Finance

What Is A Form 720 Excise Tax Return?

Published: October 29, 2023

Learn about Form 720 excise tax return in finance. Understand the requirements and process for reporting and paying excise taxes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is Form 720 Excise Tax Return?

- Who needs to file Form 720 Excise Tax Return?

- How to prepare and file Form 720 Excise Tax Return?

- Common excise taxes covered by Form 720

- Important deadlines and penalties for late filing

- Frequently asked questions about Form 720 Excise Tax Return

- Conclusion

Introduction

Welcome to the world of excise taxes! The Form 720 Excise Tax Return is a vital document that ensures compliance with U.S. tax laws for certain businesses. Understanding this form is crucial, as failure to file correctly or on time can lead to penalties and legal complications.

Excise taxes are taxes levied on the sale, use, or consumption of specific goods or activities. They are often imposed on items deemed to be harmful or non-essential, such as tobacco products, alcohol, gasoline, and certain types of equipment. These taxes not only generate revenue for the government but also serve as a means of regulating and discouraging certain behaviors.

In this article, we will explore what the Form 720 Excise Tax Return is, who needs to file it, how to prepare and file it, the common types of excise taxes covered by the form, important deadlines, and penalties for late filing. We will also address frequently asked questions to help demystify the form and provide clarity for businesses navigating the world of excise taxes.

Whether you are a business owner, accountant, or tax professional, this article aims to equip you with the knowledge and resources needed to navigate the complexities of excise taxes and ensure compliance with IRS regulations. So, let’s dig in and demystify the Form 720 Excise Tax Return!

What is Form 720 Excise Tax Return?

The Form 720 Excise Tax Return is a document used by businesses to report and pay certain federal excise taxes to the Internal Revenue Service (IRS). It is typically filed on a quarterly basis and is separate from income tax returns. This form serves as a means for businesses to fulfill their tax obligations related to the sale, use, or consumption of specific goods or activities subject to excise taxes.

Excise taxes are imposed by the federal government on various items and activities that are deemed to be harmful, non-essential, or require regulation. These taxes are typically levied on products such as tobacco, alcohol, gasoline, firearms, and certain types of equipment or services. By imposing these taxes, the government aims to generate revenue and discourage the consumption or use of certain goods or engage in specific activities.

