Finance

Why Does The VA Charge My Insurance

Published: November 22, 2023

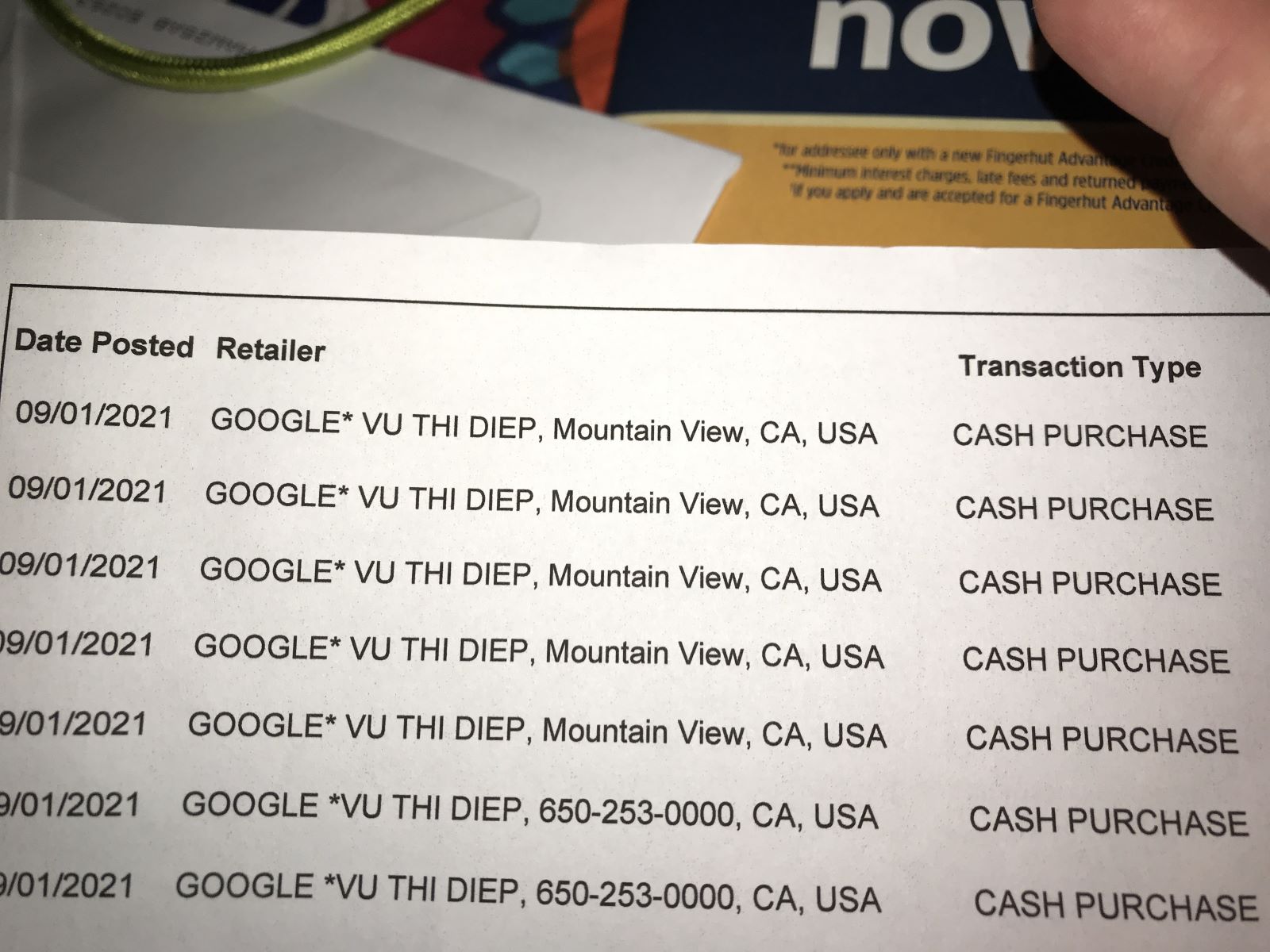

Discover why the VA charges your insurance and the impact on your finances. Uncover the hidden costs and navigate the complex landscape of VA insurance charges.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

For many veterans in the United States, the Department of Veterans Affairs (VA) provides crucial healthcare services and support. However, it can be puzzling for some veterans to find that the VA charges their insurance for medical treatments. In this article, we will explore the reasons behind this practice and its impact on veterans.

The VA is dedicated to ensuring that eligible veterans receive the medical care they need. It operates an extensive network of medical facilities and clinics across the country, offering a wide range of healthcare services. While the VA is a government-funded organization, it also has the ability to bill third-party insurance providers for certain services provided to veterans.

