Finance

How To Estimate Hedging Cost

Published: January 15, 2024

Learn how to estimate the cost of hedging in finance, including strategies and factors to consider. Maximize your understanding and minimize your risks.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing financial risks, hedging is a strategy that plays a crucial role. Whether you are an investor, a business owner, or a financial institution, understanding and estimating the cost of hedging is essential in making informed decisions. By effectively hedging your investments, you can minimize potential losses and protect your financial interests.

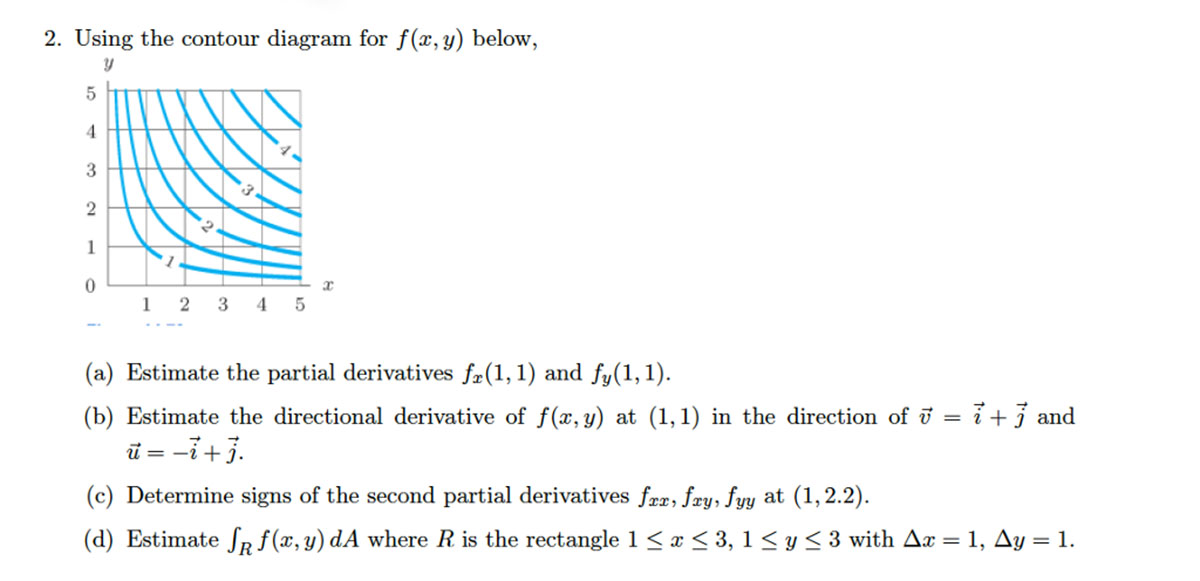

Hedging involves entering into trades or contracts that offset the potential risks of adverse price movements in an underlying asset. It serves as a form of insurance against market volatility, providing stability and safeguarding against unexpected losses. The concept of hedging is widely employed in various sectors, including the stock market, commodities market, and foreign exchange market.

The primary objective of hedging is to reduce or mitigate the impact of potential financial risks. By taking proactive measures to manage and minimize these risks, individuals and businesses can increase their financial stability and protect their investments. However, it is important to note that hedging does come with a cost.

In this article, we will explore the different factors that affect hedging cost and discuss various methods to estimate it. Understanding the nuances of estimating hedging costs can empower you to make informed decisions and optimize your risk management strategies.

What is Hedging

Hedging, in the context of finance, refers to the practice of mitigating or reducing the potential risks associated with changes in asset prices. It is a strategy that investors and businesses employ to protect themselves against adverse market movements and potential losses.

At its core, hedging involves entering into offsetting trades or contracts that will minimize the impact of price fluctuations in an underlying asset. By establishing an opposing position to their existing investments, individuals and businesses can safeguard against loss should the asset’s value decrease.

