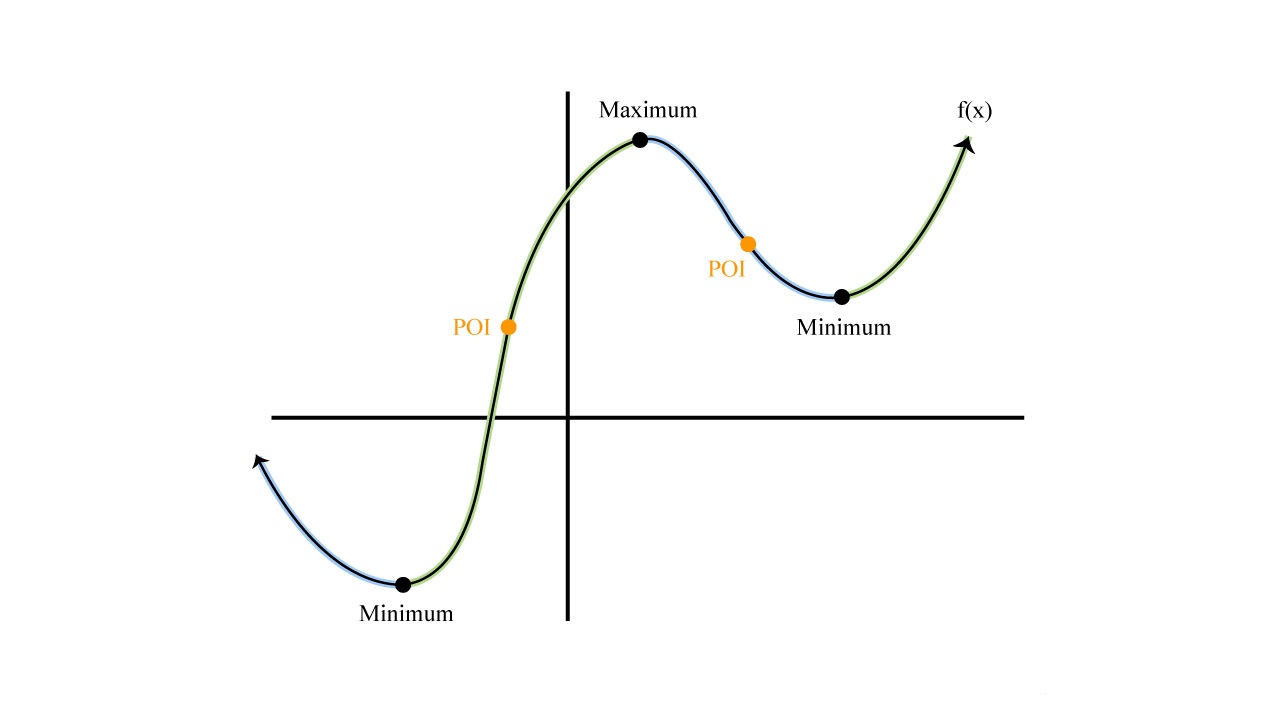

Derivatives play a crucial role in the world of finance, serving as financial instruments that derive their value from an underlying asset or benchmark. They offer individuals and businesses the opportunity to manage risk, speculate on future market movements, leverage investments, and engage in currency exchange. With their versatility and wide range of applications, derivatives have become integral to the functioning of financial markets.

