Home>Finance>How To Get Serious Delinquency Off Credit Report

Finance

How To Get Serious Delinquency Off Credit Report

Published: October 20, 2023

Learn effective strategies to remove serious delinquency from your credit report and improve your financial standing. Take steps now to regain control of your finances with expert advice on finance management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Serious Delinquency on Credit Reports

- Step 1: Requesting a Copy of your Credit Report

- Step 2: Reviewing your Credit Report for Serious Delinquency

- Step 3: Disputing Inaccurate Information with Credit Bureaus

- Step 4: Contacting Creditors to Resolve Serious Delinquency

- Step 5: Negotiating Payment Plans or Settlements

- Step 6: Building Positive Credit History

- Step 7: Patience and Persistence in the Process

- Conclusion

Introduction

Having a good credit score is essential for financial health. It allows you to qualify for loans, secure lower interest rates, and enjoy a variety of financial benefits. However, if you have serious delinquency on your credit report, it can have a detrimental impact on your creditworthiness and overall financial well-being. Serious delinquency refers to the severe late payments or non-payment of bills, loans, or other financial obligations.

In this article, we will guide you through the process of getting serious delinquency off your credit report. While it can be challenging, it is not impossible to repair your credit and improve your financial standing. By following the steps outlined in this article, you can take control of your credit and work towards a better financial future.

