Home>Finance>What Are The Three Fundamental Components Of Risk Assessment?

Finance

What Are The Three Fundamental Components Of Risk Assessment?

Published: January 15, 2024

Discover the three vital components of risk assessment in the finance industry. Learn how to effectively manage financial risks for your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to this comprehensive guide on risk assessment. In today’s ever-changing world, understanding and assessing risks has become a crucial aspect of various industries, including finance. Whether you are a financial professional, an investor, or simply someone looking to gain a better understanding of risk, this article will provide you with valuable insights.

Risk assessment is the process of identifying, analyzing, and evaluating potential risks and their impact on a particular situation. It plays a vital role in decision-making, allowing businesses and individuals to make informed choices and mitigate potential hazards. By assessing risks, you can better prepare for uncertainties and develop strategies to minimize their adverse effects.

In the realm of finance, risk assessment is crucial for making investment decisions, managing portfolios, and ensuring the overall stability of financial institutions. It involves evaluating various factors, such as market volatility, economic conditions, regulatory changes, and internal risks specific to organizations.

This article will focus on the three fundamental components of risk assessment: hazard identification, risk analysis, and risk evaluation. Understanding these components is essential for conducting a comprehensive and effective risk assessment process.

So, let’s dive in and explore each component in detail, starting with hazard identification.

Definition of Risk Assessment

Risk assessment is a systematic and organized process that involves identifying, analyzing, and evaluating potential risks to determine their likelihood and impact. It is a crucial step in risk management that allows individuals and organizations to understand and prioritize risks, develop strategies to mitigate them, and make informed decisions.

The primary objective of risk assessment is to ensure the safety and well-being of individuals, protect assets, and minimize financial, operational, and reputational losses. By thoroughly assessing risks, businesses can proactively implement control measures and establish contingency plans to address potential threats.

Risk assessment involves several important elements:

- Identification: This entails identifying potential hazards or risks that could impact an organization or project. It involves recognizing both internal and external factors that could pose a threat.

- Analysis: After identifying risks, they must be analyzed to understand their nature, severity, and potential consequences. This step involves evaluating the likelihood of the risk occurring and the potential impact it could have.

- Evaluation: Risk evaluation involves assessing the significance of identified risks based on their potential impact and the organization’s risk tolerance. This step helps prioritize risks and determine the appropriate response strategies.

Effective risk assessment requires a combination of expertise, experience, and data analysis. It involves gathering and analyzing relevant information, such as historical data, industry trends, and expert opinions, to make informed assessments. Technology, such as data analytics and risk modeling software, can also enhance the accuracy and efficiency of the assessment process.

It is important to note that risk assessment is an ongoing process and should be conducted periodically or whenever significant changes occur. Regular reassessment helps identify emerging risks and ensures that risk management strategies remain relevant and effective.

Now that we have defined risk assessment, let’s delve into the first component: hazard identification.

Component 1: Hazard Identification

Hazard identification is the first step in the risk assessment process. It involves systematically identifying potential hazards or risks that may have adverse effects on individuals, organizations, or the environment. This step aims to provide a comprehensive and accurate understanding of the risks involved.

When conducting hazard identification, it is important to consider both internal and external factors. Internal factors refer to risks that are specific to the organization or project, such as inadequate safety procedures, technology failures, or employee negligence. External factors, on the other hand, include risks stemming from the broader environment, such as natural disasters, economic fluctuations, or regulatory changes.

To effectively identify hazards, various methods can be employed, including:

- Reviewing historical data: Examining past incidents, accidents, or near misses can provide valuable insights into potential risks. This includes analyzing incident reports, safety records, and industry-specific data.

- Conducting site visits and inspections: Physically visiting the location or project site allows for the identification of potential physical hazards, such as structural weaknesses, equipment malfunctions, or unsafe work practices.

- Engaging stakeholders: Collaborating with employees, industry experts, suppliers, and customers can help identify risks that may not be immediately apparent. Their diverse perspectives and experiences can contribute to a more comprehensive hazard identification process.

- Using checklists and risk assessment frameworks: Utilizing standardized checklists or risk assessment frameworks specific to the industry or project can aid in systematically identifying potential hazards.

During the hazard identification process, it is important to document and categorize identified hazards. This documentation serves as a reference for further analysis and evaluation. It also helps in prioritizing risks and allocating necessary resources for risk mitigation strategies.

Remember, hazard identification is an iterative process. As new information becomes available or changes occur, hazards should be reviewed and updated accordingly. Regularly reassessing hazards ensures that risks are accurately assessed and managed throughout the lifespan of a project or within an organization.