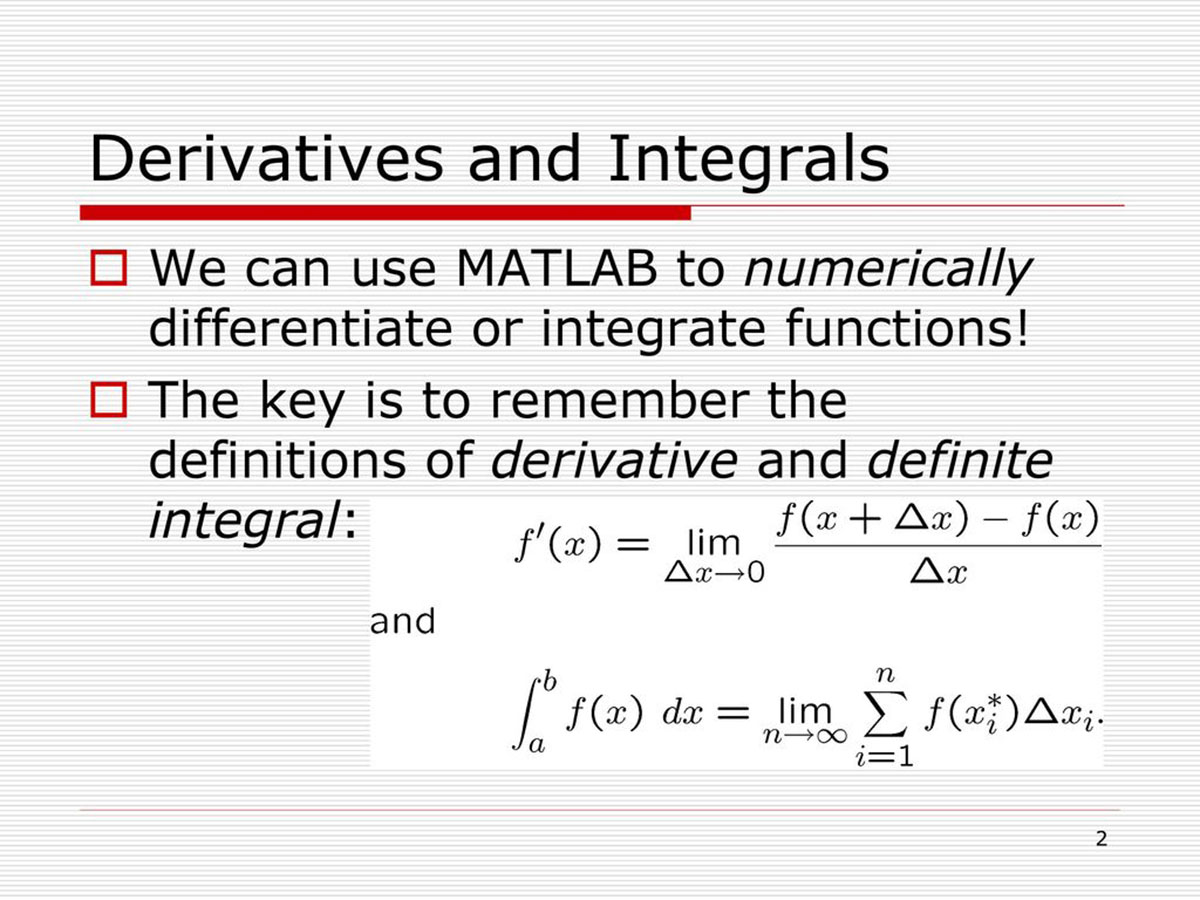

Derivatives are contracts between two or more parties, where the value is derived from an underlying asset such as stocks, bonds, commodities, currencies, or interest rates. These contracts can take various forms, including options, futures, swaps, and forwards. The main purpose of derivatives is to either hedge against potential losses or to provide opportunities for profit through speculation.

It’s important to understand that derivatives are not inherently risky or complex. They are simply tools that can be used for different purposes depending on the needs and objectives of the market participants. In this article, we will explore some of the real-life applications of derivatives, highlighting their significance in managing risk, speculating on market moves, leveraging investments, engaging in currency exchange, and meeting regulatory requirements.

By gaining insights into the practical uses of derivatives, individuals and businesses can make informed decisions when it comes to managing their financial activities. Whether it’s a large corporation hedging against currency fluctuations or an individual investor seeking to capitalize on market opportunities, derivatives offer a range of solutions and strategies to meet their specific needs and goals.

Now, let’s dive into the various ways derivatives are utilized in real-life scenarios and explore how they enable market participants to navigate the complexities of the financial world.

