Finance

What Is A Credit Privacy Number

Published: January 14, 2024

Learn what a Credit Privacy Number is and how it can impact your personal finance. Discover how to use it responsibly to protect your identity and financial information.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit privacy numbers (CPNs), a concept that has gained attention in recent years due to its potential to offer financial privacy and security. In an age where identity theft and data breaches are becoming increasingly common, individuals are seeking alternative methods to protect their personal information. A CPN is one such alternative that presents itself as a potential solution.

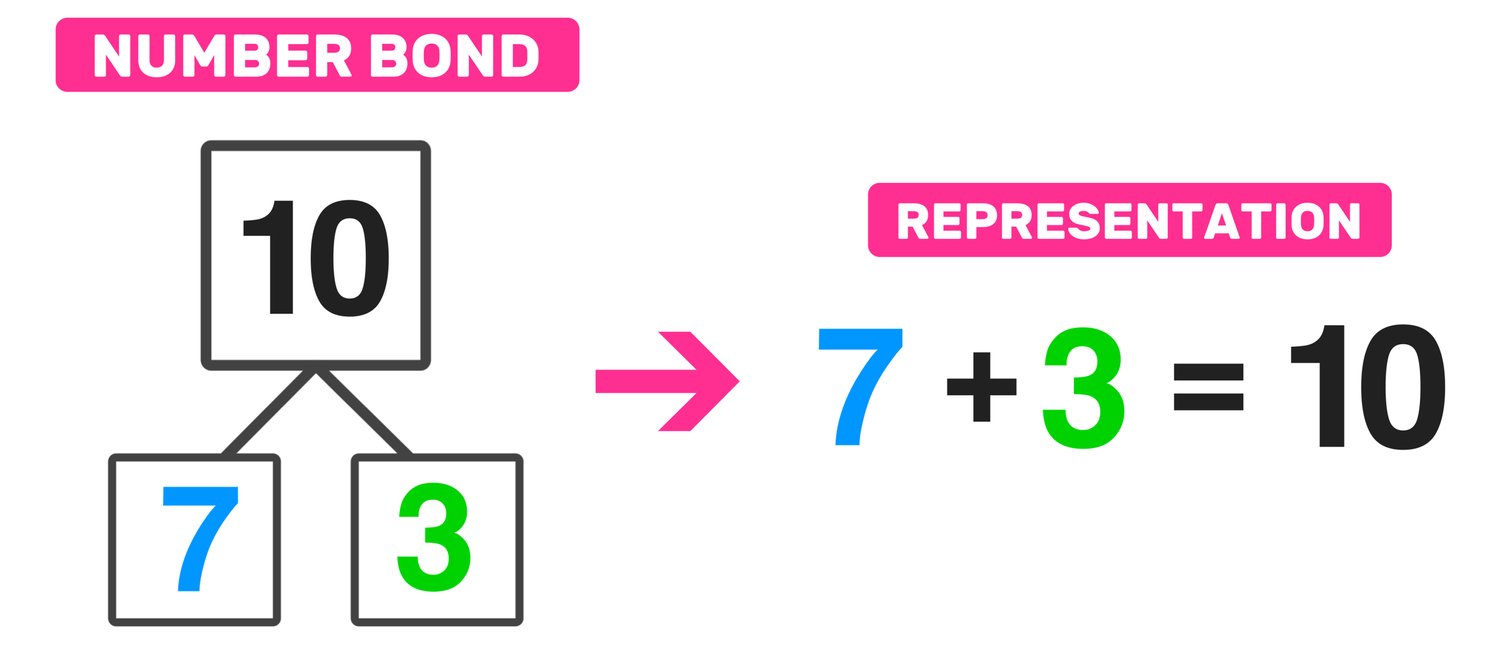

A Credit Privacy Number, also known as a Credit Profile Number, is a nine-digit number that is sometimes marketed as a replacement for a Social Security Number (SSN). The idea behind a CPN is to create a separate identity for financial purposes, allowing individuals to keep their personal and credit information separate from their SSN. While the concept may seem appealing, it is important to fully understand the legality and implications associated with using a CPN before considering its use.

In this article, we will delve into the world of CPNs, exploring what they are, how they differ from SSNs, the legality of using them, how to obtain one, their potential uses, as well as the risks and concerns associated with their usage. Our goal is to provide you with a comprehensive overview so you can make an informed decision about whether a CPN is right for you.

What is a Credit Privacy Number (CPN)?

A Credit Privacy Number (CPN) is a nine-digit number that is marketed as an alternative to a Social Security Number (SSN). It is often touted as a way to protect personal financial information and establish a separate credit identity. While not recognized or issued by the government, CPNs are used by some individuals as a unique identifier for credit-related activities.

