Home>Finance>How Do Bonds Generate Income For Investors Quizlet

Finance

How Do Bonds Generate Income For Investors Quizlet

Published: October 11, 2023

Learn how bonds generate income for investors in the field of finance with this quizlet. Understand the intricacies of bond investments and maximize your financial knowledge.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to this informative article on how bonds generate income for investors. Bonds are a key component of the financial markets and play a crucial role in generating consistent returns for investors. Understanding how bonds work and how they generate income is essential for anyone looking to diversify their investment portfolio or explore income-generating opportunities.

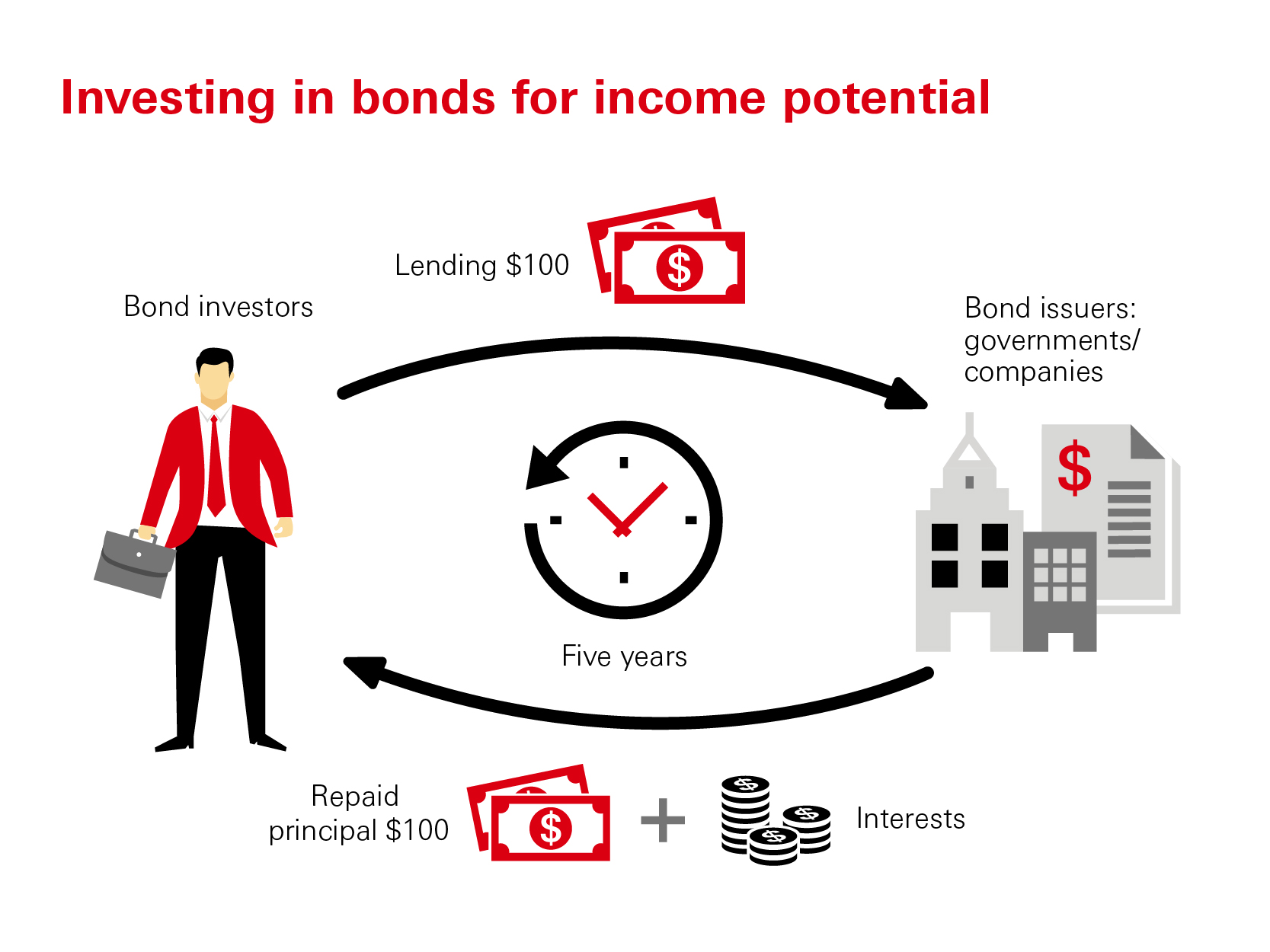

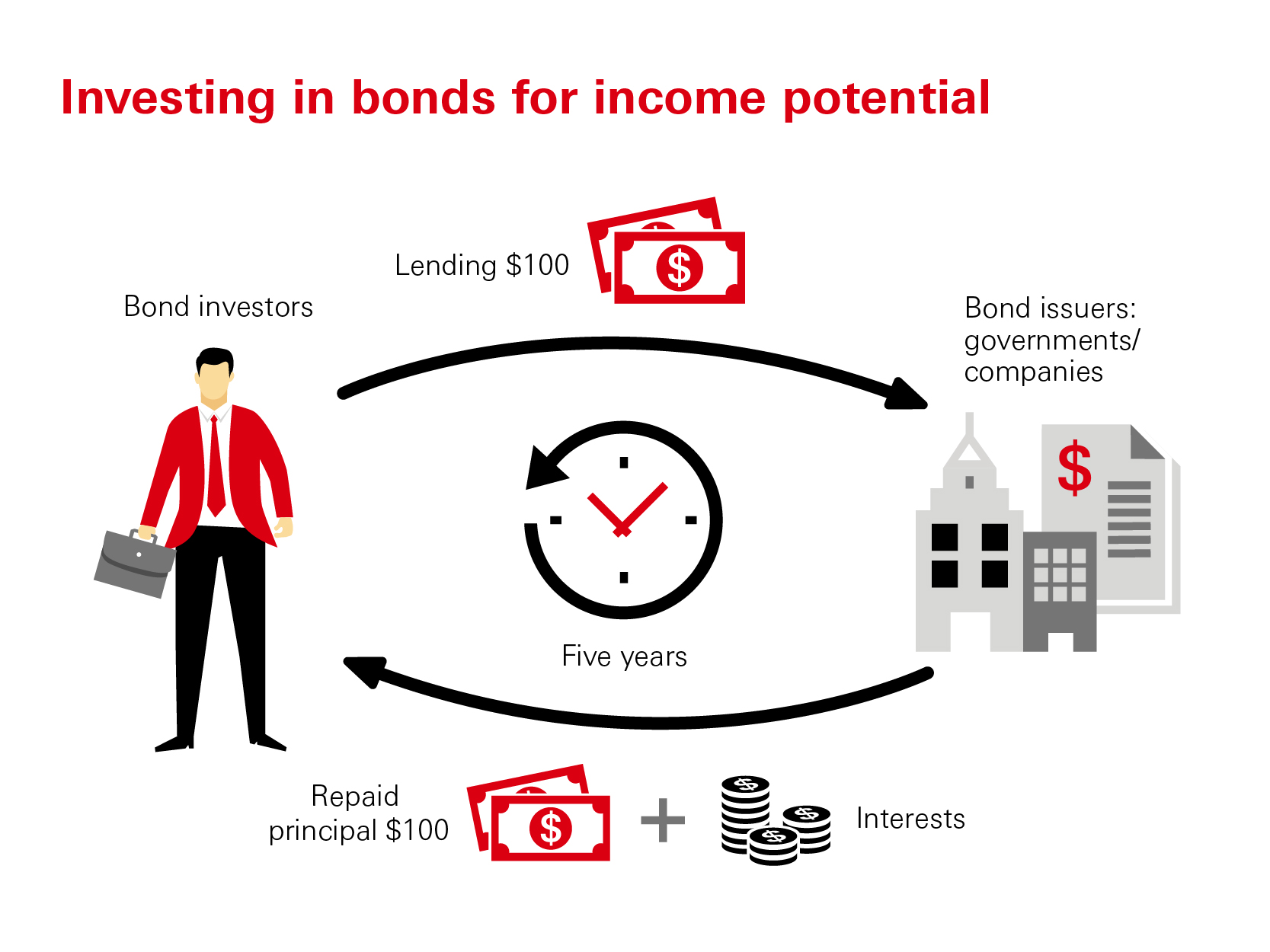

Bonds are essentially debt instruments issued by governments, municipalities, and corporations to raise capital. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for regular interest payments over a specified period of time. At the end of the bond’s term, the principal amount is returned to the investor.

Bonds are considered lower-risk investments compared to stocks because they offer a fixed income stream and have a defined maturity date. This makes them attractive to conservative investors looking for stable income and the preservation of capital.

