Finance

How Can I Add Money To My Chime Credit Card

Modified: February 21, 2024

Learn how to add money to your Chime credit card and manage your finances effectively. Explore various options and get expert tips on improving your financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Chime Credit Card

- Ways to Add Money to Chime Credit Card

- Method 1: Direct Deposit

- Method 2: Bank Transfer

- Method 3: Mobile Check Deposit

- Method 4: Cash Reload

- Method 5: Paycheck Early

- Method 6: Third-Party Money Transfer

- Method 7: Chime Cash Spot

- Method 8: Chime Card Transfers

- Conclusion

Introduction

Welcome to the world of Chime Credit Card, where managing your finances is as simple as it gets. Whether you’re looking to build credit, track your spending, or access convenient banking services, Chime Credit Card has got you covered. But what if you need to add money to your Chime Credit Card? In this article, we will explore various methods that allow you to seamlessly add funds to your Chime Credit Card, ensuring that your financial needs are met with ease.

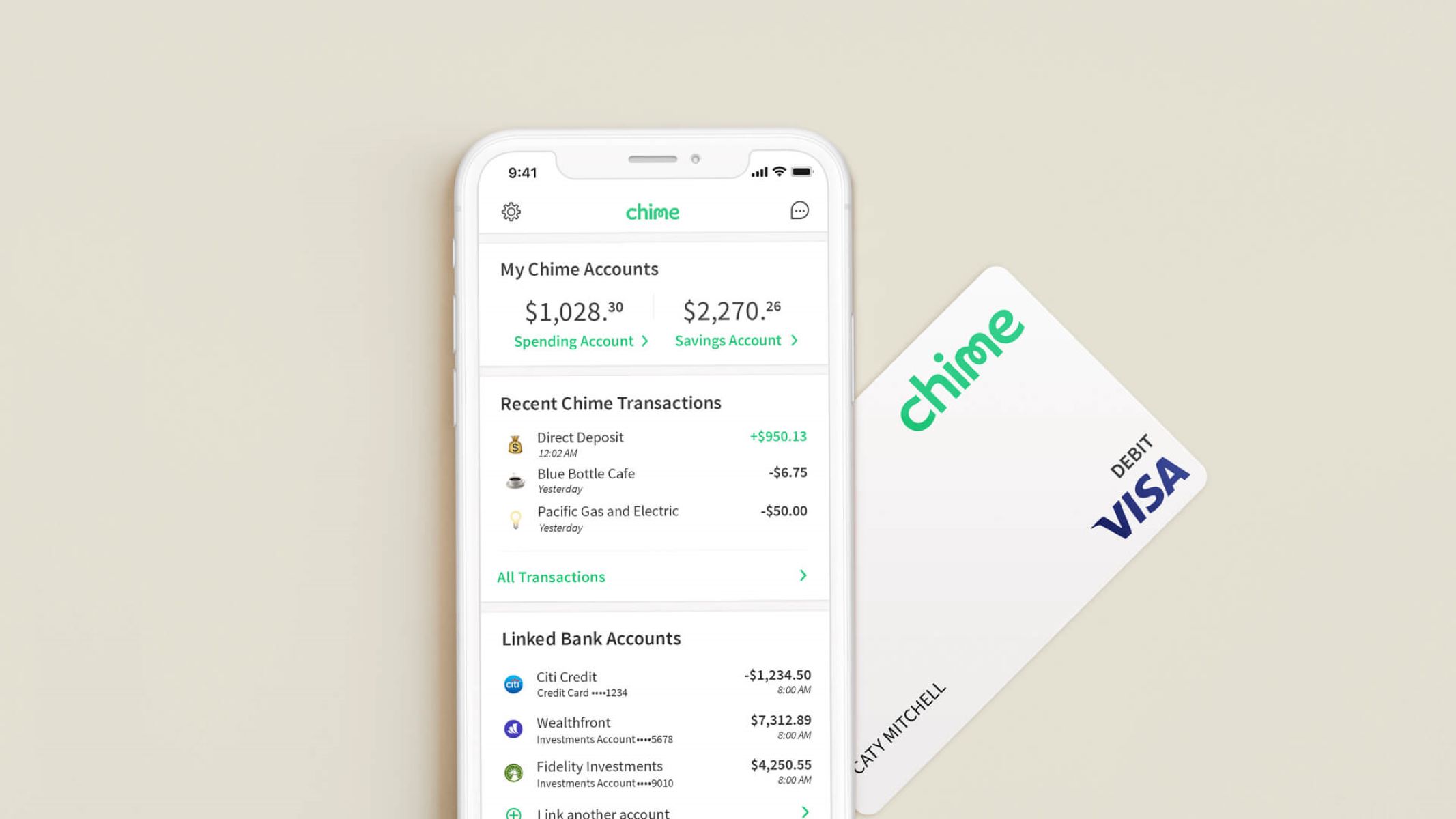

Before we dive into the different ways to add money to your Chime Credit Card, let’s take a moment to understand what exactly Chime Credit Card is. Chime is an innovative online banking platform that provides fee-free banking services and a range of financial products, including the Chime Credit Card. This credit card offers cashback rewards, no annual fees, and a user-friendly mobile app for easy account management.

Now, let’s explore the various methods you can use to add money to your Chime Credit Card.

Understanding Chime Credit Card

Before we delve into the different ways to add money to your Chime Credit Card, it’s important to have a clear understanding of how the card works. The Chime Credit Card is designed to simplify your financial transactions and help you build credit. Let’s take a closer look at its key features:

- No annual fees: Unlike many traditional credit cards, the Chime Credit Card does not charge any annual fees. This means that you can enjoy the benefits of credit card usage without having to worry about recurring costs.

- Cashback rewards: Chime Credit Card offers cashback rewards on eligible purchases. Every time you make a qualifying purchase, you can earn a percentage of the total amount back as cash rewards. This feature allows you to save money while you spend.

- Mobile app integration: Chime provides users with a user-friendly mobile app that allows you to manage your Chime Credit Card account conveniently. From monitoring your transactions to making payments, the mobile app offers a seamless experience.

