Home>Finance>Form 1040-A: U.S. Individual Tax Return Definition

Finance

Form 1040-A: U.S. Individual Tax Return Definition

Published: November 27, 2023

Learn about the Form 1040-A, a U.S. individual tax return, and understand its definition and implications. Stay updated on the latest finance-related information.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Complete Guide to Form 1040-A: U.S. Individual Tax Return Definition

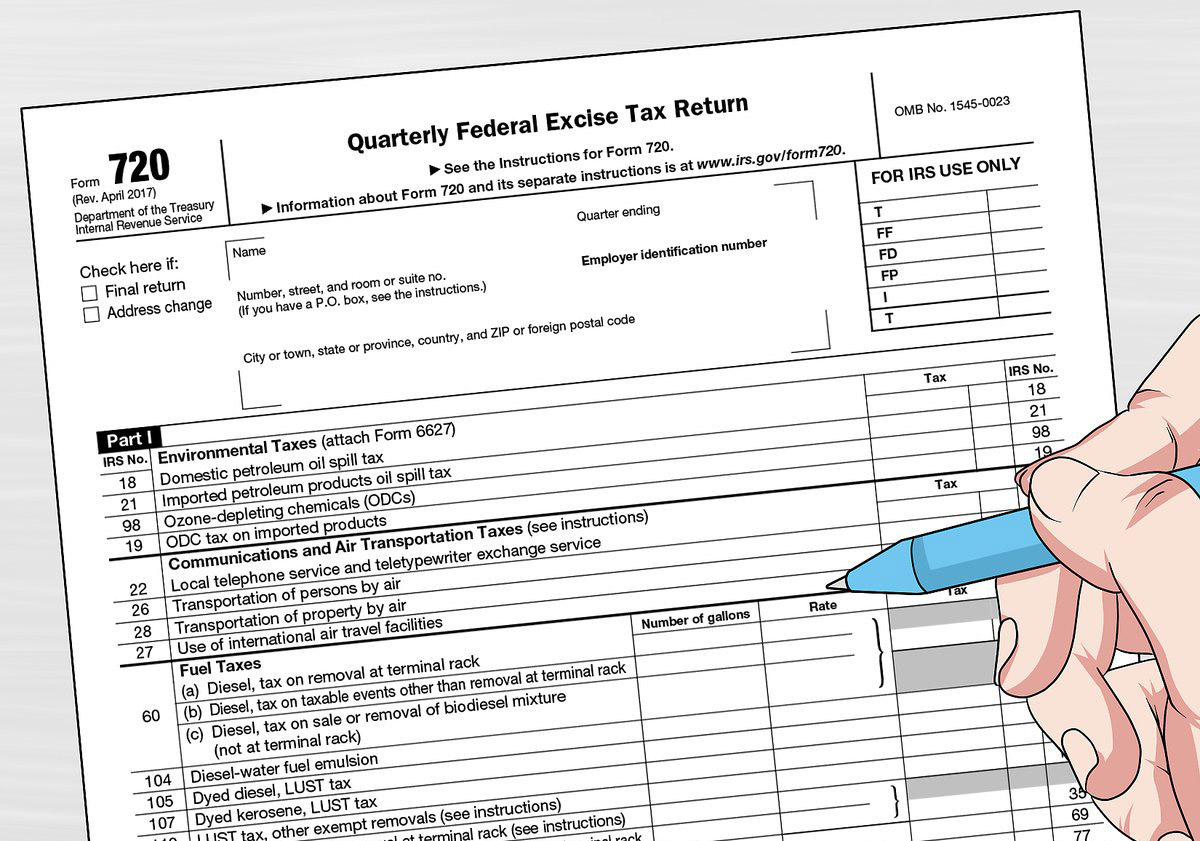

When it comes to navigating the complex world of personal finance, tax returns are often a top concern for many individuals. One common form that taxpayers use is Form 1040-A, the U.S. Individual Tax Return. In this blog post, we will dive into the ins and outs of Form 1040-A, providing you with a comprehensive understanding of how it works and what you need to know.

Key Takeaways:

- Form 1040-A is a simplified version of the standard Form 1040 and offers taxpayers with straightforward financial situations a more streamlined option for filing their taxes.

- Eligibility for using Form 1040-A depends on specific criteria, such as having taxable income below a certain threshold and not having complex tax scenarios.