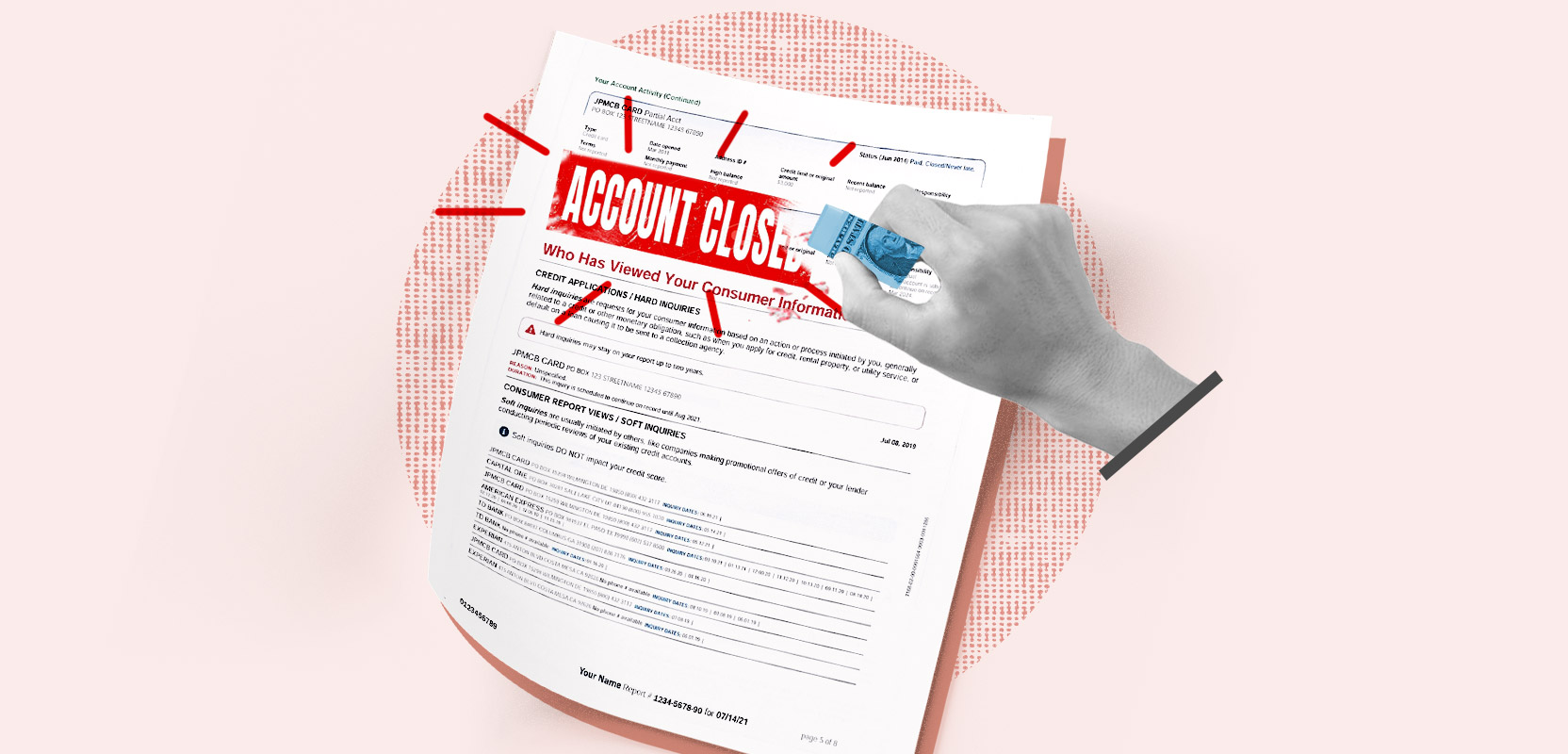

Understanding Serious Delinquency on Credit Reports

Serious delinquency is a red flag on your credit report and will negatively impact your credit score. It can include items such as defaulted loans, collections, foreclosures, bankruptcies, or accounts sent to collections agencies. These negative marks can stay on your credit report for several years, making it difficult to obtain credit or favorable interest rates.

However, it’s important to note that credit reporting agencies must adhere to the Fair Credit Reporting Act (FCRA), which outlines the rights of consumers when it comes to accuracy and privacy of their credit information. The FCRA also gives consumers the right to dispute inaccurate or incomplete information on their credit reports.

Understanding Serious Delinquency on Credit Reports

Serious delinquency on credit reports refers to instances where individuals have failed to make timely payments or have defaulted on their financial obligations. This includes overdue payments, unpaid debts, and accounts that have been sent to collections agencies. These negative marks can have a significant impact on your credit score, making it difficult to qualify for loans or obtain favorable interest rates.

Some common examples of serious delinquency on credit reports include:

- Missed or late payments: When you fail to make payments within the specified timeframe, it can be reported as a late payment on your credit report.

- Accounts in collections: If your account is consistently delinquent and remains unpaid, the creditor may decide to send it to a collections agency. This can result in a negative mark on your credit report, indicating that the debt is in collections.

- Charge-offs: When a creditor decides that a debt is unlikely to be repaid, they may charge-off the debt. This occurs when the creditor writes off the debt as a loss and closes the account. The charge-off status will remain on your credit report and can severely impact your creditworthiness.

- Foreclosures and repossessions: If you fail to make mortgage payments or car loan payments, the lender may initiate foreclosure or repossession proceedings. These events will be reported on your credit report and can have long-lasting effects on your credit score.

- Bankruptcies: When individuals are unable to meet their financial obligations and seek legal protection, they may file for bankruptcy. Bankruptcies can stay on your credit report for several years and can significantly impact your creditworthiness.

It’s important to understand that serious delinquency on credit reports can have lasting consequences. It can lower your credit score, making it challenging to secure loans or credit cards in the future. In addition, it can result in higher interest rates on loans, higher insurance premiums, and limited access to certain financial opportunities.

Fortunately, there are steps you can take to address serious delinquency on your credit report. By following these steps, you can begin the process of improving your creditworthiness and working towards a healthier financial future.

Step 1: Requesting a Copy of your Credit Report

The first step in addressing serious delinquency on your credit report is to obtain a copy of your credit report from the major credit reporting agencies: Equifax, Experian, and TransUnion. You are entitled to a free copy of your credit report from each agency once every 12 months.

To request your credit report, you can visit annualcreditreport.com, which is the only authorized website for free credit reports in the United States. Alternatively, you can contact the credit reporting agencies directly or submit a request by mail.

When requesting your credit report, you will need to provide personal information such as your name, address, Social Security number, and date of birth. It’s essential to ensure that the information provided is accurate and up-to-date to avoid any issues in obtaining your report.

Once you have received your credit reports from all three credit reporting agencies, review each report carefully. Look for any accounts that show serious delinquency, including late payments, defaulted loans, or accounts in collections. Take note of any inaccuracies or discrepancies in the information provided.