- Building credit history: For those looking to establish or improve their credit, the Chime Credit Card offers an opportunity. By making timely payments and maintaining good credit habits, you can build a positive credit history and improve your credit score over time.

Now that you have a solid understanding of the Chime Credit Card and its notable features, let’s move on to exploring the different methods you can use to add money to your Chime Credit Card.

Ways to Add Money to Chime Credit Card

Adding money to your Chime Credit Card is a breeze, thanks to the various convenient methods offered by Chime. Whether you prefer direct deposits, bank transfers, mobile check deposits, or even cash reloads, Chime has got you covered. Let’s explore the different ways you can add funds to your Chime Credit Card:

- Direct Deposit: One of the simplest ways to add money to your Chime Credit Card is through direct deposit. You can easily set up direct deposit with your employer or any other income source, allowing funds to be automatically deposited into your Chime account. This method ensures that your funds are readily available and saves you the hassle of manual transfers.

- Bank Transfer: Another convenient option is to transfer funds from your linked bank account to your Chime Credit Card. By linking your bank account to your Chime account, you can easily initiate a transfer using the Chime mobile app or website. This method allows you to transfer any desired amount quickly.

- Mobile Check Deposit: With Chime’s mobile check deposit feature, you can add money to your Chime Credit Card by simply taking a photo of a paper check. Using the Chime mobile app, you can submit the photo of the check, and the funds will be deposited into your Chime account. This method eliminates the need for physically visiting a bank or ATM to deposit checks.

- Cash Reload: If you prefer adding cash to your Chime Credit Card, you can do so through various cash reload partners. These partners include retailers such as Walmart and Walgreens, where you can deposit cash into your Chime account at their customer service counter. This method is particularly useful for individuals who deal with primarily cash transactions.

- Paycheck Early: Chime also offers a unique feature called “Early Direct Deposit.” If you have your paycheck or government benefits deposited into your Chime account, Chime often processes these funds earlier than traditional banks. This allows you to receive your funds sooner and have them available on your Chime Credit Card.

- Third-Party Money Transfer: If you have funds in third-party digital wallets or payment apps, you can transfer them to your Chime Credit Card. Services like PayPal and Venmo allow you to transfer money to your Chime account, which can then be used to add funds to your Chime Credit Card.