It is important to note that CPNs are not intended to replace SSNs or engage in any illegal activities such as identity theft or fraud. Rather, they are positioned as a means to establish a separate credit profile without relying solely on the traditional SSN. However, it is essential to understand the legal and ethical considerations surrounding the use of CPNs.

CPNs are often marketed as a tool to help individuals with poor credit or those looking to protect their personal information. The idea is that by using a CPN, individuals can build a new credit history or separate their credit activity from their SSN-related activities. This can be particularly useful in cases where an individual has a negative credit history or wants to keep their personal and financial information separate for security purposes.

While using a CPN may seem attractive, it is important to know that the use of a CPN for fraudulent purposes is illegal. Misrepresenting a CPN as a legitimate SSN or using a CPN to apply for credit or benefits under false pretenses is a federal offense. It is crucial to understand and adhere to the laws and regulations surrounding the use of CPNs to avoid legal consequences.

It is also worth noting that CPNs are not widely recognized by lenders, financial institutions, or government agencies. While some lenders may accept a CPN for credit applications, many will require a verifiable SSN. Therefore, it is essential to research and understand the policies and acceptance of CPNs before relying on them for credit-related activities.

In the following sections, we will delve deeper into the differences between CPNs and SSNs, the legality of using CPNs, how to obtain a CPN, and the potential risks and concerns associated with their usage.

How does a CPN differ from a Social Security Number (SSN)?

A Credit Privacy Number (CPN) and a Social Security Number (SSN) are both nine-digit identification numbers, but they serve different purposes and have distinct characteristics. Here are some key differences between CPNs and SSNs:

- Issuance: SSNs are issued by the Social Security Administration (SSA) to U.S. citizens, permanent residents, and temporary residents with work authorization. CPNs, on the other hand, are not issued by any government agency and are not considered an official form of identification.

- Original purpose: SSNs were initially created as a way to track an individual’s earnings for Social Security benefits. Today, they serve as a primary identifier for various purposes, including employment, taxes, and credit applications. CPNs, however, were not established for any specific governmental purpose.

- Legal recognition: SSNs are recognized and accepted by government agencies, financial institutions, lenders, and other organizations. CPNs, in contrast, are not universally recognized, and their acceptance can vary depending on the entity involved.

- Privacy and security: SSNs are linked to an individual’s personal and financial information, making them highly sensitive and valuable for identity theft. CPNs, when used legally and responsibly, can offer an added layer of privacy by keeping personal and credit information separate from SSNs.

- Legality: SSNs have a clear legal foundation, as they are issued and regulated by the government. CPNs, on the other hand, exist in a legal gray area. While it is not illegal to possess a CPN, misusing or misrepresenting a CPN as a legitimate SSN can result in legal consequences.

Given these differences, it is important to note that CPNs are not a replacement or substitute for an SSN. They are intended for specific use cases where individuals want to establish a separate credit identity or protect their personal information, but they should be used in compliance with the law and with full awareness of the potential risks and limitations.

In the next section, we will delve into the legality of using CPNs, providing further insights into their status and potential legal considerations.

Legality of using a CPN

The legality of using a Credit Privacy Number (CPN) is a complex and often controversial topic. While CPNs themselves are not inherently illegal, their usage can easily cross into illegal territory if misused or misrepresented. Understanding the legal considerations surrounding CPN usage is crucial to avoid potential legal consequences.

It is important to note that the creation and sale of CPNs as a replacement for Social Security Numbers (SSNs) is generally considered fraudulent activity. The government views attempts to use a CPN as a way to deceive or defraud lenders, creditors, or government agencies as illegal. Misrepresenting a CPN as a legitimate SSN or using it for fraudulent purposes can result in criminal charges.

However, it is essential to differentiate between the legitimate use of a CPN and its misuse. There are legal and ethical ways to use CPNs, such as establishing separate credit identities or protecting personal information. As long as a CPN is not used for illegal activities or to deceive others, it is possible to navigate within the bounds of the law.

One aspect to consider is the laws regarding CPN usage in different jurisdictions. While there is no specific federal law that explicitly prohibits the possession or use of a CPN, state laws may vary. It is important to consult with legal professionals and understand the legal landscape in your specific jurisdiction to ensure compliance.

Another consideration is the acceptance of CPNs by financial institutions and credit bureaus. While some lenders may accept CPNs for credit applications, they are not universally recognized or acknowledged. Many institutions require a verifiable SSN for credit-related activities, making it essential to research and understand the acceptance policies of potential creditors.

In summary, the legality of using a CPN lies in the intention and context of its use. Possessing a CPN itself is not illegal, but misusing it or using it for fraudulent purposes is. It is essential to stay within the boundaries of the law, understand the specific regulations in your jurisdiction, and ensure responsible and ethical usage of a CPN.

In the following sections, we will discuss how to obtain a CPN and explore the potential uses, risks, and concerns associated with using CPNs.