In this article, we will delve deeper into how bonds generate income for investors. We will explore different aspects of bond investing, including coupon payments, yield to maturity, bond prices, and types of bonds. We will also discuss the risks and considerations associated with investing in bonds to help you make informed investment decisions.

So, let’s begin our journey into the world of bond investing and discover how bonds generate income for investors.

What are Bonds?

Bonds are financial instruments that represent a loan made by an investor to a borrower. When you invest in a bond, you are essentially lending money to the issuer, which can be a government, municipality, or corporation. In return for your investment, the issuer promises to pay you interest over a specific period of time and to repay the principal amount at the end of the bond’s term.

Bonds are issued with a specific face value, which indicates the amount the issuer will repay to the bondholder at maturity. The face value is typically $1,000 or a multiple of $1,000. The bond’s term, also known as its maturity, can range from a few months to several decades.

Bonds can be classified into two main categories: government bonds and corporate bonds. Government bonds are issued by national governments, such as the U.S. Treasury bonds or German bunds. These bonds are considered the safest investment option because they are backed by the full faith and credit of the respective governments. Corporate bonds, on the other hand, are issued by companies to fund their operations or finance specific projects.

When you invest in a bond, you become a creditor of the issuer. This means that you have a higher claim on the issuer’s assets compared to shareholders if the company goes bankrupt. As a creditor, you are entitled to regular interest payments, also known as coupon payments, and the return of the principal amount at maturity.

Bonds are typically issued with a fixed interest rate, referred to as the coupon rate, which is expressed as a percentage of the bond’s face value. For example, if you purchase a bond with a face value of $1,000 and a coupon rate of 5%, you will receive $50 in annual coupon payments until the bond matures.

In the next section, we will explore in more detail how bonds generate income for investors through coupon payments and yield to maturity.

How Bonds Generate Income

Bonds generate income for investors through coupon payments and yield to maturity. Let’s take a closer look at each of these income-generating mechanisms.

Coupon Payments: When you invest in a bond, you will receive periodic coupon payments from the issuer. Coupon payments are typically made semi-annually or annually and represent the interest payments on the bond. These payments are a fixed percentage of the bond’s face value, known as the coupon rate. For example, if you invest in a bond with a face value of $1,000 and a coupon rate of 4%, you would receive annual coupon payments of $40. These coupon payments provide a steady stream of income for bondholders throughout the life of the bond.

Yield to Maturity (YTM): Another way bonds generate income is through yield to maturity. YTM is the total return anticipated on a bond if it is held until maturity. It takes into account the annual coupon payments, the price paid for the bond, and the face value received at maturity. As bond prices can fluctuate in the secondary market based on changes in interest rates and market conditions, the YTM provides a more accurate measure of the bond’s true return. Bondholders can earn income through YTM by holding a bond until maturity and receiving the face value at that time.

It’s important to note that the income generated by bonds is generally considered fixed income, meaning that the coupon payments and yield to maturity are predetermined based on the terms of the bond. This makes bonds an attractive investment for investors looking for stability and regular income. However, it’s crucial to consider various factors such as the creditworthiness of the issuer, prevailing interest rates, and the overall economic climate when assessing the income potential of a bond investment.

Next, let’s explore how bond prices and interest rates impact the income generated by bonds.

Coupon Payments

Coupon payments play a vital role in generating income for bond investors. When you invest in a bond, you receive regular coupon payments from the issuer, which represents the interest payments on the bond. These payments are typically made semi-annually or annually, depending on the terms of the bond.

The coupon payment is determined by the coupon rate, which is a fixed percentage of the bond’s face value. For example, if you invest in a bond with a face value of $1,000 and a coupon rate of 5%, you would receive $50 in annual coupon payments.

Coupon payments provide a predictable stream of income for bondholders, making bonds an attractive option for investors seeking stable cash flow. These payments are generally fixed over the life of the bond, allowing investors to plan their finances accordingly.

