Home>Finance>How Do I Get Rid Of A Consumer Finance Account Off My Credit Report

Finance

How Do I Get Rid Of A Consumer Finance Account Off My Credit Report

Modified: December 30, 2023

Learn how to remove a consumer finance account from your credit report and improve your credit score. Discover effective techniques to eliminate financial burdens and regain control of your finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Consumer Finance Accounts

- The Importance of Reviewing Your Credit Report

- How Consumer Finance Accounts Impact Your Credit

- Steps to Remove a Consumer Finance Account from Your Credit Report

- Option 1: Contact the Creditor

- Option 2: Dispute the Account with Credit Bureaus

- Option 3: Hire a Credit Repair Company

- Considerations Before Taking Action

- Conclusion

Introduction

Welcome to the world of consumer finance accounts and credit reports! If you’ve ever had a consumer finance account impacting your credit report, you may be wondering how to get rid of it. Whether it’s a forgotten credit card account, an old loan, or a collection account, items like these can have a significant impact on your credit score. Understanding the steps to remove them from your credit report is crucial in maintaining a healthy financial profile.

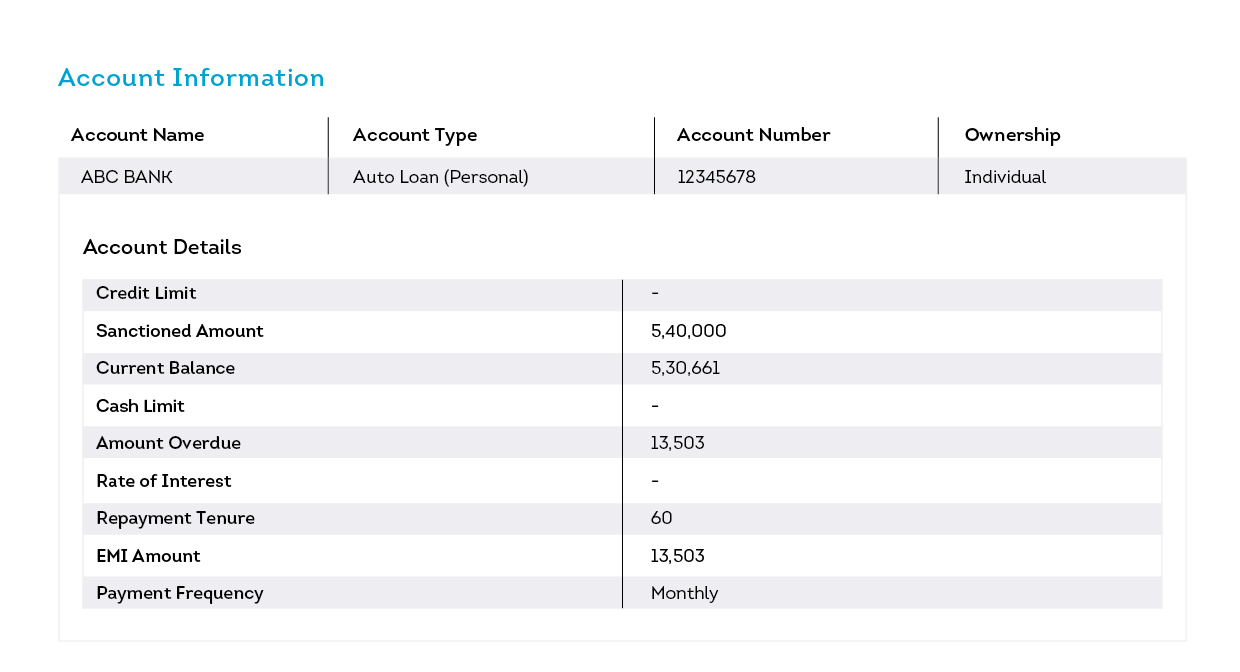

Consumer finance accounts are financial products or services provided by lenders to individual consumers. These accounts can take various forms, including credit cards, personal loans, auto loans, mortgages, and more. Managing these accounts responsibly is essential for maintaining a good credit score and overall financial well-being.

Reviewing your credit report regularly is crucial in understanding the status of all your consumer finance accounts. Your credit report is a document that summarizes your credit history, including your payment history, amount owed, length of credit history, new credit, and types of credit. It is maintained by credit bureaus and used by lenders to assess your creditworthiness when you apply for loans, mortgages, or other forms of credit.

