Home>Finance>Where To Find Customer File Number On Tax Return 1040

Finance

Where To Find Customer File Number On Tax Return 1040

Published: October 28, 2023

Looking for your customer file number on your tax return 1040? Find out where to locate it easily. #Finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tax Return Form 1040

- What is a Customer File Number?

- Importance of the Customer File Number

- Where to locate the Customer File Number on Tax Return Form 1040

- Step-by-step guide to finding the Customer File Number on Tax Return Form 1040

- Alternative ways to obtain the Customer File Number

- Conclusion

Introduction

Welcome to our comprehensive guide on where to find the Customer File Number on Tax Return Form 1040. As you navigate the world of finance and taxes, it is essential to understand the various components that make up your tax return form. One such essential element is the Customer File Number.

Completing your tax return accurately is not only a legal obligation but also helps you optimize your finances and ensure compliance with tax laws. The Customer File Number is a unique identifier that plays a crucial role in the processing of your tax return.

In this article, we will explore what the Customer File Number is, why it is important, and most importantly, where you can locate it on your Tax Return Form 1040.

Understanding the Customer File Number and its significance will not only improve your understanding of your tax return but also help you effortlessly navigate future tax-related matters. So, let’s dive in and unravel the mysteries of the Customer File Number!

Understanding Tax Return Form 1040

Tax Return Form 1040 is the standard form used by individuals to file their annual income tax returns with the Internal Revenue Service (IRS). It is the most commonly used form and serves as the foundation for reporting your income, deductions, credits, and overall tax liability.

Form 1040 is essentially a summary of your financial activities throughout the tax year. It provides a comprehensive snapshot of your income, expenses, and tax obligations, allowing the IRS to assess your tax liability accurately.

The form is divided into multiple sections, each focusing on specific aspects of your financial situation. These sections cover details such as your personal information, filing status, income sources, deductions, and credits.

By properly completing the various sections of Form 1040, you ensure that you report all your income and claim any eligible deductions or credits, thereby reducing your overall tax liability and maximizing your potential refund.

It is crucial to understand that tax laws and regulations can change from year to year. Therefore, it is recommended to review the instructions and guidelines provided by the IRS for the specific tax year you are filing.

Now that we have a basic understanding of Tax Return Form 1040, let’s delve into the significance of the Customer File Number and why it is an integral part of the form.

What is a Customer File Number?

A Customer File Number is a unique identifier assigned to taxpayers by the Internal Revenue Service (IRS). It is a 10-digit number that helps the IRS keep track of individual tax records and streamline the processing of tax returns.

Think of it as a way for the IRS to organize and classify your tax information. The Customer File Number allows them to quickly and accurately locate your specific tax records when needed, making it an essential component of your tax return.

It is important to note that the Customer File Number is not the same as your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). While your SSN or ITIN serve as your primary identification numbers for tax purposes, the Customer File Number is an additional identifier used specifically by the IRS.

The Customer File Number is assigned by the IRS when you file your first tax return. It remains the same for all future tax returns, acting as a consistent reference for your tax records over time.

Having a unique Customer File Number ensures that your tax information is accurately associated with your identity and prevents any potential mix-ups or confusion during the processing of your tax return.

Now that we have a clear understanding of what a Customer File Number is, let’s explore its importance in the context of your tax return.

Importance of the Customer File Number

The Customer File Number holds significant importance in the processing of your tax return and overall tax-related matters. Here are a few reasons why it is essential:

1. Unique Identification: The Customer File Number serves as a unique identifier for your tax records. As the IRS handles millions of tax returns each year, having a Customer File Number allows them to easily locate and organize your specific tax information.

2. Streamlined Processing: By including your Customer File Number on your tax return, you facilitate a smooth and efficient processing of your form. This helps the IRS in accurately associating your tax return with your existing records, reducing the chances of errors or delays.

3. Record Keeping: The Customer File Number aids in maintaining a comprehensive record of your tax history. It allows you, the taxpayer, to track and refer to your previous tax returns easily. This can be useful when applying for loans, grants, or any other financial transactions that require proof of income or tax compliance.