Keep in mind that it’s not uncommon for credit reports to contain errors, and these errors can have a significant impact on your credit score. If you come across any incorrect or questionable information, you have the right to dispute it and have it corrected.

By obtaining a copy of your credit report, you will have a clear understanding of the serious delinquency items that are impacting your credit score. This will allow you to move forward with the necessary steps to address and resolve these issues.

Step 2: Reviewing your Credit Report for Serious Delinquency

Once you have obtained a copy of your credit report, the next step is to thoroughly review it for any signs of serious delinquency. Carefully go through each section, paying close attention to the following:

- Accounts in collections: Look for any accounts that have been sent to collections agencies. Note down the details of these accounts, including the name of the collection agency and the amount owed.

- Late payments: Check for any missed or late payments. Take note of the dates and amounts of these payments.

- Charge-offs: Identify any accounts that have been charged off by the creditor. These are accounts that the creditor has deemed unlikely to be repaid and has written off as a loss.

- Bankruptcies or foreclosures: Look for any records of bankruptcy filings or foreclosures. These are major negative marks on your credit report.

As you review your credit report, make sure to cross-reference it with your own financial records and statements. This will help you identify any discrepancies or errors in the information reported. If you come across any inaccuracies, it’s essential to dispute them with the credit reporting agencies.

If you find multiple serious delinquency items on your credit report, it can feel overwhelming. However, it’s crucial to stay focused and remain proactive in addressing these issues. Remember that taking steps to resolve serious delinquency can have a positive impact on your credit score over time.

By thoroughly reviewing your credit report, you will gain a clear understanding of the serious delinquency items affecting your creditworthiness. Armed with this knowledge, you can proceed to the next step of disputing any inaccurate information and taking action to resolve the legitimate negative marks on your credit report.

Step 3: Disputing Inaccurate Information with Credit Bureaus

After reviewing your credit report and identifying any inaccuracies or discrepancies, it’s time to take action by disputing the information with the credit reporting agencies. The Fair Credit Reporting Act grants you the right to dispute any inaccuracies or incomplete information on your credit report.

Here’s how you can initiate the dispute process:

- Submit a written dispute: Write a formal dispute letter to the credit reporting agency (or agencies) that is reporting the inaccurate information. Clearly explain the error and provide supporting documentation, such as payment records or correspondence with the creditor, to substantiate your claim. Make sure to include your name, address, Social Security number, and any relevant account information.

- Send the letter via certified mail: It’s important to send your dispute letter via certified mail with a return receipt requested. This will provide proof of delivery and ensure that the credit reporting agency receives your dispute.

- Keep copies of all correspondence: Make copies of your dispute letter and any other documentation you include. Keep track of the dates and details of your communication with the credit reporting agency to maintain a record of your efforts.

Under the FCRA, the credit reporting agency is required to investigate the disputed information within 30 days. They will contact the creditor or entity that provided the information and request verification of the accuracy of the reported information. If the creditor cannot verify the information, the credit reporting agency must remove it from your report.

Once the investigation is complete, the credit reporting agency will send you a response with the results. If the disputed information is removed or corrected, the credit reporting agency will provide you with an updated copy of your credit report.

In case the credit reporting agency does not rectify the error or continues to report inaccurate information, you may need to take further action. Consider reaching out to a consumer protection agency or consulting with a credit repair professional to explore your options.

Remember, disputing inaccurate information is an essential step in the process of getting serious delinquency off your credit report. By taking the initiative to correct any errors, you are taking control of your creditworthiness and working towards a stronger financial standing.

Step 4: Contacting Creditors to Resolve Serious Delinquency

After addressing any inaccurate information with the credit reporting agencies, the next step is to directly contact the creditors associated with the serious delinquency items on your credit report. Communicating with your creditors can help you understand the situation, negotiate payment options, and potentially resolve the delinquency.

Here’s a step-by-step approach to contacting your creditors:

- Collect all necessary information: Before reaching out to your creditors, gather all relevant documentation related to the delinquent accounts. This includes account numbers, payment history, and any other supporting details.

- Prepare a list of questions: Make a list of questions and concerns you want to address with each creditor. This can help you stay organized and ensure you cover all important points during your conversations.

- Contact the creditors: Reach out to each creditor individually via phone or email. Be prepared to provide your account information and explain that you are addressing the serious delinquency on your credit report.

