Finance

High-Low Method Definition

Published: December 5, 2023

Learn the definition of the high-low method in finance and how it can help analyze costs and determine breakpoints. Master this essential technique for effective financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding the High-Low Method in Finance: A Detailed Explanation

When it comes to managing finances, businesses often employ various methods and techniques to analyze their costs, identify trends, and make informed decisions. One such method commonly used is the High-Low Method. This blog post aims to provide a comprehensive understanding of this technique and explain how it can be beneficial for businesses. Read on to discover the ins and outs of the High-Low Method!

Key Takeaways:

- The High-Low Method is a technique used to estimate fixed and variable costs within a given range of activity levels.

- It helps businesses determine the impact of changes in their operations by isolating variable costs and identifying fixed costs.

What is the High-Low Method?

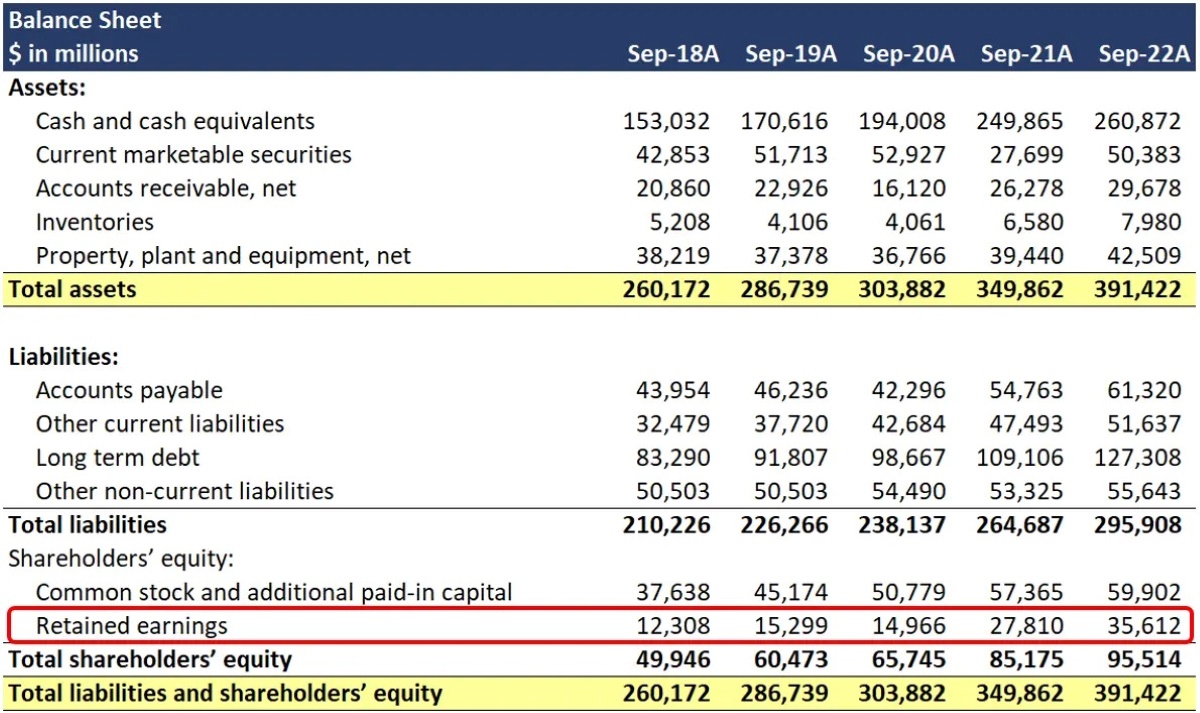

The High-Low Method in finance is a way to separate mixed costs (expenses that consist of both fixed and variable components) into their fixed and variable elements. By analyzing the costs associated with high and low levels of activity, businesses can estimate the total fixed costs and the variable costs per unit or activity.

High-Low Method Formula:

To calculate the variable cost per unit, you subtract the total fixed costs from the total costs at the highest activity level, and then divide this difference by the change in activity levels between the highest and lowest points. The formula can be represented as follows:

Variable cost per unit = (Total cost at highest activity level – Total fixed costs) / (Highest activity level – Lowest activity level)

Let’s break down the High-Low Method into a step-by-step process:

- Gather data: Collect information on costs and activity levels at different points in time.

- Identify the highest and lowest activity levels: Determine the data points that represent the highest and lowest levels of activity.

- Calculate total costs at each level: Add up the total costs corresponding to the highest and lowest activity levels.

- Determine total fixed costs: Subtract the variable costs (calculated in step 3) from the total costs at the highest activity level.

- Compute the variable cost per unit: Divide the difference in total costs by the difference in activity levels between the highest and lowest points.

- Analyze and use the results: Once you have the variable cost per unit, you can apply it to estimate costs at different levels of activity and make more informed financial decisions.

The High-Low Method simplifies cost analysis by isolating the fixed and variable parts of mixed costs. By understanding these components, businesses can better predict how changes in activity levels will affect their overall costs and ultimately make strategic adjustments to improve their financial performance.

Benefits of Using the High-Low Method

The High-Low Method offers several advantages for businesses looking to gain insights into their costs. Here are two key benefits:

- Cost estimation: By calculating the variable cost per unit, businesses can estimate their costs accurately and plan their budgets accordingly. This helps in setting prices, determining profitability, and making informed decisions about production levels.

- Identifying fixed costs: Through the High-Low Method, businesses can clearly identify their total fixed costs, making it easier for them to understand their cost structure and effectively manage their expenses.

In conclusion, the High-Low Method is a useful tool for businesses seeking to dive deeper into their cost analysis. By separating fixed and variable costs, this technique allows businesses to make accurate cost estimations, understand the impact of changes in activity levels, and make informed financial decisions. Incorporating the High-Low Method into your financial management strategy can help your business thrive in today’s competitive landscape!