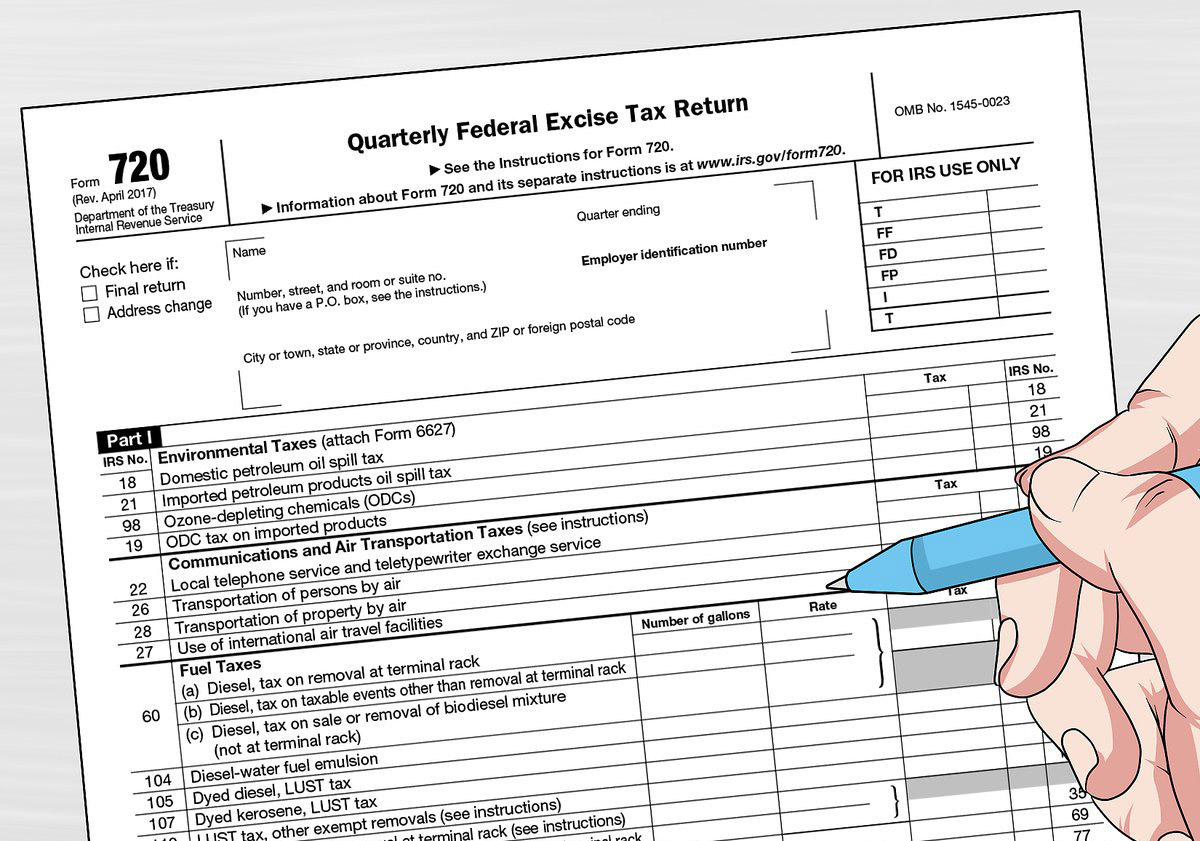

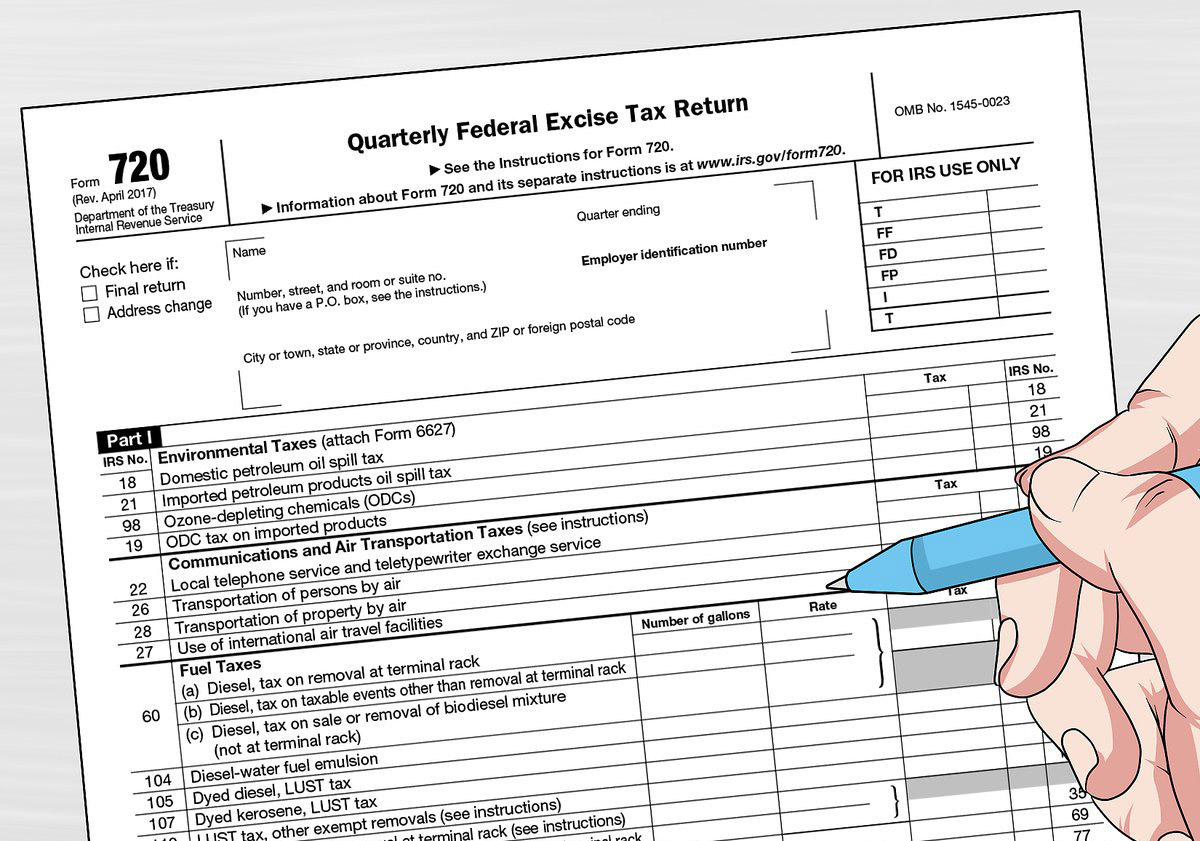

The Form 720 Excise Tax Return consists of several parts that require businesses to provide detailed information regarding their excise tax liabilities. Some of the key sections of the form include:

