Home>Finance>Everything You Need To Know About Savings Bonds

Finance

Everything You Need To Know About Savings Bonds

Modified: September 6, 2023

Discover how savings bonds offer a safe investment alternative from the government with a fixed rate of interest - and how to make them work for you.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What are savings bonds? Sure you have a savings account. Is it the same as savings bonds? Should you get yourself a savings bonds account? What are the benefits of investing? Once you get through this article you will learn everything you need to know about savings bonds and investing in them.

If you were lucky enough to receive your savings bonds for your birthday, no, they were not lazy gifters, they actually did you a favor. Why?

Savings Bonds Are Safe Investments

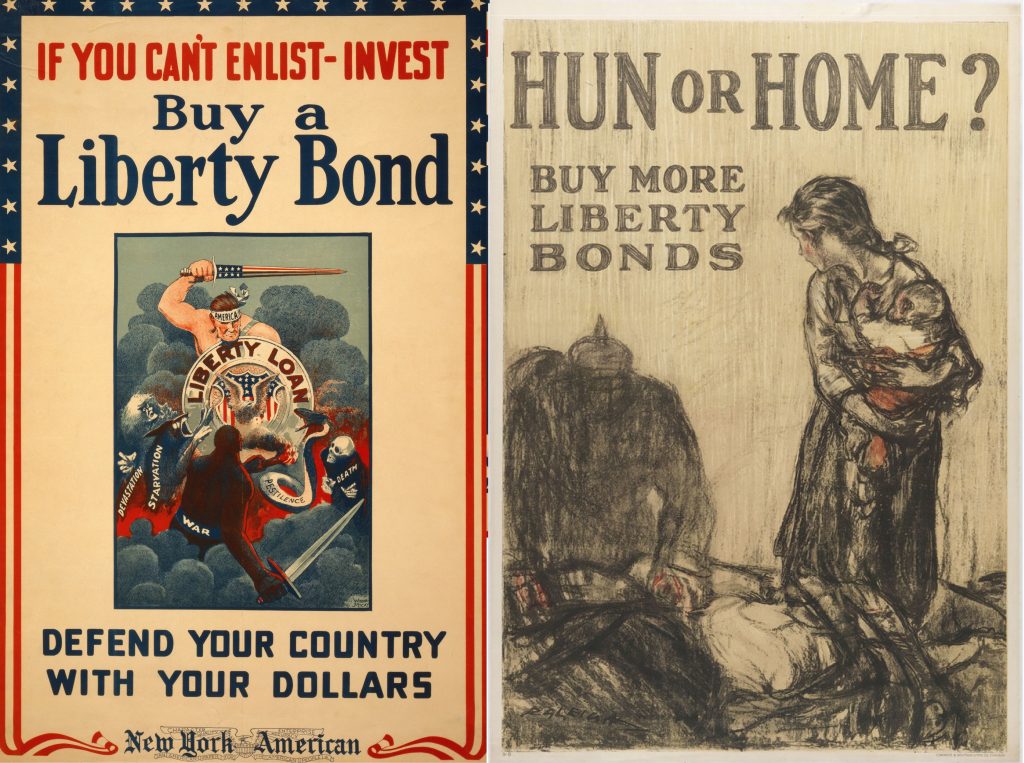

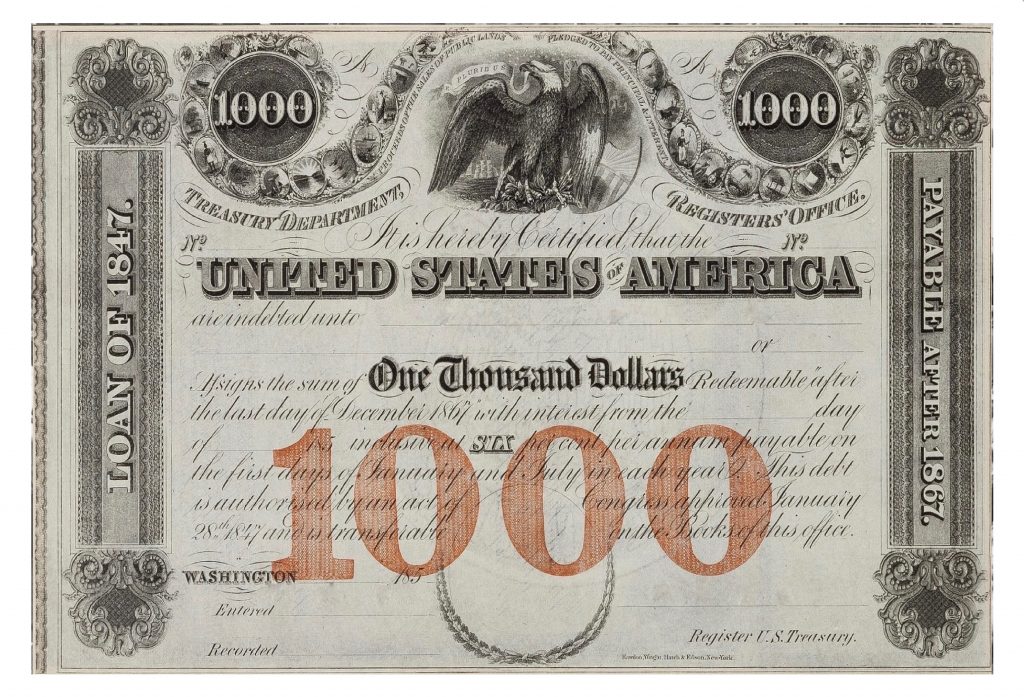

In spring 1917, federal leaders introduced liberty bonds. Those bonds were sold as a way to finance the ongoing war. The first to be produced was the Series EE U.S. Savings Bonds. On May 1, 1941, President Franklin Roosevelt (also known as FDR) bought the first Series EE bonds.

As a way of showing patriotism, and compliance with the “If you can’t enlist-invest” tagline, the citizens bought it. These days, the liberty bonds come alive in the form of savings bonds but not for funding a war anymore.

When the war ended, the citizens were lured into buying savings bonds as it provided them an opportunity to make their money grow while having a guarantee from the government.

The U.S. Department of the Treasury issued savings bonds to sustain the borrowing needs of the government basically to fund capital projects and other running operations to manage the economy.

Since the first day of 2012, these debt securities can no longer be bought from other financial institutions. However, Americans still buy this investment because of the assurance that the money invested will certainly generate returns.

Who Can Buy U.S. Savings Bonds?

In both purchasing and redeeming savings bonds, you must first be a U.S. citizen, an official U.S. resident, or U.S. government employee (regardless of citizenship status). All U.S. Savings Bonds can only be bought directly from the government. They are non-marketable. Should you encounter anyone selling it, that person should be immediately reported as it is 100% a fraud.

Should You Invest In These Bonds?

