Home>Finance>How Can I Get Late Payments Off My Credit Report

Finance

How Can I Get Late Payments Off My Credit Report

Modified: March 10, 2024

Learn effective strategies to remove late payments from your credit report and improve your finance. Get expert tips now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Having late payments show up on your credit report can have a negative impact on your credit score and financial well-being. Whether it’s due to forgetfulness, financial hardship, or other circumstances, dealing with late payments can be stressful. However, there are steps you can take to try and remove late payments from your credit report and improve your credit standing.

In this article, we will discuss the various methods you can use to get late payments off your credit report. We will explore strategies such as reviewing your credit report, disputing inaccurate late payments, negotiating with creditors, setting up automatic payments, establishing a good payment history, and seeking professional help.

Understanding the implications of late payments on your credit report is crucial. When you have a late payment, it can stay on your credit report for up to seven years, negatively affecting your creditworthiness. This can make it challenging to secure loans, credit cards, or favorable interest rates in the future.

However, it’s important to note that not all late payments are created equal. While one or two minor late payments may have a minimal impact, consistently missing payments or having significant late payment history can significantly harm your credit score. Therefore, taking steps to address and resolve late payments is essential for rebuilding your credit and financial stability.

Let’s dive deeper into the strategies you can employ to remove late payments from your credit report and improve your financial standing. With commitment and diligence, it is possible to turn your credit situation around and move towards a more secure financial future.

Understanding Late Payments on Credit Reports

Before delving into the strategies for getting late payments off your credit report, it is important to have a clear understanding of how late payments are recorded and their impact on your creditworthiness.

When you make a payment late, whether it’s on a credit card, loan, or other financial obligation, the financial institution you owe will report it to the credit bureaus. The credit bureaus, such as Equifax, Experian, and TransUnion, compile this information into your credit report, which is then used by lenders and creditors to assess your creditworthiness.

The severity of the late payment impact on your credit score depends on several factors, including the recency of the late payment, the frequency of late payments, and the severity of the delinquency. A single late payment that occurred a few months ago will have a lesser impact compared to a pattern of late payments stretching over several years.

Generally, late payments can fall into different categories:

- 30 Days Late: A payment that is 30 days overdue but hasn’t yet escalated to the next level of delinquency.

- 60 Days Late: A payment that is 60 days overdue, indicating a more serious delinquency.

- 90 Days Late: A payment that is 90 days overdue, usually resulting in penalties and further damage to creditworthiness.

It is crucial to note that even if you make a late payment and subsequently catch up, the late payment notation can still appear on your credit report. The good news is that late payments, like any other negative information, will eventually be removed from your credit report. The passage of time and responsible credit behavior can help mitigate their impact.

Now that you have a better understanding of how late payments are recorded and their potential consequences, it’s time to review your credit report to identify any inaccurate information and begin the process of rectifying any errors.