Consumer finance accounts have a direct impact on your credit score, which is a numerical representation of your creditworthiness. A high credit score indicates that you are a responsible borrower, making it easier for you to qualify for loans and obtain favorable interest rates. On the other hand, a low credit score can lead to loan denials or higher interest rates, making it crucial to maintain a positive credit profile.

In this article, we will explore the steps you can take to remove a consumer finance account from your credit report. These steps include contacting the creditor, disputing the account with credit bureaus, or hiring a credit repair company. However, before taking any action, there are a few considerations that you should keep in mind to ensure the best possible outcome.

So, if you’re ready to reclaim control of your credit report and remove unwanted consumer finance accounts, let’s dive in and explore the options available to you!

Understanding Consumer Finance Accounts

Consumer finance accounts are financial products or services provided by lenders to individual consumers. These accounts play a crucial role in helping individuals meet their financial needs, whether it’s purchasing a home, buying a car, or funding personal expenses. Understanding how these accounts work is essential for managing your finances effectively and maintaining a healthy credit profile.

There are various types of consumer finance accounts, each designed to serve specific purposes. Some common examples include:

- Credit Cards: These accounts allow consumers to make purchases on credit, with the option to repay the balance in full or carry it over from month to month with interest charges.

- Personal Loans: These accounts provide a lump sum of money that consumers can use for any purpose, such as consolidating debt, financing a large purchase, or covering unexpected expenses.

- Auto Loans: These accounts help consumers purchase vehicles by providing the necessary financing. The vehicle acts as collateral for the loan.

- Mortgages: These accounts enable consumers to purchase homes by providing long-term financing, typically repaid over several years.

- Student Loans: These accounts assist students in financing their education expenses, with repayment typically starting after graduation.

Consumer finance accounts come with terms and conditions that outline important details such as interest rates, repayment terms, fees, and credit limits. It is important to carefully review these terms before entering into any financial agreement to ensure you understand your obligations.

Managing consumer finance accounts responsibly is key to maintaining a healthy credit profile. This includes making timely payments, keeping credit card balances low, and avoiding carrying excessive debt. By demonstrating responsible financial behavior, you can build a positive credit history that will benefit you in the long run.

It’s also important to note that consumer finance accounts are reported to credit bureaus, such as Experian, Equifax, and TransUnion. These bureaus collect information from lenders and compile it into credit reports, which are used by lenders to assess creditworthiness. The information in your credit report, including your consumer finance accounts, plays a significant role in determining your credit score.

Now that we have a better understanding of what consumer finance accounts are, let’s move on to the importance of reviewing your credit report regularly to ensure accuracy and address any issues that may arise.

The Importance of Reviewing Your Credit Report

Reviewing your credit report on a regular basis is essential for maintaining a healthy financial profile. Your credit report contains a wealth of information about your financial history, including your consumer finance accounts, payment history, and any negative or derogatory information.

Here are a few key reasons why it’s important to review your credit report:

- Accuracy: Errors and inaccuracies can occur on credit reports. It’s not uncommon for incorrect information to be reported, such as accounts that don’t belong to you or inaccurate payment statuses. By regularly reviewing your credit report, you can identify and address any inaccuracies to ensure your credit information is correct.

- Identity theft detection: Reviewing your credit report can help you spot signs of identity theft or fraudulent activity. If you notice unfamiliar accounts or suspicious activity, it may indicate that someone has fraudulently used your information. By catching these issues early, you can take the necessary steps to protect yourself and mitigate any potential damage.

- Monitoring your creditworthiness: Your credit report is a reflection of your creditworthiness. By regularly reviewing it, you can see how your consumer finance accounts and payment history are impacting your credit score. This allows you to make adjustments, such as paying down debt or disputing inaccurate information, to improve your creditworthiness and overall financial health.

- Identifying potential issues: Reviewing your credit report can help you identify potential issues with your consumer finance accounts. For example, if you see a high balance on a credit card or missed payments on a loan, it may be a sign that you need to take action to address these issues before they negatively impact your credit score.

It is recommended that you review your credit report from each of the major credit bureaus at least once a year. By doing so, you can ensure the accuracy of your credit information and take proactive steps to protect your financial well-being.

If you do find errors or inaccuracies on your credit report, it’s important to take action to address them. In the following sections, we will explore the steps you can take to remove a consumer finance account from your credit report once you’ve determined that there is incorrect or problematic information present.

How Consumer Finance Accounts Impact Your Credit

Consumer finance accounts have a significant impact on your credit score, which is a numerical representation of your creditworthiness. Understanding how these accounts affect your credit is crucial for maintaining a healthy credit profile and obtaining favorable financial opportunities.