Hedging Risk

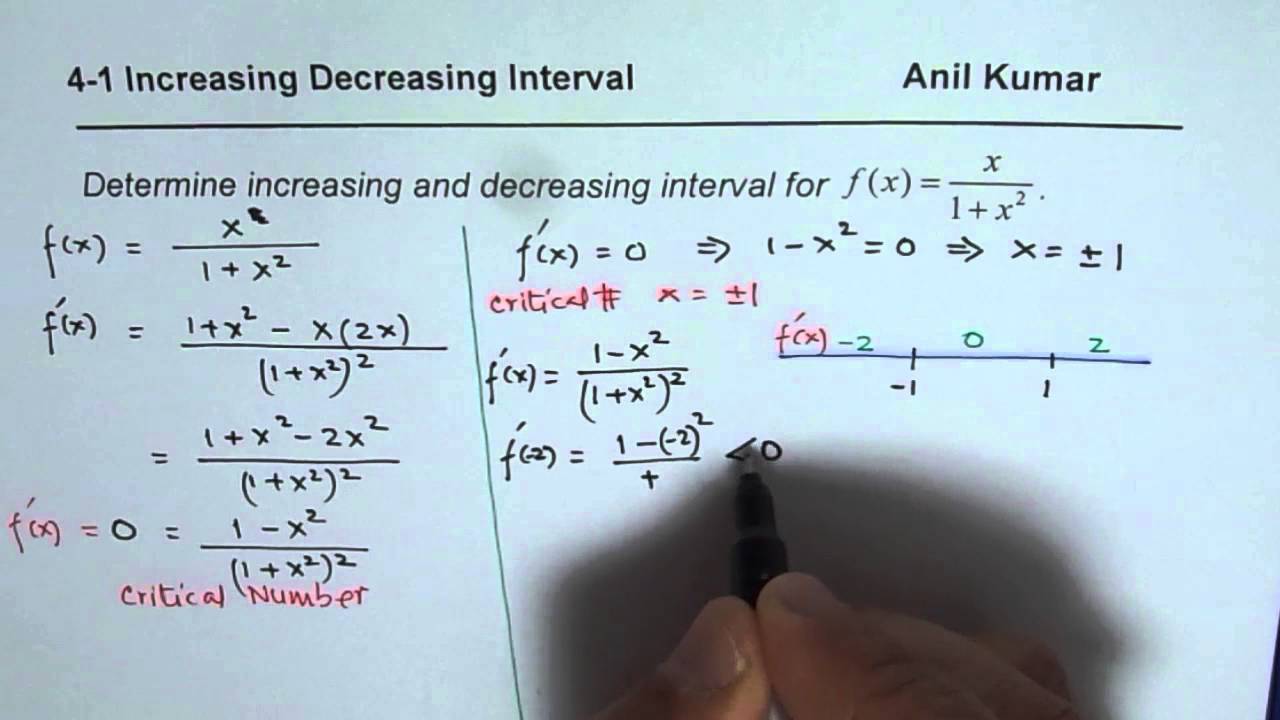

One of the primary and widely recognized uses of derivatives is hedging against potential financial risks. Hedging involves taking measures to reduce or eliminate exposure to adverse price movements in the market. It is a risk management strategy that allows individuals and businesses to protect themselves from potential losses.

Derivatives provide an effective means of hedging against various types of risks, including fluctuations in interest rates, currencies, commodities, and stock prices. For example, a company that relies heavily on imported materials could use futures contracts to hedge against the risk of price fluctuations in those materials. By entering into a futures contract that fixes the price at which the materials will be purchased in the future, the company can protect itself from potential cost increases.

Similarly, investors can use options contracts to hedge against potential stock market volatility. By purchasing put options, they have the right, but not the obligation, to sell their shares at a specified price within a certain timeframe. If the stock price declines, the put option provides a form of insurance that limits potential losses.

Hedging with derivatives allows individuals and businesses to mitigate the impact of market uncertainties, minimize financial risks, and maintain stability in their portfolios or operations. By using derivatives as hedging tools, they can focus on their core objectives without being overly exposed to volatile market conditions.

It’s important to note that while hedging can provide protection, it does not guarantee a profit nor eliminate all risks. Market conditions can be unpredictable, and there is always the possibility that the outcome may not align with the hedging strategy. Nonetheless, derivatives offer a valuable mechanism for managing risk and protecting against adverse price movements.

Speculation

Another significant application of derivatives in real-life scenarios is speculation. Speculation involves taking positions in derivatives contracts with the goal of making a profit from anticipated price movements in the underlying asset or benchmark.

Derivatives provide a platform for investors and traders to speculate on the future direction of various financial markets, including stocks, currencies, commodities, and interest rates. For example, an investor who expects the price of gold to rise in the future may purchase gold futures contracts with the intention of selling them at a higher price once the anticipated price increase occurs.

Speculation with derivatives offers several advantages to market participants. Firstly, it provides the opportunity to generate higher returns compared to investing solely in the underlying asset. Derivatives allow investors to control a larger position with a smaller upfront investment, known as leverage, amplifying potential gains (but also potential losses).

Furthermore, derivatives provide a level playing field for investors to participate in markets that would otherwise be difficult to access. For example, investing directly in foreign currencies or commodities may require specialized knowledge and infrastructure. However, through derivatives like currency futures or commodity contracts, investors can easily speculate on the price movements of these assets without the need for physical ownership.

It is important to note that speculation with derivatives carries inherent risks. Market movements can be unpredictable, and speculation involves taking on higher levels of risk compared to other investment strategies. It requires a deep understanding of market dynamics, comprehensive analysis, and risk management techniques to navigate successfully.

