Home>Finance>Trailing 12 Months (TTM): Definition, Calculation, And How It’s Used

Finance

Trailing 12 Months (TTM): Definition, Calculation, And How It’s Used

Published: February 10, 2024

Learn what Trailing 12 Months (TTM) means in finance, how to calculate it, and practical applications. Enhance your financial knowledge with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Trailing 12 Months (TTM): Definition, Calculation, and How It’s Used

Finance can be a complex and sometimes intimidating subject. One term that you may come across in the world of finance is the Trailing 12 Months (TTM) concept. In simple terms, TTM refers to the most recent 12-month period for which financial data is available for a company or investment. Understanding TTM is crucial for analyzing financial performance and making informed decisions about investments. In this blog post, we will break down the definition of TTM, explain how it is calculated, and explore its practical applications.

Key Takeaways:

- TTM represents the most recent 12-month period for which financial data is available.

- It is calculated by summing up a company’s or investment’s financial data from the previous 12 months.

Now that we have a basic understanding of what TTM is, let’s dive deeper into its definition. TTM is commonly used in financial analysis to assess the financial performance of a company or investment over a specific period. It provides a more accurate and up-to-date snapshot of the company’s financial health compared to annual or quarterly reports alone.

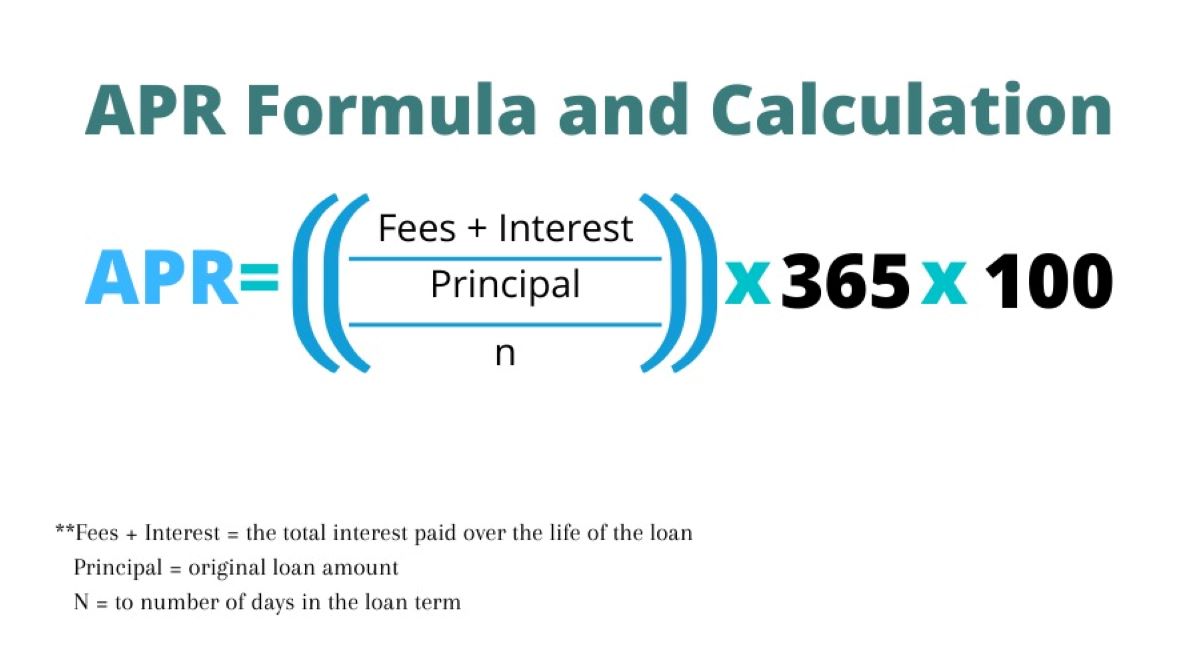

How is TTM calculated?

To calculate TTM, you add up the financial data from the past 12 months. This can include revenue, earnings, cash flow, or any other relevant financial metric. By using the TTM approach, you can smooth out any seasonal fluctuations or short-term volatility that may impact the company’s financial results. This helps in obtaining a more accurate long-term view of the company’s financial performance.

Here’s a simple example to illustrate the TTM calculation: Let’s say a company reported the following quarterly revenues: $1 million, $1.5 million, $1.2 million, and $1.3 million. To find the TTM revenue, you would add up these figures: $1 million + $1.5 million + $1.2 million + $1.3 million equals $5 million.

How is TTM used?

TTM is widely used by investors, analysts, and financial experts for various purposes. Some common applications include:

- Performance analysis: TTM allows investors to compare a company’s financial performance over a consistent time frame. It helps identify trends, patterns, or changes in the company’s growth rate.

- Valuation: TTM data is often used to determine the value of a company or investment. It is particularly useful in calculating financial ratios, such as the price-to-earnings ratio (P/E ratio), to assess the company’s valuation relative to its earnings.

- Forecasting: By analyzing TTM data, investors can make more accurate financial forecasts for the future. The trends observed in the TTM period can provide valuable insights into the company’s future growth potential.

Now that you have a better understanding of TTM – its definition, calculation, and applications – you can make more informed financial decisions. Whether you are analyzing a company’s performance or evaluating an investment opportunity, considering TTM data can provide a clearer picture of the financial health and trajectory. Remember to always consider TTM in conjunction with other key financial metrics for a comprehensive analysis.