If you’re into long-term investments, definitely yes.

If you’re into long-term investments, definitely yes.

Look at it like this. Let’s say you bought tomato seedlings for a dollar and planted it. Several days after, it starts to sprout leaves. Now you have 10 tomato seedlings. But can you sell those seedlings at the price of 10 tomatoes? Of course not. You need to wait for the tomatoes to reach their maturity before you can use or sell them.

The same goes for savings bonds. If you buy a $100 bond for $100, you can’t use it the day after in case you run out of cash or you left your credit card at home. You need to wait for at least 5 years before you can redeem it.

In other words, savings bonds are quite the opposite of liquid assets.

What Bonds Can You Buy?

Electronic savings bond can be bought online since paper savings bonds are no longer available in financial institutions. However, it doesn’t mean that paper bonds were completely phased out. You can still buy them using tax refunds at a maximum worth of $5000.

What To Do With Old Bonds?

Photo from Wikimedia Commons

If you have old bonds that your grandparents got you as a gift when you were a kid you can:

- Convert them to electronic bonds: Converting it makes it easier for you to manage and track your bonds.

- Encash them: If your old bonds have reached their maturity, it’s not a good idea to keep them. Redeem it and turn them to cash which you can use to buy other investments.

- Check your local tax records: In order to redeem your old bonds you need to pay the current year’s interest

- Have them converted to Treasury Inflation Protected Securities (TIPS)

- Pay for your education with it: Bonds can be used to pay for school fees tax-free.

2 Types Of Electronic Savings Bonds

Series EE U.S. Savings Bonds

Also called the Defensive Bonds during World War II; these bonds were issued following the legislation signed by the late President Roosevelt. They enabled the production of federally-backed bonds.

As an appreciation-type or accrual-type of bond, you can buy this bond at the same price as its worth. So, $1000 can buy a $1000 Series EE bond and its interest will go directly into your designated account.

Moreover, you won’t be allowed to buy more than $10,000 (face value) during a single calendar year. By redeeming your bonds in the first 5 years, the interest payments for the 3 most recent months will be forfeited. To avoid paying penalties, you should encash your bonds after 5 years.