- Chime Cash Spot: Chime Cash Spot is a feature that allows you to pay friends and family using your Chime Credit Card. If your loved ones are in need of cash, you can transfer funds directly from your Chime account to their Chime account. It’s a quick and convenient way to share money without any fees.

- Chime Card Transfers: Lastly, you can use your Chime Credit Card to transfer funds from another credit card or bank account. This allows you to consolidate your funds onto your Chime Credit Card for easier management and tracking.

With these various methods available, adding money to your Chime Credit Card becomes effortless, ensuring that you always have funds available for your financial needs. Choose the method that works best for you and enjoy the convenience of managing your finances with Chime.

Method 1: Direct Deposit

One of the most convenient and hassle-free ways to add money to your Chime Credit Card is through direct deposit. This method allows you to have your income automatically deposited into your Chime account, making the funds readily available for your card expenses. Here’s how you can set up direct deposit for your Chime Credit Card:

- Contact your employer: Reach out to your employer’s Human Resources department or payroll provider and inquire about their process for setting up direct deposit. Most companies have a simple form that you need to complete to initiate the direct deposit process.

- Provide your Chime account details: Once you receive the necessary form from your employer, you will need to provide them with your Chime account details. This includes your Chime account number and the Chime routing number. You can find this information by logging into your Chime mobile app or website.

- Confirm with Chime: After submitting the direct deposit form to your employer, it may take a pay cycle or two for the process to be fully set up. However, Chime typically notifies you via email once the direct deposit feature has been activated for your account.

- Receive your funds: Once your direct deposit has been set up, your employer’s payroll system will deposit your income directly into your Chime account on each payday. This means you won’t have to worry about physically depositing a paycheck or waiting for checks to clear.

Direct deposit not only saves you time and effort but also ensures that your funds are available promptly. You can confidently use your Chime Credit Card knowing that you have instant access to the money you need for your financial transactions.

It’s worth noting that direct deposit is not limited to just income from your employer. You can also set up direct deposit for other sources of income, such as government benefits or other recurring payments. Simply provide the respective payers with your Chime account details, and they can deposit the funds directly into your Chime account.

Utilizing direct deposit for your Chime Credit Card is a convenient way to add money and stay on top of your finances. With this automated process, you can focus on managing your expenses while enjoying the benefits of Chime’s fee-free banking services.

Method 2: Bank Transfer

If you prefer a more traditional approach, you can add money to your Chime Credit Card through a bank transfer. This method allows you to transfer funds from a linked bank account directly to your Chime account. Here’s how you can set up a bank transfer to add money to your Chime Credit Card:

- Link your bank account: Start by linking your bank account to your Chime account. You can do this by logging into your Chime mobile app or website, navigating to the settings or account settings section, and following the prompts to link an external bank account. You will need to provide your bank account details, such as the account number and routing number, to complete the linking process.

- Initiate the transfer: Once your bank account is successfully linked, you can initiate a transfer. Log in to your Chime mobile app or website and navigate to the “Transfer” or “Transfer Money” section. Select the option to transfer funds from your linked bank account to your Chime account.

- Specify the amount: Enter the desired amount that you want to transfer from your bank account to your Chime Credit Card. Ensure that the amount is within the available balance in your bank account to avoid overdraft fees or insufficient funds issues.

- Confirm the transfer: Review the details of the transfer, including the amount and the accounts involved, and double-check for any errors. Once you are satisfied, confirm the transfer to proceed.

- Processing time: The processing time for bank transfers can vary depending on the financial institutions involved. Generally, it can take a couple of business days for the funds to be transferred from your bank account to your Chime Credit Card. Keep this in mind when planning your transactions and ensure that you have sufficient funds available during the transfer period.

Bank transfers offer a straightforward and secure method for adding money to your Chime Credit Card. With just a few simple steps, you can transfer funds from your linked bank account to your Chime account, making the money accessible for your card transactions.

It’s important to remember that when initiating a bank transfer, you should ensure that you have the necessary funds available in your bank account. Insufficient funds or overdrafts can result in fees or transaction failures. Be proactive in managing your account balances to avoid any complications during the transfer process.