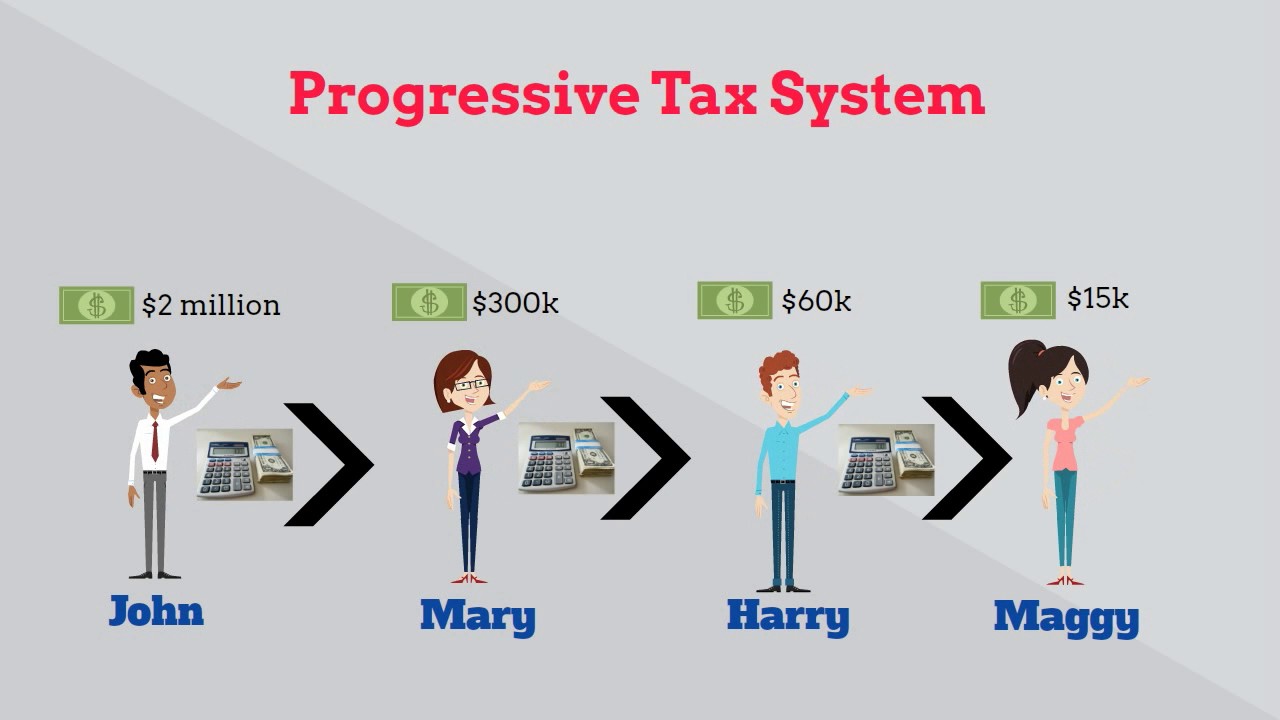

It’s important to note that coupon payments are subject to income tax. The interest earned from coupon payments is typically taxed at the investor’s applicable tax rate. The tax treatment varies between countries, so it’s important to consult with a tax advisor to understand the implications of bond income on your taxes.

Additionally, it’s crucial to consider the creditworthiness of the bond issuer when assessing the reliability of coupon payments. Bonds issued by governments or highly rated corporations are generally considered to have lower default risk, which means they are more likely to make timely coupon payments. On the other hand, bonds issued by entities with lower credit ratings may carry higher default risk, which could impact their ability to honor coupon payments.

Investors should also be aware of the concept of coupon reinvestment risk. Since coupon payments are typically paid semi-annually or annually, investors receiving these payments may face the challenge of reinvesting the funds at the prevailing interest rates. If interest rates decline, investors may face difficulty finding investment opportunities that generate similar or higher returns. On the other hand, if interest rates rise, reinvesting coupon payments at a higher interest rate can be beneficial.

In summary, coupon payments are a key component of how bonds generate income for investors. They provide a predictable stream of cash flow based on the bond’s coupon rate and face value. Investors should consider the creditworthiness of the issuer and the potential impact of coupon reinvestment risk when assessing the income potential of a bond investment.

Yield to Maturity

Yield to Maturity (YTM) is an important concept in bond investing as it helps investors assess the total return they can expect to earn if they hold a bond until maturity. YTM takes into account the bond’s coupon payments, the purchase price, and the face value received at maturity.

YTM represents the average annual return an investor would receive if they hold the bond until it matures and reinvest all coupon payments at the bond’s yield rate. It factors in both the bond’s coupon rate and its market price, which can fluctuate based on changes in interest rates and market conditions.