- Part I: Quarterly Federal Excise Tax Return – This section is used to report the excise taxes for specific activities or products, such as the sale of gasoline or diesel fuel, the use of certain vehicles, the sales of indoor tanning services, and more.

- Part II: Schedule A – This section is used to report the excise taxes for the sale of sporting goods, fishing equipment, bows and arrows, and other related items.

- Part III: Schedule C – This section is used to report the excise taxes for certain fuel-related activities, such as the use of aviation-grade kerosene.

- Part IV: Schedule T – This section is used to report and calculate the tax liability for the indoor tanning services.

It is important to note that not all businesses are required to file Form 720. The form is primarily for businesses engaged in activities that are subject to excise taxes. The IRS provides specific guidelines and instructions to determine whether a business needs to file this form. If you are unsure about your filing requirements, it is recommended to consult with a tax professional or refer to the IRS guidelines to ensure compliance.

Who needs to file Form 720 Excise Tax Return?

Businesses engaged in activities that are subject to excise taxes are generally required to file Form 720 Excise Tax Return. The specific activities that trigger the filing requirement can vary, so it is important to refer to the IRS guidelines or consult with a tax professional to determine if your business needs to file this form.

Here are some common examples of businesses that are typically required to file Form 720:

- Tobacco Manufacturers and Importers: Businesses involved in the manufacturing or importing of tobacco products, such as cigarettes, cigars, and chewing tobacco, are required to file Form 720 to report and pay excise taxes on these products.

- Alcohol Manufacturers and Importers: Businesses engaged in the production or importation of alcoholic beverages, including beer, wine, and spirits, must file Form 720 to report and pay excise taxes on these products.

- Fuel Dealers: Businesses involved in the sale or distribution of gasoline, diesel fuel, aviation fuel, or alternative fuels are required to file Form 720 to report and pay excise taxes on these fuels.

- Indoor Tanning Facilities: If your business offers indoor tanning services, you are required to file Form 720 to report and pay the excise tax on these services.

- Manufacturers of Sporting Goods: Businesses engaged in the production or importation of certain sporting goods, fishing equipment, bows and arrows, and related items are required to file Form 720 to report and pay excise taxes on these products.

It is important to note that there are specific thresholds and requirements for each type of excise tax, and not all businesses engaged in these activities will necessarily need to file Form 720. For example, if your business is a small-scale producer or importer that falls below the threshold set by the IRS, you may be exempt from filing this form.

As excise tax requirements can be complex and vary depending on the nature of your business, it is advisable to consult with a tax professional or refer to the IRS guidelines to determine your specific filing obligations. Failing to file or incorrectly filing Form 720 can result in penalties and other legal consequences, so it is crucial to ensure compliance with the IRS regulations.

How to prepare and file Form 720 Excise Tax Return?

Preparing and filing Form 720 Excise Tax Return requires attention to detail and accuracy to ensure compliance with IRS regulations. Here is a step-by-step guide to help you navigate the process:

- Gather the necessary information: Start by gathering all the relevant information needed to complete Form 720. This includes details about your business, the specific excise taxes you are liable for, and any supporting documentation required.

- Download Form 720: Visit the IRS website or use professional tax software to download the latest version of Form 720. Make sure you have the correct form for the current tax year.

- Fill out the form: Begin filling out the form by entering your business information, such as the name, address, and employer identification number (EIN).

- Complete the applicable sections: Complete the relevant sections and schedules based on the excise taxes your business is liable for. Fill in the specific details, such as the quantity of taxable products sold or the amount of taxable services provided.

- Calculate the tax liability: Use the instructions provided with Form 720 to calculate the amount of excise tax owed for each applicable section. Double-check your calculations to ensure accuracy.

- Report any credits or exemptions: If your business is eligible for any credits or exemptions, report them accurately on the form. This reduces your overall tax liability.