4. Communication with the IRS: In case you need to contact the IRS regarding any tax-related issues or inquiries, providing your Customer File Number can expedite the process. It enables the IRS agents to access your specific tax records promptly, allowing for more efficient communication and resolution of any concerns.

5. Accuracy and Compliance: Including the Customer File Number on your tax return helps ensure the accuracy and compliance of your tax information. It allows the IRS to cross-reference your reported income, deductions, and credits, minimizing the chances of discrepancies or potential audits.

6. Privacy and Security: The Customer File Number provides an additional layer of privacy and security for your tax records. It ensures that only authorized individuals, such as IRS staff or yourself, have access to your specific tax information, enhancing the confidentiality of your personal and financial data.

Overall, the Customer File Number plays a crucial role in maintaining the integrity and efficiency of the tax system. It helps both taxpayers and the IRS in accurately processing and managing tax returns, ensuring compliance with tax laws, and securing taxpayer data.

Now that we understand the importance of the Customer File Number, let’s move on to discovering where exactly it can be found on Tax Return Form 1040.

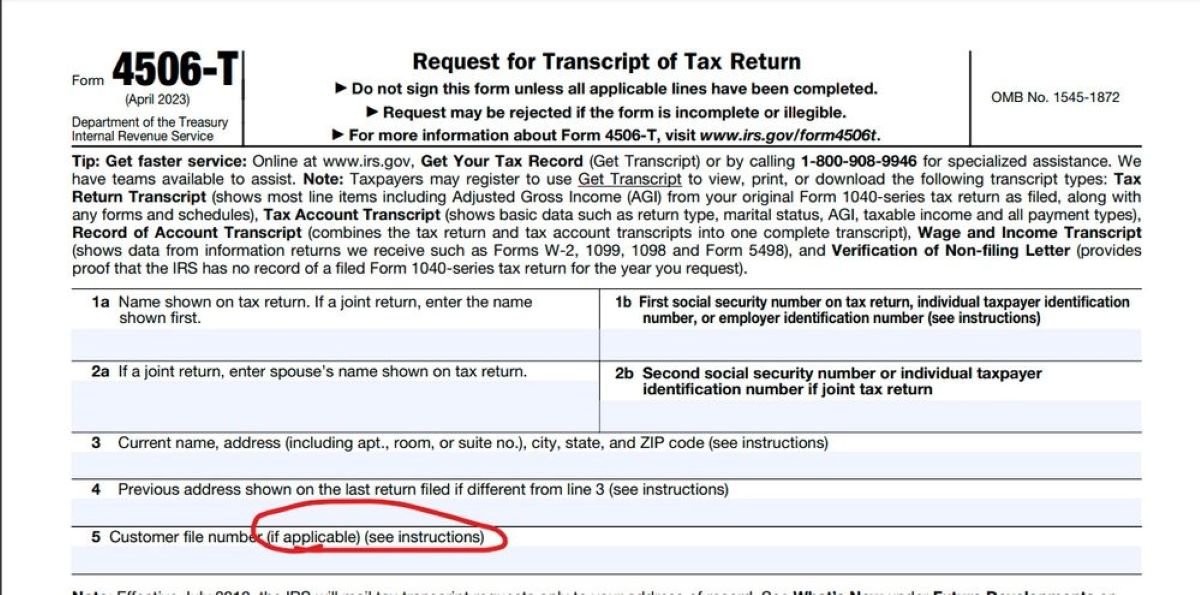

Where to locate the Customer File Number on Tax Return Form 1040

The Customer File Number can be found on the top right corner of Tax Return Form 1040, just below your name and address information. It is labeled as “Customer File Number” or abbreviated as “CFN.”

Although the IRS does not require individuals to enter a Customer File Number on their tax return, it is recommended to include it if you have been assigned one. Doing so helps streamline the processing of your return and ensures accurate identification of your tax records.

When filling out your tax return form, it is crucial to enter the Customer File Number in the designated space accurately. Double-check the number for any errors or typos to prevent any potential issues or delays in the processing of your return.

In some cases, if you have not been assigned a Customer File Number or if you are filing your tax return for the first time, the space for the Customer File Number may be left blank. However, once the IRS assigns you a Customer File Number, it is essential to include it on all future tax returns.

Now that you know where to locate the Customer File Number, let’s walk through a step-by-step guide on how to find it on Tax Return Form 1040.