- Ask for clarification: Seek clarification from the creditor about the specific details of the delinquency. Understand the reasons behind the missed payments or non-payment and inquire about any potential options for resolving the delinquency.

- Discuss payment arrangements: If possible, work with the creditor to negotiate a payment arrangement that suits your financial situation. This can include setting up a payment plan or making a lump sum payment to settle the debt.

- Obtain written confirmation: Once you have reached an agreement with the creditor, request written confirmation of the payment arrangement or settlement. This will serve as proof of the agreement and can be submitted to the credit reporting agencies as evidence of your efforts to resolve the delinquency.

Remember, be polite and professional during your interactions with creditors. It’s important to remain calm and focused on finding a resolution. Keep detailed records of your conversations, including dates, names of representatives, and the content of your discussions.

It’s worth noting that not all creditors may be willing to negotiate or accommodate your requests. However, by reaching out and engaging in conversation, you are demonstrating your commitment to resolving the serious delinquency and taking responsibility for your financial obligations.

By actively communicating with your creditors, you can gain a better understanding of the delinquency and work towards finding a mutually beneficial solution. Resolving delinquent accounts can have a positive impact on your credit score and improve your overall financial standing.

Step 5: Negotiating Payment Plans or Settlements

When dealing with serious delinquency on your credit report, negotiating payment plans or settlements with your creditors can be a viable option to resolve the outstanding debt. This step allows you to establish a structured repayment plan or potentially settle the debt for a lower amount than what is owed.

Here are some steps to consider when negotiating payment plans or settlements:

- Review your financial situation: Before reaching out to your creditors, assess your current financial situation and determine how much you can realistically afford to pay towards the delinquent debt each month.

- Prepare a proposal: Based on your financial assessment, prepare a written proposal that outlines your proposed payment plan or settlement offer. Be specific about the amount you can pay and the anticipated duration of the repayment plan.

- Contact the creditors: Reach out to your creditors and express your willingness to resolve the delinquency. Provide them with your proposal and explain how it aligns with your financial capabilities.

- Negotiate terms: Be open to negotiation with your creditors. They may counter your proposal with a different payment plan or settlement offer. Consider their suggestions and find a middle ground that is suitable for both parties.

- Get the agreement in writing: Once you have reached a mutually agreed-upon payment plan or settlement, request a written agreement from the creditor. This document should clearly outline the terms of the agreement, including the monthly payment amount, due date, and any other relevant details.

- Stick to the agreed-upon plan: It is crucial to adhere to the payment plan or settlement agreement once it is in place. Make your payments on time and in the agreed-upon amount. This will help rebuild trust with your creditors and demonstrate your commitment to resolving the delinquent debt.

Remember, negotiating payment plans or settlements requires effective communication and a willingness to find a mutually beneficial solution. Be persistent, patient, and respectful during these discussions. It is also recommended to keep detailed records of all communication and documentation related to the negotiation process.

Successfully negotiating payment plans or settlements with your creditors can help you regain control over your finances and work towards resolving the serious delinquency on your credit report. By fulfilling your obligations, you can improve your creditworthiness and create a brighter financial future for yourself.

Step 6: Building Positive Credit History

As you work towards resolving serious delinquency on your credit report, it’s crucial to simultaneously focus on building positive credit history. This step will help improve your creditworthiness over time and offset the negative impact of past delinquencies.

Here are some strategies to consider for building positive credit history:

- Make payments on time: Consistently making payments on time is one of the most important factors in maintaining and improving your credit score. Set up reminders or automatic payments to ensure that you don’t miss any due dates.

- Reduce credit card balances: High credit card balances can negatively impact your credit utilization ratio. Aim to keep your balances below 30% of your available credit to demonstrate responsible credit management.

- Apply for new credit cautiously: Opening new credit accounts can help diversify your credit profile. However, be selective and only apply for credit when necessary. Multiple inquiries can temporarily lower your credit score.

- Use credit responsibly: Use your credit accounts judiciously and responsibly. Avoid maxing out your credit cards and strive to pay off the balances in full each month. This demonstrates your ability to manage credit effectively.