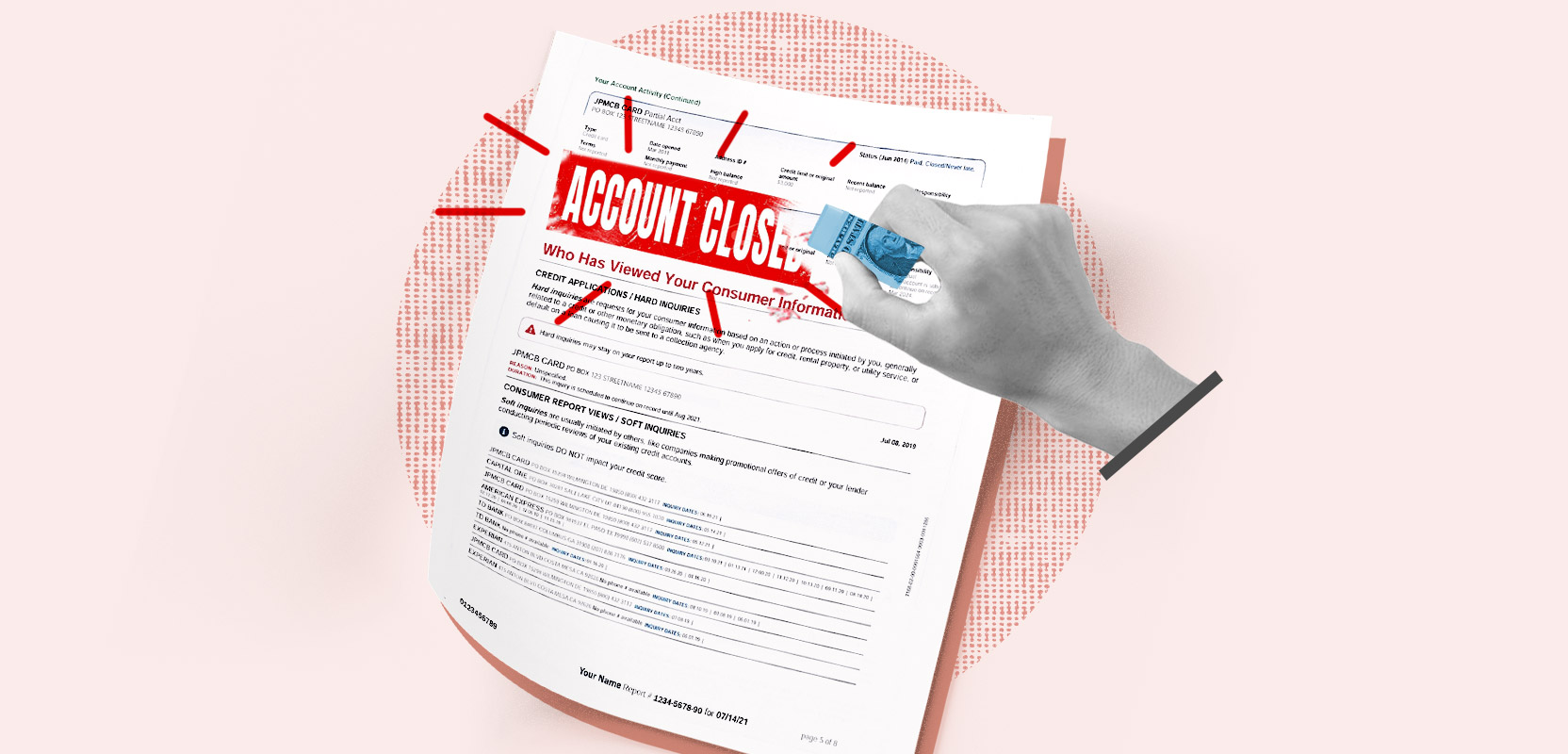

Reviewing Your Credit Report

When it comes to addressing late payments on your credit report, the first step is to thoroughly review your credit report. By doing so, you can identify any errors or inaccuracies that may be negatively impacting your credit score.

You are entitled to a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. You can request your credit reports online or by mail. It’s important to review reports from all three bureaus, as the information they contain may vary.

Once you obtain your credit reports, carefully go through each section, paying close attention to the payment history section. Look for any late payments that may be inaccurate or wrongly reported. Common errors include late payments mistakenly assigned to your account or payments that were made on time but erroneously labeled as late.

If you spot any discrepancies, gather supporting documentation. This can include payment receipts, bank statements, or any other proof that supports your claim of making timely payments. Collecting evidence can strengthen your case when disputing late payments with the credit bureaus or creditors.

Next, it’s time to initiate the process of disputing inaccurate late payments on your credit report.

Please note that reviewing your credit report and identifying errors is an essential step in rectifying late payments. It allows you to challenge and correct any inaccuracies, potentially boosting your credit score and overall financial profile.

Disputing Inaccurate Late Payments

If you have identified inaccurate late payments on your credit report during the review process, it’s important to take action and dispute these errors. Correcting inaccurately reported late payments can help improve your credit score and overall creditworthiness.

The first step in disputing inaccurate late payments is to gather all supporting documentation that proves your payments were made on time. This can include bank statements, payment receipts, canceled checks, or any other relevant evidence. Organize this documentation and make copies to submit as part of your dispute.

Next, you’ll need to contact the credit bureau(s) that are reporting the inaccurate late payments. You can do this online or by mail, following their respective dispute processes. Include all the necessary information, such as your identification details, the account number associated with the late payment, and a detailed explanation of why you believe the late payment is incorrect.

Attach copies of the supporting documentation you gathered and clearly request that the credit bureau investigate and remove the inaccurate late payment from your credit report. It’s important to remember to keep copies of all correspondence and communication with the credit bureaus for your records.

Once the credit bureau receives your dispute, they will investigate the matter by contacting the creditor or financial institution that reported the late payment. Under the Fair Credit Reporting Act (FCRA), the credit bureau must complete its investigation within 30 to 45 days and provide you with a written response regarding the outcome.

If the credit bureau determines that the late payment was indeed inaccurate, they will update your credit report accordingly. The late payment will be removed, and your credit score may see an improvement as a result.