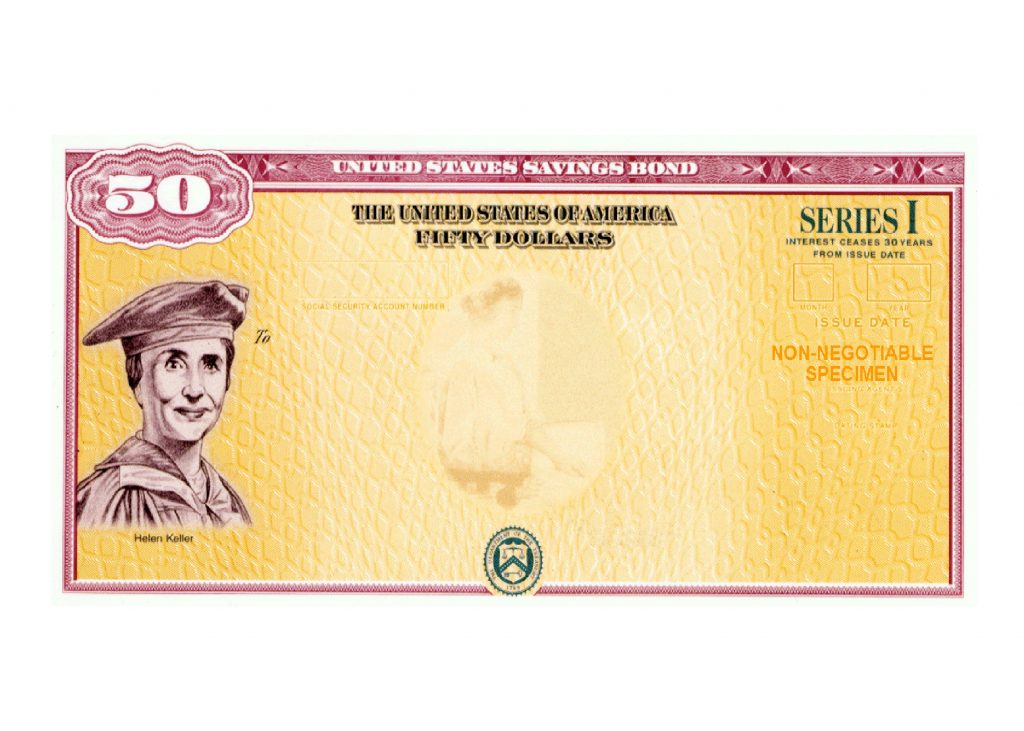

Series I U.S. Savings Bonds

Series I U.S. Savings Bonds offer a fixed-rate interest, adjusted for inflation according to the Consumer Price Index for Urban Consumers (CPI-U). You can buy this bond at face value.

In a calendar year, you can buy up to $10,000 worth of this bond. The same with Series EE bonds, you can’t redeem it in the first 5 years or you’ll get penalized.

Photo from Wikimedia Commons

It is best to encash the Series I bonds after 5 years. This type of bond gives generally-conservative and not-much-of-a-risk-takers savers the chance to invest without worrying about sub-inflation returns.

Advantages Of Savings Bonds

- Assurance and security. Designed to be non-marketable, these bonds can only be bought directly from the U.S. government. In case you lose it or your account gets hacked, your bond can be reissued/reprinted or replaced for the reason that the government has all the bonds registered to a monitored database.

- Easily accessible. You can purchase bonds online through your mobile phone or laptop and monitor them easily as well.

- Great as gifts. Be it a birthday or graduation, savings bonds make an ideal gift with forethought.

- Minors can have it in their own name. Most investment does not allow it but it won’t be a deal with savings bonds.

- Not taxed. Yes. You can avoid taxes. Savings bonds pay no local or state taxes.

- Low minimum buy-in. You can start investing at a lower price as you can buy a minimum of $25.

Photo from Shutterstock

Disadvantages And Limitations

- You can only buy a maximum of $10,000 worth of bonds.

- It takes a long time to mature. Series EE bonds mature after 30 years while the Series I after 20 years, meaning they can only earn interest after that period of time.

- Bonds should be held for at least 5 years. Redeeming them any earlier will cost you.

- The bond’s interest will be deducted with federal income tax. If you get your bonds as a gift or inheritance, you need to pay federal and/or state gift tax, estate tax or excise tax on their interest. Series I bonds that you purchased before you turn 24 will be taxed.

- After the maturity period, the bonds will no longer earn interest so they should be encashed.

Photo from Pexels

What Are Your Bond’s Worth Today?

To know about your bond’s equivalent, the government launched an online calculator to help people calculate the current standing of their bonds. This calculator can be adjusted depending on the current inflation rate or with other economic factors that will affect the value of your bonds.

Photo from Pexels

Bonds And The Economy

With The Great Depression, also known as one of the worst economic downturns in the history, panic arose in many. Especially to traders, investors, and the government.

Photo from Wikimedia Commons

As the stock market crumbles down in 1929 and with The Dust Bowl Occurrence that made matters worse, economic calamities rained down as if on a domino effect. To overcome these issues, the government came up with several methods. Savings bonds were one of them.

A lot of economists believed that savings bonds made a great impact on the United States’ economy. Saying that without it, the present American economy would not be what it is.

With high-risks investments these days, savings bonds have been one of the top investment vehicles that many Americans turn to. ‘Cause hey, besides how good it sounds that you are loaning money to U.S government, it is worth considering that the United States has never failed to give the bondholders the money they invested.

Although it takes time for the bonds to mature, it is still appealing to people who think of their retirement and for parents trying to fund their child’s future and education. Overall, savings bonds will work well with a futuristic investor as its return can be felt after a long-time though it’s non-volatile which makes it a safe investment.

Though absolutely-safe investment does not exist theoretically, allocating a portion of your savings to these securities would be a wise move for the future of your finances.