Here are a few key ways in which consumer finance accounts impact your credit:

- Payment History: Your payment history is one of the most important factors that influence your credit score. Making timely payments on your consumer finance accounts demonstrates responsible financial behavior and can have a positive impact on your credit score. Conversely, missing payments or making late payments can negatively affect your score.

- Amount Owed: The amount you owe on your consumer finance accounts, also known as your credit utilization ratio, is another significant factor in determining your credit score. Keeping your balances low compared to your credit limits shows responsible credit management and can help improve your credit score. Higher balances, on the other hand, may signal potential financial risk and can lower your score.

- Length of Credit History: The length of time you have held consumer finance accounts also plays a role in your credit score. Generally, a longer credit history reflects a more established credit profile. This is why it’s important to maintain older accounts and avoid closing them unless necessary.

- New Credit: Opening new consumer finance accounts can impact your credit score. When you apply for new credit, such as a credit card or loan, a hard inquiry is made on your credit report. Multiple recent inquiries can lower your score, as it may indicate a higher risk of being overextended financially. It’s important to be cautious and only apply for new credit when necessary.

- Types of Credit: A diverse mix of consumer finance accounts can have a positive impact on your credit score. This includes a combination of credit cards, loans, and mortgages. Having a mix of different types of credit demonstrates your ability to manage various financial obligations responsibly.

Positive and responsible management of your consumer finance accounts can help you maintain a good credit score. This, in turn, can make it easier to qualify for loans, obtain favorable interest rates, and even land certain jobs or rental agreements that may require a credit check.

However, it’s important to note that negative factors such as missed payments, high credit utilization, and derogatory marks (e.g., collections or bankruptcies) can have a severe negative impact on your credit. These negative marks can stay on your credit report for several years and make it more challenging for you to obtain credit or secure favorable terms.

Now that we have a better understanding of how consumer finance accounts impact your credit, let’s explore the steps you can take to remove a consumer finance account from your credit report if necessary.

Steps to Remove a Consumer Finance Account from Your Credit Report

If you have a consumer finance account on your credit report that you believe should be removed, there are several steps you can take. It’s important to note that the process may require some time and effort, but it’s worthwhile to ensure the accuracy and integrity of your credit report.

Here are the steps you can follow to remove a consumer finance account from your credit report:

- Step 1: Review Your Credit Report: Start by obtaining a copy of your credit report from each of the major credit bureaus – Experian, Equifax, and TransUnion. Carefully review the report and identify the specific consumer finance account you wish to remove.

- Step 2: Gather Documentation: Collect any supporting documentation that proves your case for removing the account. This may include payment records, agreements, correspondence with the creditor, or any other relevant documents.

- Step 3: Option 1 – Contact the Creditor: Reach out to the creditor associated with the consumer finance account. Explain your situation and provide any documentation to support your request for removal. If the account was reported in error or you have resolved any outstanding issues, the creditor may be willing to work with you to remove it from your credit report.

- Step 4: Option 2 – Dispute the Account with Credit Bureaus: If contacting the creditor directly does not resolve the issue, you can file a dispute with the credit bureaus. Provide them with any evidence or documentation and clearly explain why you believe the account should be removed. The credit bureaus will investigate your dispute and make a determination regarding the account’s removal.

- Step 5: Option 3 – Hire a Credit Repair Company: If you are facing challenges in removing the consumer finance account on your own, you may consider hiring a reputable credit repair company. These companies specialize in handling credit disputes and can assist you in navigating the process. However, it’s important to research and choose a reputable company to avoid falling victim to fraudulent practices.

While these steps can help in the process of removing a consumer finance account from your credit report, it’s important to manage your expectations. Not all removal requests may be successful, especially if the account is valid and accurately reported. However, by taking the necessary steps and advocating for yourself, you increase your chances of achieving a favorable outcome.

Before taking any action, it’s important to consider the following factors.

Option 1: Contact the Creditor

One of the first steps you can take to remove a consumer finance account from your credit report is to contact the creditor directly. This option allows you to communicate with the party responsible for reporting the account to the credit bureaus, giving you the opportunity to address any issues or disputes.

Here are the steps to follow when contacting the creditor:

- Gather Documentation: Before reaching out to the creditor, gather any documentation related to the account. This may include payment records, account statements, or any communication you have had with the creditor regarding the account.