Despite the risks, speculation with derivatives can be appealing to investors and traders seeking opportunities for significant returns in a relatively short period. However, it is crucial to approach speculative activities with caution, conducting thorough research and implementing sound risk management strategies to mitigate potential losses.

Leveraging Investments

Derivatives offer a powerful tool for leveraging investments, allowing individuals and institutions to control a larger position in the market with a smaller upfront capital investment. Leveraging, also known as margin trading, enables market participants to amplify potential returns and increase exposure to profit opportunities.

For instance, investors can use derivatives such as futures contracts to leverage their investment capital. By trading futures, investors only need to deposit a fraction of the contract’s value, known as the margin, while still being able to control the full value of the contract.

By leveraging their investments, market participants can enter into larger positions and potentially amplify their gains. For example, an investor with $10,000 in capital could control $50,000 worth of assets using leverage. If the value of the assets increases by 10%, the investor would realize a $5,000 gain, representing a 50% return on their initial capital.

However, while leveraging can enhance potential profits, it also magnifies potential losses. If the underlying asset’s value moves against the investor’s position, the losses incurred can exceed the initial investment. Therefore, it is important to exercise caution and employ risk management techniques when leveraging investments with derivatives.

Moreover, leveraging investments through derivatives is typically suited for sophisticated investors who have a deep understanding of the market and can afford to take on higher levels of risk. It is essential to conduct thorough research, assess the underlying asset’s market dynamics, and have a contingency plan in case the market moves unfavorably.

Leveraging investments with derivatives should be approached prudently, with a clear understanding of the risks involved. It can provide opportunities for enhanced returns but requires careful management to protect against potential losses.

Currency Exchange

Derivatives play a crucial role in facilitating currency exchange transactions and managing the associated risks. With the global nature of business and international trade, individuals and businesses often need to convert one currency into another, and derivatives provide a convenient and efficient way to do so.

One common derivative used for currency exchange is the foreign exchange (forex) futures contract. These contracts allow individuals and institutions to buy or sell a specific amount of one currency in exchange for another at a predetermined price and future date.

By using forex futures, market participants can hedge against fluctuations in exchange rates. For example, a business that has to pay a foreign supplier in six months’ time can enter into a futures contract to buy the necessary foreign currency at a fixed exchange rate. This eliminates the risk of adverse exchange rate movements affecting the cost of the transaction.

Additionally, derivatives like currency options provide flexible solutions for managing currency exchange risks. A currency option gives the holder the right, but not the obligation, to buy or sell a specific currency at a predetermined exchange rate within a specified timeframe. This allows individuals and businesses to protect themselves from unfavorable exchange rate movements while still benefiting from favorable ones.

Moreover, currency swaps are another useful derivative for currency exchange. In a currency swap, two parties agree to exchange a specific amount of one currency for another and then reverse the transaction at a future date. Currency swaps are often used by multinational corporations to manage their exposure to foreign currency fluctuations and ensure optimal cash flow management.

Derivatives for currency exchange provide liquidity, efficiency, and flexibility in managing currency risk. They allow market participants to convert currencies at predetermined rates, hedge against potential losses from volatile exchange rates, and streamline international transactions.

However, it is important to note that currency exchange derivatives carry risks, including the potential for losses due to exchange rate fluctuations. Market participants should carefully assess their currency exposure, consider the potential impact of exchange rate movements, and implement appropriate risk management strategies when engaging in currency exchange transactions with derivatives.

Insurance Contracts

Derivatives are widely utilized in the insurance industry to manage and transfer risks through insurance contracts. Insurance companies often rely on derivatives to hedge against potential losses and ensure the stability of their operations.

Insurance derivatives, also known as insurance-linked securities (ILS), allow insurers to transfer specific risks to investors and financial markets. These derivatives are typically structured as bonds or swaps and are linked to specific events, such as natural disasters or catastrophic events. By issuing ILS, insurers can transfer the risk of these events to investors and alleviate the potential financial impact on their balance sheets.

For example, insurers may issue catastrophe bonds to protect against the financial losses associated with natural disasters, such as hurricanes or earthquakes. If a specified event occurs within a predetermined timeframe, the insurance company will be compensated by the investors who purchased the catastrophe bonds.

Insurance companies also utilize derivatives to hedge against fluctuations in interest rates and investment portfolios. For instance, interest rate swaps allow insurers to manage the interest rate risk inherent in their policies. By entering into these contracts with other market participants, insurers can offset the impact of interest rate movements on their liabilities.