Now that we have identified potential hazards, let’s move on to the second component of risk assessment: risk analysis.

Component 2: Risk Analysis

Risk analysis is the second component of the risk assessment process. It involves a systematic evaluation and analysis of identified hazards to determine their likelihood of occurrence and their potential impact. This step aims to quantify and understand the magnitude of the risks.

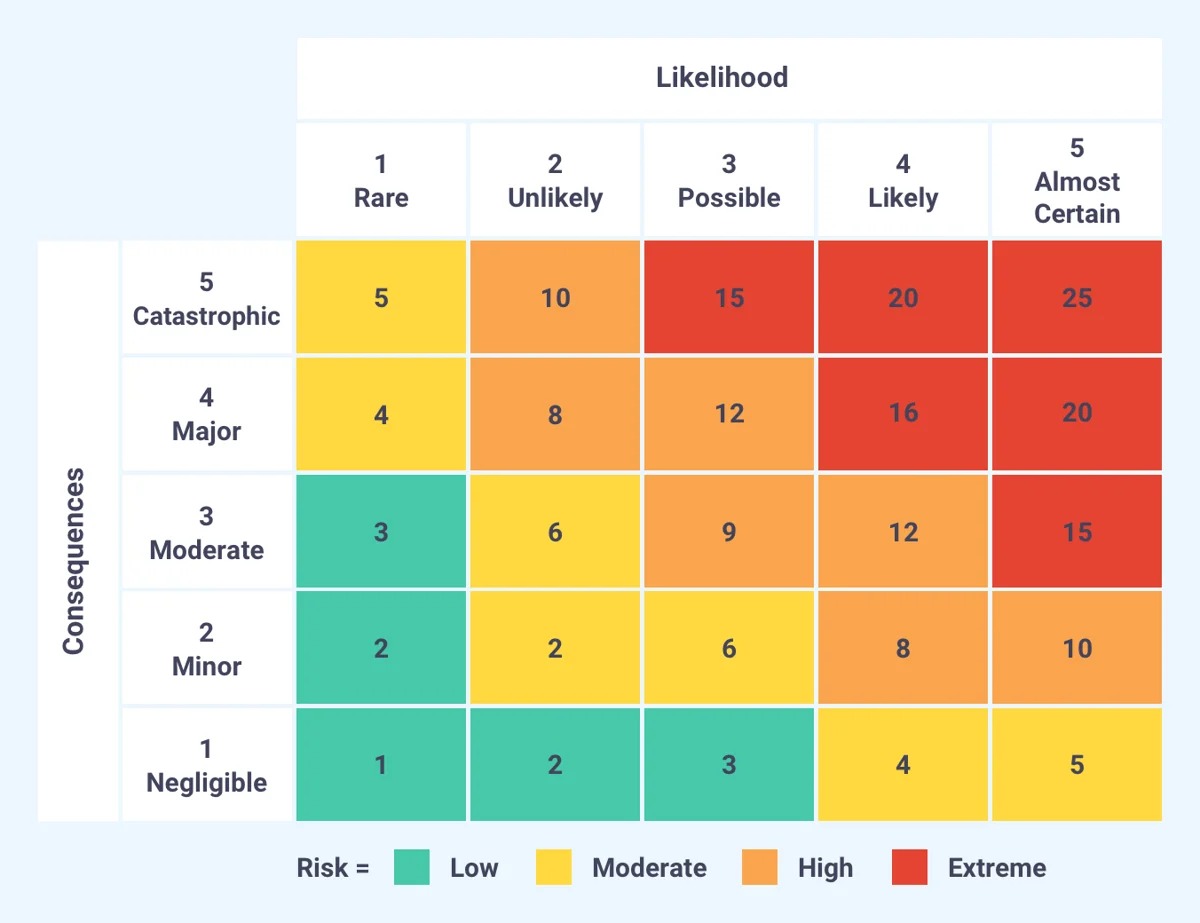

In risk analysis, each identified hazard is assessed individually. The analysis considers various factors, including the severity of the potential consequences, the likelihood of occurrence, and the vulnerability of the exposed elements. This assessment helps prioritize risks and identify those that require immediate attention and mitigation.

The following are some key steps involved in risk analysis:

- Consequence Assessment: This step involves evaluating the potential consequences or impact of each hazard. It considers both the direct and indirect effects, such as financial losses, injuries, environmental damage, or damage to reputation.

- Likelihood Assessment: Assessing the likelihood of each hazard occurring helps gauge the probability of encountering the risk. Factors such as historical data, statistical analysis, expert opinions, and industry knowledge can be utilized to determine the likelihood.