The yield to maturity is expressed as a percentage and is often considered the bond’s internal rate of return (IRR). It considers the time value of money by discounting future cash flows to their present value, taking into account the bond’s time to maturity and the discount rate, which can be influenced by prevailing interest rates.

An important point to note is that the YTM assumes that all coupon payments will be reinvested at the same yield rate until the bond matures. This may not always be possible, especially if interest rates fluctuate. However, the YTM still provides a useful measure for comparing the potential returns of different bonds.

When analyzing different bonds, investors can use the YTM to compare the relative attractiveness and potential income generation of each investment. Generally, higher YTM indicates a higher potential return, while lower YTM suggests a lower potential return.

It’s important to keep in mind that the YTM is based on several assumptions, including the bond being held until maturity and all coupon payments being reinvested at the YTM rate. These assumptions may not always hold true in real-world scenarios, as investors may choose to sell their bonds before maturity or reinvest coupon payments at different rates.

Investors should also consider the creditworthiness of the issuer when evaluating the yield to maturity. Bonds with higher credit ratings generally offer lower yields, as they are considered less risky. Bonds with lower credit ratings will typically have higher yields to compensate investors for the increased default risk.

In summary, yield to maturity provides investors with a measure of the bond’s potential return if held until maturity, considering both the coupon payments and the bond’s market price. It serves as a useful tool for comparing different bond investments and assessing the income generation potential of each bond.