There are several ways to hedge financial risks. For example, in the stock market, investors can adopt strategies such as buying put options or short selling stocks to protect themselves from a decline in stock prices. In the commodities market, participants can use futures contracts to hedge against potential fluctuations in the prices of commodities like oil or gold. Similarly, businesses that engage in international trade can employ currency hedging techniques to protect themselves against exchange rate risks.

The primary objective of hedging is not to generate profits but rather to minimize potential losses. It is a risk management strategy that allows individuals and businesses to maintain a level of certainty and stability in an otherwise volatile market environment. By hedging their investments, they can limit their exposure to market risks and protect their financial interests.

It is important to note that while hedging can provide a degree of protection, it does come with certain costs. These costs may include transaction fees, margin requirements, and the potential opportunity cost of forgoing potential gains if the market moves in their favor. Therefore, accurately estimating the cost of hedging is essential in order to make informed decisions and effectively manage financial risks.

Why is Hedging Important

Hedging plays a critical role in managing financial risks and is important for several reasons:

- Minimizing Potential Losses: One of the primary reasons why hedging is important is that it helps to mitigate potential losses. By entering into offsetting trades or contracts, individuals and businesses can protect themselves against adverse market movements. This is especially crucial in volatile markets where asset prices can fluctuate significantly.

- Stabilizing Cash Flows: Hedging is key in stabilizing cash flows, particularly for businesses. By hedging against fluctuations in input costs or foreign currency exchange rates, businesses can ensure that their cash flow remains predictable and manageable. This allows them to plan and allocate resources effectively, reducing the uncertainty and financial risks associated with volatile market conditions.

- Managing Market Volatility: Financial markets are prone to volatility, with prices of assets often experiencing sudden and significant fluctuations. Through hedging, individuals and businesses can navigate through market volatility with greater ease. By hedging their positions, they can limit their exposure to these market swings, minimizing the impact on their portfolio or operations.

- Protecting Investments: Investors, whether individuals or financial institutions, need to protect their investments from unforeseen market downturns. Hedging allows them to safeguard their portfolio against adverse movements in asset prices. This protection can be particularly important in times of economic uncertainty or when engaging in high-risk investments.

- Meeting Regulatory Requirements: In some industries, hedging may be necessary to comply with regulatory requirements. For example, financial institutions may be required to hedge certain positions to manage their risk exposure and meet the regulatory capital requirements set by governing bodies. Failure to adhere to these requirements can have serious consequences, including penalties and reputational damage.

Overall, hedging is important because it provides a means of managing and mitigating financial risks. Whether it is protecting against market volatility, stabilizing cash flows, or complying with regulatory obligations, hedging enables individuals and businesses to navigate through uncertain market conditions and protect their financial interests.

Factors Affecting Hedging Cost

The cost of hedging is influenced by various factors that individuals and businesses must consider when estimating the expenses associated with implementing hedging strategies. Here are some key factors that can affect hedging costs:

- Market Volatility: The level of market volatility can significantly impact the cost of hedging. Higher volatility generally leads to increased hedging costs as larger price swings increase the likelihood of losses that need to be offset. Therefore, when market volatility is high, hedging strategies may become more expensive.

- Time Horizon: The duration of the hedging position can also impact costs. Longer-term hedges typically come with higher costs, as they require longer commitment periods and may involve rolling over or adjusting the hedge over time. Shorter-term hedges may have lower costs but may need more frequent adjustments to ensure effective risk management.

- Size of the Position: The size of the position being hedged can affect the cost. Larger positions may require more extensive hedging strategies, which can lead to higher costs due to increased transaction fees and margin requirements. Smaller positions, on the other hand, may have relatively lower hedging costs.

- Correlation: The correlation between the hedged asset and the chosen hedging instrument is another factor to consider. If the correlation is strong, the hedge has a higher likelihood of being effective, which may result in lower costs. However, if the correlation is weak or inconsistent, additional measures may be needed to achieve a desired level of protection, potentially increasing the cost.