Enjoy the convenience and flexibility of adding funds to your Chime Credit Card through a bank transfer. With this method, you can easily manage your finances and make purchases using your Chime Credit Card with peace of mind.

Method 3: Mobile Check Deposit

Adding money to your Chime Credit Card is made even more convenient through the mobile check deposit feature. With this method, you can deposit a paper check into your Chime account using the Chime mobile app, eliminating the need to visit a physical bank or ATM. Here’s how you can use mobile check deposit to add funds to your Chime Credit Card:

- Download the Chime mobile app: If you haven’t already, download the Chime mobile app from your smartphone’s app store and log in to your Chime account. Ensure that your account is in good standing and eligible for mobile check deposit.

- Choose the mobile check deposit feature: Once you’re logged in, navigate to the “Deposit” or “Mobile Check Deposit” section within the Chime mobile app. Follow the prompts to access the mobile check deposit feature.

- Prepare the check: Before depositing the check, endorse it by signing on the back and include the words “For Mobile Deposit Only.” This endorsement ensures that the check can only be deposited through the Chime mobile app and protects against unauthorized use.

- Capture the check image: Using the Chime mobile app’s camera function, position the check within the designated area and capture images of both the front and back of the check. Ensure that the images are clear and all the information on the check is easily readable.

- Confirm the deposit amount: Enter the amount specified on the check into the Chime mobile app. Review the accuracy of the amount to avoid any discrepancies.

- Submit the deposit: Confirm the deposit details and submit the deposit through the Chime mobile app. The app will typically provide a confirmation once the deposit has been successfully processed.

- Funds availability: The processing time for mobile check deposits can vary, but in general, funds are made available within a few business days. Chime may place a temporary hold on the deposited funds to verify the check’s authenticity. Once the hold is lifted, you can access the funds and use them on your Chime Credit Card.

Mobile check deposit offers a convenient and efficient way to add money to your Chime Credit Card. It saves you time and effort by eliminating the need to physically deposit the check at a bank branch or ATM.

When using mobile check deposit, it’s important to ensure that you properly endorse the check and accurately capture the images for a successful deposit. Take care to follow the Chime mobile app’s instructions to ensure a smooth and error-free deposit process.

Enjoy the flexibility of adding funds to your Chime Credit Card through mobile check deposit. With just a few taps on your smartphone, you can securely deposit checks and have the money available for your card expenses.

Method 4: Cash Reload

If you prefer using cash to add funds to your Chime Credit Card, you can do so through the cash reload method. Chime offers partnerships with certain retailers where you can deposit cash into your Chime account at their customer service counters. Here’s how you can use the cash reload method to add money to your Chime Credit Card:

- Find a cash reload partner: Check the Chime website or mobile app to find a list of cash reload partner locations near you. Popular retailers such as Walmart and Walgreens often offer this service.

- Visit the cash reload partner: Head to one of the cash reload partner locations and go to the customer service counter. Inform the representative that you would like to do a cash reload for your Chime account.

- Provide your Chime account details: When requested, provide the representative with your Chime account number or any other required details. This ensures that the cash is deposited into the correct account.

- Deposit the cash: Hand over the desired amount of cash to the representative. They will process the deposit and provide you with a receipt for your records.

- Availability of funds: The cash reload process typically takes a few minutes to complete. Once the transaction is processed, the funds will be available in your Chime account, ready for use on your Chime Credit Card.

The cash reload method is particularly beneficial for individuals who primarily deal with cash transactions or prefer to use cash for certain expenses. It allows you to convert your physical cash into digital funds that can be easily managed through your Chime Credit Card.

Keep in mind that some retailers may charge a small fee for the cash reload service. The fee amount may vary depending on the location and partnership terms. Ensure that you are aware of any associated fees before proceeding with the cash reload.

Adding money through the cash reload method provides you with flexibility and convenience. You can conveniently convert your cash into digital funds, ensuring that you have access to the funds you need for your Chime Credit Card expenses.

Method 5: Paycheck Early

One of the unique features offered by Chime is the ability to receive your paycheck early. This means that if you have your paycheck or government benefits directly deposited into your Chime account, Chime often processes these funds earlier than traditional banks. By getting your paycheck early, you can have the funds available on your Chime Credit Card sooner. Here’s how you can take advantage of this perk:

- Set up direct deposit: Ensure that you have direct deposit set up with your employer or government agency. Provide them with your Chime account number and routing number to enable direct deposit into your Chime account.