Obtaining a CPN

Obtaining a Credit Privacy Number (CPN) can be a relatively simple process, but it is important to approach it with caution and ensure that you are obtaining it legally and from a reputable source. While CPNs are not issued by government agencies like Social Security Numbers (SSNs), there are legitimate ways to acquire a CPN.

One option is to work with a reputable credit repair agency or service that offers CPN services. These agencies have the knowledge and experience to guide you through the process and ensure that you obtain a CPN that is legal and compliant with the relevant regulations. It is crucial to research and choose a reputable agency that adheres to ethical practices and has a track record of providing legitimate CPNs.

When obtaining a CPN, it is essential to provide accurate and truthful information. Falsifying any information or misrepresenting your identity during the application process is illegal and can lead to legal consequences. Be prepared to provide relevant personal information and documentation as required by the agency or service you choose to work with.

It is important to note that not all businesses offering CPNs are legitimate. Be wary of scams or fraudulent services that promise guaranteed CPNs or claim to provide a way to “start fresh” financially. Research the reputation and credibility of any agency or service you consider working with and be cautious of any claims that seem too good to be true.

Additionally, it is worth mentioning that CPNs should not be confused with Employer Identification Numbers (EINs) issued by the Internal Revenue Service (IRS). EINs are specifically used for business purposes, while CPNs are intended for individual credit-related activities. Mixing up these numbers or using them interchangeably can lead to legal and financial issues.

Overall, obtaining a CPN can be a viable option for establishing a separate credit identity or safeguarding personal information. However, it is imperative to approach the process with caution and ensure that you are obtaining a CPN from a legitimate source that adheres to legal and ethical practices. Consider consulting with legal professionals or reputable credit agencies to navigate the process successfully.

In the next section, we will explore some potential uses of CPNs and discuss the risks and concerns associated with their usage.

Uses of a CPN

A Credit Privacy Number (CPN) can have various potential uses, but it is important to understand the limitations and legal considerations associated with its usage. While CPNs are not intended to replace Social Security Numbers (SSNs), they can serve specific purposes for individuals who want to establish a separate credit identity or protect their personal information.

Here are some potential uses of a CPN:

- Separate Credit Identity: One of the main reasons individuals acquire a CPN is to establish a separate credit identity. This can be beneficial for those with a negative credit history or those looking to keep their personal and financial information separate from their SSN-related activities. By using a CPN, individuals can build a new credit history independent of their SSN.

- Identity Protection: Using a CPN can offer an added layer of privacy and protection for personal information. By keeping your SSN separate from certain credit-related activities, you can potentially reduce the risk of identity theft, as your CPN is a separate identifier that is not as widely recognized or targeted.

- Banking Purposes: In some cases, individuals may use a CPN for banking-related purposes, such as opening a separate bank account. This can be useful for segregating personal and business finances or maintaining privacy in financial transactions.

- Privacy in Credit Applications: Certain lenders or creditors may accept a CPN in place of an SSN for credit applications. This can be particularly helpful for individuals who want to keep their personal information private or have concerns about disclosing their SSN for credit-related activities.

- Contractual Agreements: Some individuals may choose to use a CPN for contractual agreements, such as signing a lease or entering into certain business arrangements. This can help preserve privacy and limit the sharing of personal information.

It is important to note that the acceptance of CPNs can vary. While some lenders or institutions may accept them, many financial institutions, government agencies, and credit bureaus require a verifiable SSN for credit-related matters. Before relying on a CPN, it is essential to research and understand the policies and acceptance criteria of the entities you intend to interact with.

Furthermore, it is important to use a CPN responsibly and within the bounds of the law. Misusing or misrepresenting a CPN as a legitimate SSN is illegal and can lead to serious legal consequences.

In the next section, we will discuss the risks and concerns associated with using CPNs, providing insight into the potential drawbacks and pitfalls to consider.

Risks and Concerns Associated with CPNs

While Credit Privacy Numbers (CPNs) can offer some potential benefits, there are also several risks and concerns that individuals should be aware of before considering their usage. It is important to weigh the advantages against these potential drawbacks to make an informed decision.

1. Legality: The most significant risk associated with CPNs is the potential for illegal activities. Misusing or misrepresenting a CPN as a legitimate Social Security Number (SSN) is illegal and can result in criminal charges. It is crucial to use a CPN responsibly and within the bounds of the law to avoid legal consequences.

2. Limited Acceptance: CPNs are not universally recognized or accepted by lenders, financial institutions, or government agencies. While some creditors may accept CPNs for credit applications, many organizations require a verifiable SSN. This limited acceptance can restrict access to certain financial services or opportunities.

3. No Credit Repair Guarantee: Some individuals may acquire a CPN with the expectation of repairing their credit history. However, it is important to note that using a CPN alone does not guarantee credit repair or improvement. Building a positive credit history involves various factors, including responsible borrowing, timely payments, and managing existing debts.