- Transaction Costs: Transaction costs, including brokerage fees, clearing fees, and commissions, can have a significant impact on hedging costs. These costs can vary depending on the financial institution or platform used. It is important to consider these fees when estimating the overall cost of implementing a hedging strategy.

- Market Liquidity: The liquidity of the market where the hedging instrument is traded can affect costs. Illiquid markets may have wider bid-ask spreads, making it more costly to enter or exit hedging positions. In contrast, highly liquid markets generally offer lower transaction costs, making hedging more cost-effective.

It is important to carefully assess these factors when estimating hedging costs. By understanding and accounting for these variables, individuals and businesses can make more informed decisions about which hedging strategies to pursue and how to effectively manage their financial risks.

Methods to Estimate Hedging Cost

Estimating the cost of hedging involves analyzing various components and factors to determine the expenses associated with implementing a hedging strategy. Here are some methods commonly used to estimate hedging costs:

- Understanding Contract Terms: The first step in estimating the cost of hedging is to thoroughly understand the terms and conditions of the contracts or instruments being used. This includes identifying any fees, margin requirements, or other costs associated with the specific hedging instruments or derivatives being utilized.

- Assessing Market Volatility: Market volatility is an important factor in determining hedging costs. Higher levels of volatility typically result in higher options premiums or wider bid-ask spreads, which can increase the cost of hedging. Traders and investors can use various volatility indicators, such as historical volatility or implied volatility, to gauge the expected costs of implementing a hedge.

- Calculating Hedging Margin: Margin requirements are an essential component of many hedging strategies, especially when trading derivatives or utilizing leverage. Calculating the required margin amount, which often depends on the size and risk profile of the hedged position, helps estimate the ongoing cost of maintaining the hedge.

- Considering Transaction Costs: Transaction costs can significantly impact the overall cost of implementing a hedging strategy. These costs include brokerage fees, commissions, and any other charges associated with executing trades. It is important to consider these costs when estimating the expenses of hedging.

- Evaluating Hedge Effectiveness: Assessing the effectiveness of a hedge strategy is crucial in estimating costs. By determining the degree to which a hedge offsets the risk exposure of the underlying position, individuals and businesses can make more informed decisions about whether the cost of the hedge is warranted based on the level of risk mitigation achieved.

- Utilizing Financial Models: Sophisticated financial models, such as option pricing models or simulation techniques, can be employed to estimate the cost of implementing specific hedging strategies. These models consider various risk factors and input variables to generate projected costs and outcomes, providing a more accurate estimate of hedging expenses.

It is worth noting that estimating hedging costs is not an exact science, as market conditions and variables can change over time. Therefore, it is crucial to regularly monitor and reassess the costs associated with a hedging strategy and make adjustments as necessary.

By utilizing these methods and considering the aforementioned factors, individuals and businesses can gain a better understanding of the potential expenses involved in implementing a hedging strategy, enabling them to make informed decisions about risk management and financial planning.

Understanding Contract Terms

When estimating the cost of hedging, it is crucial to have a clear understanding of the contract terms associated with the hedging instrument or derivative being used. Contract terms can significantly impact the cost and effectiveness of a hedge strategy. Here are some key aspects to consider when analyzing contract terms:

- Expiration Date: The expiration date of a hedging contract is an important factor to consider. It determines the duration of the hedge and influences the overall cost. Longer-term hedges may come with higher costs, as they require a longer commitment and may require rolling over or adjusting the hedge over time.

- Strike Price: The strike price is the predetermined price at which the underlying asset will be bought or sold in a hedging transaction. The strike price, relative to the current market price, can affect the cost of the hedge. Options with lower strike prices generally have higher premiums, while options with higher strike prices tend to have lower premiums.

