Finance

Dummy CUSIP Number Definition

Published: November 15, 2023

Get a clear understanding of the definition and purpose of a Dummy CUSIP Number in the world of finance

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding CUSIP Numbers in Finance

Gone are the days when the world of finance was shrouded in mystery and complex jargon. With the digital age, access to information has become a lot easier. In this blog post, we will demystify the “Dummy CUSIP Number” widely used in the finance industry today. So, let’s dive right in and find out what this term actually means and why it is important in the world of finance.

What is a CUSIP Number?

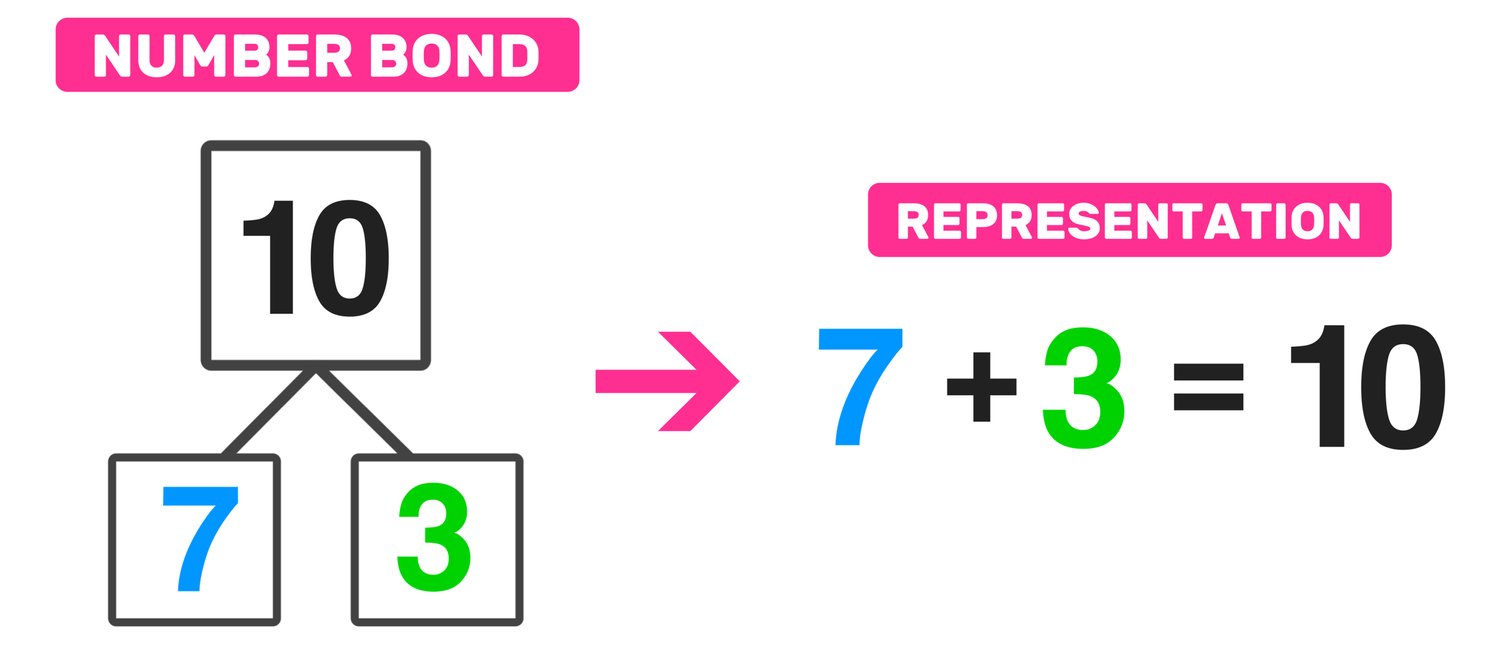

A CUSIP (Committee on Uniform Securities Identification Procedures) number is a unique nine-character code that acts as an identifier for financial instruments, such as stocks, bonds, and mutual funds. It helps investors and financial institutions track and manage their investments effectively. CUSIP numbers were introduced in 1964 to streamline the process of identifying securities and to enhance transparency in the financial markets.

Key Takeaways:

- A CUSIP number is a unique identifier for financial instruments.

- It was developed to streamline the identification process and improve transparency.

Why are CUSIP Numbers Important?

Now that we know what a CUSIP number is, let’s explore why it holds significance in the world of finance:

- Identification: CUSIP numbers serve as an essential component in the identification of financial instruments. They help investors and financial institutions accurately and efficiently track and manage their portfolios.

- Transparency: CUSIP numbers promote transparency in the financial markets. With a unique identifier for each financial instrument, it becomes easier to track ownership, transactions, and market performance.

- Regulatory Compliance: CUSIP numbers play a crucial role in regulatory compliance. They help regulators track and monitor securities, ensuring that financial institutions adhere to the laws and regulations in place.

- Trading and Settlement: CUSIP numbers are used in the trading and settlement process, facilitating the smooth functioning of financial markets. They enable accurate and timely trade matching, clearance, and settlement of securities.

Conclusion

Understanding CUSIP numbers is vital for anyone involved in the finance industry. Whether you are an investor, financial institution, or regulator, the ability to identify and track financial instruments with precision is crucial. CUSIP numbers provide the necessary transparency and efficiency needed in today’s complex financial markets. So, the next time you come across a CUSIP number, you’ll have a better understanding of its significance and how it contributes to the world of finance.