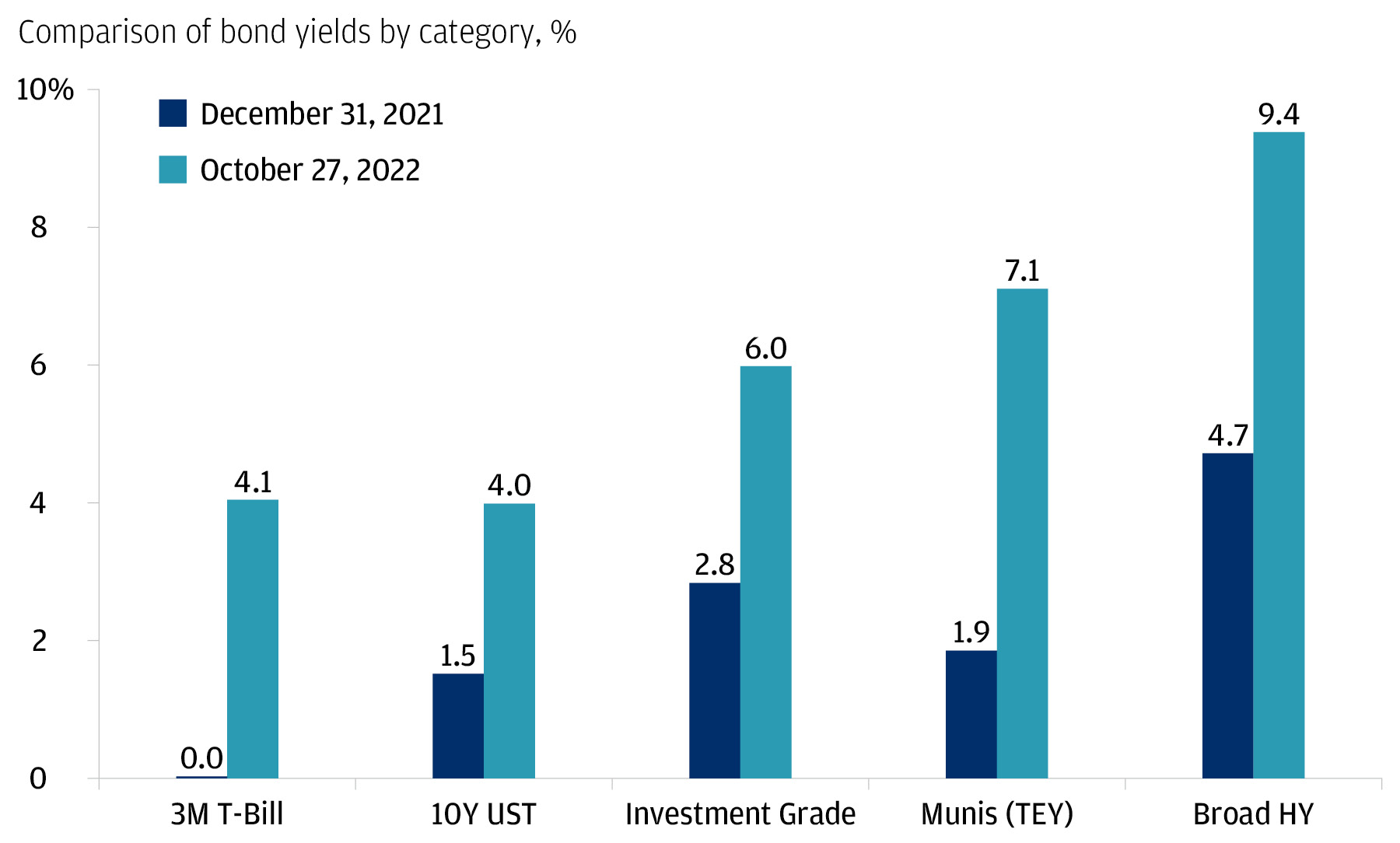

Bond Prices and Interest Rates

Bond prices and interest rates share an inverse relationship. When interest rates rise, bond prices tend to fall, and vice versa. This inverse relationship has a significant impact on both the value of existing bonds and the income generated by these bonds.

When interest rates rise, newly issued bonds start offering higher coupon rates to attract investors. This higher yield on new bonds makes existing bonds with lower coupon rates less attractive in comparison. Consequently, the market price of existing bonds decreases to align with the higher yield available in the market.

Conversely, when interest rates decline, new bond issuances come with lower coupon rates compared to existing bonds. This lower yield on new bonds makes the higher coupon rates of existing bonds more attractive. As a result, the market price of existing bonds increases to reflect their higher yield relative to new bonds.

This price movement occurs because bond prices adjust to offer investors a comparable yield based on current interest rates. Investors looking to buy or sell bonds in the secondary market consider these price changes, which can impact the income generated by the bonds.

It’s important to note that while changes in market interest rates affect bond prices in the secondary market, they do not impact the coupon payments and yield to maturity of existing bonds. Once a bond is issued, its coupon rate and maturity remain fixed for the life of the bond.

However, if an investor sells a bond before maturity, they may experience a gain or loss on their investment due to changes in interest rates. Selling a bond when interest rates are lower than the bond’s coupon rate may result in a capital gain, while selling when interest rates are higher may result in a capital loss.

It’s also worth mentioning that the inverse relationship between bond prices and interest rates is more pronounced for long-term bonds compared to short-term bonds. This is because long-term bonds are exposed to interest rate risk for a longer period, making them more sensitive to interest rate fluctuations.

Understanding the relationship between bond prices and interest rates is crucial for bond investors. Monitoring interest rate trends and assessing their potential impact on bond prices can help investors make informed decisions about buying or selling bonds and managing their investment portfolios.

Types of Bonds

There are various types of bonds available in the financial markets, each with its own characteristics and investment considerations. Understanding the different types of bonds can help investors diversify their portfolios and tailor their investments to their specific goals and risk tolerance. Let’s explore some of the common types of bonds:

- Government Bonds: These bonds are issued by national governments and are considered to have the lowest default risk. In the United States, they are commonly known as Treasury bonds, notes, and bills. Government bonds are backed by the full faith and credit of the issuing government and are considered a safe haven investment.

- Municipal Bonds: Municipal bonds, also known as “munis,” are issued by state and local governments or municipal entities. They are generally used to finance public projects such as schools, highways, or hospitals. Municipal bonds offer tax advantages for investors, as the interest income is often exempt from federal taxes and sometimes state and local taxes.

- Corporate Bonds: Corporate bonds are issued by corporations to raise capital for various purposes, such as expansion, acquisitions, or refinancing debt. These bonds carry varying degrees of credit risk depending on the financial strength of the issuing company. They typically offer higher yields compared to government bonds but come with a higher level of risk.

- Foreign Bonds: Foreign bonds are issued by foreign governments or corporations in a currency other than the investor’s domestic currency. They provide an opportunity for investors to diversify globally and potentially benefit from higher yields. However, they also come with additional risks such as currency exchange rate fluctuations and geopolitical factors.

- High-Yield Bonds: Also known as junk bonds, high-yield bonds are issued by companies with lower credit ratings. These bonds offer higher yields to compensate investors for the increased risk associated with potentially higher default rates. Investing in high-yield bonds can be attractive for investors seeking higher income, but it carries a higher level of risk.