- Vulnerability Assessment: Assessing the vulnerability of exposed elements involves examining the susceptibility of assets, individuals, or systems to the identified hazards. This assessment helps determine the potential severity of the consequences.

- Risk Estimation: By combining the consequence assessment, likelihood assessment, and vulnerability assessment, the overall level of risk can be estimated. This allows for the prioritization of risks based on their significance and the allocation of appropriate resources for risk mitigation.

Quantitative and qualitative methods can be used in risk analysis. Quantitative methods involve assigning numerical values to consequence and likelihood, enabling the calculation of risk probabilities and impact. Qualitative methods, on the other hand, rely on subjective judgments and expert opinions to assess and categorize risks.

Through risk analysis, organizations gain a deeper understanding of the potential impacts and probabilities associated with each hazard. This information forms the basis for risk evaluation, the next component of the risk assessment process, which we will explore in the following section.

Component 3: Risk Evaluation

Risk evaluation is the final component of the risk assessment process. It involves assessing the significance of the identified risks based on their potential impacts and the organization’s risk tolerance. This step helps to prioritize risks, determine potential responses, and make informed decisions regarding risk management strategies.

During the risk evaluation stage, risks are categorized and assessed based on their level of severity and likelihood. This assessment can be subjective, considering factors such as financial impact, potential harm to individuals, legal or regulatory consequences, and damage to reputation. The organization’s risk appetite, industry standards, and legal requirements also play a role in evaluating risks.

There are several approaches to evaluate risks:

- Qualitative Risk Evaluation: This approach involves a descriptive evaluation of risks using qualitative scales or categories. Risks can be categorized as high, medium, or low based on their significance and likelihood of occurrence.

- Quantitative Risk Evaluation: Utilizing quantitative methods, risks can be evaluated using numeric values. This approach involves assigning numerical values to consequence and likelihood and using mathematical calculations to assess the overall level of risk.

- Cost-Benefit Analysis: In some cases, risks can be evaluated based on the potential costs associated with implementing risk management strategies versus the potential benefits achieved in risk reduction.

Once risks are evaluated, they can be prioritized based on their importance and the resources available for risk management. High-risk areas or hazards that have significant potential consequences and likelihood of occurrence often require immediate attention and mitigation strategies. On the other hand, low-risk areas may require less prioritization or may be accepted as part of the business’s risk tolerance.

Risk evaluation helps organizations identify appropriate risk response strategies. These strategies can include risk avoidance, risk reduction, risk transfer, or risk acceptance. By evaluating risks, organizations can determine the most suitable response strategy for each identified risk.

It is important to note that risk evaluation is not a one-time process. As the business landscape evolves and new risks emerge, risks should be periodically reevaluated to ensure that risk management strategies remain effective and aligned with the organization’s goals and objectives.

Now that we have explored the three fundamental components of risk assessment, it is evident that a comprehensive risk assessment process involves careful hazard identification, thorough risk analysis, and thoughtful risk evaluation. By integrating these components into decision-making processes, organizations can effectively manage risks and enhance their ability to achieve their objectives.

Conclusion

Risk assessment is a critical process in various industries, especially in finance, where the management of risks is essential for success. The three fundamental components of risk assessment – hazard identification, risk analysis, and risk evaluation – provide a systematic and structured approach to understanding and managing risks.

Hazard identification is the first step in the risk assessment process, where potential risks are identified, both internally and externally. Through methods such as reviewing historical data, conducting site visits, and engaging stakeholders, organizations can gain a comprehensive understanding of the hazards they face.

Risk analysis follows hazard identification, involving the evaluation of the likelihood and impact of each identified risk. Consequence assessment, likelihood assessment, and vulnerability assessment are key steps in understanding the magnitude of risks and their potential consequences. Quantitative and qualitative approaches can be utilized to analyze risks and assign numeric values for further analysis.

Risk evaluation completes the risk assessment process by determining the significance of identified risks based on their potential impacts and the organization’s risk tolerance. Through qualitative or quantitative evaluations, risks can be categorized and prioritized, allowing for the development of appropriate risk response strategies.

By consistently conducting risk assessments and reassessments, organizations can proactively identify emerging risks, mitigate potential hazards, and align risk management strategies with their business objectives. This not only helps protect assets and ensure stability, but also enables organizations to make well-informed decisions and seize opportunities with greater confidence.

In the dynamic and complex world of finance, understanding and managing risks is essential for sustainable growth and success. Risk assessment provides a structured framework that empowers organizations to be proactive, adapt to changing circumstances, and effectively navigate uncertainties. By integrating the three fundamental components of risk assessment into their decision-making processes, organizations can efficiently manage risks, protect their interests, and thrive in an ever-evolving financial landscape.