Finance

What Is An Insurance Aggregator?

Published: November 20, 2023

Learn all about insurance aggregators and how they can help you compare different finance options. Find the best insurance deals and save money today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to finding the best insurance policies that suit your needs, the process can often be time-consuming and daunting. With numerous insurance providers offering a wide range of coverage options, it can be overwhelming to compare and select the right policy. This is where insurance aggregators come in.

An insurance aggregator is a platform that allows you to compare different insurance policies offered by various providers in one place. It simplifies the process of finding and purchasing insurance by providing you with a comprehensive overview of available options, enabling you to make an informed decision based on your specific requirements.

Insurance aggregators have gained significant popularity in recent years, primarily due to the convenience they offer. Instead of visiting multiple insurer websites or contacting individual brokers, you can use an aggregator to quickly and easily compare quotes, coverage details, and prices from a wide range of insurance providers.

Whether you are looking for auto insurance, health insurance, home insurance, or any other type of coverage, an insurance aggregator can save you time and effort. By using an aggregator, you can avoid the hassle of visiting multiple websites, filling out numerous forms, and dealing with different agents.

Insurance aggregation platforms work by partnering with several insurance providers and collecting information about their policies. They then present this information to users in a user-friendly format, making it easy to compare the features, benefits, and costs of different policies side by side.

In the following sections, we’ll delve deeper into how insurance aggregators work, the benefits and drawbacks of using them, popular aggregators in the market, and essential tips for choosing the right insurance aggregator for you.

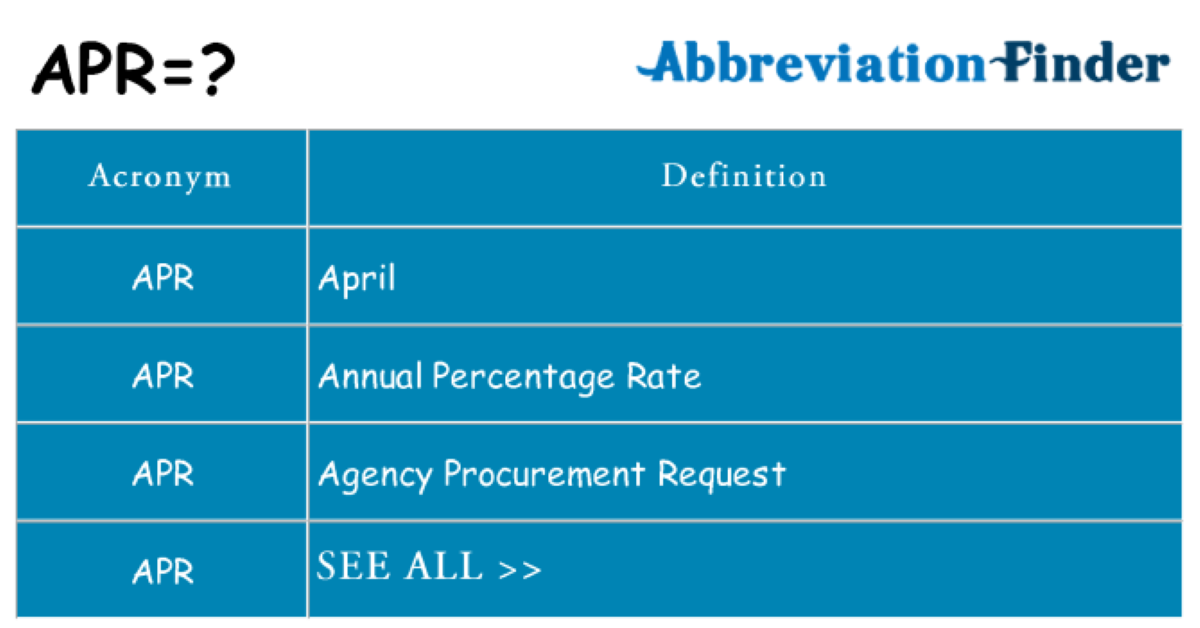

Definition of an Insurance Aggregator

An insurance aggregator is an online platform or website that allows users to compare and purchase insurance policies from multiple insurance providers. It acts as a virtual marketplace where users can access a wide range of insurance options and make informed decisions based on their specific needs.