- Convertible Bonds: Convertible bonds are corporate bonds that can be converted into a predetermined number of the issuer’s common stock. These bonds provide investors with fixed income potential as well as the opportunity to benefit from potential stock price appreciation.

- Zero-Coupon Bonds: Zero-coupon bonds do not pay periodic coupon payments. Instead, they are issued at a discount to their face value and provide investors with a return upon maturity. The return is the difference between the discounted purchase price and the face value.

These are just a few examples of the many types of bonds available in the market. Each type has its own risk profile, return potential, and investment considerations. Investors should carefully evaluate their investment objectives and risk tolerance when selecting bond investments to build a diversified portfolio.

Next, let’s discuss the risks and considerations associated with investing in bonds.

Risks and Considerations

While bonds offer the potential for consistent income and relative stability, there are several risks and considerations that investors should be aware of before investing in bonds. Understanding these risks can help investors make informed decisions and manage their bond investments effectively. Let’s explore some of the key risks and considerations associated with bond investing:

- Interest Rate Risk: Bonds are sensitive to changes in interest rates. When interest rates rise, bond prices tend to fall, affecting the value of existing bonds in the secondary market. Conversely, when interest rates decline, bond prices tend to rise. Investors should be aware of the potential impact of changes in interest rates on the value of their bond investments.

- Credit Risk: Credit risk refers to the risk of the bond issuer defaulting on its payments. Bonds issued by corporations with lower credit ratings or governments facing financial challenges may carry higher credit risk. Investors should evaluate the creditworthiness of the issuer by considering credit ratings and assessing the issuer’s financial health.

- Liquidity Risk: Some bonds may have limited liquidity, meaning they may not be easily bought or sold in the secondary market. This can potentially impact an investor’s ability to sell the bond at a desirable price or find a buyer when needed. Investors should consider the liquidity of a bond before investing.

- Call Risk: Call risk arises when the issuer has the option to redeem or call the bond before its maturity date. This can happen when interest rates decline, allowing the issuer to refinance at a lower cost. If a bond is called, investors may face reinvestment risk, as they may need to reinvest the funds at potentially lower yields.

- Inflation Risk: Inflation risk refers to the risk that rising inflation erodes the purchasing power of the bond’s fixed coupon payments and principal amount. Bonds with fixed coupon rates may not provide adequate income to keep pace with inflation, resulting in a decrease in real returns.

- Foreign Exchange Risk: When investing in foreign bonds, investors are exposed to foreign exchange risk. Fluctuations in currency exchange rates can impact the returns of bonds denominated in a foreign currency, as the value of the bond’s income and principal amount can change when converted into the investor’s domestic currency.

It’s important for investors to carefully assess these risks and consider their investment objectives, risk tolerance, and time horizon before investing in bonds. Diversification across different types of bonds and securities can help mitigate some of these risks. Consulting with a financial advisor or investment professional can provide valuable insights and guidance in navigating the bond market.

Now, let’s conclude our exploration of how bonds generate income for investors.

Conclusion

Bonds play a crucial role in generating income for investors while providing relative stability and diversification to investment portfolios. By understanding how bonds work and how they generate income, investors can make informed decisions and capitalize on the income potential of these financial instruments.

Through coupon payments and yield to maturity, bonds offer investors consistent income streams over the life of the bond. Coupon payments provide regular interest payments based on the bond’s coupon rate and face value, while yield to maturity reflects the total return an investor can expect if they hold the bond until maturity.

However, it’s important to consider various factors and risks when investing in bonds. Interest rate risk, credit risk, liquidity risk, and other market factors can impact the value and income potential of bonds. Investors should carefully assess these risks and consider their risk tolerance and investment objectives before investing in any specific type of bond.

By diversifying their bond investments across different types of bonds, such as government bonds, municipal bonds, corporate bonds, and others, investors can take advantage of various income opportunities and balance their risk exposure. Consulting with a financial advisor or investment professional can provide valuable insights and help investors tailor their bond investments to their individual needs.

In conclusion, bonds are an essential investment instrument for generating income. They offer stability, consistent cash flow through coupon payments, and the potential for capital appreciation depending on interest rate movements. By understanding the mechanics of bonds and considering the risks involved, investors can effectively incorporate bonds into their investment strategy and seize the income potential they offer.