- Check early direct deposit eligibility: Every employer or government agency has its own payroll schedule. Chime typically processes direct deposits as soon as they are received, which can be up to two days earlier than the standard payday. Confirm with your employer or agency if they support early direct deposit with Chime.

- Enjoy early access to your funds: Once you’ve confirmed your eligibility for early direct deposit, you can enjoy the benefit of having your paycheck or government benefits available on your Chime Credit Card earlier than expected. This allows you to have funds for your financial needs without having to wait for the standard payday.

Receiving your paycheck early with Chime provides a financial advantage, especially when you need immediate access to funds. It allows you to make timely payments, cover expenses, and utilize the money on your Chime Credit Card for your day-to-day transactions.

It’s important to note that while Chime processes direct deposits early, the exact timing may vary depending on factors such as your employer’s payroll practices and the timing of your direct deposit submission. Chime will notify you via email as soon as the funds are available in your account, ensuring you stay informed.

Take advantage of Chime’s early direct deposit feature to gain quicker access to your funds and effortlessly manage your finances with your Chime Credit Card.

Method 6: Third-Party Money Transfer

Another convenient method of adding money to your Chime Credit Card is through third-party money transfers. If you have funds in third-party digital wallets or payment apps like PayPal or Venmo, you can transfer those funds to your Chime account and subsequently add them to your Chime Credit Card. Here’s how to use the third-party money transfer method:

- Link your third-party account: Start by linking your Chime account to the third-party digital wallet or payment app from which you want to transfer funds. You may need to follow specific instructions from the app or wallet provider to complete the linking process.

- Initiate the transfer: Once your Chime account is successfully linked, navigate to the third-party digital wallet or payment app and locate the option to transfer funds. Enter the amount you want to transfer and select your linked Chime account as the destination.

- Confirm the transfer: Review the transfer details, including the amount and destination account, to ensure accuracy. Once you are satisfied, confirm the transfer to initiate the process.

- Processing time: The processing time for third-party money transfers can vary depending on the policies and procedures of the digital wallet or payment app. Typically, the funds should be available in your Chime account within a few business days.

By utilizing third-party money transfers, you can easily consolidate your funds from various digital wallets or payment apps into your Chime Credit Card. This simplifies the management of your finances and allows you to access all your funds within the Chime ecosystem.

Keep in mind that some third-party digital wallets or payment apps may charge fees for transferring funds. Ensure that you are aware of any applicable fees and factors them into your decision-making process.

Using third-party money transfer methods provides you with flexibility and convenience in managing your finances. Transfer funds from various sources to your Chime Credit Card seamlessly and enjoy the benefits of a consolidated financial management experience.

Method 7: Chime Cash Spot

Chime Cash Spot is a unique feature offered by Chime that allows you to pay friends and family using your Chime Credit Card. This peer-to-peer payment method enables you to transfer funds directly from your Chime account to another Chime account. Here’s how you can use Chime Cash Spot to add money to your Chime Credit Card:

- Access Chime Cash Spot: Log in to your Chime mobile app or website and navigate to the Chime Cash Spot feature. It is typically found within the section for sending money or making payments.

- Select a recipient: Input the Chime username or email address of the person you wish to send money to. Make sure that the recipient has a Chime account and has their Chime username or email associated with their account.

- Enter the transfer details: Specify the amount you want to send to the recipient. Double-check the amount to ensure accuracy, as once the transfer is initiated, it cannot be reversed.

- Confirm and send: Review the transfer details and confirm that everything is correct. Once you are ready, submit the transfer request to initiate the transaction. You may be prompted to confirm the transfer with additional security measures, such as a passcode or fingerprint authentication.

- Notify the recipient: Inform the recipient that you have sent them money through Chime Cash Spot. They will receive a notification from Chime and will need to accept the transfer to have the funds added to their Chime account.

- Recipient acceptance and availability: The recipient must have a Chime account and accept the funds within a specified timeframe. Once they accept the transfer, the funds will be made available in their Chime account, ready for use on their Chime Credit Card.