- Keep old accounts open: Length of credit history is an important factor in calculating your credit score. If you have old accounts with positive payment history, keep them open even if you no longer use them actively.

- Monitor your credit: Regularly check your credit reports for errors or discrepancies. You can also consider using credit monitoring services to stay updated on any changes to your credit profile.

- Consider a secured credit card: If you’re struggling to get approved for traditional credit cards, a secured credit card can be a helpful starting point. With a secured card, you provide a security deposit, and the card issuer extends you a credit line equal to the deposit.

Building positive credit history takes time and consistency. It’s important to be patient and persistent in your efforts. Gradually, as you demonstrate responsible credit behavior over an extended period, the impact of the serious delinquency on your credit report will diminish.

Improving your creditworthiness through positive credit habits not only increases your chances of obtaining favorable terms on future loans or credit applications but also strengthens your overall financial position.

Step 7: Patience and Persistence in the Process

Resolving serious delinquency on your credit report is not an overnight process. It requires patience and persistence to navigate through the steps and overcome the challenges along the way. Here are some important points to keep in mind:

1. Understand the timeline: Removing serious delinquency from your credit report takes time. The credit reporting agencies have 30 days to investigate your disputes, and it can take several months for changes to reflect on your report. Be prepared for this timeline and don’t get discouraged if you don’t see immediate results.

2. Keep detailed records: Throughout the process, maintain meticulous records of all communications, letters, and documentation related to your disputes, negotiations, and payment arrangements. This will help you stay organized and provide evidence of your efforts if needed in the future.

3. Stay proactive: Take an active role in monitoring your progress and following up with the credit reporting agencies and creditors. Be persistent in addressing any inaccuracies or discrepancies that arise during the process.

4. Maintain open lines of communication: Keep the lines of communication open with your creditors, maintaining regular contact to stay updated on the status of any payment plans or settlements. If you encounter any challenges or setbacks, communicate with them promptly to find potential solutions.

5. Address new financial habits: As you work towards resolving serious delinquency, take the opportunity to reassess your financial habits. Implement healthy financial practices such as budgeting, saving, and responsible credit management. These habits will contribute to your overall financial well-being and future success.

6. Celebrate milestones: Recognize and celebrate every milestone and achievement along the way. Whether it’s successfully disputing an inaccurate item or making consistent payments towards your delinquent accounts, acknowledge your progress and use it as motivation to keep moving forward.

Remember, the process of getting serious delinquency off your credit report requires time, effort, and determination. Be patient with yourself and the process. By staying persistent and remaining focused on your goals, you can overcome the challenges and ultimately improve your creditworthiness.

Building a positive credit history and regaining financial stability is a journey. Embrace it with a positive mindset and stay committed to the steps outlined in this article. With patience and persistence, you can successfully remove serious delinquency from your credit report and pave the way for a brighter financial future.

Conclusion

Addressing serious delinquency on your credit report is a crucial step towards improving your financial standing and securing a strong credit score. While it may seem daunting, it’s important to remember that you have the power to take control of your creditworthiness.

Throughout this article, we have explored the seven steps involved in getting serious delinquency off your credit report. From requesting a copy of your credit report to negotiating payment plans and settlements, each step plays a significant role in rebuilding your credit history.

By following these steps, you can gradually remove inaccurate information, resolve delinquent accounts, and start building positive credit history. It requires patience, persistence, and a commitment to practicing responsible financial habits.

Remember that the process will take time, and there may be challenges along the way. Stay proactive, keep detailed records, and maintain open lines of communication with the credit reporting agencies and your creditors. Celebrate your milestones and progress as you work towards your financial goals.

Taking control of your credit will not only improve your chances of qualifying for loans and favorable interest rates but also provide you with greater financial freedom and stability. As you build positive credit history, you pave the way for future financial opportunities and a stronger financial future.

Start today by requesting a copy of your credit report and reviewing it carefully. Take the necessary steps to dispute any inaccuracies, communicate with your creditors, and establish solid payment plans or settlements. Embrace the journey with patience, persistence, and a positive mindset.

By following the steps outlined in this article, you can overcome serious delinquency on your credit report and set yourself on a path towards a brighter financial future. Remember, you have the power to shape your financial destiny and create a solid foundation for your financial well-being.