The primary function of an insurance aggregator is to gather information from various insurance companies and present it in a simplified and standardized format. This allows users to compare the features, benefits, and costs of different policies side by side, enabling them to make a well-informed choice.

Insurance aggregators typically partner with multiple insurance carriers and brokers to provide a comprehensive list of available policies. Users can input their specific requirements and preferences, such as coverage type, deductibles, and desired premium, and the aggregator’s algorithm will generate a list of tailored insurance options.

One of the key advantages of using an insurance aggregator is the convenience it offers. Instead of visiting multiple insurance provider websites or contacting individual brokers, users can access all the information they need in one place. This saves time and effort, as they can easily compare policies and prices without the need for extensive research.

Moreover, insurance aggregators often provide additional resources and tools to help users make informed decisions. These may include customer reviews, ratings, and educational content that explain the intricacies of insurance coverage.

It is important to note that an insurance aggregator is not an insurance provider itself. It acts as an intermediary between users and insurance companies, facilitating the process of policy comparison and purchase. Once a user selects a policy through the aggregator, they are typically redirected to the insurance provider’s website or connected with a representative to complete the purchase.

Overall, an insurance aggregator serves as a valuable tool for individuals and businesses seeking insurance coverage. It simplifies the process of finding and purchasing insurance, empowers users to make informed decisions, and promotes transparency in the insurance industry.

How Does an Insurance Aggregator Work?

Insurance aggregators function by collecting information from various insurance providers and presenting it in a user-friendly manner. Here’s a step-by-step breakdown of how an insurance aggregator works:

- Data Collection: Insurance aggregators establish partnerships with multiple insurance companies and brokers. They gather data about the policies, coverage details, premiums, and other relevant information from these providers. This data is then compiled into a database for users to access.

- User Input: Users interested in purchasing insurance policies enter their specific requirements into the aggregator’s platform. This may include the type of insurance needed, desired coverage limits, deductibles, and any other preferences they have.

- Algorithmic Comparison: Using sophisticated algorithms, the aggregator compares the user’s inputs with the available insurance options in its database. It filters and presents a list of policies that closely match the user’s requirements.

- Policy Comparison: The aggregator displays the policies side by side, allowing users to compare their features, benefits, and premiums. Users can assess the coverage limits, deductibles, terms and conditions, and other important factors to make an informed decision.

- Quote Generation: Based on the user’s inputs, the aggregator provides a real-time quote for each policy in the comparison list. This allows users to evaluate the cost of the policy and how it aligns with their budget.

- Additional Information: Insurance aggregators often provide additional information and resources to assist users in their decision-making process. This may include customer reviews, ratings, expert guidance, and educational content to help users understand the intricacies of insurance coverage.

- Redirection to Provider: Once a user selects a policy, the aggregator typically redirects them to the insurance provider’s website or connects them with a representative to complete the purchase. The aggregator acts as an intermediary, facilitating the transaction between the user and the insurance provider.

Insurance aggregators aim to streamline the insurance purchasing process by simplifying the task of comparing policies and prices. They eliminate the need for users to visit each insurance provider’s website individually or contact multiple brokers, saving time and effort.

It’s important to note that while insurance aggregators provide a convenient way to compare policies, they may not include every insurance provider or policy available in the market. Users should also consider conducting independent research and directly contacting insurance providers to ensure they have explored all available options before making a final decision.

Benefits of Using an Insurance Aggregator

Using an insurance aggregator can offer several significant benefits for individuals and businesses seeking insurance coverage. Here are some key advantages:

- Time and Effort Savings: The primary advantage of using an insurance aggregator is the time and effort savings it provides. Instead of visiting multiple insurer websites or contacting individual brokers, users can access a variety of insurance policies in one place. This eliminates the need for extensive research and streamline the comparison process.

- Convenience and Accessibility: Insurance aggregators offer a convenient and accessible platform for users. They can access the aggregator’s website at any time, from anywhere with an internet connection. This allows for flexibility in comparing policies and making informed decisions at the user’s convenience.

