Home>Finance>Detection Risk: Definition, Main Components, Analysis, And Example

Finance

Detection Risk: Definition, Main Components, Analysis, And Example

Published: November 11, 2023

Learn about the definition, main components, analysis, and example of detection risk in finance. Enhance your understanding of this crucial concept.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Detection Risk: Definition, Main Components, Analysis, and Example

Welcome to the world of finance, where understanding and managing risk is crucial for success. Today, we’re going to dive deep into the concept of detection risk, an important aspect of risk assessment. By the end of this article, you’ll have a clear understanding of what detection risk is, its main components, how to analyze it, and a practical example to solidify your knowledge.

Key Takeaways:

- Detection risk is the risk that an auditor fails to detect material misstatements in the financial statements due to errors or fraud.

- The main components of detection risk are inherent risk, control risk, and the auditor’s substantive procedures.

What is Detection Risk?

Detection risk, also known as audit risk, is the risk that an auditor fails to detect material misstatements in the financial statements due to errors or fraud. In simpler terms, it is the risk that an audit fails to detect important errors or fraud within a company’s financial records, leading to inaccurate financial statements being presented to stakeholders.

Now that we have a basic understanding of detection risk, let’s explore its main components and how they influence the overall risk assessment process.

Main Components of Detection Risk

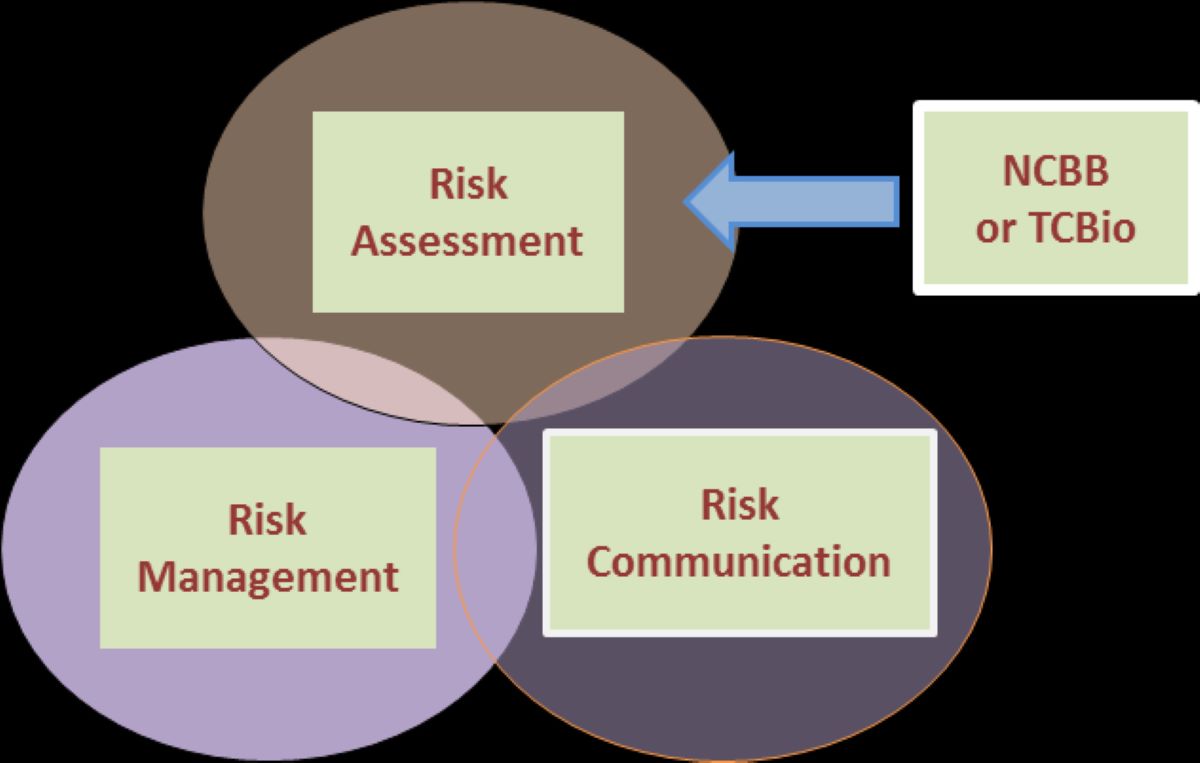

The assessment of detection risk relies on three main components:

- Inherent Risk: This component represents the risk that material misstatements exist in the financial statements before considering the effectiveness of internal controls. It is influenced by factors such as the complexity of the transactions, industry-specific regulations, and the company’s reputation.

- Control Risk: Control risk refers to the risk that a material misstatement could occur and not be prevented or detected by the entity’s internal controls. It is influenced by the effectiveness of internal controls, the competence of the company’s employees, and the presence of monitoring systems.

- Auditor’s Substantive Procedures: These are the procedures conducted by auditors to detect material misstatements in the financial statements. The nature, extent, and timing of these procedures have a direct impact on the overall detection risk.

How to Analyze Detection Risk

Assessing detection risk involves evaluating the inherent risk and control risk factors, as well as the planned substantive procedures. This analysis helps auditors understand the level of detection risk and determine the appropriate level of audit evidence required to reduce it to an acceptable level.

When analyzing detection risk, auditors consider factors such as the complexity of financial transactions, the quality of internal controls, the reliability of the financial reporting process, and the effectiveness of management’s oversight. By critically evaluating these factors, auditors can make informed decisions on the appropriate level of audit procedures to minimize detection risk.

An Example to Illustrate Detection Risk

Let’s say ABC Corp, a multinational company, is being audited by XYZ Auditors. The auditors identify a high inherent risk due to complex financial transactions involved in the company’s overseas operations. However, ABC Corp has robust internal controls in place, which reduces the control risk.

In response to the high inherent risk, XYZ Auditors decide to increase the extent of substantive procedures, such as performing additional testing, reviewing supporting documents, and conducting interviews with key personnel. These increased procedures aim to reduce the detection risk, ensuring that material misstatements are identified, and accurate financial statements are presented.

By carefully analyzing the inherent risk, control risk, and conducting appropriate substantive procedures, XYZ Auditors can effectively manage detection risk and provide reliable audit opinions to the stakeholders of ABC Corp.

In Conclusion

Detection risk is an essential component of risk assessment in the field of finance. An auditor’s ability to identify and reduce this risk is crucial for accurate financial reporting. By understanding the definition, main components, and analysis of detection risk, financial professionals can make informed decisions and take appropriate actions to ensure the integrity and reliability of financial statements.

Remember, mitigating detection risk involves assessing inherent risk, control risk, and conducting substantive procedures. By doing so, auditors can provide valuable insights and help businesses navigate the complex world of finance with confidence and trust.