- Sign and date the form: Once you have completed all the necessary sections, sign and date the form. Ensure that the person signing has the authority to do so on behalf of the business.

- File the form and make payment: Submit the completed Form 720 to the IRS by the specified deadline. If you owe taxes, include payment with your filing. The IRS provides multiple options for filing, including e-filing and traditional mail.

- Keep copies for your records: It is essential to keep copies of both the completed form and any supporting documentation for your records. These will be crucial if you are audited or need to refer back to them in the future.

It is important to note that the filing deadlines for Form 720 Excise Tax Return are typically on a quarterly basis. The specific due dates can vary, so it is essential to stay updated with the IRS guidelines and maintain a calendar to ensure timely filing.

If you find the process daunting or have complex tax situations, it is advisable to seek the assistance of a tax professional or accountant who is familiar with excise taxes. They can provide guidance, help in accurately completing the form, and ensure compliance with applicable tax laws.

Common excise taxes covered by Form 720

Form 720 Excise Tax Return covers a wide range of excise taxes imposed by the federal government. Here are some common excise taxes that businesses may need to report and pay using this form:

- Fuel Excise Tax: This tax applies to the sale or use of various fuels, including gasoline, diesel fuel, aviation fuel, and alternative fuels. These taxes are often collected at the point of sale or by the fuel distributor.

- Tobacco Excise Tax: Excise taxes on tobacco products are levied on cigarettes, cigars, smokeless tobacco, and other tobacco-related products. These taxes are intended to discourage smoking and generate revenue for public health programs.

- Alcohol Excise Tax: The sale or importation of alcoholic beverages, such as beer, wine, and spirits, is subject to excise taxes. The amount of tax varies depending on the type and alcohol content of the product.

- Air Transportation Excise Tax: This tax is applicable to the amount paid for passenger air transportation, as well as certain freight shipments. It helps fund the Federal Aviation Administration (FAA) and airport development projects.

- Indoor Tanning Excise Tax: Businesses providing indoor tanning services are required to collect and remit an excise tax on these services. The tax is aimed at discouraging excessive exposure to ultraviolet radiation and promoting skin cancer prevention.

- Medical Device Excise Tax: Manufacturers and importers of certain medical devices are subject to excise taxes. The tax applies to the sale or lease of these devices and is intended to help fund the Affordable Care Act.

- Environmental Excise Taxes: Excise taxes may apply to activities that have an impact on the environment. For example, taxes on the sale of certain chemicals or fuels that contribute to ozone depletion or greenhouse gas emissions.

These are just a few examples of the excise taxes covered by Form 720. Each tax has specific rules and regulations, including thresholds, exemptions, and credits, which businesses must adhere to in order to accurately report and pay their tax liabilities.

It’s important for businesses to stay informed about changes in excise tax laws, updates to tax rates, and any additional taxes that may be imposed by the government. Consulting with a tax professional or staying updated through IRS resources will help ensure accurate and timely filing of Form 720.

Important deadlines and penalties for late filing

Adhering to the deadlines for filing Form 720 Excise Tax Return is crucial to avoid penalties and interest charges. The specific due dates can vary depending on the tax year and the type of excise tax being reported. Here are some important deadlines to keep in mind:

- Quarterly Filing Deadline: Form 720 is filed on a quarterly basis. The due dates for each quarter are as follows:

- For the first quarter (January – March): April 30th

- For the second quarter (April – June): July 31st

- For the third quarter (July – September): October 31st

- For the fourth quarter (October – December): January 31st of the following year

It is important to note that if the due date falls on a weekend or a federal holiday, the deadline may be extended to the next business day. Failing to file Form 720 by the specified due date can result in penalties and interest charges.

The penalties for late filing or failure to file Form 720 can be significant. The IRS imposes both a late filing penalty and a late payment penalty. Here are the general penalties for non-compliance:

- Late Filing Penalty: The penalty for late filing Form 720 is typically 5% of the tax due for each month or partial month the return is late. The maximum penalty can reach up to 25% of the tax due.

- Late Payment Penalty: If you fail to pay the excise tax by the due date, you may be subject to a late payment penalty. The penalty is generally 0.5% of the unpaid tax amount for each month or partial month the tax remains unpaid. The maximum penalty can reach up to 25% of the unpaid tax.