If, on the other hand, the credit bureau does not find in your favor or the late payment remains on your credit report, you can escalate the dispute by requesting a reinvestigation or filing a complaint with the Consumer Financial Protection Bureau (CFPB).

Remember, disputing inaccurate late payments requires patience and persistence. It’s important to stay vigilant in monitoring your credit report and following up on any updates or changes to ensure the accuracy of your credit history.

Negotiating with Creditors

If you are unable to dispute inaccurate late payments or if you have legitimate late payments on your credit report, another option to consider is negotiating with your creditors. By proactively engaging with your creditors, you may be able to come to a mutually beneficial agreement that can help improve your credit situation.

Start by contacting your creditors directly and explaining your situation. Be honest about any financial difficulties you may be facing and emphasize your commitment to resolving any outstanding payments. Creditors are often more willing to work with individuals who demonstrate a sincere effort to address their financial obligations.

During your conversation with your creditors, you can consider the following negotiation strategies:

- Payment Plan: Propose a payment plan that allows you to catch up on missed payments over a specified period of time. By setting up a manageable payment schedule, you can show your commitment to meeting your financial obligations.

- Reduced Interest Rates: Request a reduction in interest rates or the waiving of late payment fees to help alleviate some of the financial burden associated with missed payments. Creditors may be more willing to negotiate if it means they will eventually receive the full amount owed.

- Debt Settlement: In some cases, creditors may be willing to negotiate a settlement amount that is less than the total outstanding balance. This can help you pay off the debt in full and potentially improve your credit standing.

- Credit Reporting Agreement: It may be possible to negotiate an agreement with your creditor to update the late payment status on your credit report. While this may not remove the late payment entirely, it can reflect a more positive outcome, such as “paid as agreed” or “account in good standing.”

Remember to get any agreements in writing and carefully review the terms before committing to any negotiated arrangements. Ensure that you understand the impact on your credit report and overall financial situation.

By taking the initiative to negotiate with your creditors, you demonstrate responsibility and a willingness to rectify your financial standing. Successful negotiations can lead to improved payment terms, reduced financial burdens, and ultimately, an improved credit score.

Setting up Automatic Payments

One effective way to avoid late payments and improve your credit history is to set up automatic payments for your financial obligations. By automating your payments, you ensure that they are made on time, eliminating the risk of forgetfulness or oversight that can lead to late payments.

Here are some steps to follow when setting up automatic payments:

- Assess Your Financial Situation: Begin by analyzing your income and expenses to determine how much you can afford to allocate towards your various financial obligations each month. This will help you create a budget that incorporates automatic payments.

- Identify Eligible Accounts: Review your bills, loans, and credit cards to identify which accounts offer the option of automatic payments. Most financial institutions provide this service, either through their website, mobile app, or by setting up direct debit from your bank account.

- Select Payment Dates: Choose payment dates that align with your income cycle to ensure you have sufficient funds in your account to cover the payments. Aim to schedule payments a few days before the due date to allow for any processing delays.

- Set Up Payment Amounts: Determine the fixed amount or percentage of your monthly payment that you will automate. It’s crucial to ensure that this amount is sufficient to cover the minimum payment due, or more if you want to pay down the debt faster.

- Monitor Regularly: Even with automatic payments, it’s essential to regularly review your bank statements, credit card statements, and payment confirmations to ensure that the payments are being processed correctly and on time.

Automating your payments not only helps you avoid late payment fees and penalties but also has the potential to improve your credit score over time. Consistently making on-time payments demonstrates responsibility and financial stability to creditors, positively impacting your creditworthiness.

However, it’s important to note that while automatic payments can be convenient, it’s crucial to maintain a sufficient balance in your bank account to avoid overdraft fees or failed payments. Regularly monitoring your account balance and keeping track of your scheduled payments will help you avoid any potential issues.

In addition to setting up automatic payments, it’s also important to establish a good payment history to further enhance your credit standing.

Establishing a Good Payment History

Building a solid payment history is crucial for maintaining a good credit score and financial reputation. Lenders and creditors consider your payment history when assessing your creditworthiness, so it’s important to establish a track record of timely payments. Here are some tips to help you establish a good payment history:

- Pay on Time, Every Time: Make it a priority to pay all your bills, loans, and credit card dues on or before their due dates. Set reminders or use automatic payments to ensure you never miss a payment.

- Pay at Least the Minimum: If you can’t pay off the full amount owed, be sure to pay at least the minimum payment due. This will prevent late fees and help maintain a positive payment history.