Understanding Form 1040-A

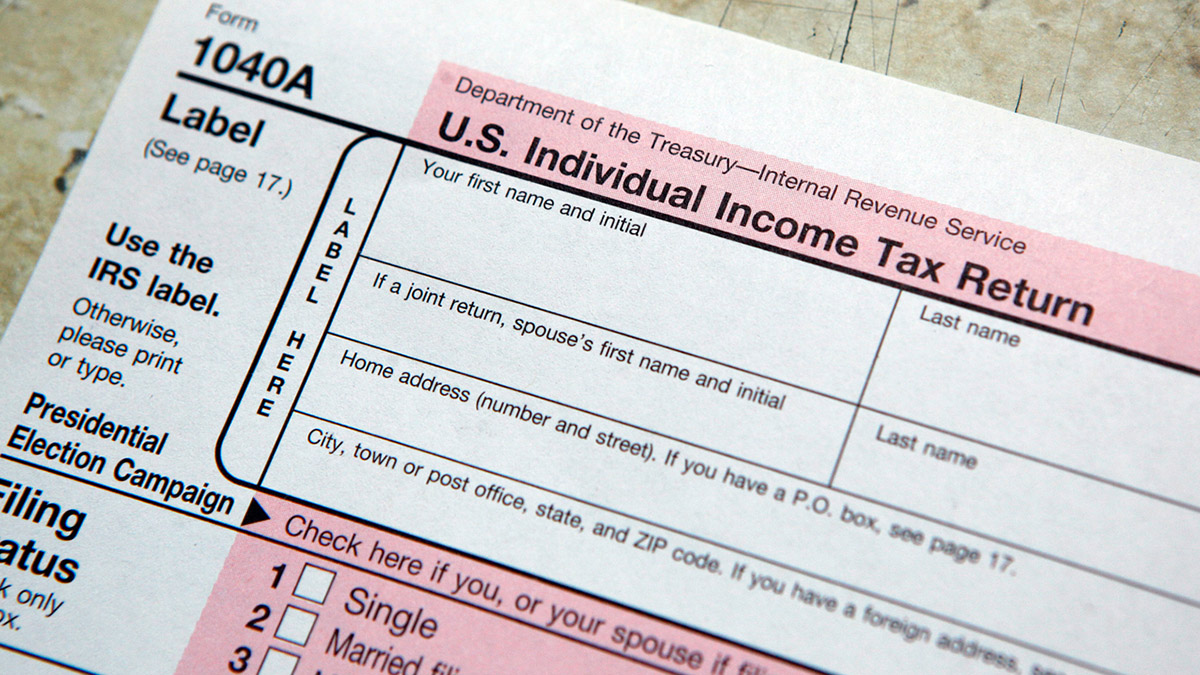

What is Form 1040-A?

Form 1040-A is known as the U.S. Individual Tax Return because it is the form that individual taxpayers use to report their income and deductions to the Internal Revenue Service (IRS). It is designed as a simplified version of the standard Form 1040, making it easier for those with less complex financial situations to complete their tax returns.

Who can use Form 1040-A?

To determine whether you are eligible to use Form 1040-A, you need to meet certain criteria set by the IRS. Generally, individuals with taxable income below a certain threshold and who do not have complex tax scenarios are eligible to file using this form. Some of the common eligibility requirements include:

- Earning income from wages, salaries, tips, and unemployment compensation

- Having taxable interest income below a specific amount

- Not itemizing deductions (such as mortgage interest or charitable contributions)

What are the advantages of using Form 1040-A?

Using Form 1040-A offers several benefits for eligible taxpayers, including:

- Simplified process: Form 1040-A reduces the complexity of filing compared to the standard Form 1040, making it faster and easier to complete.

- Faster refunds: Since the form is simplified, the processing time for your tax return is typically quicker, which means you may receive any refund owed to you sooner.

- Reduced chance of errors: The simplified nature of Form 1040-A helps minimize the risk of making mistakes or omissions on your tax return.

How to complete Form 1040-A?

Completing Form 1040-A involves providing information about your income, deductions, and tax credits. You will need to report your wages, interest, and dividends, as well as any deductions you qualify for, such as the standard deduction or the earned income credit. Additionally, you may need to attach any supporting documents or schedules required by the IRS.

Where to find Form 1040-A?

You can find Form 1040-A on the official IRS website (www.irs.gov) or request a copy to be mailed to you. Additionally, tax preparation software or online platforms often provide the option to fill out Form 1040-A electronically.

While Form 1040-A offers a simpler option for many taxpayers, it’s essential to consult with a tax professional or use specialized tax software if you have any doubts or questions about your eligibility or filing requirements. Remember, accurate and timely completion of your tax return is crucial to avoid penalties and ensure compliance with IRS regulations.

By understanding the basics of Form 1040-A, you can approach your tax return with confidence and make the filing process as seamless as possible. Take advantage of this simplified form, if eligible, and ensure you are fulfilling your tax obligations while making the most of available deductions and credits.