This might come as a surprise to some veterans who assume that their medical treatments at the VA should be fully covered by their military service-related benefits. However, understanding why the VA charges insurance can shed light on the complexities of the healthcare system and the financial aspects of providing care to veterans.

In this article, we will delve into the reasons behind the VA’s insurance charging practice, the impact it has on veterans, and steps that can be taken to address these charges. By providing this information, veterans will gain a better understanding of the healthcare services they are entitled to and how insurance coverage plays a role in their overall healthcare journey.

Understanding the VA

To comprehend why the VA charges insurance, it is essential to have a solid understanding of what the VA is and how it operates. The Department of Veterans Affairs is a government agency responsible for providing various services and benefits to eligible veterans. These services include healthcare, disability compensation, educational assistance, and more.

The VA operates a vast network of medical facilities, including hospitals, clinics, and specialized care centers, known as Veterans Health Administration (VHA) facilities. These facilities provide a wide range of healthcare services, including primary care, specialty care, mental health services, and prescription medication coverage.

Eligibility for VA healthcare services is determined by factors such as the veteran’s service-connected disability status, income level, and other criteria. Once a veteran is deemed eligible, they can receive medical care from VA facilities, often at little to no cost.

It’s important to note that the VA is primarily funded by the federal government. However, funding is not unlimited, and the VA faces budgetary constraints. To help cover the expenses associated with providing healthcare, the VA has implemented various strategies, including charging insurance providers for certain services.

This practice of charging insurance is not unique to the VA. Many healthcare organizations, both private and public, bill insurance companies to offset the costs of care. The difference with the VA is that it has a unique position, as it is both a healthcare provider and an insurer.

By billing insurance providers, the VA can acquire additional funds to enhance resources, improve services, and expand access to healthcare for veterans. However, this does not mean that veterans are left with exorbitant bills. The VA has specific rules and regulations in place to ensure that eligible veterans are not burdened with high out-of-pocket costs.

In the following sections, we will explore why the VA charges insurance, the reasons behind it, and its impact on veterans. Understanding these facets will help shed light on the complexities of the VA healthcare system and how it operates within the broader framework of insurance and funding.

Overview of Insurance Coverage

Before delving into why the VA charges insurance, it is necessary to understand the concept of insurance coverage. Insurance plays a crucial role in the healthcare industry, providing financial protection for individuals and organizations against the high costs of medical treatments and services.

Insurance coverage can be obtained through various sources, such as employer-sponsored plans, private insurance companies, or government programs like Medicare and Medicaid. It offers a range of benefits, including cost-sharing mechanisms, coverage for specific services, and access to a network of healthcare providers.

For veterans, insurance coverage typically comes from a combination of sources. Depending on their circumstances, they may be eligible for coverage through the VA, private insurance providers, or a combination of both. It is common for veterans to have additional insurance coverage through their employer or through programs like TRICARE, which provides healthcare benefits for active-duty service members, National Guard and Reserve members, retirees, and their families.

When veterans utilize VA healthcare services, the VA has the ability to bill their insurance provider for the care received. This includes services such as consultations, diagnostic tests, surgeries, and medications. The insurance coverage can help offset the costs associated with providing care and supporting the overall operations of the VA healthcare system.

It is important to note that VA healthcare remains the primary source of coverage for eligible veterans. The VA is dedicated to providing comprehensive and specialized care for veterans, particularly for service-connected disabilities and conditions. Insurance coverage from other sources is considered secondary to VA benefits.

Furthermore, the VA has agreements with insurance providers to ensure that veterans do not incur excessive out-of-pocket expenses. These agreements establish limits on the amount that insurance companies can charge veterans for VA-covered services. As a result, veterans are typically not responsible for deductibles, copayments, or coinsurance associated with VA care.

Understanding this interplay between VA coverage and insurance coverage is essential for veterans to navigate their healthcare options effectively and make informed decisions. In the following sections, we will explore the reasons why the VA charges insurance and the impact it has on veterans receiving care.

Why Does the VA Charge Insurance?

The practice of the VA charging insurance providers for medical treatments raises the question: why does the VA charge insurance? There are several reasons behind this practice that contribute to the sustainability and expansion of healthcare services for veterans.

Firstly, charging insurance allows the VA to generate additional revenue. As a government-funded organization, the VA relies on various sources of funding to provide healthcare services to veterans. By billing insurance companies, the VA can supplement its funding and allocate resources more effectively to meet the needs of its patient population.