- Wide Range of Options: Insurance aggregators typically partner with various insurance providers, offering users access to a wide range of policies. This allows users to compare multiple insurance options with different coverage levels, premiums, and terms to find the best fit for their specific needs.

- Transparency and Information: Aggregators provide transparency and a wealth of information on insurance policies. Users can compare policies side by side, examining their features, coverage limits, deductibles, and exclusions. Additionally, aggregators often provide customer reviews and ratings to help users make more informed decisions.

- Potential Cost Savings: By comparing policies from different insurance providers, users have the opportunity to find better deals and potentially save money. Aggregators allow users to easily compare premiums, deductibles, and coverage options, enabling them to make a cost-effective choice without compromising on quality.

- Expert Guidance: Insurance aggregators often provide expert guidance and educational resources to help users navigate the complex world of insurance. Users can find articles, guides, and frequently asked questions that clarify insurance terms and concepts, providing them with a better understanding of their options.

Overall, using an insurance aggregator offers convenience, time savings, access to a wide range of policy options, transparency, and the potential for cost savings. It empowers users to make informed decisions and simplifies the process of purchasing insurance.

Drawbacks of Using an Insurance Aggregator

While insurance aggregators offer numerous benefits, it is important to also consider the drawbacks associated with using these platforms. Here are some potential disadvantages:

- Incomplete Market Coverage: Insurance aggregators may not include every insurance provider or policy available in the market. Some insurance companies may choose not to partner with aggregators, which means that not all options are presented to users. Therefore, users may need to conduct additional research or contact insurance providers directly to explore all available options.

- Limited Customization: While aggregators provide a variety of policy options, the level of customization may be limited. Users must choose from the available options and may not be able to fully tailor the policy to their unique needs and preferences.

- Potential Information Bias: Aggregators rely on the information provided by insurance providers, which may create a bias in the data presented. The accuracy and completeness of the information rely on the transparency and reliability of the insurance companies’ data. Users should verify the information independently to ensure its accuracy.

- Omission of Niche Providers: Insurance aggregators typically focus on mainstream insurance providers and policies, which may result in the omission of niche providers or specialized coverage options. Users seeking specific niche coverage may need to look beyond the offerings provided by aggregators.

- Inability to Handle Complex Cases: Insurance aggregators may not be equipped to handle complex insurance needs or specialized cases. If a user requires expert advice or has unique circumstances that require a more personalized approach, working directly with an insurance agent or broker may be more appropriate.

- Data and Privacy Concerns: When using an insurance aggregator, users are required to provide personal information to generate quotes and access policy details. Some users may have concerns about how their data is used, stored, and shared by the aggregator. It is important to review the privacy policy of the aggregator before providing any personal information.

While the drawbacks mentioned above are worth considering, they are not inherent to all insurance aggregators. Different aggregators may have varying levels of market coverage, customization options, and data quality. It is essential for users to carefully evaluate and research the aggregator they intend to use, considering their specific insurance needs and preferences.

Ultimately, users should weigh the benefits and drawbacks of using an insurance aggregator to determine if it aligns with their individual requirements and whether it provides a suitable solution for their insurance needs.

Popular Insurance Aggregators in the Market

The insurance aggregator market is highly competitive, with several platforms vying to provide users with the best insurance comparison experience. Here are some popular insurance aggregators that have gained recognition in the market:

- Policygenius: Policygenius is a leading insurance aggregator that offers a wide range of insurance options, including life insurance, health insurance, and disability insurance. The platform provides a user-friendly interface and personalized recommendations based on the user’s requirements.

- Compare the Market: Compare the Market is a popular insurance aggregator in the United Kingdom. It allows users to compare insurance policies for various categories, such as car insurance, home insurance, and travel insurance. The platform also provides additional services, like utilities and financial product comparisons.

- The Zebra: The Zebra focuses primarily on car insurance comparison. It provides users with real-time quotes from multiple insurance companies, allowing them to compare coverage options and premiums. The platform also offers educational resources to help users understand car insurance in more detail.

- GoBear: GoBear is a prominent insurance aggregator in Southeast Asia. It allows users to compare a wide range of insurance products, including car insurance, travel insurance, and personal accident insurance, across multiple countries in the region. The platform offers a user-friendly interface and comprehensive information about each policy.