4. Potential for Scams: The market for CPNs has attracted scams and fraudulent services that promise guaranteed CPNs or quick fixes to financial issues. It is important to be cautious and research any agency or service offering CPNs before engaging with them to avoid falling victim to scams or fraudulent activities.

5. Legal Grey Area: The legal status of CPNs is in a grey area, with different opinions and interpretations. While possessing a CPN is not illegal, using it for fraudulent purposes or to deceive others is. This ambiguity can lead to confusion and possible legal consequences if individuals unknowingly engage in illegal activities.

6. Identity Confusion: Using a CPN can create confusion or challenges when it comes to identity verification. Some individuals may mistakenly assume that a CPN can provide complete anonymity or replace an SSN entirely, leading to complications when verifying identity for certain transactions or legal processes.

It is important to thoroughly understand and consider these risks and concerns before deciding to use a CPN. Evaluating the potential benefits and drawbacks, consulting with legal professionals, and conducting thorough research can help individuals make an informed decision about whether a CPN aligns with their needs and priorities.

In the next section, we will explore ways to protect your CPN and maintain its integrity.

Protecting Your CPN

Protecting your Credit Privacy Number (CPN) is essential to ensure its integrity and minimize the risk of misuse or unauthorized access to your personal and financial information. Here are some key steps you can take to safeguard your CPN:

1. Keep your CPN confidential: Treat your CPN with the same level of confidentiality as you would your Social Security Number. Share it only with trusted entities or individuals who have a legitimate need for it. Be cautious about disclosing your CPN unless absolutely necessary.

2. Be aware of phishing attempts: Fraudsters may attempt to trick you into revealing your CPN through phishing emails, text messages, or phone calls. Be vigilant and never provide your CPN or sensitive financial information to unsolicited requests.

3. Regularly review your credit reports: Monitor your credit reports from major credit bureaus for any suspicious activity or unauthorized use of your CPN. Promptly report any discrepancies or signs of identity theft to the appropriate authorities.

4. Safeguard your documents: Store physical documents containing your CPN, such as credit applications or statements, in a secure and locked place. Shred any documents you no longer need that contain your CPN to prevent them from falling into the wrong hands.

5. Use secure communication channels: When communicating sensitive information related to your CPN, such as providing it to legitimate entities, ensure that you are using secure communication channels. Look for secure website connections (https://) or encrypted email services to minimize the risk of interception.

6. Be cautious with CPN-related services: Exercise caution when seeking CPN-related services or attempting to repair your credit. Verify the legitimacy and credibility of credit repair agencies or entities offering CPNs to avoid falling victim to scams or fraudulent activities.

7. Regularly update your antivirus and security software: Keep your computer and other devices protected with up-to-date antivirus and security software to help prevent unauthorized access to your CPN and other personal information.

8. Educate yourself about CPN laws and regulations: Stay informed about the legal landscape and regulations regarding CPNs in your jurisdiction. Understanding the laws surrounding CPNs can help you make informed decisions and navigate the usage of your CPN more effectively.

By following these steps and practicing caution, you can help protect your CPN and minimize the risk of identity theft or misuse. Regularly reviewing your credit reports and being vigilant about your personal information will contribute to maintaining the integrity and security of your CPN.

In the final section, we will conclude our discussion and summarize the key points regarding CPNs.

Conclusion

Credit Privacy Numbers (CPNs) have gained attention as a potential solution for protecting personal information and establishing a separate credit identity. However, it is vital to approach the concept of CPNs with a clear understanding of the risks, limitations, and legal considerations involved.

A CPN is not a replacement for a Social Security Number (SSN) and should not be used for illegal activities or to deceive lenders, creditors, or government agencies. Possessing a CPN is not inherently illegal, but misusing or misrepresenting it can lead to serious legal consequences.

While CPNs can offer potential benefits, such as establishing a separate credit identity or protecting personal information, their acceptance is not widespread. Many financial institutions and credit bureaus require a verifiable SSN for credit-related activities.

To obtain a CPN, it is essential to work with reputable credit repair agencies or services that adhere to legal and ethical practices. Be cautious of scams or fraudulent services that make unrealistic promises or guarantee CPNs.

Protecting your CPN involves treating it with confidentiality, verifying the legitimacy of entities you share it with, and monitoring your credit reports for any signs of unauthorized use or identity theft. It is crucial to stay vigilant and take appropriate measures to safeguard your personal information.

Ultimately, the decision to use a CPN requires careful consideration and awareness of the potential risks and benefits. It is essential to stay informed about the legal landscape, consult with professionals if needed, and make informed decisions based on your unique circumstances and goals.

Remember, protecting your personal and financial information should always be a priority. By staying informed and cautious, you can navigate the world of CPNs responsibly and make informed decisions to protect your financial well-being and privacy.