Secondly, insurance charging helps to ensure that the VA remains financially stable. The cost of providing healthcare is substantial, especially when considering the specialized care and support required by many veterans with service-related injuries and conditions. Insurance payments provide a steady income stream that can be used to maintain and improve the quality of care delivered by the VA.

Another reason for insurance charging is to address the issue of limited resources. The demand for VA healthcare services often surpasses the available capacity, leading to long wait times for appointments and treatments. By billing insurance, the VA can generate revenue to invest in expanding its facilities, hiring additional healthcare providers, and reducing wait times for veterans who rely on the VA for their medical needs.

Furthermore, the practice of charging insurance reflects the broader healthcare landscape in the United States. As mentioned previously, other healthcare providers also bill insurance companies for services rendered. The VA, being both a healthcare provider and an insurer, follows this industry practice to ensure equity and fairness in its operations.

Importantly, it is crucial to note that veterans are not personally responsible for the costs associated with insurance charges. The VA has agreements with insurance providers that cap the amount veterans can be charged for VA-covered services. This helps to protect veterans from excessive out-of-pocket expenses and ensures that accessing care through the VA remains affordable.

In summary, the VA charges insurance to generate additional revenue, maintain financial stability, address resource limitations, and align with the practices observed in the broader healthcare industry. By understanding these reasons, veterans can gain insight into the financial complexities underlying the VA healthcare system and its implications for their access to care.

Reasons for Insurance Charges

The VA’s practice of charging insurance for medical treatments serves several important purposes. Understanding the reasons behind these charges provides insight into the financial dynamics of the VA healthcare system and helps veterans navigate their healthcare options effectively.

1. Funding and Sustainability: The primary reason for insurance charges is to generate additional revenue for the VA. As a government-funded organization, the VA relies on various funding sources to provide healthcare services to eligible veterans. Billing insurance companies helps supplement this funding and ensures the sustainability of VA healthcare operations.

2. Enhanced Resources: The revenue generated from insurance charges allows the VA to invest in resources that enhance the quality of care provided to veterans. This includes expanding facilities, acquiring state-of-the-art medical equipment, and hiring additional healthcare professionals to meet the growing demand for services.

3. Improved Access and Reduced Wait Times: The revenue from insurance charges can be used to address the issue of limited resources and long wait times for appointments. By investing in infrastructure and staffing, the VA can expand its capacity, reduce wait times, and improve access to timely and high-quality healthcare for veterans.

4. Equitable Funding: Insurance charges align the VA’s practices with those of other healthcare providers. It ensures that the burden of funding healthcare services is shared across multiple sources, including insurance companies. This helps promote fairness and equity in the allocation of resources within the broader healthcare system.

5. Collaboration with Private Providers: Charging insurance allows the VA to collaborate with private healthcare providers and leverage the benefits of their networks. In cases where specialized care is not readily available within the VA system, veterans can be referred to private providers who are paid through insurance charges. This collaboration expands treatment options for veterans while ensuring comprehensive care.

6. Minimized Financial Burden for Veterans: Importantly, insurance charges do not financially burden veterans personally. The VA has agreements with insurance providers to cap the amount veterans can be charged for VA-covered services. This safeguards veterans from excessive out-of-pocket expenses and ensures that accessing care through the VA remains affordable.

By understanding these reasons for insurance charges, veterans can navigate their healthcare options with a clearer understanding of the financial considerations involved. It also highlights the VA’s commitment to securing adequate funding, providing quality care, and continuously improving healthcare services for eligible veterans.

Impact on Veterans

The practice of the VA charging insurance can have various impacts on veterans seeking healthcare services. While it may initially seem concerning, understanding these impacts can help veterans navigate their healthcare journey effectively and make informed decisions.

1. Financial Considerations: Insurance charges by the VA do not result in direct out-of-pocket expenses for veterans. The VA has agreements with insurance providers to limit the amount veterans can be charged for VA-covered services. This ensures that veterans are protected from excessive financial burdens and can access necessary care without worrying about high costs.

2. Access to Specialized Care: The revenue generated from insurance charges allows the VA to expand its resources and collaborate with private providers. This enhances veterans’ access to specialized healthcare services that may not be readily available within the VA system. By leveraging insurance charges, the VA can refer veterans to private providers and ensure comprehensive care for complex conditions or treatments.

3. Reduced Wait Times: Insurance charges contribute to funding initiatives aimed at addressing resource limitations and reducing wait times for appointments and treatments. By investing in staff and infrastructure, the VA can increase its capacity to serve veterans more efficiently. This means shorter wait times, quicker access to care, and a better overall healthcare experience for veterans.