- Find Contact Information: Locate the contact information for the creditor. This can typically be found on the account statement or their website. If you are unable to find the contact information, consider reaching out to their customer service department for assistance.

- Prepare Your Explanation: Clearly articulate your reason for wanting the account removed from your credit report. This may include providing evidence that the account was reported in error, that you have resolved any outstanding issues, or that there has been fraudulent activity on the account.

- Communicate with the Creditor: Once you have gathered the necessary documentation and prepared your explanation, contact the creditor. Explain your situation and provide the supporting evidence. Be polite and professional during the conversation to increase your chances of a positive outcome.

- Follow Up: After speaking with the creditor, it’s important to follow up in writing to confirm the details of the conversation. Send a letter or email summarizing the discussion and include any relevant documentation. This creates a paper trail and ensures that both parties are on the same page.

It’s important to note that not all creditors may be willing to remove an account from your credit report. However, it’s worth the effort to reach out and attempt to resolve the issue with them directly. If successful, the creditor will notify the credit bureaus of the account removal, and it should be reflected in your updated credit report.

If contacting the creditor directly does not resolve the issue, you can proceed to Option 2: Disputing the Account with Credit Bureaus. This option allows you to escalate the matter and involve the credit bureaus in the dispute resolution process.

Before taking any action, it’s important to consider some additional factors that may impact your decision and approach. We will explore these considerations in the next section.

Option 2: Dispute the Account with Credit Bureaus

If contacting the creditor directly does not lead to a satisfactory resolution, you can move on to Option 2: disputing the account with the credit bureaus. Disputing the account allows you to bring the issue to the attention of the credit bureaus and request an investigation into the accuracy of the account reporting.

Here are the steps to follow when disputing the account with credit bureaus:

- Gather Documentation: Collect any documentation that supports your claim that the account should be removed or corrected. This may include payment records, correspondence with the creditor, or any other evidence that proves the inaccuracy or validity of the account.

- Access Your Credit Report: Obtain a copy of your credit report from each of the major credit bureaus – Experian, Equifax, and TransUnion. Carefully review the credit report to identify the specific account you wish to dispute.

- File a Dispute: Contact the credit bureaus and initiate a dispute on the account in question. You can typically file a dispute online, by mail, or by phone. Provide a clear and concise explanation of why you believe the account information is inaccurate or should be removed.

- Include Supporting Documentation: Attach any supporting documentation to your dispute that strengthens your case. This can include the documentation you gathered in step one or any other evidence that proves your claim.

- Wait for Investigation: Once the credit bureaus receive your dispute, they will investigate the account and contact the creditor for verification. The credit bureaus have 30 to 45 days to complete the investigation, as per the Fair Credit Reporting Act.

- Review the Results: Once the investigation is complete, the credit bureaus will provide you with the results in writing. They will either update your credit report based on the outcome of the investigation or notify you if further action is necessary.

Disputing the account with the credit bureaus can be an effective way to address inaccuracies or discrepancies on your credit report. If the investigation supports your claim, the credit bureaus will update your credit report accordingly, potentially leading to the removal of the consumer finance account.

If the credit bureaus do not resolve the dispute in your favor or if the account remains on your credit report, you may consider additional options, such as consulting a legal professional or seeking further assistance from a reputable credit repair company.

Now that you are familiar with Option 2, let’s move on to Option 3: hiring a credit repair company to help you address the consumer finance account on your credit report.

Option 3: Hire a Credit Repair Company

If you have tried contacting the creditor and disputing the account with credit bureaus without success, you may consider seeking assistance from a credit repair company. These companies specialize in helping individuals address issues on their credit reports, including the removal of consumer finance accounts.

Here are some important considerations when hiring a credit repair company:

- Research and Choose a Reputable Company: Take the time to research and select a reputable credit repair company. Look for companies with a proven track record, positive customer reviews, and a clear understanding of consumer protection laws, such as the Credit Repair Organizations Act (CROA).

- Review Services and Fees: Understand the services offered by the credit repair company and the associated fees. Reputable companies will explain their process, provide a clear breakdown of costs, and be transparent about any guarantees or expectations.

- Provide Necessary Documentation: Work closely with the credit repair company and provide them with the required documentation to support your case. This can include any information, correspondence, or evidence you have gathered regarding the disputed consumer finance account.

- Communicate Regularly: Maintain open communication with the credit repair company throughout the process. Stay informed about the progress of your case, ask questions, and provide any additional information or updates as necessary.

