Finance

Estimated Current Return Definition

Published: November 19, 2023

Learn the definition of estimated current return in finance and its significance. Understand how it impacts financial decision-making.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Estimated Current Return Definition: A Key Concept in Finance

Welcome to our finance blog! Today, we will be diving into the fascinating topic of estimated current return (ECR) and its significance in the world of finance. If you’ve ever wondered what ECR is and how it can impact your investment decisions, you’ve come to the right place. In this article, we will explore the definition, calculation, and importance of estimated current return. So, let’s get started!

Key Takeaways:

- Estimated current return (ECR) is a financial metric that calculates the projected annual income generated by an investment relative to its current market value.

- ECR is commonly used by investors to assess the potential returns of different investment opportunities and make informed decisions.

What is Estimated Current Return?

Estimated current return (ECR) is a fundamental concept in finance that measures the projected annual income generated by an investment relative to its current market value. In other words, ECR indicates the expected return an investor can expect from an investment based on its current price.

To calculate ECR, you divide the investment’s current income by its current market price and multiply the result by 100 to express it as a percentage. The formula can be represented as follows:

Estimated Current Return = (Annual Income / Current Market Price) x 100

By calculating the ECR, investors can compare the potential returns of different investment opportunities and make informed decisions. It helps them evaluate whether an investment is undervalued or overvalued and determine if the potential returns are worth the associated risks.

Why is Estimated Current Return Important?

Understanding the estimated current return is crucial for investors for several reasons:

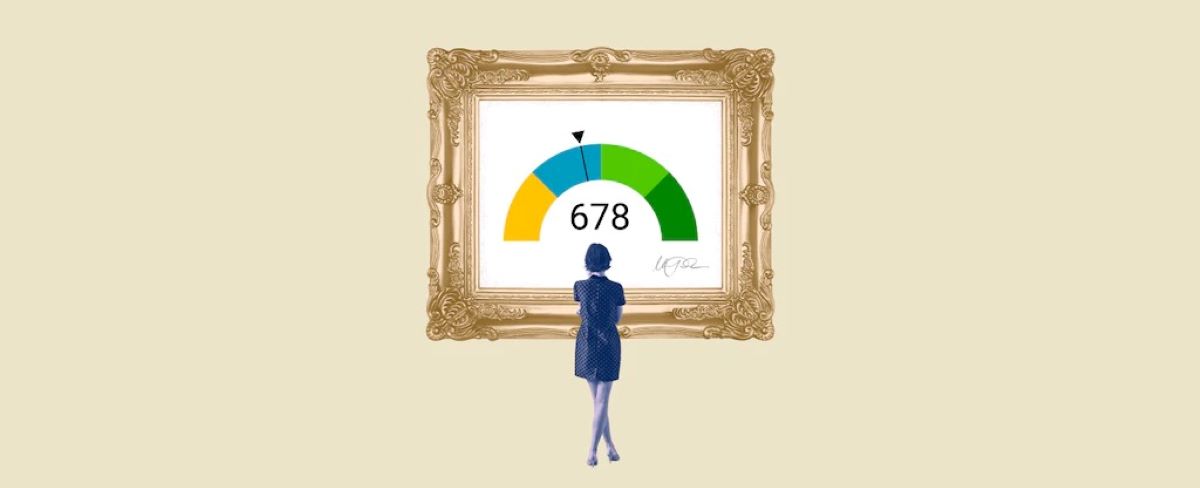

- Assessing Investment Opportunities: ECR allows investors to compare different investments and determine which ones have the potential to generate higher returns based on their current market prices.

- Managing Risk: ECR helps investors assess the risk associated with an investment by considering the potential returns. A higher ECR indicates a potentially higher return on investment but also implies a higher risk.

- Portfolio Diversification: By analyzing the ECR of various investments, investors can create a diversified portfolio with a balanced mix of investments offering different estimated current returns.

- Monitoring Financial Performance: Investors can use ECR to monitor the financial performance of their investments over time. By comparing the current ECR with the historical ECR, they can evaluate if the investment is performing as expected or if adjustments need to be made.

Overall, estimated current return provides investors with a valuable tool to assess the potential returns and risks associated with their investments. By understanding and considering the ECR, investors can make more informed decisions and optimize their investment portfolios for long-term success.

We hope this article has shed light on the concept of estimated current return (ECR) and its significance in the world of finance. Remember to take into account the key takeaways mentioned earlier to make the most out of your investment decisions. Stay tuned to our finance blog for more insightful articles on various financial topics!