- Stay Organized: Keep track of all your financial obligations, due dates, and payment confirmations. Maintain a budget and allocate funds for your payments to ensure you can meet your obligations each month.

- Avoid Maximum Utilization: Try to keep your credit card utilization below 30% of your available credit. High credit card balances can negatively impact your credit score, so aim to pay off your balances in full whenever possible.

- Communicate with Creditors: If you’re facing financial difficulties, reach out to your creditors and explain your situation. They may be able to offer temporary payment arrangements or hardship programs to help you stay on track.

- Practice Consistency: Building a good payment history takes time and consistency. Demonstrate a pattern of responsible payment behavior by consistently paying your bills on time.

Establishing a good payment history shows potential lenders and creditors that you are a reliable borrower. Over time, your consistent payment habits will reflect positively on your credit report and contribute to an improved credit score.

Remember that building a good payment history is a long-term commitment. It requires discipline, organization, and regular monitoring of your financial obligations. By diligently maintaining a positive payment history, you’ll have a solid foundation for future financial opportunities.

However, if you are struggling with a significant amount of debt or are unable to manage your payments effectively, seeking professional assistance may be beneficial.

Seeking Professional Help

If you find yourself overwhelmed with debt or facing challenges in managing your payments, seeking professional help can provide valuable guidance and support. Debt counseling agencies and credit repair services can assist you in improving your financial situation. Here are some options to consider:

Debt Counseling Agencies: Debt counseling agencies offer expert guidance to individuals struggling with debt. They can help you create a budget, negotiate with creditors, and develop a customized debt repayment plan. These agencies can also provide education on financial management and offer strategies for improving your credit standing. It’s essential to research and select a reputable agency that is accredited by organizations such as the National Foundation for Credit Counseling (NFCC).

Credit Repair Services: Credit repair companies specialize in identifying inaccuracies, errors, and discrepancies on your credit report. They will work on your behalf to dispute any negative information, including late payments, that may be impacting your credit score. It’s important to research and choose a reputable credit repair service that follows ethical practices and operates within the boundaries of the law.

Bankruptcy Attorney: If your financial situation is severely compromised and you are considering filing for bankruptcy, it’s advisable to consult with a bankruptcy attorney. They can provide legal advice tailored to your specific circumstances and guide you through the bankruptcy process, whether it’s Chapter 7 or Chapter 13 bankruptcy. A bankruptcy attorney can help you understand the implications of bankruptcy on your credit and financial future.

Seeking professional help allows you to work with experts who have extensive knowledge and experience in dealing with debt and credit issues. They can provide personalized recommendations and support based on your specific financial situation.

Remember to exercise caution when selecting a professional service. Research their reputation, read reviews, and ensure they have the appropriate licenses and certifications. Beware of organizations that make lofty promises of miraculously fixing your credit overnight, as repairing your credit takes time and effort.

In addition to seeking professional help, it’s essential to educate yourself about personal finance and credit management. Understanding the factors that impact your credit score and implementing good financial habits will help you maintain a healthy credit profile in the long term.

Ultimately, seeking professional help can be a valuable step towards developing a solid financial foundation and improving your creditworthiness.

Conclusion

Dealing with late payments on your credit report can feel daunting, but it’s important to remember that you have options to rectify the situation and improve your financial standing. By taking proactive steps and implementing the strategies discussed in this article, you can work towards removing late payments from your credit report and rebuilding your creditworthiness.

Start by reviewing your credit report thoroughly to identify any inaccurate late payments. Dispute these errors with the credit bureaus, providing supporting documentation to strengthen your case. If the late payments are accurate, consider negotiating with your creditors to set up payment plans, reduce interest rates, or explore debt settlement options.

Setting up automatic payments is an effective way to ensure timely payments, eliminating the risk of future late payments. By establishing a good payment history, consistently paying your bills on time and managing your debts responsibly, you can demonstrate your creditworthiness to lenders and improve your credit score over time.

If you’re facing significant financial challenges, seeking professional help from debt counseling agencies or credit repair services can provide valuable guidance and support. These professionals can help you navigate through debt repayment plans, negotiate with creditors, and explore appropriate strategies to improve your financial situation.

Remember, improving your credit takes time and dedication. It’s important to stay committed to responsible financial habits, regularly monitor your credit report, and proactively address any issues that arise.

With determination and persistence, you can successfully remove late payments from your credit report and pave the way for a brighter and more secure financial future.