To avoid penalties and interest charges, it is crucial to file Form 720 on time and make prompt payment of any taxes owed. If you are unable to pay the full amount by the due date, you may be eligible for an installment agreement or other payment options. It is recommended to contact the IRS or consult with a tax professional to explore available options.

To minimize the risk of penalties and ensure timely filing, it is advisable to keep accurate records of your business transactions, monitor the applicable deadlines, and promptly submit Form 720 along with the required payment. Compliance with the IRS regulations regarding excise taxes is essential for maintaining the financial health and legality of your business.

Frequently asked questions about Form 720 Excise Tax Return

As you navigate the world of excise taxes and Form 720, you may have some questions. Here are answers to some common frequently asked questions:

- Who needs to file Form 720?

Businesses engaged in activities subject to excise taxes, such as the sale or use of specific goods or services, generally need to file Form 720. It is essential to consult IRS guidelines or a tax professional to determine your specific filing requirements.

- What are some common excise taxes covered by Form 720?

Form 720 covers a range of excise taxes, including those on fuel, tobacco, alcohol, air transportation, indoor tanning, medical devices, and environmental activities. Each tax has specific rules and regulations, so it’s important to understand the requirements for each applicable tax.

- What are the deadlines for filing Form 720?

Form 720 is filed on a quarterly basis. The due dates for each quarter are typically April 30th, July 31st, October 31st, and January 31st of the following year. It’s crucial to note the specific deadlines for each quarter and ensure timely filing to avoid penalties.

- What happens if I file Form 720 late?

Filing Form 720 late can result in penalties and interest charges. The penalties include a late filing penalty of 5% of the tax due per month or partial month, up to a maximum of 25%, and a late payment penalty of 0.5% of the unpaid tax per month or partial month, up to a maximum of 25%.

- Can I e-file Form 720?

Yes, the IRS offers electronic filing options for Form 720. E-filing provides a secure and convenient method to submit your form. You can use commercial tax software or consult with a tax professional to assist you in e-filing.

- Are there any exemptions or credits available for certain excise taxes?

Yes, there are exemptions and credits available for certain excise taxes. For example, there may be exemptions for small-scale producers or importers below certain thresholds. There may also be credits available for specific activities or industries. It’s essential to review the IRS guidelines and consult with a tax professional to determine if you qualify for any exemptions or credits.

- Do I need to keep records of my excise tax transactions?

Yes, it is important to keep accurate and detailed records of your excise tax transactions, including sales, purchases, and payments. These records will not only help you accurately complete Form 720 but also serve as supporting documentation in case of an IRS audit.

These are just a few frequently asked questions about Form 720 Excise Tax Return. Remember, tax laws and regulations can change, so it’s always a good idea to stay updated with the latest IRS guidance, consult with a tax professional, and maintain accurate records to ensure compliance with your excise tax obligations.

Conclusion

Navigating the world of excise taxes and fulfilling your obligations through Form 720 Excise Tax Return can be complex, but it is vital for businesses subject to excise taxes. By familiarizing yourself with the requirements, deadlines, and penalties associated with this form, you can ensure compliance with IRS regulations and avoid costly mistakes.

Form 720 covers a wide range of excise taxes, including those on fuel, tobacco, alcohol, air transportation, tanning services, medical devices, and more. It is important to determine whether your business falls within the scope of these taxes and if you need to file the form.

Preparing and filing Form 720 requires attention to detail, accurate record-keeping, and timely submission. Consulting with a tax professional or using professional tax software can help ensure accuracy and ease the filing process. Additionally, understanding the deadlines and penalties for late filing is crucial to avoid unnecessary financial burdens.

Staying informed about changes in tax laws, rates, exemptions, and credits is essential for maintaining compliance and optimizing your tax liabilities. The IRS provides resources and guidelines to assist businesses in understanding their excise tax obligations.

Remember, these guidelines and FAQs provide a general overview, but individual circumstances may vary. It is always recommended to consult with a tax professional to navigate your specific excise tax requirements.

By staying informed, accurately reporting and paying your excise taxes, and maintaining good record-keeping practices, you can meet your tax obligations and help ensure the financial health and compliance of your business.

So, whether you are a business owner, accountant, or tax professional, make use of the resources available to you to navigate the complexities of excise taxes and Form 720 Excise Tax Return. By doing so, you can focus on what matters most – running a successful business while fulfilling your tax responsibilities.