- Option Premium: For options-based hedging strategies, the option premium is the cost of purchasing the option contract. The premium represents the probability of the option being profitable, taking into account factors such as the current price of the underlying asset, market volatility, and time to expiration. Higher premiums typically result in higher hedging costs.

- Contract Size: The contract size refers to the quantity or value of the underlying asset covered by the hedge contract. The larger the contract size, the higher the hedging costs, as it requires a larger investment of capital to execute the hedge. Conversely, smaller contract sizes may have relatively lower costs.

- Margin Requirements: Margin requirements are the amount of collateral or deposit that individuals or businesses need to maintain when trading derivatives or engaging in leveraged positions. Margin requirements can impact the upfront cost of hedging, as a greater margin requirement may necessitate a larger initial investment.

- Contract Liquidity: The liquidity of the hedging contract’s market can impact both the cost of entering into the contract and the ease of exiting or adjusting the hedge. Contracts traded in highly liquid markets tend to have tighter bid-ask spreads, resulting in lower transaction costs. On the other hand, illiquid contracts may have wider spreads and higher costs.

It is essential to carefully review and understand the terms of a hedging contract to accurately estimate the associated costs. Consulting with a financial professional or conducting thorough research on contract specifications can help individuals and businesses make informed decisions about hedging strategies and manage their financial risks effectively.

Assessing Market Volatility

Market volatility is a critical factor to consider when estimating the cost of hedging. Higher levels of volatility often result in increased hedging costs as they are often associated with larger price swings and a higher likelihood of losses. By assessing market volatility, individuals and businesses can better understand the potential expenses of implementing a hedge strategy. Here are some methods commonly used to assess market volatility:

- Historical Volatility: Historical volatility measures the degree of price fluctuation of an underlying asset over a specific period. By analyzing past price movements, investors and traders can gain insights into how volatile the market has been and use it to estimate the potential future volatility. Historical volatility can be calculated using statistical methods such as standard deviation or average true range.

- Implied Volatility: Implied volatility reflects market participants’ expectations of future price swings. It is derived from the prices of options on the underlying asset. Higher implied volatility indicates a greater anticipated level of price fluctuations and, therefore, higher hedging costs in the form of larger options premiums or wider bid-ask spreads.

- Volatility Index: Volatility indexes, such as the CBOE Volatility Index (VIX), provide a snapshot of market expectations for future volatility. These indexes are often calculated using option prices and can help gauge investor sentiment regarding market volatility. Monitoring volatility indexes can provide valuable information for estimating hedging costs.

- Analyst Reports and News: Keeping up with financial news and analyst reports can provide insights into the factors driving market volatility. News about economic indicators, geopolitical events, or major corporate announcements can impact market sentiment and subsequent volatility. Staying informed about these factors can assist in estimating the potential costs of hedging.

- Correlation Analysis: Assessing the historical correlation between the underlying asset and potential hedging instruments is important for understanding how effective the hedge may be in mitigating risk. In situations where the correlation is weak or inconsistent, additional measures may be needed to achieve the desired level of protection, potentially increasing the cost of the hedge.

By combining these methods and analyzing market volatility, individuals and businesses can make more informed decisions regarding hedging strategies and estimating associated costs. It is important to note that market volatility is dynamic and subject to change. Regularly monitoring and reassessing volatility levels is crucial for adapting hedging strategies to changing market conditions.

Calculating Hedging Margin

When estimating the cost of hedging, calculating the required margin is an important aspect to consider, especially when trading derivatives or utilizing leverage. Margin requirements refer to the amount of collateral or deposit that individuals or businesses need to maintain in their trading accounts to cover potential losses. Here are the key factors to consider when calculating hedging margin:

- Margin Rate: The margin rate is the percentage of the contract value that must be deposited as collateral. It is set by the exchange or broker and varies depending on the asset class, the contracts being traded, and the level of risk associated with the underlying asset. Higher-risk assets often have higher margin rates.