- Be Patient: Resolving credit report issues can take time, so it’s important to be patient throughout the process. Understand that every case is unique, and the timeline for resolution may vary.

Working with a reputable credit repair company can provide you with expert guidance and support as you navigate the process of removing the consumer finance account from your credit report. They have the knowledge and experience to navigate the complexities of credit reporting and can advocate on your behalf with the creditors and credit bureaus.

It’s important to note that while credit repair companies can be beneficial, they cannot guarantee specific outcomes or instant results. It’s essential to manage your expectations and be cautious of any company that promises quick fixes or claims to remove negative information that is accurate and valid.

Considering the potential costs involved in hiring a credit repair company, it’s worth exploring Options 1 and 2 first. However, if your attempts have been unsuccessful, or if you feel overwhelmed by the process, Option 3 may be a viable solution for you.

Before taking any action, it’s crucial to weigh these options and considerations carefully. Understanding the impact and consequences of each choice will help you make an informed decision about how best to move forward.

Considerations Before Taking Action

Before taking any action to remove a consumer finance account from your credit report, there are a few important considerations to keep in mind. These factors will help you make informed decisions and set realistic expectations for the outcome.

- Validity of the Account: Assess the validity of the consumer finance account in question. Make sure you are disputing accurate and valid information. If the account is legitimate, it may be challenging to have it removed from your credit report.

- Documentation and Evidence: Gather all relevant documentation and evidence to support your case. This includes payment records, correspondence with the creditor, or any other evidence that proves your claim. Strong documentation can greatly strengthen your argument for removal.

- Impact on Credit Score: Consider the potential impact of removing the account on your credit score. If the account has a long positive payment history, removing it may lower the average age of your accounts and impact your credit mix, which can temporarily lower your credit score.

- Effort and Time Involved: Understand that removing a consumer finance account from your credit report can be a time-consuming and sometimes frustrating process. It requires gathering documentation, communicating with creditors and credit bureaus, and potentially following up multiple times.

- Explore Other Options: Before hiring a credit repair company, consider exploring Option 1: contacting the creditor directly, and Option 2: disputing the account with credit bureaus. These initial steps can often yield positive results without incurring additional costs.

- Reputable Assistance: If you choose to hire a credit repair company, ensure that you select a reputable and trustworthy organization. Research the company, read reviews, and understand the services they provide, as well as any associated fees.

- Legal Advice: In some cases, seeking legal advice may be necessary, especially if you believe your rights have been violated or if you are facing complex credit report issues. Consult with an attorney who specializes in consumer law to discuss your options.

Each individual’s situation is unique, and the appropriate course of action may vary. It’s crucial to carefully consider the above factors before deciding on the best approach to deal with the consumer finance account on your credit report.

Remember that patience and persistence are key when navigating the process of removing inaccurate or unwanted information from your credit report. Stay organized, document your efforts, and maintain open communication with creditors and credit bureaus throughout the resolution process.

By taking the necessary steps and advocating for yourself, you can potentially improve the accuracy and integrity of your credit report and maintain a healthy financial profile in the long run.

Now that we have explored the various considerations, let’s wrap up the article.

Conclusion

Managing consumer finance accounts and maintaining a healthy credit profile is essential for your financial well-being. If you find a consumer finance account on your credit report that you believe should be removed, there are steps you can take to address the issue.

Start by reviewing your credit report regularly to ensure accuracy and detect any potential issues. Understand how consumer finance accounts impact your credit score, considering factors like payment history, amount owed, length of credit history, new credit, and types of credit.

If you want to remove a consumer finance account from your credit report, you have several options. Begin by contacting the creditor associated with the account to negotiate or provide evidence of its inaccuracy. If this approach fails, you can dispute the account with the credit bureaus, providing supporting documentation to back up your claim.

In situations where direct communication and dispute resolution do not yield the desired outcome, you may consider hiring a reputable credit repair company for assistance. Be sure to conduct thorough research and understand the services and fees involved before making a decision.

Prior to taking any action, evaluate the validity of the account, gather relevant documentation, and consider the potential impact on your credit score. Be prepared for the effort and time required to navigate the process effectively.

Remember to consult legal advice if needed, especially in cases of potential violations or complex credit report issues.

Ultimately, by taking informed and proactive steps, you can work towards removing unwanted consumer finance accounts from your credit report, improving your credit profile, and ensuring a more secure financial future.

Now armed with the knowledge and considerations outlined in this article, you can confidently take action and work towards achieving a more accurate and favorable credit report.