Step-by-step guide to finding the Customer File Number on Tax Return Form 1040

Locating the Customer File Number on Tax Return Form 1040 is a relatively simple process. Follow these step-by-step instructions to find it:

- Obtain a copy of your Tax Return Form 1040.

- Look for the section at the top of the form that contains your personal information, including your name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Direct your attention to the top right corner of the form, just below your personal information section.

- Locate the label “Customer File Number” or the abbreviation “CFN.”

- Note the 10-digit number next to the label or abbreviation.

- This 10-digit number is your Customer File Number.

If you are filing your tax return for the first time or have not been assigned a Customer File Number, you may find this section blank. However, if you have been assigned a Customer File Number by the IRS, it is essential to include it on your tax return to ensure smooth processing and accurate identification of your tax records.

Remember to double-check the accuracy of the Customer File Number before submitting your tax return. Any errors or typos in the number can lead to potential processing issues or delays.

By following these simple steps, you can easily locate the Customer File Number on Tax Return Form 1040 and ensure that your tax return is processed accurately.

While the Customer File Number is the primary method of identification and organization for your tax records, there are alternative ways to obtain this number should you encounter any difficulties. Let’s explore those options next.

Alternative ways to obtain the Customer File Number

In the event that you are unable to locate your Customer File Number on Tax Return Form 1040 or if you have not been assigned one, there are alternative methods to obtain this number:

- Contact the IRS: Reach out to the IRS directly for assistance in obtaining your Customer File Number. You can do this by calling their toll-free helpline or visiting a local IRS office in person. Be prepared to provide them with your personal identification information and any relevant tax return details to verify your identity.

- Review Previous Tax Documents: If you have filed tax returns in previous years and can access those documents, check for any mention of the Customer File Number. It is common for the IRS to include this number on previous tax returns, which can serve as a reference for your current tax filing.

- Review Correspondence from the IRS: Review any previous correspondence you have received from the IRS. In some cases, they may have mentioned your Customer File Number in their communications, such as notices, letters, or official documents. Look for any references to this number in those materials.

- Consult with a Tax Professional: If you are working with a tax professional, such as a certified public accountant (CPA) or an enrolled agent, they may have access to your Customer File Number or can assist you in obtaining it. Reach out to them and explain your situation for guidance.

It is important to note that the Customer File Number is specific to your tax records and is assigned by the IRS. It is different from other identification numbers, such as your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). The IRS assigns the Customer File Number to streamline the processing and organization of tax returns.

By utilizing these alternative methods, you can obtain your Customer File Number and ensure its accurate inclusion on your tax return for prompt processing and identification of your tax records.

Now that you have learned where to find the Customer File Number and explored alternative ways to obtain it, you are well-equipped to navigate the intricacies of Tax Return Form 1040.

Conclusion

Understanding the Customer File Number and its significance on Tax Return Form 1040 is essential for a smooth and accurate tax filing process. By including the Customer File Number on your tax return, you help the IRS in efficiently processing your return and maintaining accurate records of your tax history.

Throughout this article, we have explored the various aspects related to the Customer File Number, including its definition, importance, and where to locate it on Tax Return Form 1040. We have also discussed alternative methods to obtain the Customer File Number if you encounter any difficulties.

By following the step-by-step guide provided, you can easily locate your Customer File Number on Tax Return Form 1040. Remember to double-check its accuracy before submitting your tax return to avoid any potential processing issues or delays.

Should you face any challenges with your Customer File Number or require additional assistance, it is recommended to contact the IRS directly or consult with a tax professional. They can provide further guidance and ensure that you meet all necessary requirements.

As you continue your journey in the world of finance and taxes, keep in mind the importance of accurate record-keeping and compliance with tax laws. The Customer File Number serves as a vital component in maintaining the integrity of your tax records and ensuring a smooth tax filing experience.

We hope that this comprehensive guide has shed light on the significance of the Customer File Number and has empowered you with the knowledge to navigate the complexities of Tax Return Form 1040 confidently. Remember, accuracy and attention to detail are key when it comes to filing your taxes and maximizing your financial well-being.

Now that you have the necessary information, go ahead and conquer your tax return with confidence!