4. Enhanced Quality of Care: The revenue generated from insurance charges helps the VA improve the quality of care provided to veterans. It allows for investment in state-of-the-art medical equipment, expanded facilities, and additional healthcare professionals. This investment in resources helps ensure that veterans receive the highest standard of care possible within the VA healthcare system.

5. Sustainability of VA Healthcare: Charging insurance helps maintain the financial stability and sustainability of the VA healthcare system. By generating additional revenue, the VA can continue to provide crucial healthcare services to eligible veterans. This ensures that veterans can rely on the VA to meet their healthcare needs now and in the future.

Overall, the impact of insurance charges on veterans is one of improved access, enhanced quality of care, and financial protection. By understanding the financial considerations and the positive outcomes associated with insurance charging, veterans can have confidence in the VA healthcare system and the services it provides.

Steps to Address Insurance Charges

If veterans are concerned about the insurance charges imposed by the VA, there are several steps they can take to address these charges and ensure they are receiving the appropriate benefits and coverage:

1. Understand Insurance Coverage: Veterans should familiarize themselves with their insurance coverage and benefits. This includes understanding the scope of coverage, any limitations or exclusions, and the process for filing claims. By having a clear understanding of their insurance policy, veterans can better navigate their healthcare options and advocate for fair and accurate billing.

2. Communication with Insurance Providers: It is important for veterans to establish open lines of communication with their insurance providers. This includes maintaining accurate and up-to-date information, such as changes in employment or insurance plans. Veterans should also notify their insurance provider that they are eligible for VA benefits, which may help avoid unnecessary billing or confusion.

3. Review EOB Statements: Veterans should carefully review their Explanation of Benefits (EOB) statements received from insurance providers. An EOB statement outlines the services provided, the amount billed, and the insurance coverage. It is important to check for any errors, duplicate charges, or services incorrectly categorized as non-VA care. Contacting the insurance provider or the VA for clarification can help resolve any discrepancies.

4. Utilize VA Resources: The VA offers resources and support to help veterans navigate insurance-related issues. Veterans can reach out to their local VA facility or contact the VA Benefits Office to obtain guidance and assistance. VA representatives can provide information on insurance charging practices, answer questions about coverage, and help address any concerns raised by veterans.

5. Appeal or Dispute Charges: If veterans believe they have been billed incorrectly or unfairly, they have the right to appeal or dispute the charges. This may involve submitting additional documentation, providing evidence of VA coverage, or filing a formal appeal with the insurance provider. Veterans should be proactive in advocating for their rights and ensuring that insurance charges align with the agreements in place between the VA and the insurance company.

6. Stay Informed: Veterans should stay updated on changes in VA policies and insurance regulations that may impact their coverage and benefits. Keeping abreast of any updates or changes will enable veterans to make informed decisions about their healthcare options and ensure that they are receiving the appropriate benefits.

By taking these steps, veterans can actively address insurance charges and ensure that they are receiving the full extent of their entitlements. Effective communication, understanding insurance coverage, and leveraging available resources will empower veterans to address any concerns or discrepancies related to insurance charges imposed by the VA.

Conclusion

The practice of the VA charging insurance for medical treatments can initially raise questions and concerns for veterans. However, understanding the reasons behind these charges, their impact on veterans, and the steps to address them can provide clarity and empowerment in navigating the healthcare system.

Charging insurance allows the VA to generate additional revenue, enhance resources, and improve access to specialized care for veterans. It aligns with industry practices and ensures the sustainability of the VA healthcare system. Importantly, veterans are not personally burdened with excessive out-of-pocket expenses, thanks to agreements that limit the amount they can be charged for VA-covered services.

The impacts of insurance charges on veterans are generally positive. They contribute to improved access, reduced wait times, and enhanced quality of care within the VA healthcare system. With insurance charges, the VA can invest in resources and collaborate with private providers to ensure comprehensive care for veterans with specialized needs.

To address insurance charges, veterans should understand their insurance coverage, maintain open communication with insurance providers, review EOB statements, utilize VA resources, and be proactive in appealing or disputing any incorrect or unfair charges. Staying informed about changes in policies and regulations is also crucial in maximizing their entitlements and benefits.

In conclusion, the practice of the VA charging insurance is intended to enhance the overall healthcare experience for veterans. It ensures the financial stability of the VA, expands access to care, and minimizes the financial burden on veterans. By understanding and navigating the complexities of insurance charges, veterans can confidently access the healthcare services they deserve and have earned through their service to the nation.