- Contract Size: The contract size denotes the quantity or value of the underlying asset covered by each contract. The margin requirement is calculated based on the contract size. Larger contract sizes will require a larger margin deposit, while smaller contract sizes will have relatively smaller margin requirements.

- Leverage: Leveraged positions amplify potential gains and losses. Margin requirements for leveraged trades are typically lower compared to non-leveraged trades, as they allow traders to control larger positions with a smaller initial capital outlay. However, it is important to note that leveraged positions also come with higher risk.

- Initial Margin vs. Maintenance Margin: Margin requirements can be divided into initial margin and maintenance margin. The initial margin is the minimum margin deposit required to open a position, while the maintenance margin is the minimum margin required to keep the position open. If the account’s equity falls below the maintenance margin level, a margin call may be triggered, requiring additional funds to be deposited.

- Margin Call and Stop-Out Level: Margin call is a notification from the broker or exchange that additional funds need to be deposited to maintain the positions. Failure to meet the margin call may result in the broker liquidating the position. The stop-out level is the minimum account equity level at which the broker automatically closes the position to prevent further losses.

Calculating the hedging margin involves multiplying the contract size by the margin rate and determining if any leverage is being utilized. Additionally, considering whether initial margin or maintenance margin is applicable is crucial, as this will determine the amount required to open and maintain the hedged position.

It is important to note that margin requirements can vary between brokers and financial institutions. Furthermore, margin requirements can differ across different asset classes and trading platforms. Therefore, it is essential to review and understand the specific margin requirements set by the broker or exchange before estimating the cost of hedging.

Considering Transaction Costs

Transaction costs are a crucial factor to consider when estimating the overall cost of implementing a hedging strategy. These costs encompass various fees and charges associated with executing trades and managing the hedged position. Here are some key transaction costs to consider:

- Brokerage Fees: Brokerage fees are charges imposed by the brokerage firm for executing trades on behalf of investors. These fees can vary depending on the broker and the type of instrument traded. It is essential to understand the brokerage fee structure, including whether it is a fixed fee per transaction or a percentage of the trade value.

- Clearing and Settlement Fees: Clearing and settlement fees are charges levied by clearinghouses and exchanges for the processing and settlement of trades. These fees cover the administrative costs associated with verifying and finalizing the transactions. Similar to brokerage fees, clearing and settlement fees can vary depending on the broker and the specific market being traded.

- Commissions: Commissions are fees paid to brokers or agents for their role in facilitating trades. Commissions can be calculated as a percentage of the trade value or a fixed fee per transaction. Investors and traders should be aware of the commission structure imposed by their broker, as high commission rates can significantly impact the overall cost of hedging.

- Exchange Fees: Exchange fees are charges imposed by exchanges for accessing and trading on their platforms. These fees can vary depending on the volume of trades, the type of instrument traded, and other factors. Traders should consider these fees and factor them into their cost estimates when hedging through exchange-traded instruments.

- Spread Costs: Spread costs are incurred when trading financial instruments with bid and ask prices. The bid price represents the price at which a trader can sell an asset, while the ask price represents the price at which a trader can buy an asset. The difference between these prices is known as the spread. Traders incur costs when buying at the ask price and later selling at the bid price. Wider spreads can result in higher transaction costs.

- Other Charges: Depending on the broker or platform used, there may be additional charges, such as platform fees, data fees, or inactivity fees. It is important to review the fee structure provided by the broker or platform to understand and account for all relevant costs associated with the hedging transactions.

Considering transaction costs is essential in accurately estimating the total expenses of implementing a hedging strategy. Traders and investors should carefully review and compare the fee structures of different brokers and platforms to identify the most cost-effective options. Additionally, it is important to stay informed about any changes in fee structures or new charges that may impact the overall cost of hedging.