- Confused.com: Confused.com is a well-known insurance aggregator in the United Kingdom. It enables users to compare car insurance, home insurance, and other types of coverage. The platform offers a simple and intuitive interface, along with additional services like energy comparison and personal finance tools.

These are just a few examples of popular insurance aggregators in the market. It is worth noting that the popularity and availability of insurance aggregator platforms may vary by region. Users should explore options specific to their location and evaluate the reputation, user reviews, and features offered by each aggregator before making a decision.

Additionally, it’s important to keep in mind that new insurance aggregators may emerge and existing ones may introduce updates and improvements to their platforms over time. Therefore, regularly exploring and staying informed about the evolving market is essential for users seeking the best insurance aggregator experience.

Tips for Choosing the Right Insurance Aggregator

With the wide range of insurance aggregator options available, choosing the right one can be crucial to ensure a positive and efficient insurance shopping experience. Here are some tips to help you select the right insurance aggregator for your needs:

- Research and Compare: Take the time to research and compare different insurance aggregators. Look for aggregators that specialize in the type of insurance you require, such as auto insurance or health insurance.

- User-Friendly Interface: Consider the user interface and ease of navigation. The aggregator should have a clear and intuitive platform, making it easy for you to input your requirements and compare insurance policies.

- Market Coverage: Evaluate the aggregator’s market coverage. Ensure that it partners with a wide range of reputable insurance providers to provide you with a comprehensive list of policy options. A broader market coverage increases the likelihood of finding the best policy for your needs.

- Transparency: Look for an aggregator that provides transparent information about the policies and insurance providers. It should clearly display policy details, coverage options, deductibles, and exclusions, enabling you to make an informed decision.

- Additional Tools and Resources: Consider whether the aggregator offers any additional tools or resources to assist you in your decision-making process. This may include customer reviews and ratings, educational content, or expert guidance on insurance topics.

- Privacy and Security: Review the aggregator’s privacy policy and ensure that your personal information will be handled securely. Look for assurance that your data will not be shared or sold to third parties without your consent.

- Customer Support: Check if the aggregator provides customer support options, such as live chat, email, or phone support. A responsive support team can help address any queries or concerns you may have during your insurance shopping process.

- Read User Reviews: Take the time to read user reviews and experiences with the aggregator. This can give you insights into the aggregator’s reputation, customer satisfaction, and overall reliability.

- Compare Quotes: Obtain quotes from multiple aggregators to compare pricing and coverage. Remember that the cheapest option may not always provide the best coverage for your needs, so consider both cost and policy details when making a decision.

- Consider Independent Research: While an insurance aggregator can be a valuable tool, it’s always a good idea to conduct independent research as well. Explore insurance providers’ websites, seek advice from insurance professionals, and compare policies directly if needed.

By considering these tips, you can make a more informed decision when choosing an insurance aggregator. Remember to prioritize your specific insurance needs and preferences, as well as the reputation and features offered by the aggregator, to ensure a smooth and successful insurance shopping experience.

Conclusion

Insurance aggregators have revolutionized the way individuals and businesses shop for insurance coverage. These platforms offer a convenient and efficient solution for comparing insurance policies from multiple providers in one place.

By using an insurance aggregator, users can save time and effort by eliminating the need to visit individual insurance company websites or contact multiple brokers. Aggregators provide a comprehensive overview of available policies, allowing users to compare coverage options, costs, and other important factors to make an informed decision.

While insurance aggregators offer numerous benefits, it is important to consider their limitations as well. Market coverage may vary, customization options may be limited, and data accuracy may depend on the information provided by insurance providers.

When choosing an insurance aggregator, it is essential to conduct thorough research, compare platforms, and consider factors such as user interface, market coverage, transparency, and additional tools or resources provided. Reading user reviews and considering independent research can also help in making a well-informed decision.

Overall, insurance aggregators bring transparency, convenience, and efficiency to the insurance purchasing process. They empower users to make informed decisions and provide a comprehensive platform for comparing insurance policies. Whether you are looking for auto insurance, health insurance, home insurance, or any other type of coverage, utilizing an insurance aggregator can simplify the process and help you find the best insurance policy that suits your unique needs.