Derivatives such as weather derivatives are also utilized in the insurance industry. These products provide insurance against specific weather conditions that can adversely affect businesses, such as agriculture, construction, or tourism. Companies in these industries can purchase weather derivatives to protect their revenue or manage their supply chain risks.

Insurance derivatives provide insurers with the ability to transfer and manage risks efficiently. These derivatives allow insurance companies to mitigate potential losses and stabilize their financial position, ensuring the long-term viability of their business operations.

It’s important to note that insurance derivatives are sophisticated financial instruments that require expertise to design and understand. Due diligence and proper risk management practices are necessary when utilizing insurance contracts through derivatives to ensure the effective management of risks.

Regulatory Requirements

Derivatives are subject to various regulatory requirements imposed by governmental authorities and regulatory bodies. These regulations aim to ensure the stability and integrity of financial markets, promote transparency, and protect investors and market participants.

Regulatory requirements for derivatives vary across jurisdictions, but they generally cover areas such as trading, reporting, clearing, and capital requirements. These regulations are designed to promote fair and efficient markets while reducing the risks associated with derivative transactions.

One key aspect of derivatives regulation is the reporting of transactions. Market participants, including banks, investment firms, and hedge funds, are often required to report their derivative transactions to regulatory bodies. This enhances the transparency of the market and allows regulators to monitor potential risks and systemic issues.

Another important regulatory requirement is the clearing of derivatives. Central counterparties (CCPs) play a crucial role in clearing derivative transactions by acting as intermediaries between buyers and sellers. Clearing houses facilitate the settlement process, reduce counterparty risk, and ensure the smooth functioning of derivative markets.

In addition to reporting and clearing, regulatory authorities impose capital requirements on market participants engaging in derivative activities. These requirements ensure that market participants have sufficient capital to support their derivative positions and cushion against potential losses. Capital requirements aim to enhance the stability of financial institutions and mitigate systemic risks.

Regulatory frameworks also focus on risk management and governance practices in relation to derivatives. Market participants are expected to implement robust risk management procedures, including appropriate risk measurement and monitoring systems, to identify and control risks associated with derivative transactions.

Furthermore, regulatory authorities may implement restrictions on certain types of derivatives or trading practices to safeguard the interests of investors and maintain market stability. These restrictions may include banning or limiting the use of certain derivative instruments or imposing position limits to prevent excessive speculation or market manipulation.

Overall, regulatory requirements for derivatives play a crucial role in maintaining the integrity and stability of financial markets. These requirements promote transparency, risk management, and investor protection, ensuring that derivative transactions are conducted in a fair and efficient manner.

Market participants must stay abreast of the evolving regulatory landscape and adhere to the applicable requirements to operate compliantly and effectively in derivative markets.

Conclusion

Derivatives are versatile financial instruments that serve various purposes in real-life scenarios. They offer opportunities for hedging against risks, speculating on market movements, leveraging investments, facilitating currency exchange, and managing insurance-related risks. Through derivatives, individuals and businesses can navigate the complexities of the financial world and make informed decisions to achieve their financial goals.

Hedging with derivatives allows market participants to mitigate potential losses and maintain stability in their portfolios or operations. By using derivatives as hedging tools, they can protect themselves against adverse price movements in interest rates, currencies, commodities, or stock prices.

Speculation with derivatives provides opportunities for potentially higher returns compared to investing solely in the underlying asset. However, it requires a deep understanding of the market and effective risk management techniques to navigate successfully.

Leveraging investments with derivatives allows individuals and institutions to control a larger position in the market with a smaller upfront capital investment. While leverage can amplify potential gains, it also magnifies potential losses and should be approached prudently with careful risk management.

Derivatives play a significant role in currency exchange transactions, allowing individuals and businesses to convert currencies at fixed rates and hedge against potential losses from volatile exchange rates.

Insurance contracts with derivatives, known as insurance-linked securities, provide insurance companies with a tool to transfer specific risks to investors and financial markets, ensuring the stability of their operations.

Regulatory requirements for derivatives aim to promote transparency, stability, and protect investors and market participants. These requirements cover areas such as reporting, clearing, capital requirements, risk management, and trading practices. Market participants must comply with these regulations to maintain the integrity of financial markets.

In conclusion, derivatives are valuable tools that offer flexibility, risk management capabilities, and profit opportunities in the world of finance. Understanding their applications in real-life scenarios empowers individuals and businesses to make informed decisions and effectively manage their financial activities, contributing to overall financial stability and growth.