Evaluating Hedge Effectiveness

Assessing the effectiveness of a hedge is crucial when estimating hedging costs. Evaluating hedge effectiveness involves analyzing how well the hedge offsets the risk exposure of the underlying position. Here are some key considerations when evaluating hedge effectiveness:

- Correlation: The correlation between the hedged asset and the chosen hedging instrument is an important factor to assess. A strong positive correlation indicates that the hedge is effective in offsetting the risk exposure, potentially resulting in lower costs. However, if the correlation is weak or inconsistent, additional measures or adjustments may be required to achieve the desired level of protection, potentially increasing the cost of the hedge.

- Delta and Sensitivity Analysis: Delta is a measure of how much an option’s price changes in response to a small change in the underlying asset’s price. Conducting a sensitivity analysis by examining different delta values can help determine the effectiveness of the option as a hedge. A higher delta signifies a closer correlation between the option and the underlying asset, indicating stronger hedging effectiveness.

- Hedge Ratios: Determining the appropriate hedge ratio is crucial for achieving an effective hedge. Hedge ratios represent the proportion of the hedging instrument required to offset the risk exposure of the underlying position. By calculating the optimal hedge ratio, traders and investors can ensure that the hedge is adequately addressing the market risks, resulting in a more efficient and cost-effective hedge.

- Backtesting: Backtesting involves analyzing historical data to assess the effectiveness of a proposed hedging strategy. By comparing the performance of the hedge against past market conditions, traders can gain insights into how well the hedge would have performed in different market scenarios. Backtesting can help refine the hedge strategy and estimate its potential costs based on historical outcomes.

- P&L Analysis: Analyzing the potential profit and loss (P&L) outcomes of the hedged position can provide insights into the effectiveness of the hedge. By simulating different market scenarios and assessing the impact on the overall P&L, traders can estimate the costs associated with implementing the hedge and evaluate its effectiveness in mitigating potential losses.

- Monitoring and Adjustments: It is important to continuously monitor the effectiveness of the hedge over time and make adjustments as needed. Market conditions and risk exposures can change, requiring ongoing evaluation of the hedge strategy. By making necessary adjustments, traders can optimize the hedge effectiveness and manage costs effectively.

By evaluating hedge effectiveness, individuals and businesses can make informed decisions about the cost and benefits of implementing a specific hedge strategy. An effective hedge can help mitigate risks and reduce potential losses, providing greater value for the costs incurred in implementing the hedge.

Conclusion

Estimating the cost of hedging is a vital aspect of effective risk management in the financial world. Hedging plays a crucial role in minimizing potential losses, stabilizing cash flows, managing market volatility, protecting investments, and meeting regulatory requirements. However, accurately estimating hedging costs requires a comprehensive understanding of various factors.

Factors such as market volatility, time horizon, position size, correlation, and transaction costs can significantly impact the cost of implementing a hedge. Therefore, it is essential to assess these factors and employ different methods to estimate hedging costs effectively.

Understanding contract terms, such as expiration dates, strike prices, and option premiums, helps outline the financial obligations associated with the hedging instrument. Assessing market volatility through historical and implied volatility analysis, as well as monitoring market news and correlation, helps gauge the potential costs of hedging.

Calculating hedging margin entails considering the margin rate, contract size, leverage, and margin requirements to estimate the upfront capital needed to maintain the hedge. Evaluating hedge effectiveness involves analyzing correlation, delta, hedge ratios, backtesting, and monitoring P&L to assess how well the hedge offsets the risk exposure.

Transaction costs, including brokerage fees, clearing and settlement fees, commissions, and spread costs should also be taken into account. Carefully considering these costs ensures a realistic estimation of the overall expenses associated with hedging.

In conclusion, by thoroughly understanding and estimating the cost of hedging, individuals and businesses can make informed decisions about risk management strategies. A well-planned and cost-effective hedge can provide stability, protect investments, and mitigate potential losses in the face of market uncertainty. A comprehensive evaluation of hedging costs enables individuals and businesses to optimize their risk management efforts and navigate the financial landscape with greater confidence and financial security.