Chime Cash Spot provides a convenient way to transfer money to friends and family who also utilize Chime. It eliminates the need for cash transfers or using external payment apps, allowing you to quickly and easily share funds within the Chime ecosystem.

Keep in mind that Chime may impose limits or fees on Chime Cash Spot transfers, so it’s important to familiarize yourself with any associated terms and conditions.

Utilize Chime Cash Spot to simplify money transfers and add funds to your Chime Credit Card seamlessly. Share money with your loved ones while enjoying the benefits of Chime’s user-friendly platform.

Method 8: Chime Card Transfers

If you have funds available on another credit card or bank account, you can utilize the Chime Card Transfers feature to move those funds to your Chime Credit Card. This method allows you to consolidate your finances and have all your funds conveniently accessible through your Chime account. Here’s how you can use Chime Card Transfers to add money to your Chime Credit Card:

- Gather account information: Collect the necessary account information for the credit card or bank account from which you want to transfer funds. This includes the account number, routing number, and any other required details.

- Link the external account: Log in to your Chime mobile app or website and navigate to the settings or account settings section. Look for the option to link an external account. Enter the account information you gathered in the previous step and follow the prompts to link the account to your Chime account.

- Initiate the transfer: Once the external account is successfully linked, navigate to the “Transfer” or “Transfer Money” section and select the option to transfer funds from the linked external account to your Chime Credit Card.

- Specify the amount: Enter the desired amount that you want to transfer from the linked account to your Chime Credit Card. Double-check the amount to ensure accuracy.

- Confirm the transfer: Review the transfer details, including the amount and the accounts involved, to ensure accuracy. Once you are satisfied, confirm the transfer to initiate the process.

- Funds availability: The processing time for Chime Card Transfers can vary depending on the external financial institution. Typically, the funds will be available in your Chime account within a few business days, ready to be used on your Chime Credit Card.

Chime Card Transfers provide a convenient way to consolidate your funds and manage your finances within the Chime ecosystem. It allows you to have all your funds easily accessible through your Chime account and simplifies your financial management.

Be aware that the external financial institution may have its own terms and conditions regarding transfers, including any associated fees or limitations. Familiarize yourself with these details to make informed transfer decisions.

Take advantage of Chime Card Transfers to streamline your finances and add funds to your Chime Credit Card seamlessly. Consolidate your accounts and enjoy the convenience of having all your funds in one place with Chime.

Conclusion

Adding money to your Chime Credit Card is a simple and convenient process thanks to the various methods offered by Chime. Whether it’s through direct deposit, bank transfers, mobile check deposits, cash reloads, early paycheck access, third-party transfers, Chime Cash Spot, or Chime Card Transfers, you have multiple options to choose from based on your preferences and needs.

Direct deposit provides a seamless way to have your income automatically deposited into your Chime account, keeping your Chime Credit Card funded without any manual effort. Bank transfers allow you to transfer funds from a linked bank account directly to your Chime account, giving you flexibility and control over your finances. With mobile check deposits, you can deposit paper checks into your Chime account using the Chime mobile app, saving you time and a trip to the bank. Cash reloads enable you to add cash to your Chime account at partner locations, catering to those who prefer using physical currency. Early paycheck access grants you the benefit of receiving your paycheck early, ensuring your Chime Credit Card has funds available before the standard payday. Third-party money transfers allow you to transfer funds from other digital wallets or payment apps to your Chime account, providing a consolidated platform for managing your finances. Chime Cash Spot makes it easy to send money to friends and family who also use Chime, while Chime Card Transfers allow you to move funds from other credit cards or bank accounts directly to your Chime Credit Card.

By utilizing these varied methods, you can conveniently add funds to your Chime Credit Card, ensuring that you always have the necessary funds available for your financial transactions. Whether it’s for everyday expenses, large purchases, or emergency situations, Chime offers a range of options to meet your needs.

Take advantage of the features and services provided by Chime to simplify your financial management and enjoy the benefits of a fee-free banking experience. With Chime Credit Card, you can track your spending, earn cashback rewards, and build your credit history while easily adding money to your account.

Start harnessing the power of Chime Credit Card today and experience a seamless and user-friendly way to manage your finances!