Home>Finance>Form 1040: U.S. Individual Tax Return Definition, Types, And Use

Finance

Form 1040: U.S. Individual Tax Return Definition, Types, And Use

Published: November 27, 2023

Discover the definition, types, and use of Form 1040: U.S. Individual Tax Return in the world of finance. Simplify your tax filing process with this essential form.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Form 1040: U.S. Individual Tax Return

For many individuals, tax season can be a stressful time. Filing taxes correctly and on time is essential to avoid penalties and ensure compliance with the Internal Revenue Service (IRS). To navigate through the annual tax process, you need to familiarize yourself with different tax forms, including Form 1040: U.S. Individual Tax Return. In this blog post, we will provide an in-depth definition of Form 1040, discuss its types, and explore its uses.

Key Takeaways:

- Form 1040 is the main tax form used by individuals to report their annual income to the IRS.

- There are different versions of Form 1040, including Form 1040EZ, Form 1040A, and the standard Form 1040.

What is Form 1040?

Form 1040 is the primary tax form used by individuals to report their income, deductions, and tax liability to the IRS. It is filled out by most taxpayers in the United States who earn a taxable income. Form 1040 is a comprehensive form that covers various sources of income, including wages, self-employment income, interest, dividends, and rental income.

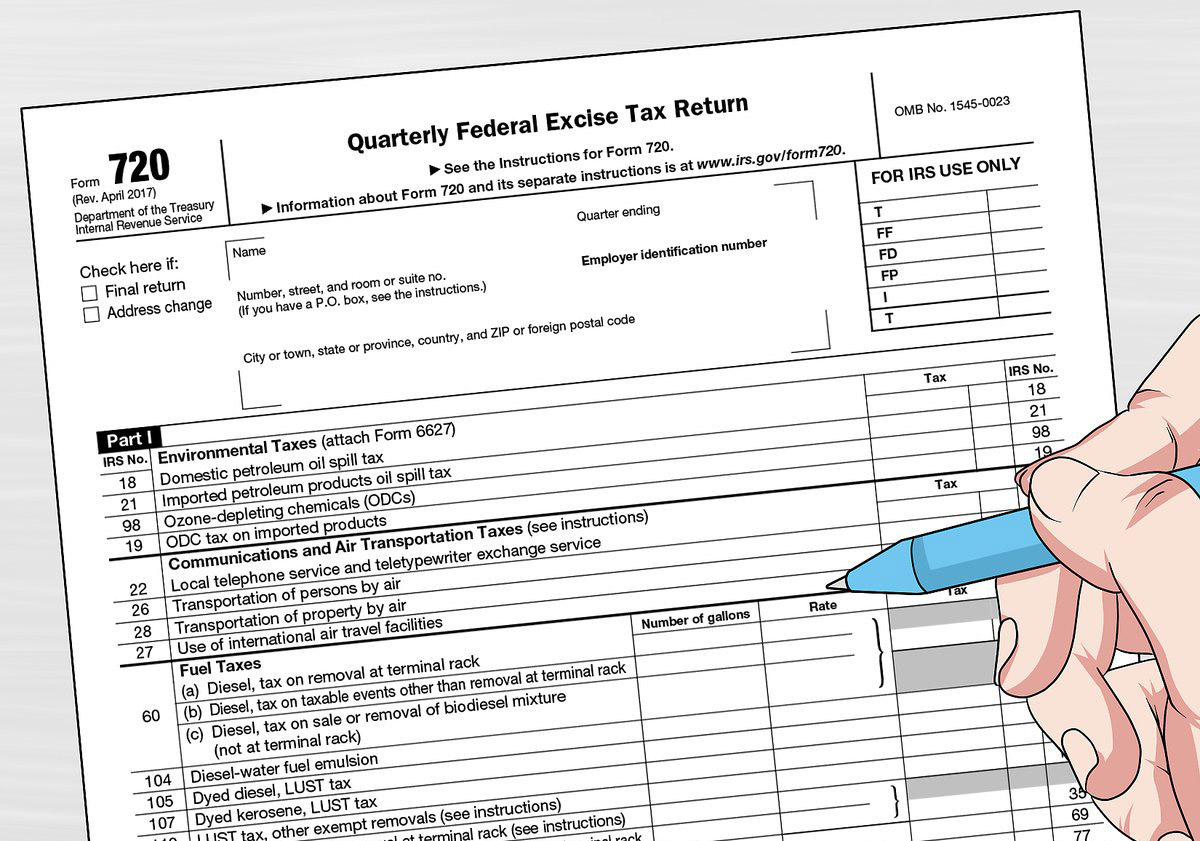

The form consists of several sections, allowing taxpayers to report their filing status, claim deductions, calculate their tax liability, and request tax refunds or make additional tax payments. Some of the key sections of Form 1040 include:

- Filing Status: Taxpayers must indicate their filing status, such as Single, Married Filing Jointly, Married Filing Separately, or Head of Household.

- Income: This section requires taxpayers to report their various sources of income, including wages, tips, business income, and investment income.

- Deductions: Taxpayers can claim deductions such as student loan interest, mortgage interest, and charitable contributions to reduce their taxable income.

- Tax Liability: Here, individuals calculate their tax liability based on their income, deductions, and applicable tax rates.

- Refunds and Payments: Taxpayers can request tax refunds if they have overpaid their taxes or make additional tax payments if they owe more than their withholdings.

Types of Form 1040

While Form 1040 is the standard tax form used by most individuals, there are also simplified versions available for eligible taxpayers:

- Form 1040EZ: This shorter and simpler version of Form 1040 is designed for taxpayers with basic tax situations. It is available to individuals who meet specific criteria, such as having no dependents, no itemized deductions, and income below a certain threshold.

- Form 1040A: Form 1040A is an intermediate form that allows individuals to claim certain tax credits and deductions not available on Form 1040EZ. It is suitable for individuals with limited deductions but who do not qualify for the standard Form 1040.

- Standard Form 1040: This is the most comprehensive version of Form 1040. It is used by individuals with complex tax situations, such as those who itemize deductions, have self-employment income, or need to report other types of income not covered by the simplified versions.

Uses of Form 1040

Form 1040 serves several purposes, including:

- Income Reporting: Individuals use Form 1040 to report their annual income to the IRS and calculate their tax liability.

- Deduction and Credit Claims: Taxpayers claim various deductions and tax credits on Form 1040 to reduce their taxable income and ultimately lower their tax liability.

- Tax Payment and Refund: Form 1040 allows individuals to calculate any additional tax payments they owe or request refunds for overpaid taxes.

- Audit Documentation: Form 1040 serves as a vital piece of documentation if individuals are audited by the IRS.

Understanding Form 1040 is essential for individuals seeking to navigate the complexities of the U.S. taxation system. By familiarizing yourself with its types, uses, and structure, you can ensure accurate and timely tax filings while taking full advantage of available deductions and credits.

Disclaimer: This blog post is for informational purposes only and does not constitute professional tax advice. Please consult a tax professional or the IRS for specific questions regarding your tax situation.