Finance

Guaranteed Income Bond (GIB) Definition

Published: December 3, 2023

Learn about guaranteed income bonds (GIB) in finance, including their definition, features, and benefits. Find out how GIBs can provide a steady stream of income for investors.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Guaranteed Income Bond (GIB): A Reliable Investment Option

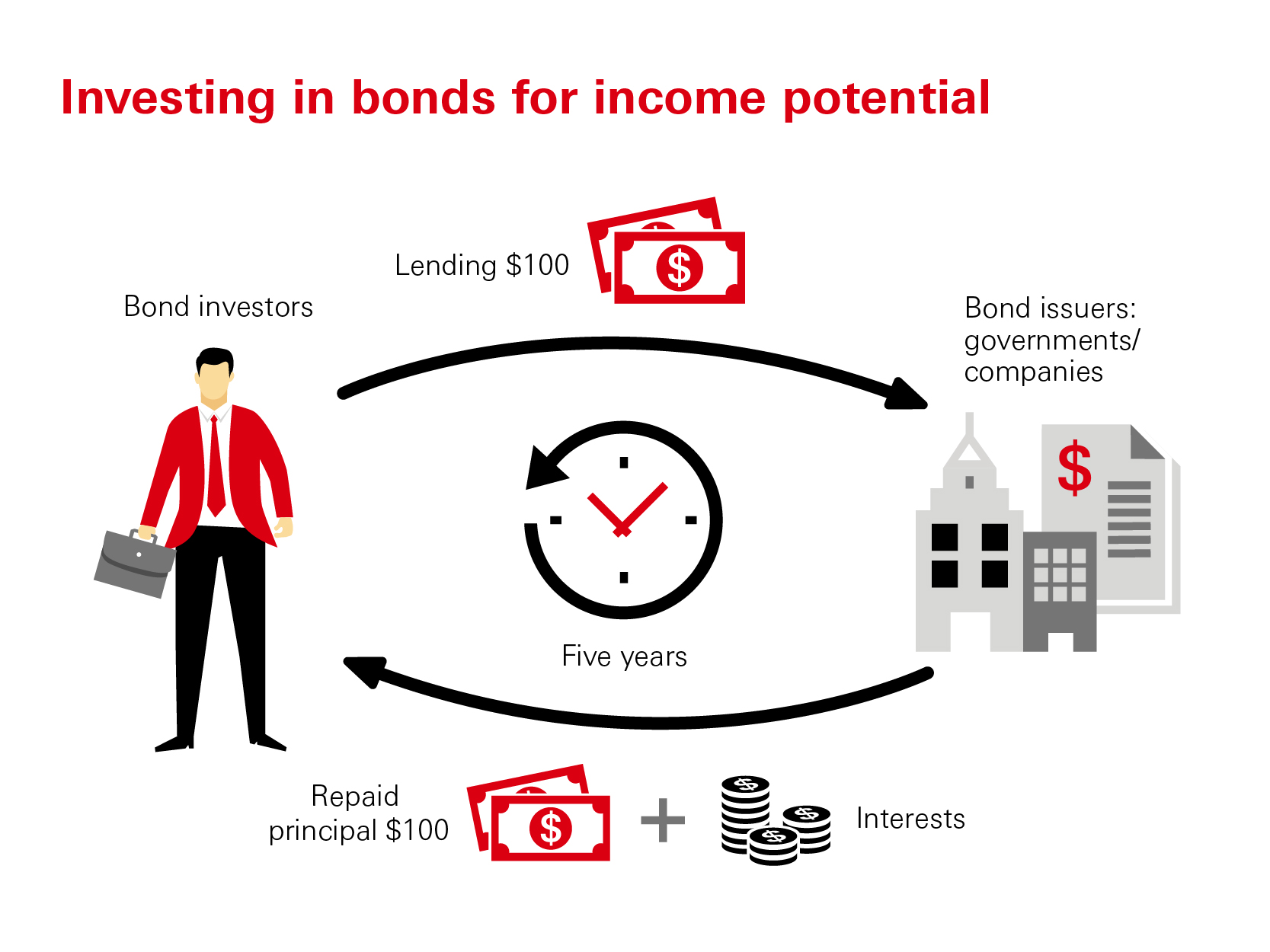

When planning for our financial future, it’s important to explore different investment options that can provide a steady stream of income. One such option is a Guaranteed Income Bond (GIB), which offers investors a guaranteed fixed income over a specified period of time. In this blog post, we will delve into the definition of GIBs and how they can be a reliable addition to your investment portfolio.

Key Takeaways:

- GIBs are fixed-income securities that guarantee investors a predetermined amount of income for a specific duration.

- These bonds are typically issued by government agencies or reputable financial institutions.

So, what exactly is a Guaranteed Income Bond? A GIB is a type of fixed-income security that offers investors a guaranteed return on investment. Unlike stocks or mutual funds, where returns can fluctuate based on market performance, GIBs provide a fixed and predictable income. These bonds are usually issued by government agencies or reputable financial institutions, making them a suitable investment option for those seeking stability and reliability.

Investing in a GIB can offer several benefits, including:

- Steady Income: With GIBs, investors can enjoy a reliable source of income, as the bond issuer guarantees regular payments over a fixed duration. This can be particularly attractive for retirees or individuals seeking a consistent cash flow.

- Low Risk: Since GIBs come with a guarantee of income, they are considered a relatively low-risk investment option. Investors can have peace of mind knowing that their principal investment and income payments are secure.

- Diversification: Adding GIBs to your investment portfolio can help diversify risk. By including different types of assets, such as stocks, bonds, and GIBs, investors can reduce the impact of market fluctuations on their overall returns.

- Flexibility: GIBs often have different maturity periods, ranging from a few months to several years. This allows investors to choose a bond that aligns with their investment goals and time horizon.

It’s important to note that while GIBs provide a fixed income, the returns may be lower compared to other investment options. This is because the guarantee of income comes with a trade-off in potential returns. However, for risk-averse individuals or those looking for stable income, GIBs can be an attractive choice.

When considering investing in GIBs, it’s crucial to research and choose bonds issued by reputable institutions. Take into account the issuer’s credit rating, as this indicates their financial strength and ability to fulfill their payment obligations.

Overall, a Guaranteed Income Bond can be a reliable investment option for individuals seeking a steady and predictable income stream. With their low-risk nature and consistent payouts, GIBs can provide financial security and peace of mind.

If you’re looking to diversify your investment portfolio and prioritize stability, consider exploring the world of GIBs. However, as with any investment, it’s essential to consult with a financial advisor to ensure that GIBs align with your personal financial goals and risk tolerance.